Taxes in the US vs Europe come with stark terms and conditions. In the US, extending TCJA keeps the 21% corporate tax clause and could lift GDP by 1.2% long-term. But the IRS’s $80 billion boost will push big-corp audit odds to 22.6 %. Europe, by contrast, offers a 21.5% norm plus property tax cushions that feel friendlier for ambitious tech enterprises, eyeing scaling.

I’m Oleh Danylchenko, Head of Legal at Alcor. I get the headaches you’re facing: double-withholding, eating your margins, property tax surprises, and tricky VAT clauses tucked into brick-thick contracts. I believe there’s a smarter path: our tech R&D center model.

We combine IT recruitment in Poland, Romania, Ukraine, and Bulgaria with an Employer of Record in Eastern Europe, so you can build an R&D team while we handle every tax breakdown and ops. Scale from 10 to 100 devs in a year, while saving 40% vs IT outsourcing models.

Discover how taxes in the US vs EU can quietly make – or break – your margins, so you’ll know whether next year’s expansion belongs on the Continent or in your home country.

Key Takeaways

- Federal 21% corporate plus layered state levies and rising IRS audits make the American code pricier in compliance time, yet still globally competitive for headline CIT.

- Across the Continent, the average European tax rate on corporate income sits near 21.5%, with heavier social-security slices and VAT shifting collection duties onto businesses.

- Eastern Europe plays tax small-ball: flat 10-19% CIT and 10-16% PIT in Bulgaria, Romania, Poland, Ukraine, slash bills by up to 40% vs US benchmarks.

- Trendline watch – US taxes vs Europe: Washington locks TCJA’s 21% rate yet boosts audits, while Brussels tempts R&D with green incentives and Pillar Two’s 15% floor, improving EU allure.

- With semiconductor tariffs and audit heat stateside, many tech leaders pivot east – CEE hubs offer lower tax, deep talent, and NATO-backed stability, ticking every strategic expansion checkbox.

- Alcor’s full-package deal bundles elite tech hiring, Employer of Record, and ops, letting you score touchdown-ready R&D centers in Eastern Europe without flag-throwing compliance penalties.

Comparison of US and European Tax Rates

When it comes to American taxes vs European taxes, you should take into account that both regions have different tax systems. The US has a rather complicated tax filing system. Beyond just paying taxes, employers face additional costs and admin burdens due to more intricate reporting requirements and expensive tax preparation services.

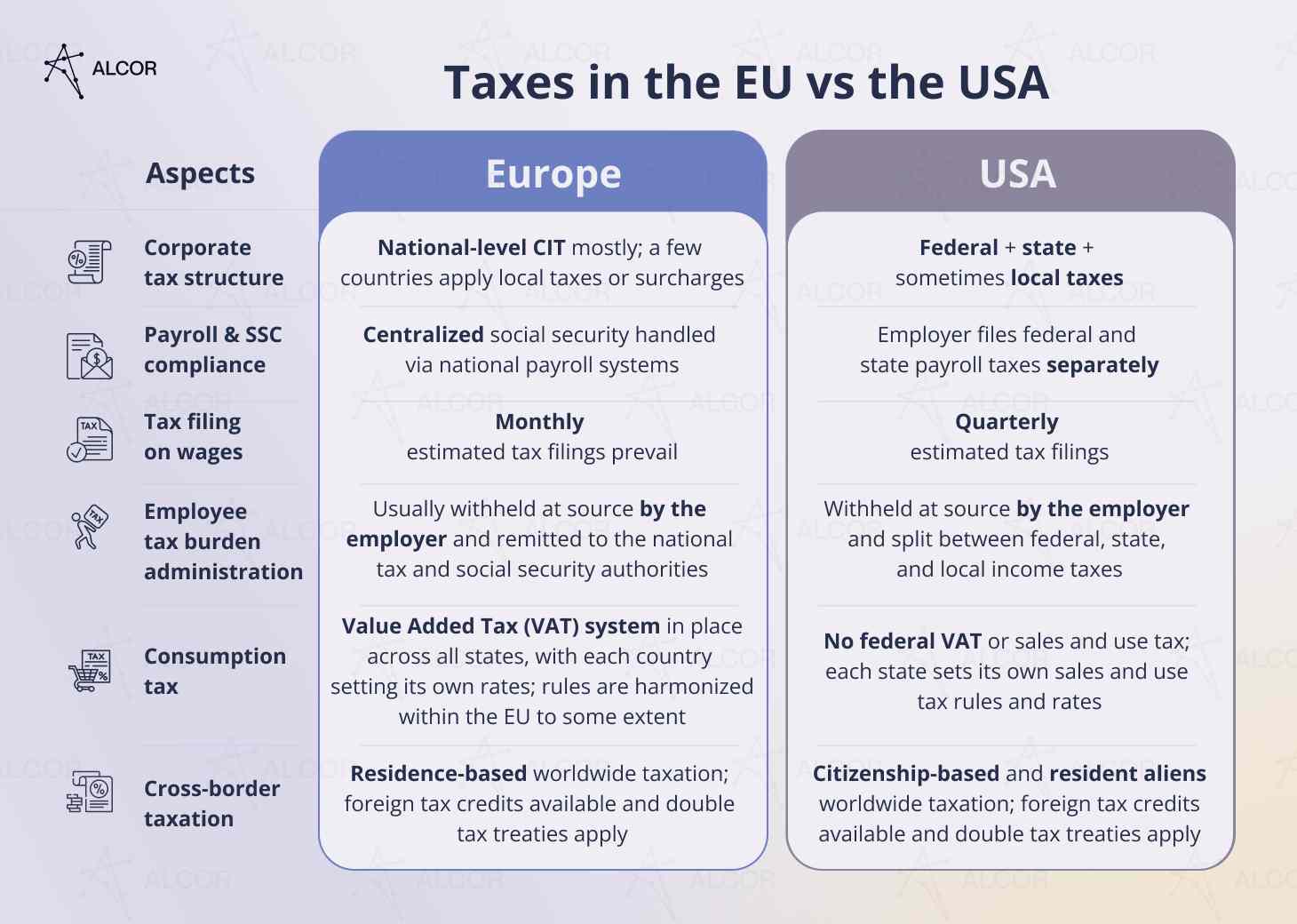

Another important note about taxes in the EU vs the USA is that the use of VAT in Europe, compared to the sales tax in the US, is different, shifting more responsibility for collection and reporting onto businesses in the EU.

See the table below to explore the peculiarities of the taxes in the EU vs the USA:

Now, let’s look at both in greater detail. So, how does tax work in America?

US Tax Rates Overview

First and foremost, corporations in the US pay 21% of federal corporate income tax, plus state corporate income tax of 1-11.5%, depending on the state and applicable tax brackets. Some states impose no tax under a certain threshold (or at all), and local taxes may also apply. For example, Nevada and Wyoming have no corporate income tax at all, while New York exempts small businesses under specific revenue limits.

Additionally, the Corporate Alternative Minimum Tax (15%) applies usually to companies with profits above $1 billion, ensuring a minimum tax burden on large firms.

Then, there’s an equivalent to the personal income tax in the US, which is levied on a federal, state, and sometimes local level, making up the bulk of respective budgets. Typically, both federal and state income taxes are withheld from employees’ wages and remitted to the tax authorities by their employers:

- Federal tax ranges from 10% to 37% across different tax brackets.

- State income taxes range from 0.25% to 13.3%, depending on the state and tax bracket (if applicable), with some states imposing no tax under a certain threshold or no tax at all.

Most employers also pay the federal unemployment tax (FUTA), which is 6% of the first $7,000 of each employee’s annual wages. In addition, there are state unemployment taxes (SUTA), where rates and wage base vary depending on the state and the employer’s experience. FUTA is paid solely by the employer and is not withheld from employee wages, unlike SUTA in most states.

However, in a few states – including Alaska, New Jersey, and Pennsylvania – employees are also required to contribute to SUTA. Many employers qualify for credits against FUTA for SUTA taxes paid, which can reduce the effective FUTA rate to a maximum of 0.6%.

According to the Employer’s Tax Guide (Publication 15), employers are required to pay Social Security and Medicare taxes (FICA) at a combined rate of 7.65%: 6.2% for Social Security and 1.45% for Medicare. The same amounts are withheld from employees’ wages, resulting in a total FICA burden of 15.3%. The Social Security wage base limit (i.e., maximum earnings subject to the tax) increases annually, with the 2025 cap reaching $176,100. The Medicare tax, by contrast, applies without wage caps, and employees earning more than $200,000 annually are subject to an additional 0.9% Medicare surtax.

On the whole, the average US tax rate may be high if federal tax bills are at their maximum level. Exorbitant federal tax rates beginning in 2023 stem from the 2022 Inflation Reduction Act, alongside the phasing out of some provisions from the 2017 Tax Cuts & Jobs Act, says Forbes. As of 2025, these measures continue to shape the federal tax landscape.

Meanwhile, many state-level business cuts are aimed at providing tax relief. Here are a couple of examples:

- Louisiana’s corporate income tax changed from a bracket system with a top rate of 7.5% to a flat rate of 5.5%, effective January 1, 2025.

- North Carolina is gradually phasing out its corporate income tax, aiming for elimination by 2030, with further rate reductions scheduled in the coming years.

- States like Nebraska and Pennsylvania have also lowered their corporate income tax rates for 2025, improving competitiveness and offering better business opportunities.

In conclusion, while the average federal tax rates may be rising, corporate tax balances out the expenses and may alleviate the tax burden. Importantly, the US tax rate compared to other countries remains competitive.

What about tax rates in Europe?

European Tax Rates Overview

Unfortunately, no-tax countries are a myth. For example, Monaco offers a 0% personal income tax rate, but levies a 25% corporate income tax. Across OECD countries, the average combined corporate tax rate stands at 21.5% in 2025, according to the Tax Foundation.

While personal income tax (PIT) rates vary widely between countries and across income brackets within each country, tax rates in European countries vs the US turn out to be similar or even higher.

- When we consider the personal tax rate in Denmark vs the USA, it is approx. 35-55.9% against 10-50.3%, depending on the state.

- As for Germany’s tax rate vs the US, the result is 0-45% (plus up to a 5.5% solidarity surcharge on top of income tax for high-income earners) against 10-50.3%, depending on the state.

On the other hand, when US taxes are compared to other countries, mostly Eastern European ones, the former are clearly higher. For instance, Czechia has a personal income tax rate bracket of 15-23%, and it’s not at the top of the list of countries with low income taxes. For a broader perspective, in 2024, the average single-worker tax wedge across the 38 OECD countries, including the US, was 34.9%, edging higher in 2025.

On social security, the contrast is stark between the European tax rates vs the USA ones. US payroll taxes (FICA) total 15.3%, whereas European systems can push the tax wedge to around 30% on average and in some cases even above 60%.

Speaking about European taxes vs American taxes in 2025-2026, the EU’s rollout of the Pillar Two global minimum tax aims to establish a 15% effective CIT floor across member states, although some low-tax countries are still negotiating its implementation.

The Highest and Lowest Tax Rates in Europe and the US

While contrasting taxes in the USA vs the EU, you may find the details overwhelming. That’s why I’ve prepared a table chart with tax rates of the US and 11 European countries to give you the big picture.

| Country | Corporate Income Tax (CIT), % | Personal Income Tax, % | Social Security Contributions, % |

| US | 21-32.5% (+) approximate range: Federal – 21% flat rateState – 0-11.5% flat or progressive rates (varies by state)(+)Corporate AMT – 15% for large corporations | 10-50.3% approximate range:Federal – 10-37% progressive ratesState – 0-13.3% flat or progressive rates (varies by state) | 15.3%-16.2% approximate range:Employer: 6.2% Social security tax + 1.45% MedicareEmployee: 6.2% Social security tax + 1.45% MedicareAdditional Medicare tax: 0.9% for high-income employees |

| Denmark | 22% flat rateR&D incentives are available | 35–55.9% average range:State tax – 12.01-15%Municipal tax – 25.068% (the country’s average)Labour market tax – 8%Church tax – 0.64% (optional) | 10,666-20,054 DKK/year approx. range:Employer:Labour market pension (ATP) – DKK 2,376/year;Contribution to maternity fund – DKK 1,550/year;Industrial injuries insurance – DKK 252-9,640/year (may vary by the field of work)Other social security schemes – DKK 5,300/year approx.Employee:ATP pension – DKK 1,188/year |

| France | 25% standard flat rateSmall companies: 15% reduced tax under certain conditionsLarger companies: 3.3% additional temporary contribution on corporate tax liability | 0-45% progressive rates(+) Surtax: 3% on taxable income over €250,000, and 4% on income over €500,000 | 65-68% approximate range:Employer: ~ 45%,Employee: ~ 20-23% |

| Germany | 22-35.3%(+) approximate range:Federal – 15% flat rate(+) 5.5% solidarity surcharge on CIT amountMunicipal trade tax –7-20.3%, depending on the location | 0-45% progressive rates(+) up to 5.5% solidarity surcharge on income tax for high-income earners [IM4] | 42.65% approximate rate:Employer ~ 21.1%Employee ~ 21.55% (may vary by location and industry) |

| UK | 19-25% total range:25% – applies to companies with profits over £250,00019% – for companies with profits up to £50,000Marginal Relief – for companies with profits between £50,000 and £250,000 (i.e. a sliding scale of tax rates 19-25%) | 0-45% progressive rates in England, Wales and Northern Ireland0-48% progressive rates in Scotland | 17-23% approximate range:Employer – 15% on National Insurance contributionsEmployee – 8% on earnings between £12,570 and £50,270 a year; 2% on earnings over £50,270 a year |

| Italy | 27.9% average rate:National – 24%Regional production tax – 3.9% averageReduced rate – 20% is available for companies that satisfy the conditions of the Italian 2025 Budget Law[6] | 24.23-47.23% approximate range:National income tax:23% on taxable income up to €28,00035% on income between €28,001 and € 50,00043% on income above €50,000Regional tax: 1.23-3.33 %Municipal tax: 0-0.9 % | 40% approximate rate:Employer ~30%Employee ~ 10% |

| Spain | 25% standard flat rateNewly created companies/startups:15% under certain conditionsR&D tax credits are also available | 17.5-54% approximate range:State rates: 9.5-24.5%Local rates: vary by region | 37.05-39.8% (+) approximate range:Employer ~ 30.57-33.27% (plus a variable rate for occupational accidents)Employee ~ 6.48-6.53%, depending on the type of contract.[IM5] (+) An additional contribution 0.92-1.17% for high earners is applicable |

| Poland | 19% standard flat rateSmall taxpayers: 9% (with certain exceptions) | 12-32% (+) progressive rates:12% for income up to PLN 120,000 and 32% applied to the portion of income that exceeds PLN 120,000 (+) 4% solidarity surcharge applied to the portion of income that exceeds PLN 1 million | 42.19-44.85% approximate range:Employer – 19.48-22.14%Employee – 22.71% (healthcare contribution included) |

| Bulgaria | 10% flat rate | 10% flat rate | 32.7-33.4% approximate range:Employer – 18.92-19.62%Employee – 13.78% |

| Romania | 16% standard flat rateSmall taxpayers: 1% or 3% rates are available (with certain exceptions) | 10% flat rate | 37.25-45.25% approximate range:Employer – 2.25-10.25%Employee – 35% |

| Ukraine | 18% flat rate | 18% flat rate+ 5% Military tax | Employer – 22% of salary, up to UAH 160K/month |

| Hungary | 9-11% approximate range:National CIT: 9%Local business tax: 2% maximum, varies by municipality | 15% flat rate | 31.5% total:Employer – 13%Employee – 18.5% |

| Sources: Tax Foundation, Skat.dk, PwC, Trading Economics, Service-Public.fr, Madrid Times | |||

*Please note that while the chart is designed to highlight key differences of the European tax rates vs the US, it doesn’t capture every nuance or exception due to the complexity of tax systems, and should be treated as a general reference for 2025.

Overall, when it comes to European tax rates vs the US, the burden is similar in the United States and some Western European countries, such as France, Denmark, Germany, and Italy. France and Denmark lead the pack with the highest Euro tax rates. In contrast, corporate and personal income taxes are far higher in the US than in low-tax countries in Europe like Poland, Bulgaria, Romania, Ukraine, and Hungary. So, Eastern European tax rates compared to the US are more favorable.

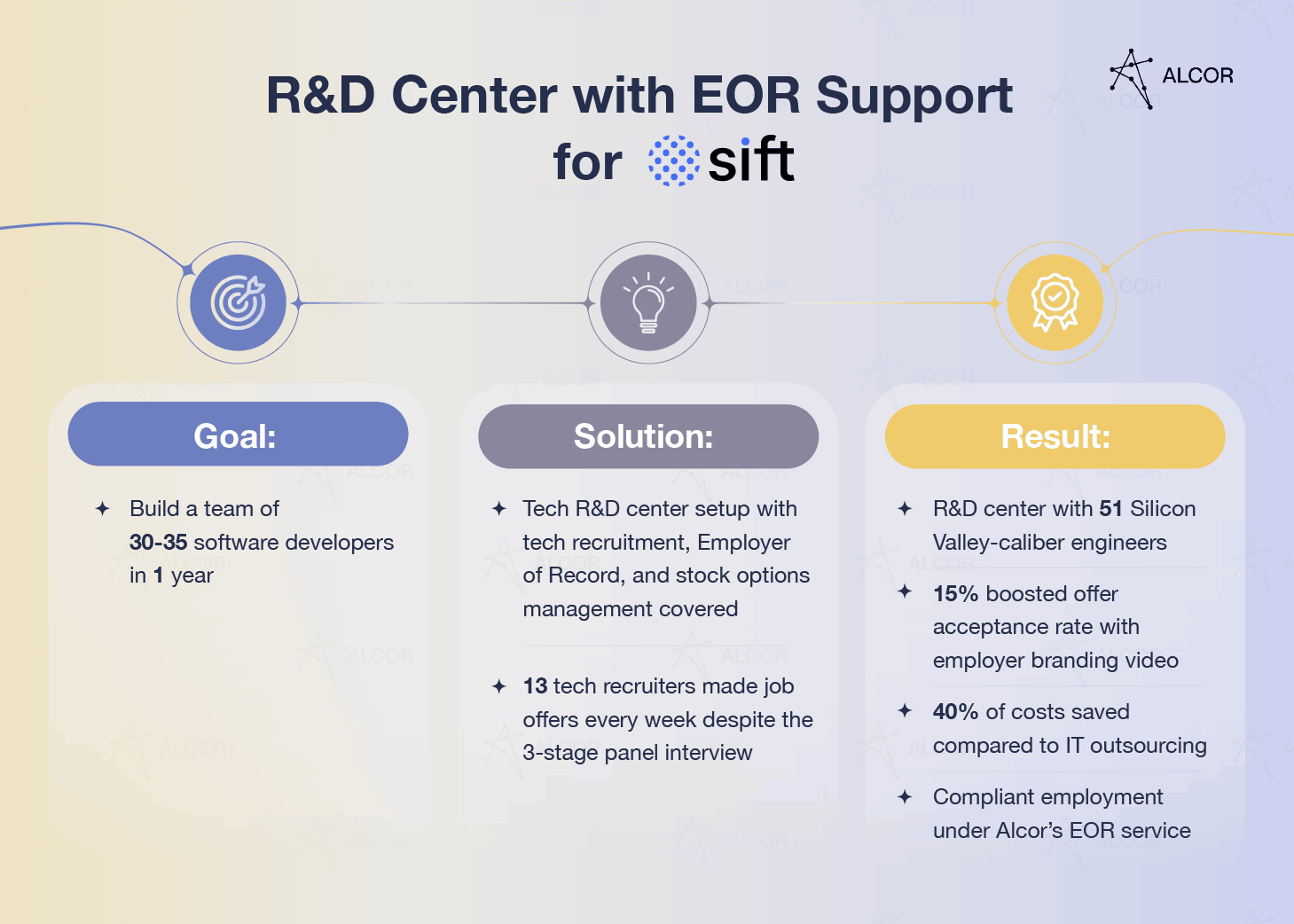

Knowing about this fact, the US-based tech company, Sift, decided to take advantage of the EE taxation system. With Alcor’s help, they built their own 30-dev team of Polish and Ukrainian devs, without legal headaches. We handled everything: compliance with European and US laws, taxes, labor & contract law, and IP rights protection, even stock options. Plus, we ran full-cycle tech recruitment of senior devs – everything for a smooth, compliant expansion into Eastern Europe.

Considering the CEE region for your expansion? Learn more about tax rates in Romania and Polish taxes!

Regarding the social security contributions, Denmark tax rates vs the USA, they are somewhat lower in Denmark than in the US, but all other ranges are higher. However, most other European countries impose higher rates in this category; the exception is the UK taxes.

All things considered in terms of European tax rates compared to the US, Eastern European countries offer more favorable conditions for personal income tax. Meanwhile, the CIT and SSC in the US are still quite reasonable.

Even though launching a business in the USA or Western Europe might seem feasible, Eastern Europe offers more favorable tax rates, as well as developer salaries and back-office expenses.

Are you looking for IT staffing in Europe? Contact us to learn more!

Many US tech companies consider Eastern Europe for software development. But there is a risk-free, tech-focused solution. It provides you with top-tier software developers in EE and full support with taxes, payroll, compliance, and more. Keep on reading to uncover it!

Recent Trends in European vs. the US Tax Policies

Main trend in Europe: Strategic autonomy

The Russia-Ukraine war exposed Europe’s overdependence on external energy and fragile supply chains. Combined with escalating US-China trade tensions, the European Union has started to actively move towards “strategic autonomy.”

- The war pushed investment in defense tech, energy independence, and infrastructure resilience, much of it coupled with corporate tax relief or investment incentives to drive private-sector participation.

- In response to US-China trade fragmentation, Europe positioned itself as a “neutral” hub, offering political stability, access to a large pool of talent, and a transparent regulatory environment.

- Many EU countries, like France, Poland, and Spain, launched generous R&D tax credits and deductions for greentech companies. Meanwhile, Horizon Europe and Digital Europe allocate billions of euros into R&D partnerships with private companies, making the cost of innovation lower than in the US.

Impact: From a US taxes vs Europe angle, geopolitical turbulence has actually strengthened Europe’s tax competitiveness. As companies rethink China-dependent supply chains and rising US production costs, Europe, especially its lower-cost locations like Poland or Romania, emerges as an optimal alternative for expanding businesses. Regulatory certainty and political alignment make Europe an increasingly attractive spot for cross-border innovation.

Main trend in the US: Tax strategy shifts & protectionism

As of August 2025, the new US administration is actively reshaping the tax and regulatory landscape with three major moves.

- One Big Beautiful Bill Act, signed in July 2025, makes permanent key provisions of the 2017 TCJA, like the 21% corporate tax rate and pass-through deductions, while extending bonus depreciation and R&D tax credits through 2026 (Bloomberg Government, Kiplinger).

- The IRS is rapidly scaling up enforcement. Backed by $80B in Inflation Reduction Act funds, it plans to increase large corporate audit rates from 8.8% in 2019 to over 22.6% by 2026, with a focus on transfer pricing, offshore income, and tech sector structures involving low-tax jurisdictions (IRS Strategic Plan).

- US trade policy continues to become more protectionist. The administration continues to impose tariffs on critical tech imports, especially semiconductors and electronics. Analysts warn that a 25% tariff on chip imports could reduce US economic growth by about 0.18% in the first year and 0.76% over ten years. At the same time, it will affect the US AI competitiveness in the world, as data centers require semiconductors.

Impact: All these shifts create a more complex, high-stakes tax environment for US-based tech companies. While the permanence of TCJA rules provides some planning certainty, the IRS crackdown adds compliance burdens and audit risk. On top of that, persistent tariffs increase costs for hardware and semiconductor-reliant tech companies, prompting many to diversify supply chains and operations beyond the US.

As a result, the US is becoming a less attractive hub for scaling tech operations, resulting in more companies turning to more favourable tax environments like those in Eastern Europe.

US vs Europe: Strategic Decision for Global Expansion

According to Kearney’s GSLI, choosing Eastern Europe for your tech business expansion is a smart move, especially if it’s Poland, Bulgaria, or Romania, which rank in the top 30. But what makes this region so appealing? Here are just a few reasons:

- Exports of commercial ICT services in the CEE region have increased more than sixfold between 2005 and 2021. Some countries have seen dramatic growth. For instance, Poland reached about $42 billion in exports in 2024, a 10.1% jump compared to 2023.

- The EE startup ecosystem grew faster than the European one in the last decade, with an average of 12x compared to 7x. Poland, Ukraine, and Czechia have the most value-rich ecosystems and the highest number of unicorns.

- Eastern Europe got €3.89 billion in VC funding across 1,286 deals in 2024, compared to approximately €1.85 billion in 2023. It’s a remarkable 56% year-over-year increase.

- Eastern Europe is home to 1.8 million software engineers who are real tech ninjas. They always appear and rank high in various coding competitions like TopCoder, Meta Hacker Cup, or Google Code Jam.

Now, let’s look at EE top locations for tech business expansion:

Poland

- 650K+ tech talents and 74K STEM graduates

- 41% lower senior dev salaries vs. the US

- #4 for tech skills and #3 for data science in EE

- Deduction of 200% of qualifying R&D costs

Romania

- 250K+ tech talents and 10K STEM graduates

- 41% lower senior dev salaries vs. the US

- #6 for both tech data science skills in EE

- Deduction of an additional 50% of the eligible R&D expenses

Discover how to hire developers in Eastern Europe within just 2-6 weeks!

Ukraine

- 302K+ tech talents and 38K STEM graduates

- 51% lower senior dev salaries vs. the US

- #7 for both tech data science skills in EE

- Reduced tax rates via Diia.City regime

Bulgaria

- 128K+ tech talents and 3K STEM graduates

- 50% lower senior dev salaries vs. the US

- #5 for both tech data science skills in EE

- 10% CIT and PIT – the lowest in the EU

Still unsure which EE location offers the best mix of tax benefits, legal ease, talent availability, and cost-efficiency? Alcor will help you pick the best location and also take the weight of expansion off your shoulders.

We make it possible with our Employer of Record in Europe:

- Save up to 3.5 months on company setup

- Get 100% compliance & legal shield

- Choose between FTE and B2B options

- Enjoy zero prepayment, markups, and hidden fees

- Get 24/7 Customer Success Manager support

See how it worked for US tech company BigCommerce:

With Alcor’s EOR for tech services, they employed their development team through our legal entity, stayed fully compliant with Ukrainian laws and GDPR, received accounting outsourcing services, and their devs got timely and accurate payments. We also handled in-house tech recruitment and even rented an office for their dev team. All of this under our all-in-one tech R&D center solution.

Alcor Provides 360° Operational Support in LATAM & Eastern European Countries

Unlike ordinary EOR providers, we don’t stop at the basics. We offer a full-package deal:

- In-house tech recruitment: Serving as an IT recruitment agency in Romania and other EE and LATAM countries, our 40 headhunters need only 2-6 weeks to hire top-10% of the market talent. 98.6% of our hires pass probation and stay with our clients for an average of 2.5 years.

- EOR for the IT business: We cover FTE and B2B contract management, legal compliance, developer on/offboarding, payroll, and benefits. Our lawyers also consult you on how social security contributions and tax rates differ in Eastern Europe and LATAM to pick the location with the highest financial benefit for your business. Plus, we always keep you updated on any tax reforms and legal changes.

- Operational support: Need something extra? We can rent an office or coworking space, procure hardware, or launch employer branding – pay only for what you use.

As a result, tech companies can easily expand to low-tax countries in Eastern Europe and Latin America, skipping red tape and admin hassle. People.ai, Ledger, Dotmatics, and many others have already successfully built their R&D teams with our solution.

Thinking about Build-Operate-Transfer in LATAM or EE? See how it stacks up against our R&D model in the latest article.

Here is another real-life case:

ThredUP, a US-based consignment store, decided to set up a software R&D center in Eastern Europe to advance its product. The main stumbling block was navigating local laws. Not only did ThredUP want to hire Ukrainian developers, but also scale their team compliantly and hassle-free. So, they turned to Alcor for help.

We consulted them on taxes in the EU vs the US, ensured uninterrupted payroll, and handled all transactions and accounts. Additionally, our lawyers took part in lease negotiations and provided professional support during the establishment of the R&D center.

The result? ThredUP established a compliant, fully operational R&D team, which helped them go public, raising $168 million in funding.

Would you like to achieve the same success? Fill the form below and let’s build your R&D center in EE or LATAM!

FAQ

1. How does the US tax system differ from the European one?

The tax system in the US is more complicated in terms of filing taxes and also includes the federal corporate tax, the state income tax, the federal unemployment tax (FUTA), the state unemployment tax (SUTA), and the Federal Insurance Contributions Act tax (FICA), unlike European countries. On the other hand, social security taxes in Europe often comprise multiple taxes, such as pension, medical care, etc.

2. What is the highest taxed nation in the world?

According to our sample of countries, France has the highest rates for social security taxes, making it the most taxed country.

3. Are US taxes higher than in Europe?

As for who pays more in taxes, it depends on the particular country. If we compare taxes in Europe vs. the USA, we can see that the US has higher rates compared to Eastern European countries (Poland, Bulgaria, Romania, Ukraine, Hungary), which makes them low-income tax countries. Meanwhile, the US has lower rates compared to most Western European states (France, Germany, Denmark, and Italy).

4. What countries have no tax?

Monaco has a 0% personal income tax rate, but its corporate tax rate is 25%.