An Employer of Record in Mexico is a third-party provider that acts as the legal employer for your team abroad, handling payroll, taxes, benefits, and compliance, which significantly simplifies your entry into the foreign market.

It’s no surprise that 39% of US companies, especially in tech, are now embracing EOR to set up and manage their global teams without risks.

I’m Gilda Orozco, a Legal Adviser in LATAM at Alcor, a software R&D accelerator that provides recruitment, ops, and Employer of Record services. We build fully compliant teams from 10 to 100+ hi-tech developers in Latin America and Eastern Europe, with 40% cost savings and no need to establish a legal entity.

Today, you’ll finally get the A-to-Z breakdown of how EOR in Mexico works – what benefits it offers, how it simplifies market entry, and how it helps you stay compliant with local labor laws. And to wrap it up, I’ll share a go-to checklist to help you choose the right EOR partner in Mexico.

Key Takeaways

- An Employer of Record (EOR) provider in Mexico is a legal employer that handles employment contracts or SLAs, payroll, compliance, and benefits on your behalf. At the same time, you remain in charge of all the decision-making and management.

- Partnering with an Employer of Record in Latin America brings key benefits: faster market entry, 40% cost savings, reduced legal risks, and streamlined HR operations.

- When it comes to hiring employees or contractors in Mexico, tech companies tap into an 800K-strong, 54% more affordable, and #3-ranked tech talent pool in the region, and EOR vendors help them bypass complex incorporation.

- Choosing the right EOR provider in Mexico means checking for tech focus, transparent pricing, strong local infrastructure, and full PEO-style support tailored to your business needs.

- With Alcor’s EOR for tech solution, you can easily tap into the Mexican market and build your own Mexican Silicon Valley–caliber team with 100% legal coverage and individual operational support.

Benefits of Using an Employer of Record in Mexico

For companies growing into new areas, an Employer of Record (EOR) vendor in Mexico provides a number of advantages:

- lowers risks

- enables quicker market entry

- saves money by lowering hiring and operational expenses

EOR platforms increase the accuracy of legal compliance by 29% by precisely handling labor laws, taxes, benefits, and terminations. EOR also simplifies operations by managing contracts, PTO, payroll, compliance, and benefits locally, relieving internal teams of excessive bureaucracy. Alcor, a reputable EOR in Mexico, oversees all aspects of compliance and payroll. And now let’s go into detail.

Faster market entry

When expanding into a new region, time is everything. My legal team estimates that incorporating a legal entity in Mexico on your own can take anywhere from 1.5 to 3.5 months. With an Employer of Record in Mexico, you can hire and onboard employees in just a few weeks, skipping the delay. That means you can begin product development immediately and launch faster than competitors who choose to set up a legal entity and supporting processes on their own.

Reduced risks

A compliant EOR in Mexico acts as a legal buffer between your business and unfamiliar local laws. Labor codes, taxes, benefits, and terminations are handled with precision and accuracy. In fact, EOR platforms have been shown to improve legal compliance accuracy by 29%, dramatically reducing the risk of lawsuits, penalties, or reputational damage according to Global Growth Insights.

Cost savings

Thanks to the Employer of Record concept in Mexico, companies can cut hiring and operational expenses by up to 50%, based on our client experience. These savings can then be strategically reinvested into marketing, customer support, and other growth initiatives.

Streamlined operations

Managing payroll laws, contracts, PTO, and benefits across borders is a logistical challenge. With an Employer of Record in Mexico, all admin and HR processes are handled locally, freeing your internal team from bureaucratic overload. The result? It reduces time-to-productivity by up to 35%.

Employer of Record in Mexico: Key Functions

An Employer of Record in Mexico is a third-party legal employer that handles employment contracts or SLAs, payroll, taxes, benefits, and more, while clients retain full control over decision-making and management. Under EOR, they can hire employees or contractors without opening a local entity. It ensures compliance with local labor laws, speeds up hiring, and allows cost-effective expansion.

An EOR service costs only $200-$650/month per person, covering payroll, accounting, and legal admin, compared to roughly $29,000/month to maintain a full internal HR, legal, and payroll team. It saves you up to $28,000 and frees your internal team to focus on core business tasks rather than onboarding, payroll processing, tax filings, and legal compliance.

Now, let’s dig deeper.

Acts as a legal employer

An Employer of Record (EOR) in Mexico assumes full responsibility for employment contracts or SLAs, taxes, statutory benefits, onboarding, and terminations. Meanwhile, you remain the actual employer, making all key decisions regarding hiring, promotions, and dismissals of your employees. Unlike a Professional Employer Organization (PEO), an EOR does not require you to establish a local entity and serves as the sole legal employer, rather than a co-employer, so you don’t have to share liabilities.

Fully ensures compliance

One of the most vital aspects of using an EOR in Mexico is seamless compliance with local labor laws. From mandatory benefits and social security to complex PTO and PTU (profit-sharing) regulations, the EOR ensures every process is legally sound.

Speeds up onboarding

Onboarding speed can define your market entry success. Every week lost to contracts, compliance, or payroll setup is a week your new hires aren’t coding, innovating, or delivering results.

Alcor’s EOR in Mexico changes that. Our streamlined process lets you hire employees and onboard them in just 1–2 weeks. It is well ahead of the month or more that many companies face while working with other providers. When Intel 471, a US-based cyber threat intelligence company, needed to quickly expand operations, we onboarded 20 developers for them in just one month.

Allows cost-effective expansion

According to the data provided by Alcor’s legal team, opening your own legal entity in Mexico can cost $15K–$25K upfront, while an EOR charges $0 in setup fees. Instead, you pay $200–$650/month per person, covering payroll, accounting, and legal admin – far more affordable than hiring a full internal HR, legal, and payroll team that can cost up to $29,000/month.

Lets you focus on core business

With an EOR in Mexico, you delegate time-consuming administrative tasks – such as onboarding, payroll processing, tax filings, and legal compliance – to experts. It allows your internal team to focus on product development and strategic growth.

Fundamental Employee Rights in Mexico

In Mexico, employees have the right to a written employment contract, including job type, location, salary, hours, benefits, and beneficiaries. They are entitled to profit sharing (PTU), and employers must protect personal data. Workers must receive at least the national minimum wage and a maximum 48-hour workweek. They also have the right to vacation, Aguinaldo, and mandatory benefits. With an EOR in Mexico, the provider acts as the official employer, ensuring all these rights are met while shielding the client from employer liabilities and keeping them fully informed. Let’s look at this more thoroughly.

- In Mexico, the employee has the right to receive a written employment contract specifying job type (task-based, fixed term, indefinite, seasonal, probationary, or training), work location, salary, hours, benefits, and beneficiaries, with at least two signed copies provided if no collective agreement applies. With an EOR in Mexico, the provider hires the client’s team through its own legal entity, becoming the official employer and handling all employment contracts or SLAs. Clients avoid employer liabilities while receiving full contract copies and a direct service agreement for complete transparency.

- Employees are entitled to profit sharing (PTU), receiving 10% of the employer’s taxable income to be sharedequallyamong themwithin 60 days after the tax filing date.

- Personal data must be protected under the Federal Law on Protection of Personal Data, with employers required to issue clear privacy notices, obtain explicit consent, and safeguard sensitive information – non-compliance can result in significant fines.

- Employees must receive at least the national minimum wage, and work a maximum of 48 hours a week, with mandated overtime pay (typically 50% extra for extra hours).

- There is a legal right to vacation and a Christmas bonus (Aguinaldo), plus mandatory benefits, such as social security (IMSS), housing funds (INFONAVIT), and retirement savings schemes.

- Employees have a legal right to safe and healthy working conditions, with employers required to follow official safety and hygiene regulations.

- The constitutional protection of association and union rights includes freedom of association, collective bargaining, and the right to strike.

Employee Benefits in Mexico

Under the Mexican Federal Labor Law, employees are entitled to benefits including weekly rest days, paid public holidays, annual paid vacation, Christmas bonus, social security enrollment, maternity and paternity leave, parental leave, and sabbatical leave for teachers. Many companies also provide additional perks such as private medical and life insurance, internet allowance, tech courses, stock options, food vouchers, savings funds, and productivity bonuses to attract senior talent and reduce attrition. Want more insights? Read further!

Mandatory employee benefits

According to the Mexican Federal Labor Law, mandatory employee benefits in Mexico include:

- Weekly rest day: One fully paid day off every six days worked; 25% Sunday premium if working on Sundays.

- Paid public holidays: Statutory days off or triple pay if worked.

- Annual paid vacation: Minimum of 12 working days after one year, increasing with tenure, plus a 25% vacation premium.

- Christmas bonus (Aguinaldo): At least 15 days’salary, paid before Dec 20.

- Social security: Mandatory enrollment for healthcare, maternity, disability, and retirement benefits.

- Paid maternity leave (84 calendar days, typically split into 42 days before and 42 days after birth, beginning at least 14 days prior to the due date) and paternity leave (5 days).

- Paid parental leave for parents caring for children under 16 who have been diagnosed with a medical condition.

- Paid sabbatical leave for teachers: Teaching staff can request a paid sabbatical year every six years after being confirmed as tutors.

Non-mandatory employee benefits

Did you know that over 1.3 million employees surveyed by Great Place to Work (GPTW) said they prioritize factors like job security, growth opportunities, and positive work cultures in employers, alongside a big paycheck and traditional benefits?

That’s why to win over senior talent and reduce attrition, companies typically go further, offering a mix of common non-mandatory benefits in Mexico, such as:

- Private medical insurance,

- Life insurance,

- Internet allowance,

- Tech courses & English classes,

- Stock options,

- Food vouchers,

- Savings fund,

- Productivity bonus.

Payroll Laws and Taxes in Mexico vs in Other LATAM Countries

Most companies weigh two hiring models: FTE (full-time employment) and B2B (hiring independent contractors). Each comes with different legal and financial implications:

- FTE (Full-time employment): This model includes a formal employment contract, where the worker is entitled to statutory benefits such as PTO, social security, vacations, and profit sharing. It also comes with significant employer tax contributions and legal obligations.

- B2B (Contractor agreements): This model is often used to engage freelancers or self-employed professionals via commercial contracts. While it offers more flexibility and reduced tax obligations, companies should ensure that such agreements are structured in accordance with Mexican labor law.

For better context, let’s compare tax-related obligations for companies under both models across Mexico, Argentina, and Colombia – the three most popular nearshoring destinations in Latin America.

|

Taxes in Mexico vs Other LATAM Destinations |

|||

|

|

Mexico |

Argentina |

Colombia |

|

Social security contribution (Employer’s share) |

18.4-25.5%* |

27.8% |

21.022% |

|

Payroll taxes (Employer’s share) |

3% |

0 |

9% |

*Standard (SSC): Those in which the base used for calculation is the employee’s SBC (MXN 3,606.66 daily).

The B2B model operates a bit differently: it doesn’t require companies to pay taxes, such as personal income tax or social security contributions, on behalf of contractors.

What about payroll laws and regulations? My team put together a quick cheat sheet with key details you shouldn’t overlook if you want to stay compliant when incorporating and hiring in Mexico.

|

Payroll Laws Peculiarities in Mexico vs Other LATAM Destinations |

|||

|

|

Mexico |

Colombia |

Argentina |

|

Working hours/week |

48 |

46 |

48 |

|

Overtime |

200% of the regular rate in regular hours and 225% on a Sunday or holiday |

125% of the regular rate in regular hours and 175% during night, additional rates apply if performed during a Sunday or a holiday |

150% of the regular rate in regular hours and 200% on a Sunday or holiday. |

|

Vacation |

12-30 working days + a bonus of 25% of regular salary |

15 working days |

14-30 working days + a bonus of 20% of regular salary |

|

National holidays |

7 |

18 |

19 |

|

Annual bonus |

15 days of salary: once a year, paid in December |

30 days of salary: twice a year, on 15 days every 6 months. 12% interest on 30 days’salary |

30 days of salary: twice a year, on 15 days every 6 months |

Non-compliance with Mexican labor law, misclassification of workers, or payroll errors when expanding internationally can result in legal exposure, tax penalties, or damage to the employer’s brand. That’s where an Employer of Record in Mexico backs you up.

Employee Taxation in Mexico

As mentioned earlier, employee taxation in Mexico is made up of Social Security Contributions and Payroll Taxes. Let’s examine what each of these includes.

Social Security Contributions (federal)

|

Sickness and Maternity – fixed rate* |

20.40% |

|

Sickness and maternity |

1.75% |

|

Sickness and maternity – additional fee |

1.10% |

|

Disability and Life |

1.75% |

|

Retirement |

2% |

|

Unemployment and Old-age Scheme |

6.422% |

|

Occupational risk |

0.54%-7.59% (depending on the risk category) |

|

Nursery and social benefits |

1% |

|

Housing Fund (INFONAVIT) |

5% |

*Sickness and Maternity fixed rate of 20.40% is based on the UMA (Unidad de Medida y Actualización). For 2025, the daily UMA is MXN 113.14, so the fixed contribution is 20.40% × MXN 113.14 = MXN 23.08 per day (around MXN 692 per month).

Payroll taxes (local)

|

Payroll CDMX tax |

3% |

The CDMX payroll tax increased to 4% as of January 2025 (per the 2025 CDMX decree). However, following our company’s internal discussions earlier this year, we chose to keep a 3% rate in client budgets.

Notably, other major tech hubs in Mexico, where most tech talent is concentrated, will also maintain a 3% payroll tax rate in 2025, including:

- Guadalajara (Jalisco): 3%;

- Monterrey (Nuevo León): 3%;

- Querétaro: 3%.

An employee earning a monthly salary of $5,000 and working as a tech specialist would require the employer to budget roughly 24.1% extra for social security contributions and payroll taxes on top of the gross pay.

Employee Visa and Work Permits Peculiarities

Temporary Resident Visa + Work Permit is a go-to combo that allows foreign professionals to legally live and work in Mexico for up to four years. Employers must initiate the application with the Instituto Nacional de Migración (INM), and employees then transform the visa into a Temporary Resident Card within the first 30 days in Mexico.

However, temporary visa holders are required to stay with their sponsoring employer. If the contract ends, they must secure a new sponsor for a visa transfer or leave Mexico.

After four years, an employee can apply for a Permanent Resident Visa with Work Authorization, granting unrestricted work rights. Some may qualify earlier through family reunification or retirement routes.

In Mexico, work permits are issued as part of a residency card, not as standalone documents. Common work permission categories include:

- General Employment: For standard hires.

- Intra-Company Transfer: For relocating within the same corporate group.

- USMCA Professional: Fast-track for eligible US/Canadian professionals.

- Independent Activities: For self-employed work.

- Seasonal/Temporary: For short-term projects.

- Corporate Representative: For executives representing foreign companies.

Employee Probation and Termination in Mexico

According to the data provided by our legal team, the probation periods in Mexico vary by role:

- up to 1 month for standard positions

- up to 6 months for technical or managerial roles.

During probation, termination is simpler and does not require a notice period, but certain payments still apply.

If employment is ended during the probation period:

- No notice period is required.

- Dismissal can be with or without cause.

- Employees are entitled to payment for unused vacation days, a pro-rated Christmas bonus (13th-month salary), and any worked but unpaid days.

Outside probation, termination follows stricter rules:

- Employers are not obliged to provide a notice period but must inform the employee of thereasonsfor dismissalwithin 5 days.

- Dismissal may be with or without cause; for justified dismissals, it is recommended to have at least two witnesses present.

- Standard payments include unused vacation pay, pro-rated Christmas bonus, and pending wages.

If dismissal is deemed unjustified, additional severance applies:

- 90 days’salary.

- 20 days’salary per year of service.

- 12 days’salary per year of service (seniority premium).

Special protections apply to pregnant employees, union leaders, and employees on sick leave, requiring additional legal justification or official approval before termination.

Diversity, Equity, and Inclusion (DEI) Driven Employment in Mexico

Mexico’s labor framework strictly prohibits discrimination on grounds such as ethnic origin, gender, disability, age, marital status, or social status, and mandates equal pay for equal work in the same conditions. The National Council to Prevent Discrimination (CONAPRED) oversees implementation and addresses complaints under the Federal Law to Prevent and Eliminate Discrimination, along with the National System for Equality and INMUJERES.

Despite policy efforts, women remain underrepresented in STEM. To address this gap, initiatives like Laboratoria provide women with technical and life skills bootcamps, resulting in a 79% job placement rate for its graduates across Latin America.

However, equal pay remains elusive in Mexico in general: women earn about 65‑75 pesos ($3.50-$4) for every 100 ($5.5) earned by men, leading to a gender wage gap of approximately 25%.

Areas of Responsibility Covered by EOR Providers in Mexico

Employer of Record in Mexico handles various areas of responsibility, including employment and termination procedures, payroll and reporting, fiscal responsibilities, IP rights protection, benefits and PTO management, and local representation. They ensure compliance with federal labor laws, draft compliant employment contracts, manage terminations, process local payroll, navigate fiscal responsibilities, integrate local data protection laws into employment contracts, manage statutory benefits, and ensure local representation. They also manage PTO policies in line with local regulations and monitor updates to the Federal Labor Law, protecting companies from surprise obligations. Need the specifics? Scroll down!

Employment and termination procedures

A Mexican EOR ensures that all employee contracts comply with federal labor laws – from correct job classification and probation periods to severance packages. The EOR provider drafts compliant employment contracts or service-level agreements, manages terminations with proper cause documentation, and handles mandatory notice periods to mitigate employer liability.

Payroll and reporting

EOR in Mexico processes local payroll, pays salaries to employees on time, and provides all statutory tax reports to authorities like SAT and IMSS. Itincludes monthly tax returns and annual declarations, which can be overwhelming without the guidance of local experts.

Fiscal responsibilities

Mexico’s fiscal and payroll laws are nuanced, with variable employer contributions, progressive income taxes, and mandatory payments like social security and PTU. Your EOR provider navigates all of this – from salary withholdings and tax filings to IMSS registrations, ensuring full compliance with SAT regulations.

IP rights protection

For tech product companies, intellectual property and confidential information are non-negotiable assets. A trusted Employer of Record in Mexico integrates local data protection laws into employment contracts, ensuring that NDAs, IP assignment clauses, and confidentiality terms are fully enforceable under Mexican law.

Mexico’s Federal Law for the Protection of Industrial Property (FLPIP) safeguards patents, trademarks, industrial designs, and trade secrets. At the same time, the Federal Labor Law ensures that inventions created within the scope of employment belong to the employer. By drafting contracts that align with these regulations, companies can secure ownership of code, algorithms, and other innovations. Enforcement is carried out through the Mexican Institute of Industrial Property (IMPI) and supported by international agreements like USMCA and TRIPS.

In 2023, IMPI successfully ruled in favor of a software company whose former employee attempted to use proprietary source code in a competing startup. The court upheld the company’s IP assignment clause, preventing the commercial use of the stolen code and imposing damages.

Benefits and PTO management

The Employer of Record in Mexico handles statutory benefits, including paid vacations, public holidays, Christmas bonuses, and healthcare coverage – ensuring you’re not only compliant, but also competitive. They also administer PTO policies in line with local regulations, which increased significantly under Mexico’s recent labor reforms.

Local representation

In Mexico, labor unions and employee representation can be a sensitive topic because of their long history of state control. A local EOR in Mexico ensures compliance with collective bargaining rules and helps you avoid labor disputes. They monitor updates to the Federal Labor Law, protecting your company from surprise obligations.

Hiring in Mexico for Your Business’ Success

Hiring in Mexico offers US companies a powerful way to overcome talent shortages while benefiting from a skilled, cost-effective workforce. With over 800,000 tech professionals and 124,000 STEM graduates annually, Mexico is home to one of the largest talent pools in Latin America. Key sectors such as cybersecurity, fintech, and automotive are driving growth, supported by a rapidly expanding IT services market. Success, however, requires understanding local corporate culture too. By partnering with an EOR provider in Mexico, companies can hire there in as little as 1–2 weeks, ensure full compliance, and focus on scaling their teams without the burden of local entity setup.

Read ahead for detailed insights.

Why Mexico stands out

Today, 71% of US companies report a shortage of specialists especially in the information technology industry. If you’re an American tech business, you’re likely part of this statistic. So, what’s the solution? It’s time to look toward Mexico. This country is home to the #2 largest pool in the region, with over 800,000 skilled tech professionals and 124,000 STEM graduates each year. An EOR in Mexico provides you with immediate access to this talent, removing geographical and legal barriers.

Where the demand for talent is the highest

Driven by high demand, today, global companies actively hire talent in Mexico across these key sectors:

- Cybersecurity: With the market projected to reach $3.19 billion by 2028, demand for cybersecurity specialists in Mexico is rapidly increasing across the finance, healthcare, and technology sectors.

- Fintech: Over 1,000 fintech companies operate in Mexico, with the sector growing by 20% annually and projecting 86 million users by 2027.

- Automotive & manufacturing: Hiring activity in the automotive sector rose by 7% in Q2 2024, driven by major OEMs expanding nearshoring operations.

The growing trend of relocating key tech operations to Mexico is already paying off: the IT services market in Mexico is projected to reach over $16.1 billion in 2025, making it one of the most dynamic and profitable industries in the country.

Corporate culture in Mexico

Succeeding in Mexico’s talent market is about both finding the right skills and understanding how business is done. It is essential to understand key aspects of Mexican corporate culture:

- Hierarchy is accepted as natural and unquestionable, with organizational ranks seen as reflecting inherent inequalities, centralization favored, subordinates expecting clear directives, and the ideal leader viewed as a benevolent autocrat.

- Managers in Mexico are expected to be decisive and assertive, with a strong focus on equity, competition, and performance, and conflicts are typically resolved through direct confrontation.

- Since Spanish is the primary business language, even basic knowledge is seen as a sign of respect.

- Professional, formal dress is standard in major business hubs.

- Family commitments and major holidays can impact timelines, so planning is essential.

Your hiring options

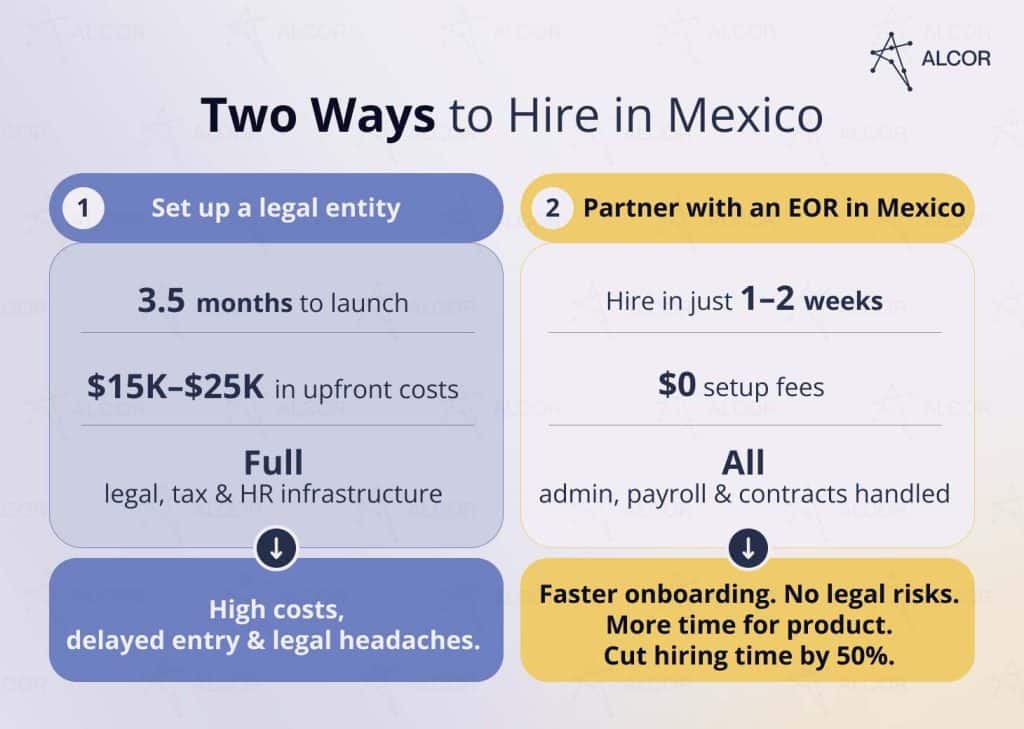

There are two main ways to hire locally:

- Set up a legal entity: It grants control but takes up to 3.5 months and $25,000, as well as the establishment of legal, tax, and HR infrastructure.

- Partner with an experienced Employer of Record provider in Mexico: This is a faster, low-risk route that allows you to start hiring in weeks without the need for incorporation & prepayment.

Now, let’s break down why this option is considered the simpler route. An Employer of Record takes over the bureaucracy, from drafting contracts to registering workers with local authorities. For your business, that means:

- fast onboarding (often within 1–2 weeks)

- no surprises with Mexican labor laws or tax compliance

- more time to focus on product, not paperwork

- reduce hiring time by over 50%, according to Globalization Partners

At Alcor, we’ve already made hundreds of successful hires for companies like Dotmatics, Ledger, and GoTransverse. Check out our success stories on the website – and get inspired to scale your engineering team the smart way.

Annual Employment Cost in Mexico: Tech Industry Example

Hiring developers in Mexico goes far beyond just offering a lower salary. Even though wagesin Mexico are lower than in the US, that’s just the tip of the iceberg. To truly understand the cost of your development team, you need to calculate total labor expenses in Latin America. That includes:

- Employee benefits package, which typically includes health insurance, professional training, hardware, and corporate merchandise, totaling about $6,500 in LATAM and $15,500 in the US;

- Aguinaldo, a year-end bonus equal to 15 days of salary;

- Recruitment fee, which is typically 20% of the gross annual salary for a senior developer in Latin America and 30% in the US.

After conducting in-depth research on the local talent market and salary benchmarks, I compiled a detailed breakdown of what the total employment cost looks like for some of the most common tech roles in Mexico:

|

Total Annual Engineer’s Employment Cost, USD |

||

|

Position |

Mexico |

USA |

|

AI/ML Engineer |

$67,590-$97,390 |

$171,400-$202,600 |

|

Cloud Engineer |

$76,530-$106,330 |

$226,000-$257,200 |

|

Mobile Developer (iOS/Android/Xamarin) |

$69,080-$98,880 |

$148,000-$179,200 |

|

Blockchain Developer |

$76,530-$106,330 |

$171,400-$202,600 |

|

C/C++ Developer |

$73,550-$103,350 |

$148,000-$179,200 |

The result? When you run the full numbers – including Aguinaldo, benefits, and recruitment fees – Mexico still offers a 48–62% savings on senior software engineers’total compensation compared to the US.

EOR in Mexico vs Legal Entity

The decision to incorporate in Mexico or partner with an Employer of Record (EOR) depends on factors such as time to hire, budget, control over employees, and scalability plans. EORs offer a shared employment model, full operational control, compliance with Mexican labor and tax laws, and scalability. Alcor’s EOR in Mexico offers full-cycle tech recruitment, onboarding, payroll, and benefits administration, all compliant with national and state-level labor laws.

Read on for a more detailed overview!

If you’re asking yourself, “Should we incorporate in Mexico or partner with an EOR in Mexico?” – the answer depends on how quickly you want to build your team, the size of your budget, the level of control you want over your employees, and your scalability plans.

So, let’s break down what it takes to set up a legal entity, and how this compares to partnering with an experienced Employer of Record in Mexico.

|

Category |

Employer of Record (EOR) |

Legal Entity |

|

Time to hire |

1–3 workweeks |

2–6 months (incl. registration) |

|

Setup cost |

Low initial cost |

High legal & compliance fees ($10k–25k+) |

|

Control |

Shared employment model; you manage work, EOR handles legal matters |

Full operational and employment control |

|

Compliance |

EOR ensures compliance with Mexican labor & tax laws |

Your team is liable for all labor, tax, and HR compliance |

|

Scalability |

Ideal for SMEs |

Efficient for long-term growth |

|

Customization |

Standardized contracts and benefits packages |

Fully customizable policies, payroll, and incentive schemes |

What does Alcor’s EOR in Mexico offer?

At Alcor, we specialize in helping tech product companies not only hire talent in Mexico quickly and legally but also build long-lasting teams without the burden of incorporation. Our EOR model in Mexico covers full-cycle tech recruitment, onboarding, payroll, and benefits administration – all fully compliant with both national and state-level labor laws.

And here’s the proof: For Tonic Health, we built a fully operational tech R&D center in just 3 months. Our team:

- handled 100% of accounting, payroll, and legal duties

- took care of leasing and equipment provisioning

- hired 15 top-tier PHP engineers

The result: 4 years of ongoing cooperation with full legal handling, timely payments, and seamless tax management.

Want to explore more real-life client testimonials and success stories? Check the video to get all the details and hear what real tech companies have to say about working with Alcor.

EOR Agencies in Mexico: The Competitive Edge Map

If you’re comparing EOR agencies in Mexico, it’s easy to get lost in a sea of big promises and sleek platforms. Every provider claims “compliance” and “speed,” but the real difference lies beneath the surface: in who actually employs your people, how transparent their pricing is, and how human their support feels when things go off-script.

That’s why I made this quick comparison – not just to stack up features, but to help you see what truly separates the best EOR services in Mexico from the rest:

1. Alcor

Alcor offers an all-in-one solution called the software R&D center, which combines Employer of Record services with tech recruitment and full operational support across Latin America and Eastern Europe.

Pros:

- Focused exclusively on the technology sector, Alcor has deep expertise in sourcing and managing engineering talent.

- Offers flexible, pay-as-you-go pricing without hidden fees or prepayments.

- Provides reduced per-employee fees as hiring volume increases.

- Has its own legal entity and an in-house tech recruitment team, removing the need for third-party vendors.

- Delivers a deferment from mobilization service.

- Offers an AlcorOS – an integrated system for automated payroll, compliance tracking, onboarding, and financial reporting that adds transparency and efficiency to workforce management.

- Each client is assigned a personal Customer Operations Manager, replacing chatbots with direct human assistance.

Cons:

- Alcor’s solution is designed specifically for tech and is not suitable for other industries.

- Most suitable for hiring teams of 10+ developers in one target market, not small crews.

- Provides comprehensive Employer of Record services in only 5 top markets for tech yet, and Contractor of Record services across other countries in LATAM & Eastern Europe.

2. G-P Globalization Partners

Founded in 2012, Globalization Partners is one of the earliest and largest providers in the EOR industry. Its G-P Meridian™ Suite supports international hiring and compliance in more than 180 countries.

Pros:

- Integrates with major HRIS platforms like ADP and BambooHR.

- Provides dedicated in-country HR and legal specialists for local compliance.

- Delivers full-service benefits administration and payroll management.

- Uses a flexible, custom pricing model based on region and team size.

Cons:

- Relies on third-party partners in certain countries rather than fully owned entities.

- Leverages automation for customer support through its AI tool, G-P Gia™.

- Takes a broad, cross-industry approach rather than focusing on a specific sector.

- Some processes (like onboarding or payroll changes) can be slower than expected.

3. Deel

Deel enables businesses to hire employees and contractors in 150+ countries without establishing local entities. Its platform automates global payroll, compliance, and contract management for fast international expansion.

Pros:

- Owns legal entities in 100+ countries.

- Automates key processes like contract creation, tax documentation, and compliance monitoring.

- Offers real-time dashboards and reporting tools for full visibility into payments, contracts, and workforce data.

- The pricing for Employer of Record services starts at $599 per employee/month.

Cons:

- Some features (benefits, immigration, advanced HR modules) come at an additional cost or require custom quotes.

- Focused mainly on EOR functionality and lacks built-in recruitment tools, applicant tracking, advanced analytics, or performance management features.

4. Oyster HR

Oyster HR helps companies hire, pay, and manage distributed teams in more than 180 countries. The platform was built around a mission to make global employment accessible to businesses of any size

Pros:

- Offers customizable benefits packages tailored to local labor standards and employee expectations.

- Built for fast setup with minimal manual effort required.

- Provides discounted pricing for nonprofits and dedicated programs for companies hiring refugees.

- The pricing is $699 per employee monthly + annual plan with custom pricing for 3+ EOR hires.

Cons:

- Relies on a network of third-party local partners in many countries rather than fully owned entities.

- Takes a broad, multi-industry approach without specialization in a specific sector.

- Some users report slower turnaround times for onboarding and payroll adjustments.

5. Native Teams

Native Teams provides EOR services in 85+ countries, allowing businesses to legally employ global workers with localized benefits.

Pros:

- Provides compliant employment status for international hires through locally registered entities.

- Generates legally compliant, localized employment agreements tailored to each jurisdiction.

- Displays estimated hiring costs, including taxes and contributions, before onboarding.

- Assists with international mobility for employees and contractors working across borders.

- Plans start from €99 per employee/month, with flexible pricing for larger hiring volumes and custom requirements.

Cons:

- Communication between the provider and clients can occasionally be slow.

- Less suitable for large or complex organizations that need deep integrations, advanced analytics, or highly customized workflows.

- Caters to a wide range of industries rather than focusing on one specific sector.

6. Pebl

Founded in 2014 and rebranded in 2024, Pebl – previously known as Velocity Global – is one of the trusted vendors in the Employer of Record market. The company provides the global hiring solution across 185+ countries.

Pros:

- Its Global Work Platform™ combines automation with advisory support from local HR and legal specialists.

- Enables employee activation in as little as 48 hours for many regions.

- Offers the advisory on immigration, benefits, and cultural integration.

- Includes account managers who assist with scaling plans and market entry 24/7.

- The pricing typically starts at $599 per employee/month.

Cons:

- Onboarding timelines may take longer than expected.

- Certain costs are not always clearly outlined upfront.

- Has a relatively low Trustpilot rating of 2.5/5.

- The rebrand from Velocity Global to Pebl may cause confusion or hesitation in the market.

7. Remote

Remote is a global Employer of Record platform that helps companies hire, pay, and manage distributed teams in over 180 countries.

Pros:

- Owns legal entities in supported countries, ensuring direct compliance and streamlined operations.

- Provides payroll and benefits management in 100+ currencies, including insurance, stipends, and equity options.

- Includes time tracking, expense management, and integrated HR tools.

- Offers strong IP protection and local labor law compliance.

- The pricing starts at $699 per employee/month.

Cons:

- Pricing may be high for startups or smaller teams.

- While optimized for salaried employees, hourly or overtime payments often require manual processing.

- Standard plans may offer limited customization for large or highly complex enterprise needs.

8. Serviap Global

Founded in 2010 in Mexico, Serviap Global provides Employer of Record services to international teams. The company supports clients in over 100 countries.

Pros:

- Operates with over 15 years of experience in LATAM markets and global expansion.

- Offers multilingual, human-powered support with dedicated account managers.

- Uses the Serviap Global Hub platform for managing payroll, compliance, and team oversight.

- The pricing starts at €399/employee per month.

Cons:

- The platform sometimes offers insufficient detail in dashboards.

- The offerings are generalized, lacking specialized modules for niche HR or industry needs.

9. Multiplier

Multiplier provides a technology-driven Employer of Record platform that enables businesses to manage global talent in over 150 countries. The company focuses on automation, compliance, and localized employment solutions for fast-scaling teams.

Pros:

- Operates owned legal entities in 150+ countries to ensure compliance and service consistency.

- Automates payroll processing in local currencies and manages benefits administration.

- Includes multilingual customer support and legal experts across jurisdictions.

- The pricing starts at $400 per employee/month, with modular service options available.

Cons:

- Onboarding and payroll updates may occasionally take longer than expected.

- Relies heavily on AI-driven compliance and analytics, which can reduce the personal support element.

- It is not ideal if you also need recruitment, deep performance management, L&D, etc., all in one system.

|

Alcor |

G-P Globalization Partners |

Deel |

Oyster HR |

Native Teams |

Pebl |

Remote |

Serviap Global |

Multiplier |

|

|

Entity Model |

Own legal entity |

Hybrid: own legal entity in some countries & local partner in others |

Own legal entity |

Hybrid: own legal entity in some countries (including Mexico) & local partner in others |

Own legal entity |

Own legal entity |

Own legal entity |

Own legal entity |

Own legal entity |

|

Pricing Transparency |

Custom pricing only |

Custom pricing only |

$599 per employee/ month + custom pricing for scale |

$699 per employee/ month + custom pricing for scale |

Starts at €99 per employee/ month + custom pricing for scale |

$599 per employee/ month |

$699 per employee/ month |

Starts at €399 per employee/ month + custom prising (3+ EOR hires) |

Starts at $400 per employee/ month |

|

Client Support Model |

Ongoing Customer Operations Support |

24/7 Support via G-P Assist + Dedicated Customer Success Manager (only for G-P EOR Prime plan) |

24/7 live chat support |

Dedicated AM support |

Dedicated AM & support portal |

Local 24/7 concierge-level customer support |

24/7 support |

Human-powered, multilingual, and multichannel support |

24/7 support with dedicated managers |

|

Onboarding/ Offboarding Speed |

10 business days |

N/A |

N/A |

48 hours |

N/A |

48 hours |

up to 5 business days |

N/A |

5 minutes |

|

Visa/Work Permits Handling |

Full Visa/Work Permits Handling process |

Visa Support (only for G-P EOR Prime plan) |

Full visa process |

Full visa sponsorship / talent mobility support |

Full work permits and visa assistance |

Full global immigration and visa services, and permit management |

Full international moves with visa, immigration, and relocation support |

Full coordination of the visa and immigration process |

Full Visa management and support from local immigration experts |

|

Platform Automation |

Alcor OS |

G-P Globalization Partners |

Deel HR |

Oyster HR platform |

Native Teams EOR platform |

Global Workforce Platform™ |

Remote HRIS |

Serviap Global Hub |

Multiplier’s Global Human Platform |

The takeaway: Not all Employer of Record companies in Mexico operate equally. Some rely on partners, others own their legal entities. Some automate everything but lack the human touch. Others, like Alcor, blend full legal ownership, tailored pricing, and real customer operations support. And unlike many providers that advertise onboarding times that look good on paper, Alcor’s timelines reflect real, verified delivery speed.

Choosing the right partner isn’t about picking the biggest name. It’s about finding EOR solutions in Mexico that give you both speed and strategic partnership.

Checklist for Choosing an EOR Partner in Mexico

1. Deep understanding of local labor & tax laws

Your ideal Employer of Record in Mexico partner should not only understand Mexican employment contracts, PTU, and PTO regulations, but also actively implement them for your workforce. Look for providers who stay ahead of regional updates, like recent changes in payroll taxes in Mexico City or evolving data protection regulations.

Ask yourself: Do they offer state-specific guidance and handle reporting to SAT and IMSS?

2. Consider your industry focus

Each sector has its own compliance requirements, talent needs, and onboarding processes. The right Employer of Record in Mexico should understand these nuances and adapt services accordingly. Whether it’s handling commission plans in sales, safety protocols in manufacturing, or offshore dev team setup in tech, your provider should go beyond one-size-fits-all solutions.

For tech product companies, that means managing compliance without disrupting delivery. That’s why, whether you’re hiring DevOps engineers, data scientists, or full-stack developers, Alcor delivers full legal and HR support under our EOR services while you stay in control of performance and culture.

Ask yourself: Does your Employer of Record in Mexico have proven experience in your industry, or do they apply the same approach to every client?

3. Transparent cost structure & invoicing

Hidden fees and prepayments are, unfortunately, common among global EOR platforms such as Deel and Rippling. A reliable Employer of Record in Mexico will disclose all costs upfront and provide clear invoicing, especially regarding local taxes, benefits, and severance.

Ask yourself: Will I receive one predictable monthly invoice, or will I be surprised by “additional charges”?

4. Local infrastructure & support

An Employer of Record in Mexico is only as good as its on-the-ground execution. My advice: ensure your provider has a local HR team or presence in Mexico to handle onboarding, resolve labor disputes, and offer fast communication in case of employee issues.

Ask yourself: Who will my team communicate with – a local expert or a generalist in a different time zone?

At Alcor, we go a step further. We offer the perfect blend of EOR services, tech recruitment, and full operational support tailored specifically for product companies that want to scale fast and remain compliant.

Our Employer of Record services in Mexico are designed with tech businesses in mind and include:

- No need to set up a legal entity

- 100% compliance with local labor and tax laws

- Payroll, taxes, benefits support

- Dedicated Customer Success Managers

But what truly sets us apart? You also get full-cycle tech recruitment with Silicon Valley–grade engineers – up to 30+ hires in 3 months – plus complete back-office support: from office leasing and legal advising to hardware provisioning and daily operations. All as part of your own branded software development center in Mexico.

And the cherry on top: Zero upfront or buyout fees.

Interested? Your future Mexican team is already waiting for you. And you’re just one call away from making it real.

FAQ

1. What is the difference between EOR and PEO?

An Employer of Record (EOR) becomes the legal employer of your international workforce and assumes full responsibility for payroll, taxes, benefits, and compliance without requiring you to establish a local legal entity.

In contrast, a Professional Employer Organization (PEO) enters a co-employment model, which usually requires you to incorporate locally. A PEO handles payroll, HR administration, benefits, and partial compliance, while you remain the legal employer. They may also assist with employee training, development, and performance management. For companies expanding into new markets without a local presence or internal infrastructure, partnering with an EOR is often the faster and more practical choice.

2. How does an EOR provider handle visa and work permit–related matters?

A local EOR provider supports foreign nationals with visa sponsorship and work permit applications by acting as the official employer in the country. They coordinate with immigration authorities, gather the necessary documents, and ensure that all submissions comply with local legal requirements. It reduces the risk of visa denials and helps speed up onboarding timelines. Some EORs also advise on the best visa types based on employee roles and contract duration.

3. Are layoff laws comparatively flexible in Mexico?

Layoff laws in Mexico are generally less flexible than those in the US. Employers must demonstrate just cause, follow formal documentation procedures, and provide statutory severance pay, especially in case of termination without cause. However, working with a local EOR helps mitigate risks as they manage compliant terminations and ensure all legal steps are properly handled. This reduces liability and protects your company from wrongful dismissal claims.

4. Why should I trust an EOR provider to handle IP rights protection procedures?

In Mexico, protecting your intellectual property goes beyond signing an NDA. It requires agreements that are fully enforceable under local law. Alcor, as your Employer of Record in Mexico, embeds IP protection into every stage of the employment relationship.

Our contracts include locally compliant NDAs, IP assignment clauses, and confidentiality terms to ensure your ownership of code, inventions, and other proprietary work is recognized by Mexican law. With a legal team that stays current on national and state-level regulations, we safeguard your IP from day one.

Unlike global EOR providers, we specialize in working with tech product companies, which means we understand the value of source code, product designs, algorithms, and trade secrets. By acting as the legal employer, we ensure these protections are enforceable in Mexican courts, giving you peace of mind and reducing the risk of IP leakage or disputes.

5. What is the difference between hiring contractors vs full-time employees in Mexico?

In Mexico, the key difference lies in the legal relationship and compliance obligations. Full-time employees work under a formal employment contract, with employers responsible for social security contributions, payroll taxes, and compliance with strict labor laws on working hours, overtime, and termination. Contractors, typically hired under a B2B model, are considered self-employed and do not require the company to pay social security or payroll taxes, making them a more flexible and often lower-cost option, though with different legal protections.

6. What are the tax implications of using EOR vs hiring contractors in Mexico?

In Mexico, an EOR lets you hire both full-time employees and contractors. Full-time hires come with mandatory employer costs (around 18.4-25.5% on top of salary for social security and payroll taxes) plus benefits like Aguinaldo, vacation premium, and profit-sharing.

If you hire contractors under the B2B model, you can’t hire FTEs. However, contractors handle their own PE taxes, so the company isn’t responsible for these contributions, making their hiring a lower-cost option without the benefits of formal employment.

7. How fast can an EOR partner onboard a software engineer in Mexico?

With the right Employer of Record in Mexico, you can hire and onboard a software engineer in just a few weeks, compared to the 1.5–3.5 months it can take to set up your own legal entity. At Alcor, we streamline every step so a software engineer can be onboarded in as little as 10 business days.