Made with

The Latin American IT market has been a go-to choice for software development for a while now. Many tech companies, including Google, IBM, Uber, and others, have already found success in this vibrant region. One of the countries that stands out as a frontier of software engineering activities in LatAm is Argentina. So, what does the software development industry in this country have in store for your business?

I’m Sergiy Ovcharenko, CBDO at Alcor, with in-depth expertise in offshore development models and tech product business structuring in Latin America and Eastern Europe. Alcor assists product tech companies in establishing their own R&D centers and IT recruiting in Argentina, as well as other LatAm & Eastern European countries.

In this article, I’ll take you on a tour of the IT industry in Argentina, share insights about its key segments & upcoming trends, and compare the legal intricacies of running a tech business in Argentina and the US.

Argentina’s IT Industry: General Overview

The Argentinian technology industry thrives, fueled by innovation and a dynamic spirit. As the third-largest IT market in Latin America, with a current value of $11 billion, it yields ground only to Brazil and Mexico. The forecast for the near future is exceptionally promising — the IT market in Argentina is set for robust expansion with an 8.3% CAGR from 2022 to 2027. This will add a noteworthy $6.6 million to its overall value.

The country also stands out for its ripe startup scene. In 2023, Argentina ranks 4th in the region in the Global Startup Ecosystem Index and is considered one of the best countries to set up a startup in South America. The lion’s share of them is in the capital, Buenos Aires, and equals 293, followed by Córdoba with 192, and an additional 37 distributed among Rio Cuarto, Mendoza, and Rosario. Interestingly, Argentina proudly hosts 11 of the 34 unicorns within the Latin American arena. Among the most prominent are Globant, MercardoLibre, Despegar, and others.

But that’s far from everything the technology industry in Argentina can boast of. The local talent pool, boasting over 100,000 software developers, is set to expand to around 130,000 IT specialists this year with the annual addition of ICT graduates. Notably, Argentinian tech experts excel in Python, TensorFlow, Cloud APIs, SQL, R, and NLP. In addition to solid programming skills, Argentinian tech talents are #1 in Latin America and 28th globally in terms of English proficiency.

IT Services Market in Argentina

It’s worth mentioning that Argentina boasts a thriving IT services market, which makes the country a popular outsourcing destination among Western tech companies. It’s set to see continuous growth, with an expected total tech services revenue boost of $4.5 billion from 2023 to 2028.

As of December 2023, there are approximately 300 IT services companies in the country that offer custom software development solutions, mobile and web development, and BI & Big Data consulting. Most of them are located in the leading IT hubs:

- Buenos Aires. The biggest tech powerhouse in the country, Buenos Aires, hosts over 85% of the Argentinian talent pool, which makes it a frequent location for getting IT staff augmenation services. Moreover, the capital boasts a thriving business climate and hosts offices of global tech giants such as Microsoft, Dell, Amazon, Meta, and others. Buenos Aires also has diverse parks and centers, including AreaTres, Startup Buenos Aires, Palermo Valley, and Catalinas Norte Technology Park.

- Córdoba. While not as large as Buenos Aires, Córdoba contributes notably to the country’s tech landscape thanks to its prestigious educational institutions. The National University of Córdoba, National Technological University, and Blas Pascal University stand out as top universities with STEM programs, annually adding around 27,000 tech graduates to the tech industry in Argentina.

Argentina’s IT Sector Overview by Segment

BFSI

The BFSI (Banking, Financial Services, and Insurance), one of the fastest-growing technology sectors in Argentina, has seen a steady growth trajectory since 2021, experiencing an annual increase of 11.5%. With an initial valuation of over $2,1 billion in 2017, it demonstrated sustained growth thereafter. Today, there is a notable peak in investment activities facilitated by Fintech companies in Argentina. The Central Bank of the Argentine Republic (BCRA) reveals in its Retail Payments Report that, from January to July 2023, balances invested through these platforms skyrocketed by a striking 183%.

Telecom

Argentina’s telecom sector is advancing with robust mobile growth and extensive LTE coverage. Following the introduction of 5G services in 2021 and plans for additional advancements in 2023, the future appears promising for continued progress. In 2025, around 5.7 million 5G connections will be in Argentina, and this number will likely grow to 34.7 million by 2030.

The government is diligently enhancing nationwide internet access while various fixed, mobile, and cable companies compete to boost and improve their services. Thus, the sector notched a substantial revenue of approximately $2.6 billion in 2022. Looking ahead, the Argentinian telecom market is set to expand, with an anticipated annual growth rate of 8.5% over the next five years.

Healthcare

Previously struggling with their healthcare systems, South American countries, including Argentina, are actively integrating Healthtech to reshape and modernize the delivery of medical services. Thus, the digital health market in Argentina is expected to demonstrate an annual growth rate (CAGR 2023-2028) of 7.71%, resulting in a projected market volume of US$1,2 million by 2028.

According to the HolonIQ LATAM Health Tech 50 report, the country makes up around 10% of HealthTech startups in the region. Some well-known examples include Pura Mente, a mobile app for meditation and mindfulness activities; DOC24, an online video consultation platform, OTTAA Project, among others.

IoT

The Internet of Things (IoT) sector in the Argentinian IT market is gaining momentum across industries like agriculture, manufacturing, healthcare, and smart cities. Anticipated to grow steadily from 2023 to 2028, the sector is expected to experience a substantial 102.5% increase in total revenue, reaching $7.6 billion.

Notably, Argentina has recently entered the market for satellite-supported IoT services in agriculture, launching its first pico-satellite through Innova Space. The satellite, launched from SpaceX at Cape Canaveral, symbolizes not only a technological achievement but also underscores Argentina’s proactive role in harnessing IoT for agricultural innovation.

Government

The information technology landscape in Argentina also presents unexpected facets, notably within the sphere of e-government initiatives.

In 2022, the country was recognized as having one of the world’s most advanced e-government developments, according to the UN E-Government Survey. At the forefront of this digital transformation is the city of Buenos Aires, which is spearheading innovative initiatives to modernize bureaucratic processes. In a groundbreaking move, the city integrates blockchain technology to enhance administrative efficiency.

This October, residents got access to their identification documents through a secure digital wallet. This blockchain platform will initially offer essential documents such as birth certificates, marriage certificates, income statements, and academic certificates.

Want to learn more about the tech potential of other LATAM countries? Check out the IT industry in Chile!

Tech Business in Argentina vs the USA

Legislation

The legal landscape for IT businesses in Argentina is governed by a robust framework that includes both general and specific laws. The Civil and Commercial Codes oversee contractual relations, the Commercial Companies Law guides company incorporation, the Fiscal Code establishes taxation rules, and the Intellectual Property Law regulates intellectual property protection, including software.

In contrast, the U.S. legal framework for the software industry is characterized by a complex interplay of federal and state laws. Contractual relations are primarily governed by the Uniform Commercial Code, while business incorporation is regulated at both federal and state levels.

Taxation

The Argentinian tax system is rather straightforward compared to the US one:

- Corporate Income Tax (CIT) ranges from 25% to 35%,

- Withholding Tax of 7% applies to dividends and fund transfers,

- Capital Gains Tax is levied at progressive rates from 25% to 35%,

- Value-Added Tax (VAT) at a standard rate of 21%.

For self-employed IT professionals, Personal Income Tax (PIT) ranges from 5% to 35%, and a 15% Capital Gains Tax applies to securities not listed on a stock exchange.

Interestingly, Law 27,506, active until December 31, 2029, offers tax incentives for IT activities, including a 60% CIT reduction for small companies, 40% for medium-sized, and 20% for large. Exemptions from VAT and withholdings are granted for export operations, and employers can receive fiscal credits for social security contributions, potentially increasing to 80% for specific hires.

Conversely, the U.S. tax system involves a federal corporate tax rate of 21%, with additional state taxes varying by jurisdiction. Dividends are taxed at individual rates, and capital gains follow a progressive structure. The U.S. does not have a national VAT, but states may impose sales taxes.

Accounting & Payroll

As a rule, employers in Argentina pay Social Security contributions (SSC) ranging from 24% to 26.4% of an employee’s monthly compensation. They include:

- 18%-20.4% for the Pension Fund

- 6% for Health Insurance

- and fixed amounts for labor risk and life insurance

Notably, there’s no maximum threshold for SSC payments.

Regarding employee taxes, a recent amendment to the Income Tax Law, effective January 1, 2024 (Law 27725), brings significant changes. Employees with a gross annual income below approximately $66,000 (180 times the minimum wage) are exempt from income tax, while those exceeding this threshold face a progressive tax rate ranging from 27% to 35%.

Importantly, top-management positions, including directors, CEOs, and managers, remain subject to the progressive tax rate, ranging from 5% to 35%, unaffected by the recent reform.

Apart from that, employee Social Security contributions include a fixed 17% rate:

- 11% for pension funds

- 3% for health insurance

- and 3% for social services.

On the other hand, the United States has a complex personal income tax system featuring federal rates between 10% and 37%. State rates, such as California’s high 13.3%, add another layer of intricacy. Businesses and individuals must grapple with social security contributions (SSC), with both parties contributing 6.2%, totaling 12.4%.

Here’s a table comprising key tax rates in both the US and Argentina:

| Taxes | USA** | Argentina |

| Corporate Income Tax | 21% | 25%-35% |

| Personal Income Tax | 10-37% | Exempt below $66,000* |

| Social Security Rate | 12.4% | 24%-26.4% for employers 17% for employees |

* Progressive rates above

* Only federal rates

Salaries

Last but not least, the salary rates differ significantly in Argentina and the US, just like tax regulations. For instance, Java developers in Argentina earn around $24,000 a year, while their counterparts from California get almost $100,000. Such a big difference in wages lures US-based businesses to hire software developers in Argentina because they can potentially save up to 4-5 times on labor costs. Imagine: you can get an entire offshore Salesforce development team thanks to the annual salaries that start from $10,000 a year! Just compare the remunerations for other positions in both IT markets:

| Senior Positions | Gross Annual Salary, USD | |

| Argentina | USA | |

| Full-Stack Developer | 40,000-60,000 | 128,000-150,000 |

| Front-End Engineer | 38,000-55,000 | 118,000-127,000 |

| Back-End Engineer | 40,000-60,000 | 125,000-151,000 |

| AI Developer | 33,000-66,000 | 73,000-93,000 |

| Game Developer | 38,000-54,000 | 100,000-140,000 |

| DevOps Engineer | 40,000-60,000 | 145,000-170,000 |

| Cloud Engineer | 35,000-60,000 | 140,000-169,000 |

| Mobile Developer | 37,000-53,000 | 98,000-162,000 |

Technology Trends in Argentina for 2024-2030

E-commerce

From 2021 to 2022, annual e-commerce revenue in Argentina experienced an impressive 87% increase. Today, the country is the fourth-largest e-commerce hub in the Latin American IT market and the Caribbean and commands nearly 7% of the region’s total online sales revenue.

Looking ahead, the e-commerce sector in Argentina is poised for sustained growth, with a projected CAGR of 20.69% from 2022 to 2027. This positive trend is driven by increased internet and mobile usage, a growing number of cardholders, and the widespread adoption of digital wallets in the country.

Blockchain

Due to persistent inflation and a preference for stability in Argentina, the locals increasingly turn to cryptocurrencies as a digital alternative to safeguard their savings. According to Chainalysis, Argentina emerges as one of the swiftly expanding cryptocurrency markets and secures the 13th spot in the 2022 Global Crypto Adoption Index. In the next few years, the Argentinian cryptocurrency market is expected to grow significantly — by 30.58% annually from 2023 to 2027. By 2027, the total revenue is anticipated to reach $327 million.

AI

Currently, only 19% of Argentine companies use AI. However, there’s a noteworthy trend on the horizon: 60% of businesses are actively exploring AI’s potential, as a recent IBM study indicates. The IT sector in Argentina is taking confident strides in implementing artificial intelligence across various sectors, including healthcare, logistics, agriculture, finance, and others. Notably, the country already holds the 3rd position in the Latin American region regarding AI policy implementation.

In a forward-looking move, the state has introduced ARGENIA, a National Plan of Artificial Intelligence scheduled for implementation by 2030. The plan aims to harness AI technology in Argentina for economic growth, foster inclusive and sustainable development, cultivate AI-related talent, and encourage nationwide adoption of AI technologies.

Establishing a Software Company in Argentina Has Never Been Easier

Intrigued by Argentina and its tech industry? Consider opting for an offshore development center model for your IT business in this country!

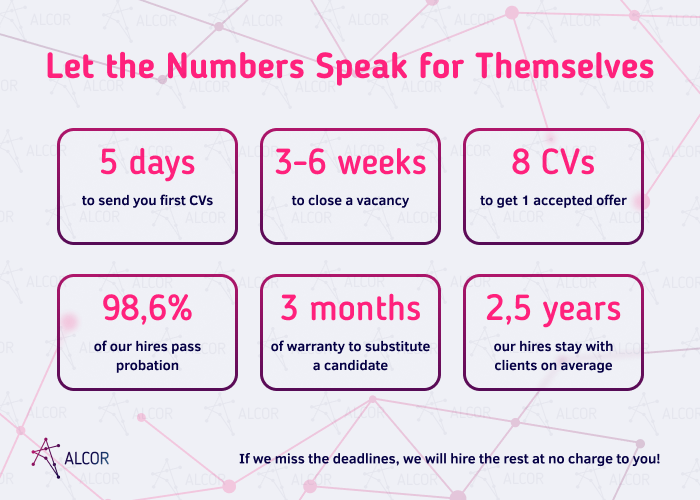

Alcor is an experienced software R&D center & operational services provider in Argentina, Mexico, Colombia, Chile, and other Latin American and Eastern European countries. Our all-in-one solution includes full-cycle IT recruitment, EoR, legal compliance, office lease, tech infrastructure setup, employer branding, and other additional services. With an extensive team of 40 IT headhunters, we guarantee to build your research and development office in just 2 months! Our hiring quality speaks volumes — 98,6% of our candidates successfully pass the probation period and stay with the clients for 2.5 years on average.

Here’s how Alcor’s solution played out for People.ai, a US-based software company venturing into the foreign IT market. Seeking a reliable local partner, they turned to Alcor for comprehensive support in launching their office. Our IT recruiters successfully hired over 25 skilled tech talents, 50% of whom specialized in AI engineering. The legal and finance teams ensured an efficient legal structure for our client in their chosen location. Once the formalities were complete, we expedited the location selection and preparation process. Within just 4 weeks, People.ai had its brand-new office up and running. Now, boasting a team of over 220 employees, the company has big plans for future growth.

Apart from People.ai, Alcor has also assisted Sift, Gotransverse, Ledger, and others in fulfilling their ambitious plans. Ready to discover more about how we can support your growth journey in Argentina? Let’s discuss what we can do for you!

profile

profile

Contact Us

Contact us to receive a free analysis of your positions!

It includes the salary ranges and availability of the requested developers in Poland, Romania, and other countries in EE (as well as time-to-hire metrics and other KPIs for your case).