75% of Western IT companies actively seek to leverage software development in Latin America. With the LATAM IT market projected to rise up to $74.5 billion by 2029, the strategy to hire LATAM developers seems a reasonable investment. Is it?

I’m David Gomez, Lead LATAM IT Recruiter at Alcor, a software R&D center accelerator. We provide tech recruitment services to US tech product companies, helping them to scale into Latin America or Eastern Europe by building elite engineering teams—5 devs in the 1st month, 30+ in three months, and up to 100 in a year.

In this article, you’ll see the big picture of the software development industry in Latin America, its key trends, tech hubs, advantages, and disadvantages of the region, and finally, learn about the best business approach to set foot in the region.

Latin American IT Industry Overview

The region’s IT industry is moving up at a CAGR of 6.5%. Currently, South America is leading the charge, with countries like Brazil, Mexico, Colombia, Argentina, and Chile as its tech powerhouses.

Also, the software development market in Latin America stands out in innovation thanks to:

- over 60 unicorns, including the ones with the highest valuation in 2025, like Colombian Rappi, Brazilian QuintoAndar, and Mexican Kavak.

- 9k+ funded startups that raised $3.6 billion in 2024.

- Fintech as the top informational technology sector, attracting 61% of all VC investments in 2024.

- Noteworthy sectors like E-commerce, Healthtech, AI & ML, Cleantech, and Agtech.

Software Development Trends in Latin America

Explore our breakdown of the software development industry in Latin America by application type to spot the newest trends in AI & ML, mobile development, IoT, and Cloud.

AI & ML solutions

The AI & ML IT sector can boost Latin America’s GDP by over 5% in the next five years. Such potential impact spurs AI adoption, investment, infrastructure expansion, and AI talent development.

The stats speak for themselves:

- By 2027, the largest 5,000 companies in the region will dedicate over 25% of their IT budgets to AI initiatives.

- Mexico and Brazil hold nearly 95% of all AI patents filed in South America.

- The University Tecnológico in Monterrey opened a GenAI laboratory to drive innovative AI technology in Mexico, while Chile emerged as the AI leader in the Latin American Artificial Intelligence Index.

Mobile development

According to IMARC, the LATAM mobile development market reached $18.9 billion in 2024 and is expected to hit $55.5 billion by 2033 with a stable CAGR of 11.4%. Such continuous growth results from enhanced internet connectivity, rising digitalization in fintech and e-commerce, and increasing 5G penetration. Regional leaders in digital payments? Brazil, Mexico, and Argentina.

At Alcor, we know about Mexican mobile development from experience. When Franki, a US software development company, sought to build a mobile capability team, we provided a robust pipeline of 20 iOS engineers to meet their needs. With our Employer of Record, Franki didn’t need to legally establish a software development company in Latin America. Instead, they focused on integrating 7+ senior hires into their team and scaling their product.

IoT & Cloud

The public cloud sector in Latin America is forecast to grow at a high CAGR of 14.3% to achieve $29.2 billion by 2030. Cloud computing, in turn, propels the LATAM IoT sector—in 2025, it should generate over $45.6 billion, while the number of IoT connections in the region will reach 1.3 million. At the moment, Brazil, Argentina, and Colombia stand out in the LATAM IoT market, while Chile is gaining momentum thanks to its well-developed digital infrastructure.

Reasons to Go For Software Development in Latin America

Tech talent trove

One of the reasons to outsource to Latin America is that it boasts an impressive talent pool of over 2.75 million IT specialists. These software developers are well-versed in .NET, Java, Ruby, Python, C++, C#, React, and Node.js. LATAM developers also excel in mobile development, data analytics, cloud computing, database development, and operating systems.

Smart salary savings

Developers in Latin America charge up to 53% less than their US counterparts while maintaining high-quality standards. Building a team of five AI software engineers will cost you $660,000 in the US in comparison with $306,000 in Latin America—and that’s only salary-wise.

Elite engineer education

Software engineers in LATAM receive high-quality STEM education in local universities, 20 of which are recognized among the Best Global Universities in Latin America. Institutions like the University of Chile, the Monterrey Institute of Technology, and the University of Buenos Aires nurture exceptional Latin American software development talent, placing it in top tech skills rankings on Coursera.

Leading launchpad location

Geographical proximity is a major advantage for US tech product companies opting for software development in Latin America. The US West Coast is just 1 hour behind Mexico, 2 hours behind Colombia, 3 behind Chile, and 4 behind Argentina. This not only facilitates face-to-face interactions between in-house and offshore tech teams but also enhances the supervision of the development process and streamlines onboarding for remote Latin American developers.

Corporate culture compatibility

Software developers in Latin America seamlessly integrate into foreign teams thanks to shared business ethics, customs, and workflow. They are known for dedication, punctuality, and a willingness to go the extra mile to meet deadlines. They excel in collaborative and independent work and adapt to changing project needs, while their straightforward communication style ensures everyone is on the same page.

Software Developer Salaries in Latin America in 2025

What could be the financial benefits of leveraging LATAM software development? Here are the average senior software development market rates in LATAM per year:

| Annual Senior Developer Compensation, USD | ||||

| Position | Mexico | Colombia | Argentina | Chile |

| Python Developer | 62,400 | 60,000 | 57,600 | 60,000 |

| AI Engineer | 62,400 | 60,000 | 60,000 | 62,400 |

| ML Engineer | 60,000 | 60,000 | 56,400 | 60,000 |

| Java Developer | 66,000 | 60,000 | 57,600 | 60,000 |

| Angular Developer | 50,400 | 48,000 | 45,600 | 48,000 |

| Node.JS Developer | 66,000 | 60,000 | 57,600 | 60,000 |

| React.JS Developer | 60,000 | 62,400 | 56,400 | 60,000 |

| Ruby Developer | 66,000 | 60,000 | 57,600 | 60,000 |

| Mobile Developer | 62,400 | 62,400 | 62,400 | 62,400 |

| Drupal Developer | 60,000 | 51,600 | 51,600 | 51,600 |

Argentina boasts the most budget-friendly senior developer salaries in South America, averaging between $45,600 and $62,400 annually. Colombia follows closely, with an annual range of $48,000 to $62,400. Meanwhile, Chile and Mexico have the highest rates, from $48,000 to $66,000 per year.

Check out our article on software engineer salaries in Argentina to learn more about the local wages!

Now, let’s put into perspective average senior developers’ salaries in LATAM in comparison with those of their US colleagues.

| Annual Senior Developer Compensation, USD | |||

| Position | US | LATAM | |

| Python Developer | 126,000 | 60,000 | |

| AI Engineer | 132,000 | 61,200 | |

| ML Engineer | 132,000 | 59,100 | |

| Java Developer | 114,000 | 60,900 | |

| Angular Developer | 120,000 | 48,000 | |

| Node.JS Developer | 114,000 | 60,900 | |

| React.JS Developer | 120,000 | 59,700 | |

| Ruby Developer | 114,000 | 60,900 | |

| Mobile Developer | 114,000 | 62,400 | |

| Drupal Developer | 115,200 | 53,700 | |

The most affordable positions in LATAM comprise those of Angular Developer, ML Engineer, and React.js Developer, averaging between $48,000 and $59,700 a year. In the US, at the same time, this expertise requires from $120,000 to $132,000. If you need mean stack or fintech expertise, this difference will help you cut costs by up to 60% when hiring South American tech specialists.

Top Outsourcing Destinations in Latin America and Their Hubs

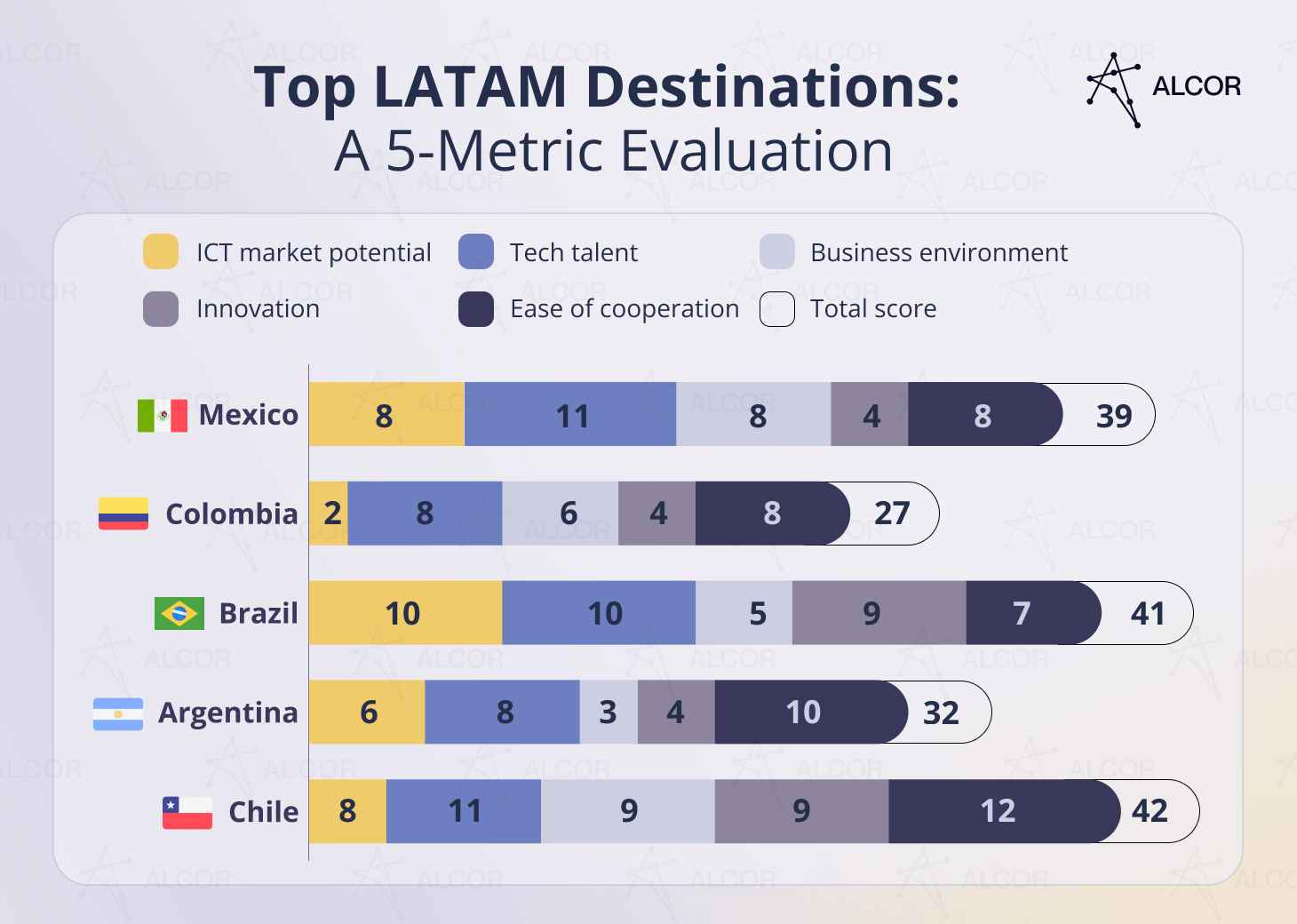

In this section, you’ll explore the main tech hubs in LATAM that strengthen the sought-after IT talent pool in Latin America. Bonus: a business environment ranking breakdown to help you navigate the region!

Mexico

Mexico is undoubtedly the most frequent choice among North American IT companies when hiring software developers in LATAM. Its convenient location, overlapping time zones, and impressive cost-effectiveness are just a few factors that attract foreign tech businesses.

- Talent pool: 800,000+

- Tech education: Top STEM universities—Tecnológico de Monterrey, the National Autonomous University of Mexico, and the Universidad Autónoma de Nuevo León

- Programming languages: JavaScript, Python, SQL, C#, React.js, and Angular

- Tech hubs: Mexico City, Monterrey, Guadalajara.

Colombia

Another excellent option for doing remote software development in Latin America is IT outsourcing to Colombia. This country ranks as the region’s fourth-largest provider of IT services, with a tech market currently valued at $8.2 billion and projected to reach $12.98 billion by 2026.

- Talent pool: 165,000+

- Tech education: 9 universities featured in the Best Global Universities in Latin America

- Programming languages: Java, Python, C#, SQL, and Ruby

- Tech hubs: Bogotá, Medellín, Cali.

Dive deeper into Colombia vs Costa Rica for software nearshore outsourcing.

Argentina

For tech companies seeking cost-effective software engineering in South America, nearshoring to Argentina is often a top choice. The Argentinian IT market is projected to reach $2.5 billion by 2026, growing at a CAGR of 8.3%.

- Talent pool: 150,000+

- Tech education: #1 in English proficiency, top in mobile development and data analysis

- Programming languages: Python, Cloud APIs, TensorFlow, and SQL

- Tech hubs: Buenos Aires, Córdoba, Mendoza.

Chile

One more great spot for hiring a software development team in Latin America is Chile. Software development in Chile looks quite promising: the country’s IT market has been experiencing remarkable growth, projected to reach $2.5 billion by 2028, with an annual growth rate of 8.2%. Chile also stands as the second most attractive South American country for startups, hosting over 122 startup companies and three notable unicorns: Betterfly, Cornershop, and NotCo.

- Talent pool: 100,000+

- Tech education: top in data analytics, mobile development, and statistical programming

- Programming languages: Java, Python, and PHP

- Tech hubs: Santiago Aires, Valparaíso, Concepción.

Learn more about nearshore outsourcing to Latin America!

Disadvantages of Outsourcing Software Development to Latin America

Complex Labor Laws

Each country has local labor laws that can feel like a maze for foreign companies looking to do software development in South America. Here’s a quick glimpse:

- Workweek. Colombia, Mexico, and Argentina follow a 48-hour workweek, while Chile sticks to 45 hours. All these countries generally allow for a six-day work week with the possibility of overtime work.

- Overtime. From double pay in Mexico to triple pay after the 9th hour, overtime rules differ across the region. In Argentina, employees who work overtime are entitled to 150% of their average pay or 200% if working on holidays. In Colombia, on the other hand, employees can work up to two hours of overtime per day and up to 12 hours per week. They’re paid an extra 25% on top of their regular salary.

- Paid public holidays. Colombia offers the most public holidays (18), followed by Argentina (12), while Mexico and Chile have 8 and 9-12, respectively.

- Paid vacations. After a year, Mexican labor law grants workers 12 paid vacation days, while Colombians get 15, and Argentines with less than 5 years of experience get 14.

Plus, there are differences in employment and taxation, which might be tricky when choosing Latin American software development. My advice? Use Employer of Record in Latin America to make your offshoring journey seamless.

Language barrier

LATAM developers may be slightly inferior in English proficiency compared to their Eastern European colleagues. However, the situation is changing in favor of Latin America every year. Argentina stands out as a bright spot in the top 30 countries of the world with the highest English proficiency in the region. At the same time, Chile has a moderate level, which is a drastic improvement from a low English proficiency level just ten years ago. And it’s likely to increase even more.

Simpler Than Outsourcing Software Development to Latin America

Alcor is your package deal for tech expansion to Latin America. We’ve merged EOR, LATAM tech recruitment, and operational support into a transformational business model that lets you build a high-performing tech team in Latin America from 10 to 100+ developers within a year.

Why does it work?

- We’re tech-focused. Our experience of IT recruitment in Latin America has built a foundation of a 253,000+ database of verified candidates, a 98% probation period pass rate, and a 90% talent retention rate.

- We’re legally savvy. No need for your own entity—the Alcor team handles HR, payroll, accounting, and legal matters, while you manage a Silicon Valley-caliber tech team—yours from day one.

- We go the extra mile. On top of 360° operational and AM support, we want you to succeed in the new market. That’s why we can cover your employer’s brand promotion like we did for Sift, negotiate the office lease like for Dotmatics, or even devise stock option plans (SOPs) like for ThredUP.

References on Software Development in Latin America

- Business Insider

- Statista

- Mordor Intelligence

- TechCrunch

- Latin America Venture Capital Report 2025

- Economist Impact

- Bnamericas

- Latin American Artificial Intelligence Index

- IMARC

- Grandview Research

- USnews

- Coursera Global Skills Report 2024

- English Proficiency Index 2024