Despite massive layoffs, the US IT market is experiencing a boom, with over 400,000 active job postings. But here’s the kicker — about 117,000 are just sitting there, unfilled! According to Gartner, the struggle to find and retain skilled IT talent will persist.

So, what’s to do? Go nearshoring! And Colombia might be the ideal destination you’ve been looking for.

I’m David Gomez, Lead IT Recruiter in LATAM at Alcor. We provide a software R&D center solution that encompasses IT recruitment in Latin America and Eastern Europe, Employer of Record services, and comprehensive operational support — everything needed to build top teams from 0 to 100 developers for US tech companies within a year.

With over 7 years of experience hiring Latin American developers, I’m here to share insights into the technology industry in Colombia and explore its emerging trends and nearshoring benefits. As a cherry on top, I’ll also present you with a workable approach to scaling your development team with Colombian coders. So, let’s get started!

Colombia IT Industry Overview

One of the sparkling gems of the Latin American region is undoubtedly the IT industry in Colombia. It’s a vivid example of the ITSM market in Latin America that has been steadily evolving and showing stable year-on-year growth. Since 2010, the Colombian tech industry has seen a cumulative growth of 24.5%, contributing almost 3% to the country’s GDP. No wonder it’s ranked as the fourth-largest IT market in the region, right after Brazil, Mexico, and Argentina. And guess what? It’s not slowing down, with a predicted CAGR of 13.63% to soar past $35 billion by 2027.

Talking exports, the technology industry in Colombia has been on the rise, with a 4.7% increase from 2016 to 2021, reaching $299 million. The demand for tech services is sky-high in sectors like fintech, healthtech, agritech, oil and gas, and energy and telecommunications. Some of the main consumers of Colombian information technology services are the United States, Mexico, Costa Rica, Uruguay, and Spain. Meanwhile, the locals are stepping up their game too, with applications development and system infrastructure software topping the charts in IT spending.

The startup ecosystem of the Colombian tech sector also delights with bright colors of success thanks to multiple initiatives supporting entrepreneurship and increased investment. StartupBlink ranks Colombia 3rd in South America and 40th globally for its startup scene. There are a total of 1,327 startup companies in the country, with the majority being in the fintech (15.3%), retailtech (8.1%), and healthtech (7%) sectors. Among the stars are Rappi, ADDI, Bold, Platzi, Habi, and LaHaus. Colombia’s also a birthplace of top tech hubs of Latin America: Bogotá is the place for startups, hosting over 60% of them, followed by Medellin with 21%, and Cali with 8%.

If nearshoring to Colombia, power up your dev team via IT recruitment in Medellin!

Nearshoring to Colombia — a Trend?

According to Business Insider, about 75% of US companies turn to nearshoring to Latin America, and the yearly hiring of developers from this region has surged by 50%. These numbers paint a clear picture: IT outsourcing to Latin America, especially Colombia, is a hot trend among US tech firms looking to expand their business capabilities.

Colombia’s IT outsourcing sector is experiencing rapid growth as one of the go-to destinations for software development nearshoring. Projections indicate that its revenue will surpass $2 billion in 2024. The technology sector in Colombia boasts over 11,100 companies, with about 400 specializing in outsourcing. They excel in custom software development, mobile app and web development, technology consulting, and team augmentation services.

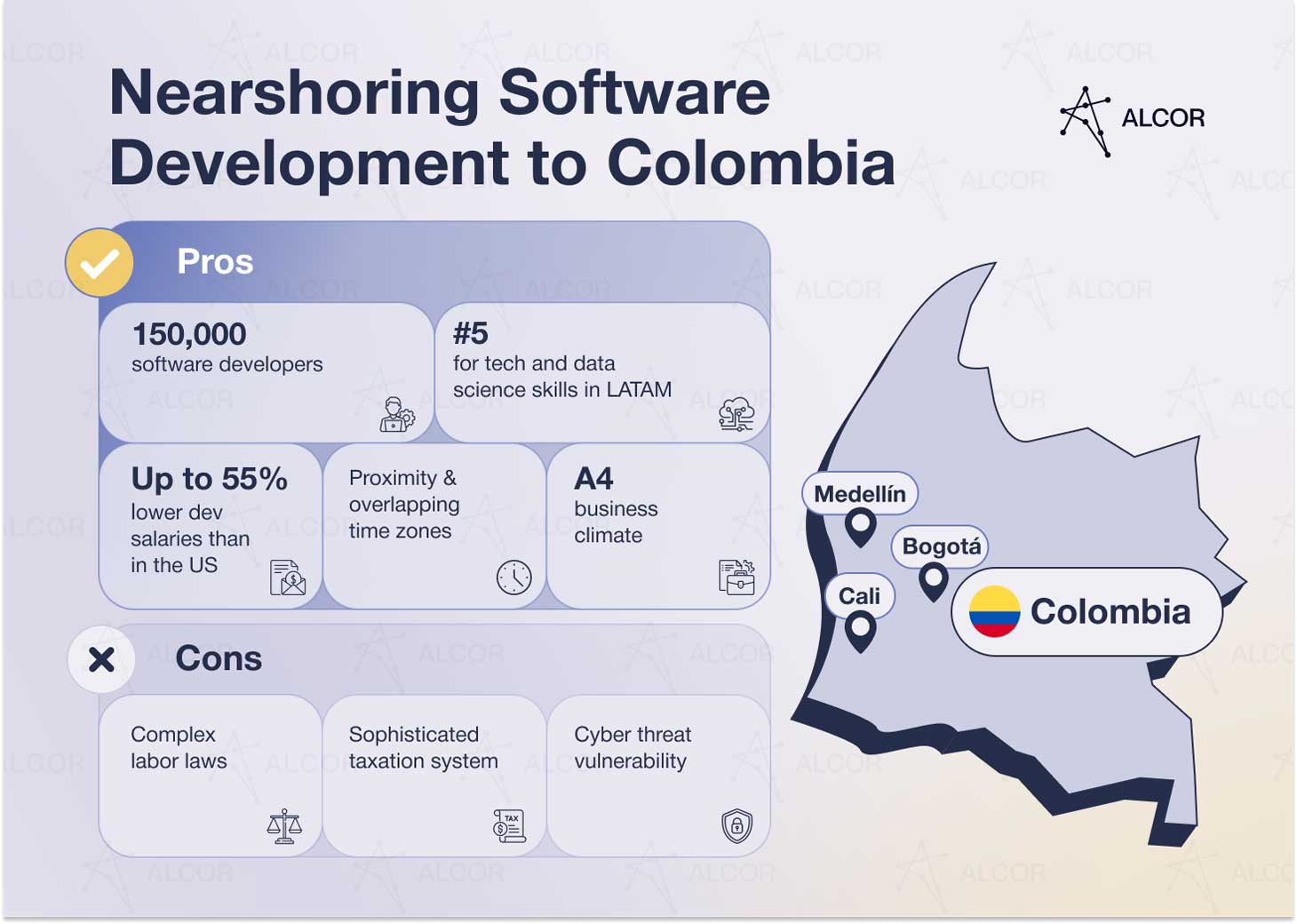

So, what are the pros and cons of nearshore outsourcing to Colombia? Take a sneak peek at the picture below to find out.

Realizing the benefits of the information technology market in Colombia, lots of foreign tech businesses are tapping into its potential. Among the leading US tech companies engaged in software development in Colombia are Google, Microsoft, Amazon, IBM, and Oracle, each with dedicated teams of software engineers. Dive into the next chapter to explore a practical solution for assembling software development teams in Colombia.

Compare Colombia vs Argentina for nearshore technology outsourcing andColombia vs Peru for nearshoring!

Software Team from 0 to 100 — Possible?

Yes, if you opt for Alcor’s unique solution for building software R&D centers. It’s explicitly devised for tech product businesses seeking ways to expand in countries (like Colombia) with high talent availability and up to 60% lower rates.

So, what does this comprehensive solution include?

IT Recruitment

Our 40 IT recruiters provide a full-cycle tech recruitment that includes:

- composing ideal candidate profiles and attractive EVP;

- sourcing, headhunting, and pre-screening candidates;

- conducting HR interviews;

- providing weekly reports;

- managing job offers and working with counteroffers;

- consulting you on the region’s salaries, talent availability, and overall tech hiring landscape.

With our dedication to closing one vacancy in 2-6 weeks, we guarantee only high-quality candidates, as clients approve 80% of our candidates. Moreover, 98,6% of our hires successfully pass probation and stay with clients for an average of 2,5 years.

Check out Colombian developers’ salaries to know how much you can save!

Employer of Record

You don’t need to establish a legal entity abroad with Alcor’s comprehensive Employer of Record in Colombia. Plus, we take all the administrative burden off your shoulders:

- employment of software developers;

- compliance with all local laws;

- tax payments;

- onboarding/offboarding;

- payroll in Colombia;

- employee benefits coverage.

In case of a fine because of our mistake, we provide 100% compensation.

Full Operational Support

As part of our R&D solution, you can also get additional services:

- your employer’s brand promotion in the local market;

- hardware procurement for your development team;

- office lease, plus negotiations of the best price and contract terms;

- insurance assistance;

- background verification;

- legal services (stock options plans (SOP), migration services);

- visa support;

- IT support.

Plus, we allocate a dedicated account manager to guide you through the expansion journey. You’ll enjoy our pay-as-you-go approach, keeping all expenses under your control.

Tech Trends in Colombia for 2024-2030

Digital Transformation

Since 2010, Colombia has been on a digitalization path spurred by the “Vive Digital” initiative. It aimed to expand internet access, digital literacy, and modern infrastructure nationwide. Consequently, the percentage of internet users in Colombia surged from 38% in 2014 to over 69%, with 48.9 million internet connections identified in 2022. Notably, Colombia now ranks among the top 70 countries in the Global Innovation Index 2023.

To keep the momentum going, the government rolled out the “National Digital Strategy” and “National Development Plan.” They aim to further promote the digitalization of the Colombian technology industry, especially in sectors like education, healthcare, government services, and the economy. The main goals are achieving 100% internet access, implementing modern regulatory frameworks, and ensuring a secure digital environment. One standout result of these efforts is the Cédula Digital, an ID app that simplifies identity verification and public service usage.

In the business realm, programs like “Colombia 4.0” and “Digital Business Development” have bolstered digital entrepreneurship through funding schemes, incubators, accelerators, and networking events. Thanks to them, Colombia has already emerged as a leading player in the digital landscape of Latin America and the Caribbean, hosting 12.8% of the region’s technological companies.

Cloud Technologies Adoption

With Colombian businesses adopting new technologies and the need for online operations skyrocketing, cloud computing is the name of the game. No wonder Colombia ranks among LATAM’s top three spenders on cloud computing.

The impact of public cloud adoption is massive, as it’s injecting about $17.3 billion into the national GDP and producing a staggering $30.6 billion in economic output. The Colombian Department of Labor has rolled out IT training initiatives to maintain the pace. For instance, the National Training Service (SENA), in collaboration with AWS, aims to train 10,000 students in cloud technology and IT in Colombia. Meanwhile, another leading cloud provider, Oracle, announced the opening of an Oracle Cloud Region in Bogotá. It will turbocharge the Colombian technology industry’s digitalization, spark innovation, and modernize local companies.

State of Different IT Sectors in Colombia

AI

Colombia sees endless potential in AI technology, unleashing its potential across various sectors like healthcare, finance, agriculture, defense, and beyond. The country’s AI market is set to skyrocket to $1,2 million in 2024, growing at a CAGR of 14.56%.

To keep up this momentum, the Colombian government is tackling key issues on multiple fronts, from policy to education to entrepreneurship. They already published a set of policy initiatives, including the AI strategy, the first-ever AI ethics framework in the region, and an international AI council.

But that’s not all. Colombia’s MinTIC is doubling by investing over $25 million in constructing two “AI Centers for Excellence” in Bogota and Zipaquira. These centers will be hotbeds of research and development, focusing on everything from data analytics and cloud computing to robotics and quantum technologies and fostering tech education.

Speaking of talent, Microsoft is launching its AI Laboratory in Colombia. With plans to train over 1,200 AI experts in the next three years, this initiative is expected to fuel businesses throughout the country. Currently, the tech industry in Colombia is buzzing with about 165 AI startups, including Wipro, Treble.ai, DataGran, Datawifi, and Kite.

Find out more by comparing Colombia vs Mexico for nearshore technology outsourcing or Colombia vs Brazil for nearshore tech outsourcing!

Fintech

Colombia stands out as the third-largest fintech hub in Latin America, with its industry soaring at a staggering 120% growth rate annually. According to Finnovista, Colombia boasted a robust 369 fintech startups in 2023, with numbers climbing steadily at an average rate of 19.7% per year since 2019.

With a whopping $1 billion attracted into the industry over the past three years, Colombia’s “fintech adoption” rate is now one of the highest in LATAM. 76% of its population uses fintech services, while the percentage of adults holding a banking product rose from 55% to over 90%.

Behind these impressive achievements lies the government’s dedication to fostering fintech businesses to promote financial inclusion in the country. They’ve established agencies like Innpulsa to train entrepreneurs and simplify the business startup process. Moreover, the government is championing a transparent financial ecosystem, exploring initiatives like bank account portability and launching an instant payment system by 2024.

Blockchain & Cryptocurrency

With economic instability and a population’s limited access to banking services, blockchain and cryptocurrency technologies have emerged as game-changers in Colombia. Here are some groundbreaking developments:

- Land registration. The Colombian National Registry and blockchain company RSK have introduced the “Registro de Propiedad” platform. Harnessing blockchain, this platform records and verifies property transactions, enhancing transparency and security.

- Payment system upgrade. Colombia’s Central Bank created an initiative to incorporate blockchain, aiming to streamline cross-border payments, cut costs and reduce processing time.

- Medicine logistics. The Ministry of Health launched a blockchain platform to track medicines from the manufacturer to the consumer, reducing the risk of counterfeit drugs entering the market.

With over 2.5 million Colombians already holding cryptocurrency, blockchain and digital currencies are increasingly viewed as alternatives for wealth preservation. As adoption rates soar and more blockchain companies establish a presence in Colombia, the cryptocurrency market revenue is forecasted to hit nearly $54 million by 2024.

Healthtech

Access to healthcare has long been a pressing issue in Colombia, worsened by the global pandemic. With only half of the population accessing medical services effectively, the need for technological innovation in the national healthcare system has become more urgent than ever.

Telemedicine is leading the charge in transforming healthcare accessibility, particularly for rural areas. Colombian healthtech startup doc-doc is one of the prominent players in the market, aiming to create Latin America’s largest virtual hospital. With a hefty $1 million investment, doc-doc is already making waves and transforming lives.

Colombia’s healthtech landscape is buzzing with innovation. It boasts a robust ecosystem of 93 startups—a solid 7% of the country’s startup environment. Among the standout players are 1Doc3, SaludTools, and LentesPlus.

Beyond telemedicine, integrating electronic health records, mobile health apps, and healthcare analytics are reshaping Colombia’s healthcare sector, making it more efficient and personalized.

Cybersecurity

Colombia is among the top 5 countries in Latin America susceptible to cybersecurity attacks. Only last year, Colombia suffered a massive cyberattack, affecting 34 Colombian entities and 762 LATAM companies.

The Colombian government has implemented stringent laws and regulations to bolster the country’s resilience against cyber threats. The Law on Data Protection regulates personal data collection, processing, and storage, aiming to enhance privacy and security. The Ministry of ICT has also introduced a draft Decree to establish a governance structure focused on digital and cybersecurity. Additionally, creating a Cyber Police unit underscores the government’s commitment to investigating cybercrimes and apprehending perpetrators.

Local IT companies are encouraged to contribute to cybersecurity innovations, further fortifying Colombia’s defenses against cyber threats. Consequently, the cybersecurity market in Colombia is estimated to reach $1.03 billion in 2024, with a projected CAGR of 11.12% over the next five years.

Tech industry in Colombia vs USA

About one-third of the global information technology market, which constituted $8852.41 billion in 2023, is in the United States, making it the largest tech market in the world. The country boasts a whopping 582,000 tech businesses that employ over 9 million people — a drastic technology market difference between the US and Colombia.

The US market for IT services is much bigger than the Colombian one, with a revenue of $454 billion in 2023. The local vendors mainly offer digital transformation services, with key players being IBM, Accenture, DXC, and Cognizant Source.

When it comes to tech industry trends, the US and IT sector in Colombia are quite on the same page. The US tech industry is rapidly adopting cloud computing for saving money and resources on information storage and artificial intelligence, particularly in the field of healthcare. Among other burning trends are integration of business intelligence, data security and privacy protection, 5G technology, Blockchain, and AR.

What about Colombia vs Uruguay for nearshore technology outsourcing? Discover their differences!

Regarding tech talent, the technology market in the US, compared to Colombia, is like night and day. The former is home to over 4 million IT experts, with about 1.7 million of them being software developers. The US talent market has been on a wild talent rollercoaster since the pandemic hit, experiencing mass layoffs. Fortunately, recent market analysis forecasts for this turbulent trend to slow down, which will drive more IT companies to outsource software development to Colombia and other LATAM countries. But wait, here is a better solution for you.

We Build Turnkey R&D Centers in Latin America & Eastern Europe

Alcor offers a refreshing alternative to traditional IT outsourcing and outstaffing. Instead of leasing software developers, we hire them in your team, eliminating buy-out fees, hidden costs, rate cards, and common risks associated with outsourcing practices. We help nearshore technology to Uruguay, Mexico, and Chile, hire software developers from Colombia, Poland, Ukraine, Romania, and even provide IT recruitment services in Argentina. Our R&D center solution also includes EOR for tech and operational support, ensuring a smooth expansion of your innovative business.

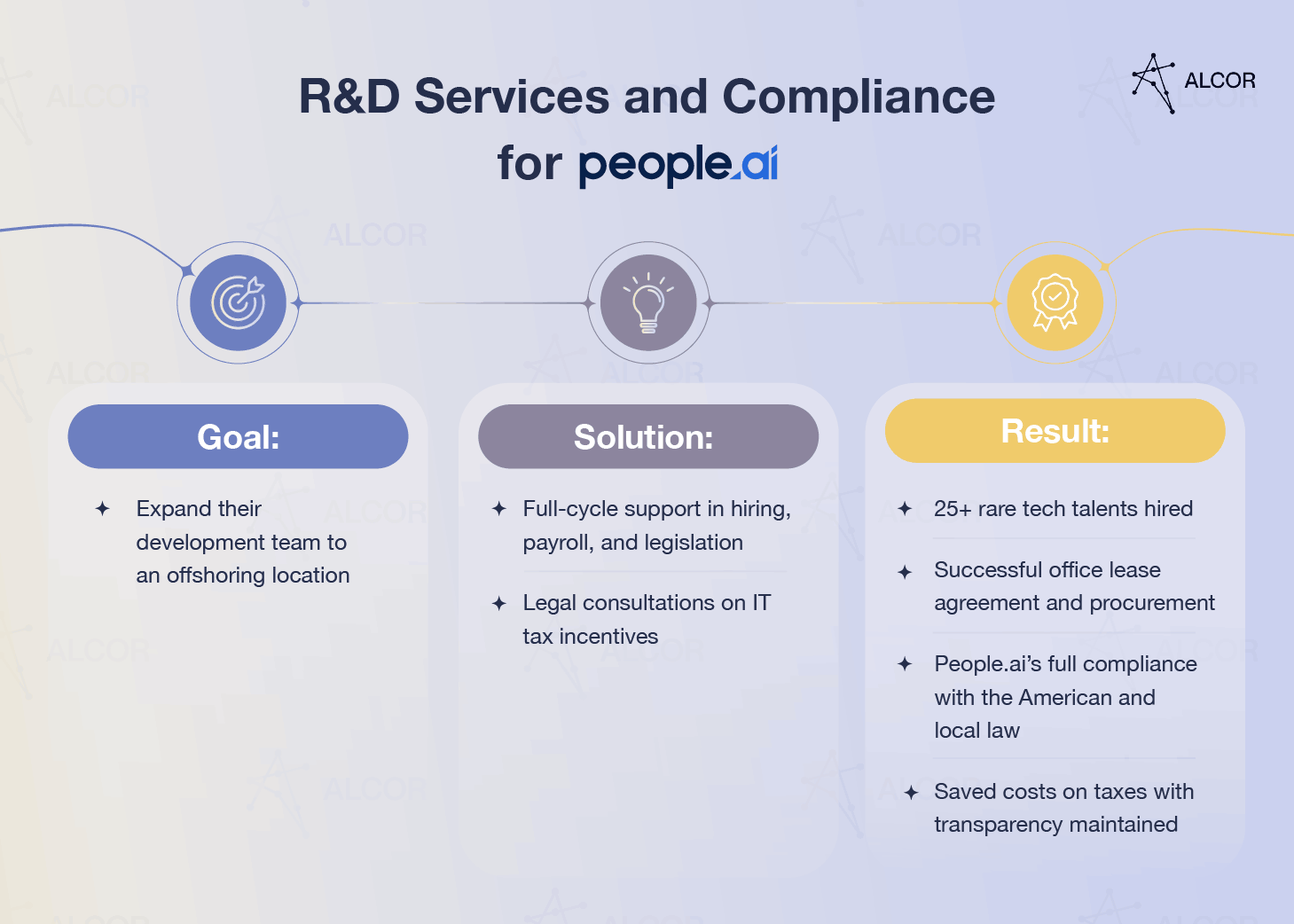

Discover how this solution worked for a similar tech company to yours:

When expanding abroad, the US-based IT company People.ai decided to hire EE software engineers for balanced price-to-quality reasons. For IT recruitment and further R&D center establishment, they turned to Alcor. Within just a month, our team performed a whole spectrum of operational and EOR services, from legal compliance and payroll to office leasing and hardware procurement to set up a fully functioning R&D office. On top of that, we hired 25 software developers who perfectly matched the requirements of our client.

Achieve comparable results as People.ai, Dotmatics, ThredUp, BigCommerce, and other tech companies via your own R&D hub in LATAM or Eastern Europe!