Gartner predicts a 14.2% surge in worldwide software development spending in 2025, and all eyes of tech companies are on Eastern Europe once again. Why? Because of its 1.8M+ tech talents, up to 50% lower costs, and a strong IT competitiveness. Is it a perfect time for you to opt for software development outsourcing in Eastern Europe, too?

I’m Dmytro Ovcharenko, the CEO and founder of Alcor, a software R&D accelerator. We build teams from 10 to 100 elite developers for expanding tech companies—40% cheaper than traditional outsourcing and with zero buyout fees.

After reading this article, you’ll know the key reasons to do software development in Eastern Europe, explore its top tech hubs to expand to, and discover a proven cooperation model to avoid common IT outsourcing pitfalls.

Key Takeaways

- The software development industry in Eastern Europe is steadily developing, fueled by the local startup boom, digital transformation, and increased R&D investment.

- As the demand for skilled developers grows, US tech companies will continue to pick Eastern Europe for software development outsourcing, while 35% of Western European businesses are also planning to increase the use of nearshore outsourcing over the next two years.

- 1.8M+ tech talent pool, about 46% lower senior developer salaries, top technology and data science skills, strong STEM education, and cultural alignment are the main reasons to choose EE for software development.

- Poland, Romania, Ukraine, and Bulgaria are the ideal outsourcing destinations in Eastern Europe. They offer access to a total of over 1.3 million tech talents, rank top 7 in the region for tech skills and English proficiency, and provide attractive R&D incentives for tech businesses.

- With Alcor’s tech R&D center solution, you can set up your own team of 5 Silicon Valley-caliber developers in just one month while bypassing the risks and challenges of traditional IT outsourcing in EE.

Software Development in Eastern Europe: Market Overview

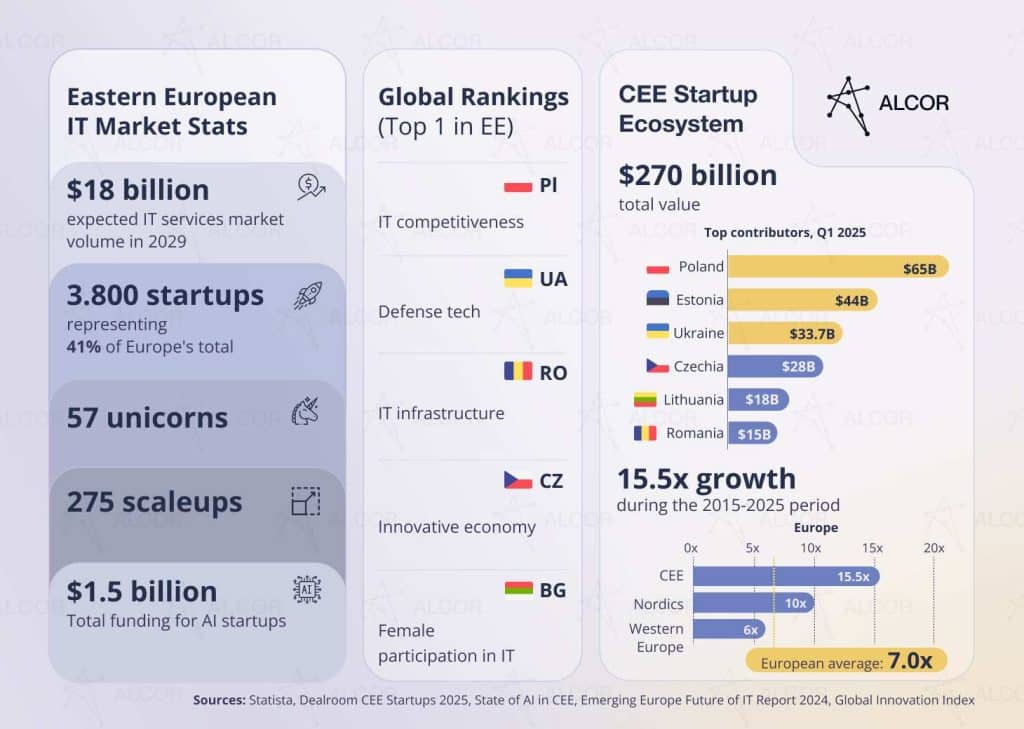

The software development industry in Eastern Europe is gearing up for significant expansion, with a projected annual growth rate (CAGR 2025-2029) of 4.54%. This trajectory is expected to result in a market volume of almost $18 billion by 2029. What are the main drivers of such growth?

1. Digital transformation

By following the European Union’s Digital Decade Policy Programme 2030, the CEE countries have been actively investing and developing their ICT infrastructure, digitizing the public sector, and promoting digital inclusion. Internet accessibility already reaches 94%, while 5D technology is expected to hit 88% adoption by 2028.

One of the vibrant trends is the implementation of AI and cloud solutions, which already positions CEE countries as a hotspot for data centers, with Poland and Romania leading in the region.

2. Startup boom

CEE houses over 3.800 startup companies, 57 unicorns, and 275 scaleups, accounting for about 41% of Europe’s total. Its startup ecosystem is currently worth over $273 billion, with Poland ($65 billion), Estonia ($44 billion), and Ukraine (33.7 billion) contributing the most to the combined value. The most funded startups are in tech sectors, such as transportation, fintech, and energy, while AI, climate tech, and robotics are actively gaining traction.

3. Increased R&D investments

Through the EU’s Horizon Europe program and local governmental and business financing, Central and Eastern Europe is actively developing its innovation and dispersing knowledge and technology. Here are the key leaders of gross domestic expenditure on R&D in CEE:

- Slovenia hit the mark of $1.5 billion or 2.13% of national GDP in 2023.

- Czechia spent $6.2 billion, or 1.83% of its GDP, in 2023.

- Poland allocated 1.56% of its GDP, or $14 billion, on R&D, marking an 18.8% increase since 2022.

Against this backdrop, the ICT services exports have dramatically soared in some of the Eastern European countries. A strong player is Poland, with about $42 billion of exports in 2024—a 10.1% jump compared to 2023. Ukraine is another striking example: even amid war, its ICT sector accounted for 37.4% of its total exports.

Is Outsourcing to Eastern Europe Still a Trend in 2025?

Without a doubt! But before diving into details, let’s look at the main trends in outsourcing:

-

Prioritizing value over price

Software development outsourcing is no longer about just cutting expenses. Deloitte states that cost reduction as a primary driver for outsourcing dropped from 70% in 2020 to 34% in 2024. Today, companies are seeking easy access to skilled talent, high service quality at a decent price, global delivery, and agility opportunities when opting for outsourcing strategies.

-

Back–office outsourcing

Outsourcing vendors’ markups and limited control over product quality and strategic capabilities push tech companies to insource or to set up their global in-house centers, states Deloitte. For this reason, more tech businesses are increasingly delegating back-office functions to trusted companies. Legal, payroll, taxes, tech recruitment, HR, and procurements—all to focus on their core business.

-

Strategic partnerships

More and more companies are saying goodbye to traditional IT outsourcing and opting for strategic models that are progress-oriented rather than process-oriented. Building their own loyal teams of developers via local partners is safer and can be even 40% cheaper compared to a vendor’s team leasing. Look how it worked out for Alcor’s client, Dotmatics, a US-based tech company:

This is already a good answer to the question of this chapter, but let me give you some more facts. Just like Dotmatics, BigCommerce, People.ai, and ThredUP, a growing number of US tech companies are opting for offshore software development outsourcing in Eastern Europe. All because of the high demand for software developers, which is set to grow by 17%, and with 140,100 new tech job openings to appear annually during 2023-2033, the skill gap and competition for talent will need to be addressed.

Meanwhile, 35% of businesses in Western and Nordic Europe are also planning to increase the use of nearshore outsourcing over the next two years. And guess what, they will also choose outsourcing software development in Eastern Europe. Why? Check out the reasons below.

Why Tech Businesses Move Software Development to Eastern Europe

Reason #1. 1.8M+ tech talents

Yes, you heard it right, the Eastern European region boasts a massive pool of tech professionals with diverse skill sets and expertise. At the talent list, there is Poland, boasting 650K developers. Ukraine secures the second spot with a pool of 302K programmers, followed by Hungary and Romania with 253K and 250K software engineers, respectively.

The benefit? A possibility to find even the rarest tech talent and reduce time-to-hire. That’s exactly what our client Mako (formerly A2Labs) experienced. They were seeking talent with niche GPU optimization skills to develop their LLM-powered AI platform, and Poland was chosen as the most talent-rich hub. With the help of Alcor’s local tech recruiters, Mako got several senior ML specialists within just a few weeks and was wowed by their high quality.

Reason #2. Budget-friendly salaries

Silicon Valley price tag? Not even close when it comes to software engineers from Eastern Europe. The average senior developer salary in this region ranges from $62,000 to $75,500 per year. Ukraine and Bulgaria offer even more savings—about 16% and 12% compared to Poland and Romania. For instance, senior AI Engineers earn $72,000 in Bulgaria vs. $80,500 in Poland. Blockchain Developers make $60,000 in Ukraine vs. $81,500 in Romania. Compare the rates yourself:

| Annual Senior Developer Compensation, USD | ||||

| Position | Poland | Romania | Ukraine | Bulgaria |

| AI/ML Engineer | 80,500 | 78,000 | 75,500 | 72,000 |

| Blockchain Developer | 78,000 | 81,500 | 60,000 | 74,500 |

| Cloud Engineer | 72,000 | 84,000 | 50,500 | 57,500 |

| Mobile Developer | 72,000 | 81,500 | 72,000 | 78,000 |

| DevOps Engineer | 87,500 | 81,500 | 72,000 | 78,000 |

| Salesforce Developer | 72,000 | 72,000 | 51,500 | 66,000 |

| Manual/Automation QA | 72,000 | 66,000 | 54,000 | 48,600 |

| Ruby Developer | 84,000 | 81,500 | 72,000 | 78,000 |

| Java Developer | 84,000 | 81,500 | 72,000 | 78,000 |

| Python Developer | 81,500 | 81,000 | 72,000 | 69,000 |

And now you’d ask: How much can I, as a CEO of a US tech company, save by hiring developers in Eastern Europe?

The answer is…

Impressive cost-effectiveness, don’t you think? This is one of the decisive factors for US tech companies when considering to hire a team in Eastern Europe. But what about the quality of the software product?

Reason #3. Top tech expertise

It’s top-tier, as Eastern European software developers are real technology ninjas. Whether it’s TopCoder, Meta Hacker Cup, or Google Code Jam, they always rank high. Coursera backs up the tech savviness of the developers from Eastern Europe:

- Top for tech skills in CEE: Poland, Czechia, Slovakia

- Top for data science in CEE: Czechia, Bulgaria, Ukraine

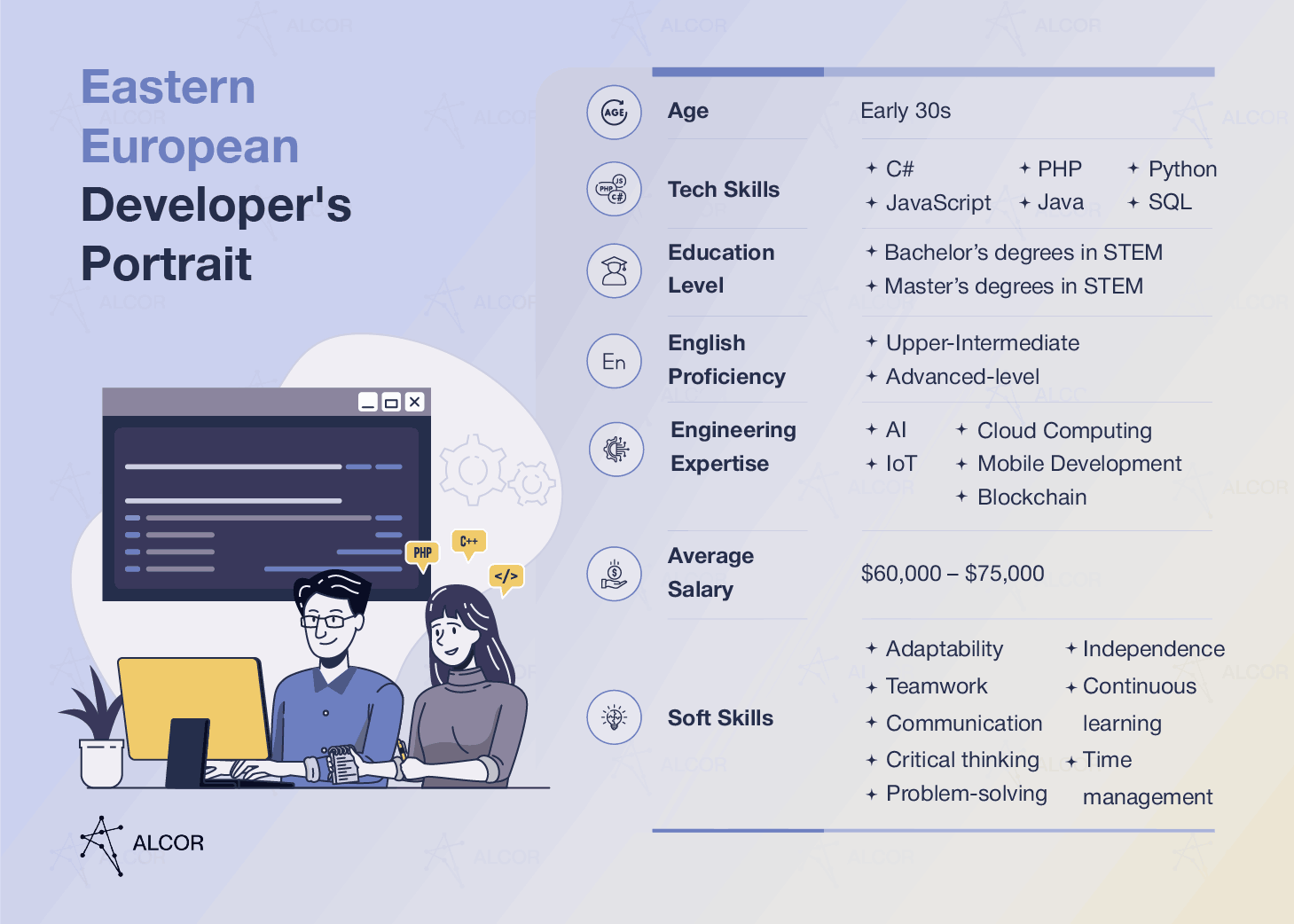

Software developers in Eastern Europe will be a great asset to your engineering team, bringing the most value in mobile app development, web development, data science & AI, cloud & DevOps, and cybersecurity. They also demonstrate a broad palette of coding languages and frameworks:

- Poland: JavaScript, Java, Python, TypeScript

- Romania: PHP, C#, Java, C++, Python

- Ukraine: JavaScript, Java, C#, Python, and TypeScript

- Bulgaria: C#, JavaScript, Java, and Python

Reason #4. Strong STEM education

Profound tech know-how of software developers from Eastern Europe comes from a long-standing tradition of solid STEM education. More than 300 higher educational institutions offer ICT programs, with over 80 of them ranking in the QS World University Rankings 2025. Among them are Warsaw University of Technology, Taras Shevchenko National University of Kyiv, Czech Technical University in Prague, and Babes-Bolyai University, to name just a few.

The region generates about 60,000 STEM graduates annually. In Poland, 76% of software developers hold a higher education degree, while in Ukraine, this rate reaches 90%. But formal education is not the only way programmers in Eastern Europe gain tech savviness. Coding schools, courses, and bootcamps are also in common practice. Some of the most popular include Coders Lab in Poland, Skylab Coders Academy in Ukraine, Coding Bootcamp Praha in the Czech Republic, and Bucuresti School of Code in Romania.

Reason #5. Cultural proximity

When assembling Eastern European development teams, the cultural aspect is undoubtedly one of the most essential ones. And these programmers will fit your team as seamlessly as missing puzzle pieces, ensuring effective communication and productive cooperation.

- Effective communication: Forget about a language barrier, as most programmers from Eastern Europe have high English proficiency, with Romanian, Polish, and Bulgarian devs topping the list. It’s also common for these engineers to be fluent in an additional European language, like German, French, or Spanish.

- Western mentality: Tech talent in Eastern Europe shares the same values and work ethic as their colleagues in the US, meaning they can easily integrate into your corporate culture and teams and adapt to new working conditions—another good reason to move software outsourcing to Eastern Europe.

How Fast Can I Set Up a Software Team in Eastern Europe?

It all depends on the cooperation model. Here are a few common ones you may consider:

1. IT outsourcing & outstaffing

By outsourcing software development to Eastern Europe, you get a preassembled team that can start working on your project in the short term. But this game may not be worth the candles since these developers don’t belong to you but have a service provider as their official employer. This minor detail entails huge issues like loss of control over development and expenses, subpar quality of the end product, and even IP breaches.

2. Business incorporation

Building a development team on your own is a safer option than opting for software development outsourcing in Eastern Europe, as you get a second in-house team. The challenge lies in establishing a legal entity to legally employ local developers. The process varies from country to country, lasting for months and draining tens of thousands of dollars in legal fees, registration, and insurance. Moreover, failure to comply with local laws and practices can lead to hefty fines or even legal actions, putting your expansion plans at risk.

3. Software R&D center

An optimal solution for expanding tech companies that combines the best of both worlds—building your own team of remote Eastern European programmers while bypassing the need to open a legal entity. How is it possible? With Alcor’s Employer of Record in Eastern Europe! You can hire developers through our readily established legal entities in Poland, Romania, and Ukraine, saving an average of 3.5 months on business incorporation.

What else is included?

- EOR for tech: We take admin and legal complexities off your shoulders, including FTE or B2B employment, onboarding/offboarding, compliance with local laws, payroll processing, and benefits management. So, you can focus on your software development instead.

- Top-notch hiring: Our 40 tech recruiters in Eastern Europe and Latin America need 2-6 weeks to hire the top 10% talent of the EE market. With 98.6% of our hires passing probation and demonstrating 2.5 years of tenure, we provide the best-fitting software developers.

- Operational support: If you need something extra, like leasing an office or procuring equipment, we’ve got your back. You’re never alone with any issues, as our Customer Success Managers provide 24/7 in-country assistance.

Our software R&D center solution has already proven effective for tech companies like People.ai, BigCommerce, Sift, Dotmatics, and dozens of others. 93% of tech CEOs and CTOs are satisfied with our services and commitment.

Top Eastern European Countries as Outsourcing Destinations

Poland

- 650K+ tech professionals

- 37% lower dev salaries vs. the US

- #1 in the CEE region for tech skills

- #2 in CEE for English proficiency

- #4 innovative economy in CEE

IT services market: Poland shines as a key player in the EE tech scene. Its software development market is already getting to the point of $10.44 billion in revenue, expected to grow by 20.5% by 2029. Meanwhile, Poland’s IT exports have grown at an annual rate of 13.64% over the past five years.

Startup landscape: With over 3,000 startups and the most unicorns in the region, Poland ranks 4th across EE in the Startup Ecosystem Report. What’s impressive is that its AI startups attracted the highest amount of funding in the region—$172 million. Except for AI, Poland is also strong in e-commerce, fintech, marketing and sales, healthcare, and IoT.

Business friendliness: The Polish ICT market lures many international tech companies to its shores with favorable R&D incentives, namely 200% tax deduction on eligible R&D expenses. Plus, there is a possibility to cooperate with Polish developers on B2B terms, where client companies are exempt from paying taxes and social contributions.

Ripe tech hubs: Warsaw, Krakow, Wroclaw, Katowice, and Tricity are home to over 62% of all software developers in Poland.

Romania

- 250K+ tech professionals

- 40% lower dev salaries vs. the US

- #7 in the CEE region for tech skills

- #1 in CEE for English proficiency

- #7 innovative economy in CEE

IT services market: Romania’s ICT industry is forecasted to account for a whopping 10% of the national GDP by 2030. And it’s no surprise as its IT services will most likely generate a revenue of $1.38 billion in 2025, growing at a CAGR of 6.78% during the next five years. IT outsourcing is a leading segment in the market with a volume of $506 million.

Startup landscape: Ranking 8th in the region for startup ecosystem, Romania has over 1,662 startup companies and scale-ups worth €19 billion in enterprise value. Unicorns? There are three of them: UiPath, eMAG, and MultiverseX. The best-performing sectors are ICT, fintech, media, marketing, and gaming.

Business friendliness: Tech companies innovating in Romania enjoy profit tax exemption for the first 10 years, a 50% deduction of the eligible R&D expenses, and can also apply to get accelerated depreciation for R&D equipment.

Ripe tech hubs: Bucharest, Cluj-Napoca, and Iasi together account for 86% of the ICT revenue in the country.

Ukraine

- 302K+ tech professionals

- 48% lower dev salaries vs. the US

- #5 in the CEE region for tech skills

- #7 in CEE for English proficiency

- #8 innovative economy in CEE

IT services market: Despite the ongoing war, the revenue of the IT market in Ukraine continues to steadily increase, demonstrating an average annual growth of 8.2% and contributing 4.4% to the national GDP. New tech companies? A 5.9% jump since 2024—a vivid sign of the country’s resilience.

Startup landscape: Ukraine’s startup ecosystem is among the three fastest-growing in the CEE region. The number of startup companies increased to over 2,600 in 2024—a tripling of the ecosystem’s value since 2020. Over the past 6 years, Ukrainian tech companies have raised almost $1.5 billion in venture capital. And last year’s superstars are Creatio and Rentberry, who together raised $290 in funding, both reaching a unicorn status.

Business friendliness: Ukrainian special legal and tax framework, Diia.City is designed specifically for tech companies. It offers some of the lowest tax rates in Europe, IP protection, stable business regulations, and tools for scaling tech businesses. You can employ software developers via any of the 3 cooperation formats, namely employment contracts, gig contracts, or B2B contracts. Currently, it hosts 1.650+ residents, including companies Visa, Rakuten Viber, Samsung, and Capgemini.

Ripe tech hubs: Kyiv, Lviv, Odesa, Dnipro, and Kharkiv secure 78% of all software developers in Ukraine.

Find out why nearshore software development to Ukraine is safe and beneficial for tech product companies from the US and Europe.

Bulgaria

- 116K tech professionals

- 46% lower dev salaries vs. the US

- #4 in CEE for tech skills

- #3 in CEE for English proficiency

- #4 innovative economy in CEE

IT services market: Thanks to significant government investments in digital transformation, Bulgaria‘s ICT services sector has seen remarkable growth, with a turnover increase of 18.6% over 2020-2021. And now its IT services market is expected to hit $463.30 million in revenue and contribute over 4.5% to Bulgaria’s GDP.

Startup landscape: Being home to over 800 startup companies, Bulgaria ranks 6th in the region for the startup ecosystem. Among the key industries of Bulgarian startups are software & data, fintech, social & leisure, and healthtech. AI is a rising star in the local market, which was already able to attract $112 million last year.

Business friendliness: Bulgaria stands as a tax-friendly haven in the EU with a flat 10% rate for both personal and corporate income taxes, making it increasingly attractive for Western companies to explore Eastern European software development options.

Ripe tech hubs: Sofia, Burgas, and Plovdiv, among which Bulgaria’s capital accounts for 87% of all local startups.

Czechia

- 226K tech professionals

- 42% lower dev salaries vs. the US

- #2 in CEE for tech skills

- #6 in CEE for English proficiency

- #1 innovative economy in CEE

IT services market: The software development industry in the Czech Republic is on the roll, growing at a CAGR of 9.7% between 2020 and 2025. Currently, its tech industry ranks #13 in Europe for revenue, estimated to bump up to $6.47 billion in 2025. The biggest slice of the pie? IT outsourcing is forecasted to reach $2.52 billion in market volume.

Startup landscape: Czechia is the 3rd largest startup ecosystem in the region, contributing over $27 billion to the combined enterprise value of the CEE startups ecosystem. Last year, it attracted a total amount of over $293 million for the recorded rounds. One of the six Czech unicorns, Rohlinik, made the biggest contribution to the total funding of around $177 million.

Business friendliness: International tech companies can unlock major savings in Czechia with its R&D tax incentives. You can deduct up to 100% of R&D expenses from your tax base, on top of the standard deduction, essentially writing off R&D costs twice. On top of that, if your current R&D spending exceeds the previous year’s, you get an extra 10% deduction. For profitable large companies, this adds up to a 21% effective tax subsidy on R&D, making innovation significantly more budget-friendly.

Ripe tech hubs: Prague, Brno, and Ostrava, with Czechia’s capital hosting 65% of all startups in the country.

Slovakia

- 81K tech professionals

- 45% lower dev salaries vs. the US

- #3 in CEE for tech skills

- #5 in CEE for English proficiency

- #6 innovative economy in CEE

IT services market: The Slovak ICT market is rapidly and vigorously developing, with projections indicating it may surpass the mark of $1 billion this year and further develop at a CAGR of 6% during the next 5 years. At the heart of this boom is IT outsourcing, set to hit almost $600 million.

Startup landscape: Being in the top 20 startup ecosystems in the region, Slovakia is decisively moving forward, having already experienced 2.2x combined enterprise value growth over the 5-year period. Most startup companies work in marketing & sales, software & data, ecommerce, edtech, and fintech. Notably, AI startups alone attracted $41 million in investments.

Business friendliness: Slovakia offers a range of appealing tax incentives for tech product companies. The income tax rate here is only 21%. Furthermore, there is an enticing additional benefit of a 200% deduction on R&D expenses from the taxable base—more money to innovate and grow.

Ripe tech hubs: Bratislava and Kosice, with Slovakia’s capital hosting 73% of all startups in the country.

Challenges of Outsourcing Your Software Development to Eastern Europe

Cloudy pricing

While initially appearing as a cost-effective choice, Eastern European software development outsourcing services may not always be the optimal long-term solution. This is due to some outsourcing companies imposing additional fees for various, often unnecessary, services without transparent communication with the client. Consequently, the final invoice often surpasses the initially anticipated cost significantly.

Team dedication

Even if you cooperate with Eastern European top software development companies, it doesn’t mean that external programmers will be ready to go the extra mile for your business idea. Typically, these tech experts collaborate with multiple companies, moving between projects and emphasizing productivity over dedication.

Lack of control

When you engage in traditional software development outsourcing in Eastern Europe, you give up all control over your product development and team management. This can hinder your ability to promptly assess project performance, implement necessary changes, or align your product with evolving business requirements.

Expand Your Software Development to Eastern Europe with Ease

just like Gotransverse did. With Alcor by their side, they got

- 6 top-notch hires in 6 weeks: we closed Full-Stack Engineer and a Product Manager roles with a 95% CV pass rate;

- 40% of costs saved vs. outsourcing: Gotransverse didn’t have to deal with any markups, but received transparent developer salaries and Alcor’s fees from the start;

- Entity-free developer employment: The client was able to hire EE developers hassle-free via Alcor’s legal entities;

- 100% operational coverage: We helped Gotransverse with equipment procurement and tech infrastructure, leaving their Head of Engineering, Dmitrii Iermiichuk, truly wowed:

“Alcor solved every problem, even crazy things like buying certified hardware in the middle of nowhere on Bali and shipping it to the EU.”

Would you like to build a software development team in Eastern Europe as seamlessly and hassle-free? Fill out the form below and let’s make your expansion goal a reality!