The Latin American IT Services market will gain more than $500 million by 2028. While that testifies to its continuous development, Deloitte states that 87% of software industry firms are considering nearshoring. To where? Well, you’ve already put two and two together!

I’m David Gomez, Alcor’s Lead Recruiter in LATAM. We help tech businesses scale fast and for good by providing Tech Recruitment & EoR services, plus offer an R&D center in Mexico, Colombia, Chile, Uruguay, and Argentina.

In this article, I’ll share crucial stats on the dynamics of the ITSM market in Latin America, delve into its most prospective sectors, outline the opportunities & threats of the Latin American software industry, and list top-tier LATAM destinations for running your IT business. Let’s kick it off with…

Latin American ITSM Market Dynamics

The ITSM market in LatAm has shown unparalleled growth in the years following the global pandemic. Why is that so? First, thanks to the IT market FDI surge in Latin America and the Caribbean. Its skyrocketing 56% CAGR naturally drove the demand. In 2022, the region received $224.5 billion in FDI, according to ECLAC’s report, overtaking the previous year by 55.2% and hitting the highest value recorded. Brazil led the pack and reached the global top 5, followed by Mexico, Chile, Colombia, Argentina, and Peru. In addition, LAVCA’s 2024 report confirmed an upward trend for VC funding. In 2023, LATAM startups attracted $2.1 billion of funds, surpassed only by the previous two years.

The second factor propelling the IT Services market in LatAm forward is its quick adoption of innovative information technology. LATAM countries rely on digital business transformation and the implementation of DevOps, which contribute to further IT market acceleration. This can’t go unnoticed by tech giants, resulting in 5 leaders in the Latin American ITSM market: Amazon, Cisco, Google, IBM, and Microsoft. At the onset of 2022, Cisco strengthened its telco cloud services presence by signing a deal with Rakuten. Dell also expanded to Latin America by launching two data centers, and the tendency is ongoing.

Such developments spur optimistic IT market predictions. For the forecast period of 2024-2029, the IT market size is expected to grow at a CAGR of 7%, demonstrating medium market concentration. The IT Services market is further segmented by type, end-user, and country. For instance, Healthcare, Retail & Consumer Goods fall into the second category, while IT Outsourcing, IT Consulting & Implementation, and BPO services represent the first sector of this IT industry. In the next section, I’ll outline the trendy software industry spheres revolutionizing the IT Services market in Latin America, such as AI, Fintech, and Healthtech.

Latin American IT Industry Trends

The end-user IT industry of the Latin American IT sector directly depends on the introduction of AI, cloud computing, and blockchain technology. It’s precisely the factor responsible for ensuring the subsequent advancement of software development in LatAm. How do these IT industry sectors look now?

Fintech

By 2025, Latin America will have 484 million mobile phone users, with 87% able to access the Internet. The IMF’s analysis states that IT market infrastructure improvements contributed to the boom of the LATAM fintech software industry. Brazil and Mexico dominate the fintech IT market, with Colombia, Argentina, and Chile following closely. Currently, Latin American fintech software industry companies number at least 2,482 and represent 22% of the global fintech landscape. That’s not all: Statista estimates that in 2023, LatAm was home to 11,000 fintech startups.

According to the International Monetary Fund, the verticals with the highest development potential for this tech industry, comprise Digital Banks, Digital Payments, Alternative Finance, Insurtech, and Bigtech. Meanwhile, the investment bank Goldman Sachs considers the sectors of loans, personal finance, and insurance to be the most promising ones in the fintech IT market.

Discover how Colombia and Brazil stack up in fintech and gain other valuable insights by comparing Colombia vs Brazil for tech nearshoring!

Artificial Intelligence

Statista confirms: Latin America’s IT market doesn’t lag behind in embracing AI. Not only did the region rake in more than $3 million in funds for AI-based startups in the fourth quarter of 2023, but it also considers the future of its adoption. For instance, the share of software industry companies implementing AI soared from 58% to 71% in 2020-2023.

The region also spots emerging key players through the Latin American AI Index ranking: Chile’s IT industry scored the highest, followed by Brazil and Uruguay. The region’s government knows that AI IT market development may contribute 5.4% to LATAM’s GDP. The stakes are high, leading to an increased focus on preparing AI-savvy software developers from Latin America to beef up IT services.

Healthtech

Healthtech reflects the grand trend of the Latin American IT industry, which has also sped up due to the pandemic. In 2021, this sphere of the IT market bounced back after COVID-19 and raised more than $1B in VC funding. The Digital Health market is expected to show a revenue of $6.56 billion in 2024 and reach $8.9 billion in 2028.

In 2023, Brazil and Mexico led the healthcare startup technology in Latin America. The former hosted 40% of healthtech startups, and the latter housed 38%, respectively. Chile, Argentina, and Colombia came next, with 20% of healthtech IT market firms each.

LATAM IT Market Opportunities and Threats

Pro: Profitable Investment & IT Market Growth

While IT Services make up a significant share of the IT market in Latin America, let’s consider the bigger picture of the LATAM software development industry. In 2022, for instance, the LATAM IT Market generated $18.6 billion. Besides, the CAGR rate of 6.5% speaks of stable growth from 2019 to 2029. But what attests to the breakthrough tech industry more than startups? Dealroom singles out the LATAM startup ecosystem as home to over 9,000 funded startups, which totaled nearly $4B in VC investment in 2023. Unicorns? Sixty in the LATAM IT industry and counting!

Pro: Prime Code by Skilled Talent

The Latin American talent pool includes as many as 1.75 million talented devs. Following the latest IT market trends in AI, fintech, and cloud, 30 regional universities have broadened their scope of services and made it to the 2024 QS World University Rankings. For now, students perform best in tech (75%) and data science (69%), according to Coursera’s 2023 report. Bloomberg sums it up: regarding software industry tech skills, the top five are Mexico, Argentina, Chile, Brazil, and Peru. Isn’t that encouraging for the IT market in LatAm? For more details, read on to our section about IT market destinations!

Level up your tech product with prowess of software developers from Argentina!

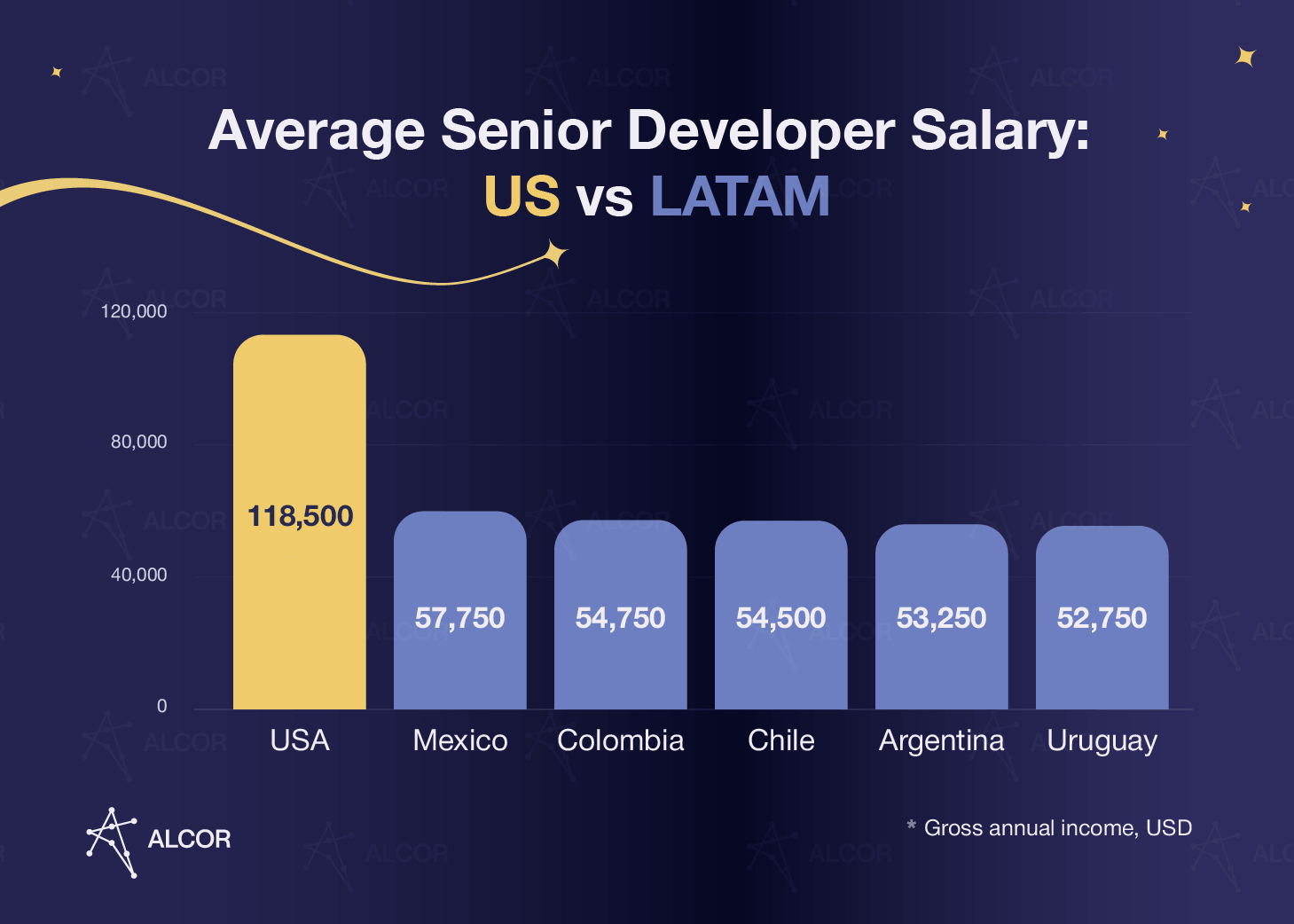

Pro: 3 Times Lower Costs

Latin American software engineers boast deep tech expertise; at the same time, they tend to earn less than their US IT Market counterparts for the same services. Look at the picture below to see the comparison between LATAM annual salaries and the US ones:

Con: Cybersecurity Threatscape

Cyberattacks are the main pitfall of IT outsourcing to the Latin American tech market. The saying goes: if you outsource to Latin America, safeguard your data. In 2023, for instance, there were 1,498 ransomware attacks targeted at the LATAM region. Still, the good news is that regional governments are ready to face the issue. After harsh cyber threats on their IT industry, Colombia and Chile created cybersecurity agencies, while Brazil established the National Cybersecurity Policy & Committee, FTI Communications reports. While Latin America is building up its IT Market cyberattack resilience, my tip is to nearshore wisely and avoid sharing your core product data.

Con: Legal Complications

Undeniably, the Latin American software development industry is a tech-scaling magnet. However, legal matters in this IT market do pose a challenge. Issues may arise in the tax, employment, accounting, and payroll areas:

- Mexico is renowned for its pro-employee policy. When employing coders, you should know that they might have a 48-hour workweek, are entitled to a 2x salary for overtime, and have 8 annual paid public holidays and 12 days of paid vacation guaranteed after one year of work.

- Regarding software developers in Chile for hire, the company must give a notice prior to termination. Also, if you employ more than 25 programmers, 85% of them should be of Chilean nationality;

- Colombia has no treaty with the US to prevent double taxation. Hence, cooperation with a local provider of EOR in Latin America is a must.

What can a seasoned provider do? Take the case of Ledger. This French online cryptocurrency wallet company encountered the challenge of double IT market legislation when planning its foreign expansion. With a goal of a development hub of 20 QA engineers abroad, they reached out to Alcor. We did our best and provided “wow” services: 5 outstanding QA specialists in just 2 weeks and 27 hires in total, plus full legal compliance and IT security for both home and foreign offices.

So, my tip is to aim for a Latin American IT staffing services provider with significant experience in the IT market and software industry legal aspects.

Top Latin American IT Destinations

What’s a better way of breaking down LATAM’s software industry than looking at key players in its software development market? Let’s see the main IT market stats:

Mexico

- Talent pool: 700,000;

- IT businesses: 400 tech businesses and 450 startups;

- Tech hubs: Mexico City, Monterrey, Guadalajara, and Mérida;

- Leading industries: mobile development and fintech;

- Most-prized tech skills: JavaScript, Java, Python, SQL, and C++;

- English proficiency: 19th in LatAm;

- The average annual salary in tech: $40,050.

- Delve deeper into nearshore software outsourcing to Mexico!

Argentina

- Talent pool: 115,000;

- IT businesses: 3,800 tech businesses and 1,107 startups;

- Tech hubs: Buenos Aires and Córdoba;

- Leading industries: database and mobile development;

- Most-prized tech skills: Python, TensorFlow, SQL, NLP, R, and Cloud APIs;

- English proficiency: 1st in LatAm;

- The average annual salary in tech: $35,500.

- Discover the pros of nearshore software outsourcing to Argentina!

Chile

- Talent pool: 61,000;

- IT businesses: 200 tech businesses and 303 startups;

- Tech hubs: Santiago, Valparaíso, and Concepción;

- Leading industries: data science, data analytics, and statistical programming;

- Most-prized tech skills: Java, Python, Node.js, Perl, PHP, and ASP.NET;

- English proficiency: 10th in LatAm;

- The average annual salary in tech: $37,870.

Colombia

- Talent pool: 150,000;

- IT businesses: 11,000 tech businesses and 1,300 startups;

- Tech hubs: Bogotá and Medellín;

- Leading industries: startup programming;

- Most-prized tech skills: HTML/CSS, JavaScript, Python, Ruby, and SQL;

- English proficiency: 17th in LatAm;

- The average annual salary in tech: $37,500.

Learn more about Colombia vs Costa Rica for nearshore technology outsourcing to make the right choice!

Uruguay

- Talent pool: 21,000;

- IT businesses: 530 tech businesses and 1,010 startups;

- Tech hubs: Montevideo;

- Leading industries: AI tech;

- Most-prized tech skills: JavaScript languages and frameworks;

- English proficiency: 4th in LatAm;

- The average annual salary in tech: $34,840.

Curious about LATAM powerhouses? Uncover the differences by comparing Colombia vs Uruguay for technology nearshoring!

Your Own Software Development from 0 to 100 in a year in LatAm

Alcor is your reliable scaling provider in the LATAM and EE IT market. We provide a 360-degree R&D center service that covers 9 locations, including Mexico, Chile, Colombia, Argentina, Uruguay, Poland, Romania, Bulgaria, and Ukraine.

What sets our services apart? First, it’s recruitment expertise: our team of 40 headhunters spots tech IT industry gems within 2-6 weeks and hires developers from Mexico and other LATAM countries. Next, we combine Tech Recruitment & EoR: no need to establish a legal entity, and we cover HR & payroll for you. Finally, our R&D center services include office lease, equipment procurement, and IT infrastructure setup.

Our software industry track record speaks for itself: 100% of Alcor’s clients – Sift, Dotmatics, Grammarly, and others – continued cooperation in 2023, while 98% of our talents pass the probation period. You get exceptional service with no buy-out fees; the team is yours from the start! Ready to discuss your tech vacancies? We’re a click away!