Made with

The rise in demand for digital transformation — poised to reach a remarkable $2.3 trillion in 8 years — has illuminated a pressing shortage of skilled tech professionals. Unless it is bridged, the U.S. alone will likely lose $162 billion worth of revenue annually. This scarcity is not merely a financial concern but also a catalyst for increased employee turnover, prolonged hiring timelines, and challenging retention rates amidst escalating salary and benefits expectations. No wonder why more and more U.S. tech companies are turning to nearshoring their software development team in Argentina. But what makes this country so attractive?

I’m Dmytro Ovcharenko, CEO of Alcor, with over 15 years of tech industry expertise at the forefront. At Alcor IT recruitment agency we help product tech companies build their software R&D centers and top-tier engineering teams from 0 to 100 employees within a year in LATAM and Eastern Europe.

In this article, I’ll delve into the reasons why Argentina is an attractive hub for tech companies, unravel the challenges associated with nearshoring software development to Argentina, provide an overview of the country’s laws and taxes, and suggest better solutions to help you thrive in this burgeoning business landscape. So, stay tuned!

Software Development Industry in Argentina

The IT market in Argentina is on a dynamic ascent — its size was estimated at over $19 billion in 2022 and will likely soar to $42,5 billion by 2027. This makes the country the third biggest tech market in LatAm after Mexico and Brazil. Meanwhile, the revenue in the local IT services market is now around $3,6 billion per year and is expected to reach a staggering 8.1 billion U.S. dollars by 2028. Sounds promising for those considering IT nearshoring in Argentina, doesn’t it?

But that’s not all. The country proudly stands as a hub for IT ventures with 19 commercial structures, 3,800 tech enterprises, 1,107 startups, and 11 unicorns. Beyond sheer numbers, Argentina distinguishes itself as an innovation leader in the Latin American region as it clinches the 73rd spot on the 2023 Global Innovation Index.

Even better, the country is the fourth-largest e-commerce market in Latin America. This vibrant landscape extends beyond with exciting opportunities in actively developing sectors like BFSI, telecom, healthcare, IoT, cloud computing, AI, agtech, and blockchain.

The Advantages of Nearshoring Software Development to Argentina

Now, let’s dive into the strategic advantages of nearshoring software development to Argentina’s tech prowess for your business:

Large Pool of Skilled Talents

Over 115,000 software developers were in the Argentine tech talent pool as of 2023. This number will be fueled even more in 2024 by the annual production of around 27,000 graduates currently obtaining technical education. Argentine software engineers rank 30th worldwide and #3 in LATAM for technology skills. They excel in mobile development, programming, and databases and showcase expertise in Python, TensorFlow, Cloud APIs, SQL, R, and NLP.

Cost Efficiency

US-based tech companies can save a decent amount of money on software developer salaries, given that Argentinian wages are nearly 6 times lower. On average, developers earn around $113,600 annually in the U.S. and $20,300 in Argentina. Such a difference allows employers to save up to 80% of costs on compensation and allocate these funds to other strategic activities.

Check out the table below to gain a comprehensive overview of the current salary rates in various countries:

|

Annual Salary Ranges for Middle Software Developers |

|||||||||||

| Position | Argentina | Mexico | Brazil | USA | Canada | Germany | France | ||||

| JavaScript Developer |

$16,000 | $20,000 | $17,000 | $105,000 | $77,000 | $54,000 | $52,000 | ||||

| Django Developer |

$32,000 | $35,000 | $37,000 | $120,000 | $107,000 | $80,000 | $68,000 | ||||

| UX Developer |

$27,000 | $24,000 | $33,000 | $123,000 | $96,000 | $78,000 | $63,000 | ||||

| Node.js Developer |

$17,000 | $20,000 | $20,000 | $107,000 | $84,000 | $57,000 | $57,000 | ||||

| React.js Developer |

$20,000 | $35,000 | $16,000 | $136,000 | $93,000 | $63,000 | $60,000 | ||||

| ASP.NET MVC Developer |

$22,000 | $28,000 | $28,000 | $111,000 | $71,000 | $70,000 | $71,000 | ||||

| QA Software Engineer |

$16,000 | $20,000 | $17,000 | $80,000 | $53,000 | $58,000 | $48,000 | ||||

| Indie Game Developer |

$12,000 | $16,000 | $21,000 | $86,000 | $64,000 | $69,000 | $54,000 | ||||

| Cobol Software Developer |

$15,000 | $27,000 | $20,000 | $75,000 | $82,000 | $60,000 | $60,000 | ||||

Argentinian salaries were converted to US dollars at a relevant exchange rate for January 2024. |

|||||||||||

High Level of Education

Argentina provides solid tech education that future software developers receive in top national universities like the University of Buenos Aires, Pontificia Universidad Católica Argentina, and Universidad Austral featured in QS World University Rankings. Zealous coders can secure scholarships for equipment and further pursue Bachelor’s or Master’s degrees. The education quality is pretty good, with three Argentine universities mentioned in the top 50 in Latin America and seven globally. There are also STEM initiatives supported by organizations such as OECD and Siemens.

English Language Proficiency & Cultural Compatibility

Argentine devs stand out for their impressive English proficiency, as they rank #1 in the LatAm region and 28th globally in the EF English Proficiency Index 2023. This guarantees a perfect grasp of development requirements, full integration of client feedback, and smooth written and verbal communication with their international colleagues.

And these are not the only benefits of nearshoring to Argentina. Argentinian coders also bridge cultures seamlessly — they share Western values like teamwork, creativity, and proactive decision-making. This makes them adaptable and dedicated to growth. They sound like perfect team players, don’t they?

Haven for Startup Development

Argentina’s vibrant startup ecosystem secured 4th place in the LATAM region. The country alone concentrated 45% of the startup ecosystem value in LatAm 4 years ago. Thriving in Buenos Aires, Argentina’s tech startup scene has birthed and housed 293 startups, among which are notable unicorns like Aleph, Bitfarms, Mural, Tiendanube, Ualá, Vercel, and Mercado Libre, currently the largest e-commerce platform in Latin America.

Córdoba is the second-largest Argentinian startup hub after Buenos Aires; it hosts 192 startups. Its ecosystem features 22 incubators, 8 venture capital institutions, 2 angel investment clubs with almost 70 investors, and over 20 entrepreneurial support organizations, which, in turn, highlights Argentina’s dynamic role in the global startup scene. Other cities like Río Cuarto, Mendoza, and Rosario together have 37 startups.

Time Zone and Proximity

Argentina is in GMT-3, just a one–hour time difference from New York, Washington D.C., Miami, and Atlanta. This proximity streamlines communication and ensures timely feedback and efficient project management with software developers from Argentina.

Government incentives

Through Law 27,506, the Argentine government offers tax incentives for various activities, including information technology. To qualify for the incentives, legal entities must register in a National Registry of Beneficiaries and demonstrate that a minimum of 70% of their recent annual revenue originates from one or more promoted activities.

Employers may also benefit from a non-transferable fiscal credit certificate, equivalent to 70% of the SSC paid on behalf of their employees engaged in promoted activities. This credit can be utilized to offset specified taxes, with the potential to increase to 80% for SSC related to new hires that fall within special interest groups, such as individuals with disabilities or residents in disadvantaged areas.

Moreover, Argentina has been improving its bureaucratic system for online business establishment. Now companies can be fully set up within 24 hours. This reflects the government’s desire to create an appealing environment for foreign businesses.

When It’s Better to Nearshore to Argentina

1) When you experience the lack of software developers in your local IT talent pool.

69% of the U.S. tech companies and three-quarters of European businesses are struggling to find and hire skilled employees with in-demand skills. The situation is expected to worsen by 2030, as the global talent shortage will likely reach 85 million. If you’re one of the companies facing challenges in finding the right people for your team, looking for them in less heated IT markets like Argentina’s is a good idea. After all, the number and quality of local developers meet the expectations of giants such as Google, Oracle, IBM, Microsoft, and Accenture.

2) When hiring costs and developer salaries are overwhelming in your home country.

Emerging from economic challenges that resulted in numerous layoffs, many businesses require cost-effective solutions to build their teams. Nearshoring to Argentina offers significant savings – up to 82% compared to the U.S. market. That makes it a smart option for businesses that don’t have the extra resources to compete for talent in the expensive U.S. market.

3) When you need to expand your business abroad.

Lastly, once you’ve set your eyes on business expansion to other countries and continents, why not start with LATAM and Argentina, in particular? Its tech market has been rapidly developing by an 8.3% CAGR since 2022, according to Technavio, and new companies are more than welcome to enter the local business environment and create new workplaces. A bonus for you: the local talents stay with foreign employers who pay the salaries in USD more eagerly. For the last year, talent turnover has reduced by 5%.

Or maybe you need to offshore/nearshore in Poland? That’s more than possible with Alcor!

Legislation on Nearshoring Software Development to Argentina

And now, let’s uncover the legal framework for nearshoring software outsourcing or creating a tech team in Argentina:

General legal framework

Contractual relations in the country are governed by the Civil and Commercial Codes. Additionally, the Commercial Companies Law oversees the incorporation and corporate relations within a company. The Fiscal Code sets the fundamental rules for business taxation, while the Intellectual Property Law regulates intellectual property protection and transfer, including computer software. Together, these legal components form the comprehensive framework that guides various aspects of business operations in Argentina.

Specific legislation tailored for the IT business sector

Law No. 27,506 implements the ‘Promotion Regime‘ with tax incentives and deductions. Additionally, Law No. 6,392 provides deferred payment options and/or exemptions from the Gross Receipt Tax for IT businesses that operate in the Buenos Aires area. Notably, no significant legislative challenges impact the operation of IT businesses in Argentina.

IT Nearshoring to Argentina: Taxes, Accounting, and Payroll

Corporate Income Tax (CIT) and Withholding Tax (WHT)

Argentina’s corporate income tax (CIT) applies to resident companies and Argentine branches of foreign companies, with rates ranging from 25% to 35% on adjustable income bands. Small companies benefit from a 60% CIT reduction, medium-sized companies receive a 40% reduction, and large companies get a 20% reduction. Additionally, a 7% withholding tax is imposed on dividends paid by Argentine companies to resident individuals and nonresidents, as well as on funds transfers by Argentine branches of foreign entities to their head offices.

Payroll taxes:

Personal Income Tax (PIT)

PIT in Argentina is levied on the worldwide income of Argentine residents, with a progressive rate ranging from 5% to 35%. For instance, with an annual income of $60,000, the effective PIT rate would be approximately 31.5% or $18,900. A standard personal allowance applies to taxpayers (both employees and self-employed) who have resided in Argentina for over six months in the relevant tax year and have not earned income over ARS 451,683.19 (~$1,252) within the same period.

Starting from January 1, 2024, Argentina implemented updated regulations for PIT. Under which employees* with a gross annual income of less than 180 minimum wages (approximately $66,000 per annum) are exempt from paying income tax. Those who exceed this threshold face a progressive PIT rate, that ranges from 27% to 35%. However, this reform does not cover top-management occupations like directors of public limited companies, CEOs, and assistant managers. They will continue to pay taxes under the progressive PIT rate, ranging from 5% to 35%.

Social Security Contributions

Employers in Argentina are required to pay Social Security contributions (SSC) on employees’ monthly compensation, which varies from 24% to 26.4% (for companies primarily involved in the provision of services or trade).

Typically, SSC consists of 18%-20.4% for the Pension Fund, with 6% allocated to Health Insurance. Additionally, employers must contribute a fixed amount of ARS 173 ($0.5) for labor risk insurance (plus a percentage of the employee’s salary based on the profession) and a fixed amount of ARS 37.21 ($0.1) to the life insurance fund per each employee.

Argentine employers are exempt from paying SSC for the first ARS 7,003.68 ($19.5) of the employee’s monthly compensation. Meanwhile, employers with no more than 25 workers get a single additional allowance of ARS 10,000 ($28).

Employees are also subject to a comprehensive social security tax rate of 17%, where:

- 11% allocated to pension funds,

- 3% for health insurance, and

- 3% to social services.

As of September 1, 2023, Argentina has established the minimum and maximum bases for SSCs, pegged to a monthly salary of ARS 29,456.43 (approximately $82) and ARS 957,320.12 (around $2,654), respectively.

Additionally, SSC withheld by the employer is deductible from the employee’s income for Personal Income Tax (PIT) purposes.

| Pension System | Healthcare | Professional Risks | |||

| Employer | Employee | Employer | Employee | Employer | Employee |

| 18%-20.4% | 11% | 6% | 3% | ARS 173 — $0.5 (to labor risk insurance)

ARS 37.21 — $0.1 (to the life insurance) |

3% (to social services) |

Capital Gains Tax

Capital gains are generally taxed as income under Argentina’s progressive Corporate Income Tax (CIT) system, with 25% to 35% variable rates. However, Argentine residents are liable for a tax of 15% on gains arising from the sale of shares, bonds, and other securities not listed on a stock exchange or authorized for the public.

Value-Added Tax (VAT)

All transactions that involve goods or services in Argentina are subject to VAT, a standard rate of which is 21% unless specifically exempted. Legal entities that carry out export operations to the promoted activities are exempted from VAT withholdings and additional withholdings.

Is There a Better Option than Nearshoring Software Development to Argentina?

There are different ways to team up with talented Argentinian developers, the most common of which include:

Freelance Powerhouse

If you need to get some small tech tasks or projects done, you might consider hiring remote Argentinian developers on a freelance basis. This offers flexibility and on-demand expertise and suits quite well for short-term needs. However, it might not be sufficient for tech companies eager to create a whole new product with advanced features.

IT outsourcing companies

Cooperation with an Argentinian software development outsourcing vendor means this company takes responsibility for project outcomes and quality. Such nearshore software development companies in Argentina independently manage the development process from A to Z. Thus, it leaves you very minimal control over the team and development, which often leads to unexpected results. Another concern is the poor dedication of outsourced developers as they do not engage in projects long-term and might even handle multiple projects simultaneously. Nearshore outsourcing in Argentina also has more significant risks of data exposure as you entrust your sensitive information to a third party that will also own the intellectual property of your project until you make sure it’s transferred to you.

IT recruitment agencies

Tech hiring agencies will pre-screen, interview, and present you with qualified software engineers based on your needs to let you focus on other strategic tasks. The best are those who specialize in the IT industry and know the ins and outs of hiring software developers. Also, such an agency should have transparent client feedback on independent review sites and possess real cooperation cases. Sometimes, if you opt for cooperation with IT recruiters in Argentina or any other LATAM location, you might miss an opportunity to build your company’s employer branding since not all these agencies offer this service. Also, they may not help you with other operational functions, which would have made your nearshoring journey to Argentina a breeze.

But there’s also one more solution.

R&D Center Model

The R&D center combines the perks of IT recruitment while ensuring comprehensive payroll, legal support, and furnished office space in a selected location. Technically, it allows you to establish your own branch abroad with the Employer of Record, legal compliance, employer branding, and other back-office support. Still, it might be pricy for non-tech or micro businesses.

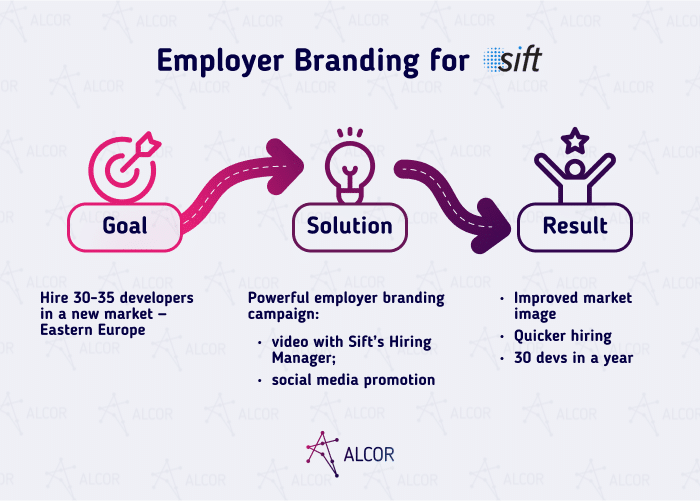

That is precisely what Sift, a leading USA-based tech product company that produces online fraud detection and management solutions using machine learning and AI, went for and reached out to Alcor.

To expand their global presence, they set out to hire around 30 top-tier tech specialists. To achieve this, we engaged 10 IT researchers, 3 recruiters, and an account manager who hired 20 developers in the client’s team in just 1,5 years. Our impactful employer branding campaign, the result of which was a video with a Hiring Manager, boosted the recruitment pipeline and further positioned Sift as the top choice for candidates. Additionally, we provided legal and compliance support, handled procurements, and helped the client highlight the importance of stock options to their prospective employees.

Nearshoring Software Development to Argentina Can be Easier with Alcor

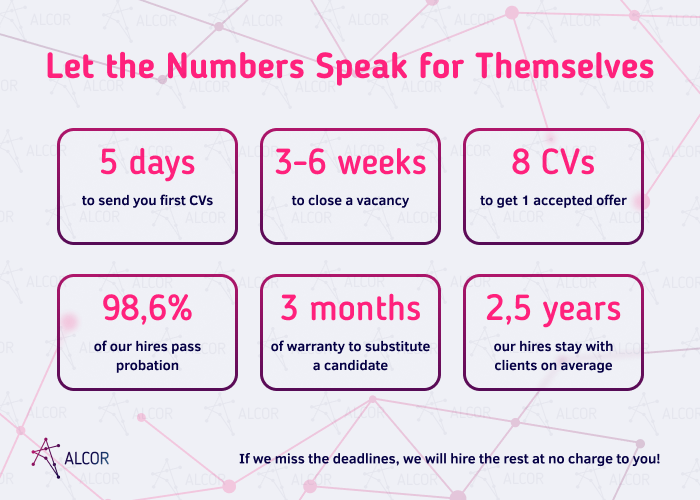

Whether you are looking for full-cycle IT recruitment or a complete R&D center solution, our team of 40 IT recruiters, deeply embedded in local markets, can help you hire developers in Argentina — 5 in just 1 month. In LatAm, we also help nearshore software development to Uruguay, Mexico, Colombia, and Chile. Our commitment to quality speaks volumes:

- 80% of CVs are approved by clients;

- 98,6% of our candidates successfully pass the probation period;

- Our hires stay with clients for 2,5 years on average.

Our solution includes operational support, such as the employer of record, legal and compliance, employer branding, equipment procurement management, office lease, and IT infrastructure setup. If we miss the deadline, we’ll hire the rest of your team at no cost. Plus, you will get a 3-month warranty to replace any candidate. Our clients like Ledger, People.ai, Globality, Dotmatics, ThredUP, and many others have already benefitted from our services. Want the same for your business? We’re here for you.

profile

profile

Contact Us

Contact us to receive a free analysis of your positions!

It includes the salary ranges and availability of the requested developers in Poland, Romania, and other countries in EE (as well as time-to-hire metrics and other KPIs for your case).