What if I told you that Eastern Europe is poised to become the second Silicon Valley, offering a fresh and dynamic alternative? With its tech services market growing from $9.93 billion in 2020 to an impressive $14.39 billion in 2024, it’s more than possible! Eastern European tech hubs are becoming global hotspots, ranking in the top 15 for software development outsourcing. So, what’s the magic behind this region’s appeal?

I’m Dmytro Ovcharenko, the CEO and founder of Alcor, a company that disrupts traditional outsourcing models with its all-in-one R&D center solution in Eastern Europe and Latin America. Enjoy 40% savings and zero buy-out fees while expanding your development team from 0 to 100 Silicon Valley-caliber talents in just one year!

In this article, I’ll shed light on the current market trends in the Eastern European tech hubs, highlighting the leading cities rapidly emerging as regional innovation centers. You’ll also discover the main advantages of outsourcing software development to these vibrant tech powerhouses and see what they have in store for you in 2025.

So, let’s get down to business!

Eastern European IT Market Dynamics

In the last few years, the Eastern European digital landscape has witnessed significant progress, with its hubs moving to the forefront not only in the region but also globally. According to the Future of IT Report 2023, Romania has the best tech infrastructure, Poland ranks 1st in IT competitiveness and tech talent, and Czechia is the top country in the CEE with the most favorable business environment for ICT development.

No wonder the software market in EE is expected to skyrocket, hitting $8.31 billion by the end of 2024. With this positive momentum and an impressive annual growth rate of 15.58%, the software development outsourcing in Eastern Europe is set to almost double in size, reaching a projected $17.14 billion in volume by 2029.

But what’s driving the rapid development of the tech industry in Eastern Europe? Let’s have a look at the core factors.

State-led tech transformation

Government initiatives are a potent source of fueling EE market growth. For instance, Romania’s National Recovery and Resilience Plan, launched in 2021, focuses on digitalization, promotion of digital education, startups and businesses support, R&D investing, and more.

National programs such as Digital Bulgaria 2025 are helping to modernize the IT sector by implementing educational programs, increasing the number of programmers, and improving the tech skills of the nation.

Poland also has an ambitious plan to stimulate tech growth. The European Funds for a Modern Economy 2021-2027 program, initiated by the Polish government in partnership with the European Union, aims to support innovation, research, and increase the competitiveness of Polish businesses.

Ukraine is not lagging behind, with its Ministry of Digital Transformation presenting a plan to promote open data use during the Open Data Day 2024 event. It focuses on five strategic areas: implementing the national open data policy, addressing security concerns during martial law, modernizing national and local open data portals, and enhancing data quality and proficiency in working with open datasets.

Investment waves in tech

Another exciting trend is that technology is becoming a key driver of investment in the Eastern European tech market. In 2023, Poland attracted over $7.4 billion in FDI, including Intel’s $4.6 billion investment in a semiconductor facility near Wroclaw.

In 2022, FDI flows to Romania totaled $11.2 billion, 6.6% more than the level recorded a year earlier, with the leading investors from Germany, Austria, and France. In addition, the US tech giant Google intends to invest up to $2 billion in a data center planned to open in the country.

Ukraine draws significant interest from foreign companies in its DefenseTech industry, having garnered over $9 million in investments last year alone. Meanwhile, Bulgaria’s companies based in Sofia Technology Park secured more than $9 million in investment last year.

Expanding tech talent pool

One more positive trend is the surge of technical graduates in the region. Over 300 higher education institutions dish out a variety of STEM programs. Universities in Poland, Ukraine, Romania, and Bulgaria have earned recognition in the World University Rankings 2025, showcasing the high quality of education they offer. They produce a staggering 82,000 ICT graduates annually, with Ukraine and Poland collectively accounting for over half of this talent.

Now, moving on to the most exciting part – exploring the key tech hubs in Eastern Europe that are driving innovation and becoming a real treasure trove for local and foreign tech companies and investors.

Warsaw

- Rating: 1st in Poland

- Startups: 1,800 startups

- Top tech sectors: E-commerce, Fedtech, Fintech, Hardware & IoT

- Annual developer salary: $63,200

- Top universities: University of Warsaw, Warsaw University of Technology

- Foreign tech corporations with hubs in Warsaw: Google, Microsoft, Affirm, Goldman Sachs

- Other tech hubs: Krakow, Katowice, the Tri-City (Gdansk, Gdynia, Sopot), Poznan, and Lodz.

Kyiv

- Rating: 1st in Ukraine

- Startups: 1,000+ startups

- Top tech sectors: Software & Data, Edtech, Foodtech, Fintech

- Annual developer salary: $51,000

- Top universities: Taras Shevchenko National University of Kyiv, National Technical University of Ukraine, Kyiv Polytechnic Institute

- Foreign tech corporations with hubs in Kyiv: Google, Samsung, Grammarly, Snapchat

- Other tech hubs: Lviv, Dnipro, Kharkiv, and Odesa

Bucharest

- Rating: 1st in Romania

- Startups: 267+ startups

- Top tech sectors: Software & Data, Hardware & IoT, E-commerce, Fintech

- Annual developer salary: $60,000

- Top universities: Politehnica University of Bucharest, University of Bucharest

- Foreign tech corporations with hubs in Bucharest: Microsoft, Amazon, Deloitte, Adobe

- Other tech hubs: Cluj-Napoca, Timișoara

Sofia

- Rating: 1st in Bulgaria

- Startups: 380+ startups

- Top tech sectors: Fintech, Software & Data, Edtech

- Annual developer salary: $54,000

- Top universities: Sofia University “St. Kliment Ohridski,” Sofia Technical University

- Foreign tech corporations with hubs in Sofia: Oracle, Cisco, VMware, Experian

- Other tech hubs: Burgas, Plovdiv

Prague

- Rating: 1st in Czech Republic

- Startups: 470+ startups

- Top tech sectors: E-commerce, Software & Data, Healthtech

- Annual developer salary: $53,000

- Top universities: Charles University, Czech Technical University in Prague, University of Chemistry and Technology

- Foreign tech corporations with hubs in Prague: Microsoft, Oracle, Red Hat, SAP

- Other tech hubs: Brno, Ostrava

Bratislava

- Rating: 1st in Slovakia

- Startups: 138+ startups

- Top tech sectors: Edtech, Hardware & IoT, Fintech

- Annual developer salary: $54,000

- Top universities: Slovak University of Technology in Bratislava, Comenius University in Bratislava,

- Foreign tech corporations with hubs in Bratislava: Dell, AT&T, IBM, Amazon

- Other tech hubs: Košice, Trnava

Curious about nearshore software development? Discover what leading tech hubs in Latin America have to offer!

Is Outsourcing to Tech Hubs in Eastern Europe a Good Idea in 2025?

Yes, absolutely, and here are just a few reasons why:

- Large talent pool: With a huge human capital, bigger than in Western Europe or the Nordic countries, leading IT hubs in Eastern Europe already boast over 1.5 million software developers, with Poland, Ukraine, and Romania leading the pack. The first two stand out regarding the most significant number of tech experts, with 607,000 and 346,000 developers, respectively.

- Top-tier tech skills: By hiring remote developers in Eastern Europe, you can expect high-quality software products. These IT talents possess strong expertise in the popular programming languages and technologies, with Poland, Czechia, Ukraine, and Bulgaria ranking among the top 30 countries globally in terms of tech skills. .

- Cost-effective salaries: Outsourcing software development in Eastern Europe can save you a pretty penny, costing 2-3 times less than hiring developers in the USA. For example, the annual salary of a senior AI Engineer in Bulgaria is $72,000, while in Ukraine, it’s about $75,600. In contrast, the same tech expert in the US demands around $132,000 per year.

- Business incentives: Many EE countries are implementing various ‘perks’ to attract tech companies. For instance, in 2023, Bulgaria adopted the Start-Up Visa, which opened its market to foreign businesses aiming to develop high-tech projects and contribute positively to the local economy. Ukraine, on its part, stands out with its tax policies. Despite martial law, the Ministry of Digital Transformation fully supports the tech sector through Diia City, a special economic zone with simplified regulations. Tech companies pay only 5% income tax and benefit from reduced social security taxes. The IP Box in Poland offers a preferential 5% tax rate on income from qualifying intellectual property (IP) rights, significantly lower than the standard 19% corporate tax rate. This incentive, combined with Poland’s wide-ranging support for R&D activities, makes it an attractive destination for IT outsourcing in Eastern Europe.

- Time flexibility: Western European tech companies benefit from a 1-hour time difference with Ukraine, Bulgaria, and Romania, and have no time difference with Poland, the Czech Republic, and Slovakia when working with their remote teams. Meanwhile, American companies have the opportunity to establish a round-the-clock product development.

Eastern European developer’s portrait

When considering team extension in Eastern Europe, it’s essential to have a clear picture of local tech talents, discovering their level of education, as well as strengths in both hard and soft skills. Below you can find a profile of an Eastern European programmer and a potential member of your development team!

Eastern Europe has many advantages, so it is not surprising that a lot of tech entrepreneurs choose this region as their expansion destination. The presence of companies such as Microsoft, Panasonic, Google, Oracle, Apple, Intel, Amazon, BigCommerce, and People.ai, along with their R&D centers across these locations, speaks volumes about the high potential of this region.

Top Tech Countries in Eastern Europe

The EE region continues to consolidate its position steadily on the global technology map, becoming a favorite destination for those looking for offshore or nearshore software development in Eastern Europe. Local tech powerhouses are already transforming into ripe ecosystems, entering the top 60 for innovation. Day by day, they are shifting their focus to a Nordic-like setup, where companies go global from day one, and their products are highly innovative. So, let’s see what these top tech countries in Eastern Europe have to offer.

- Poland

Pros: As the 1st country in the region for the number of skilled developers, Poland already boasts Europe’s 7th most potent tech market, unlocking a vast reservoir of talent ready to fuel your business growth.

Cons: The 2023 Global Business Complexity Index, Poland ranks 4th in Europe for difficulty due to complex reporting standards, ever-changing regulations, legal hurdles for investment, and intricate HR/payroll rules.

Future forecast: The dominance of IT outsourcing is projected to drive Polish market growth by over $5 billion by 2029, making offshoring or nearshoring to Poland an increasingly compelling option for tech companies seeking high-quality tech solutions.companies seeking high-quality tech solutions.

- Ukraine

Pros: Ukraine offers the 2nd largest talent pool in the EE region, ranking 5th in EE for technology skills, with expertise in JavaScript, Java, C#, Python, PHP, TypeScript, Swift, and Xamarin. Additionally, lower developers’ salaries compared to Poland, Romania, and Bulgaria ensure that outsourcing to this country not only guarantees high-quality output for your product but is also beneficial for your business overall.

Cons: Despite the resilience of Ukrainian developers and improvements in infrastructure like building reliable shelters and ensuring constant Internet connectivity, security concerns still pose potential obstacles for foreign tech businesses to enter Ukraine’s tech market.

Future forecast: Since July 2023, 144 grants totaling $2.48 million have been issued specifically for innovations in DefenseTech. This, alongside the growing demand for MedTech and AI, is positioning Ukraine as a rising leader in these industries across the region.

- Romania

Pros: Offering access to over 240,000 tech talents, IT industry in Romania stands out as the leader in Europe and 6th globally for the number of certified developers per 1,000 inhabitants.

Cons: Romania provides attractive tax incentives for tech companies, but frequent legislative changes, like the 2024 Fiscal Code updates, make it crucial to stay up to date with local regulations when expanding to this vibrant EE hub.

Future forecast: Thanks to foreign investment and companies entering the local market, the Romanian tech industry is projected to continue its steady growth, with ICT market revenue expected to exceed $21.09 billion by 2028 and the IT services sector to reach $1.8 million by 2029.

- Bulgaria

Pros: With the lowest tax rates in Europe—10% on both personal income and corporate profits—Bulgaria creates an ideal A3 Business climate that’s hard to beat. Combined with skilled workforce and competitive developer rates, it’s a magnet for international tech companies looking for quality and cost-effective development.

Cons: Despite Bulgaria’s favorable tax policies, navigating its complex legal framework, particularly in relation to establishing B2B contracts with your future developers, poses a challenge for businesses aiming to maximize benefits. But you can always use EOR in Eastern Europe to bypass these challenges.

Future forecast: The Bulgaria ICT Market size is expected to reach $10.4 billion by 2029, mainly driven by high Internet penetration, digital transformation initiatives, and a great emphasis on cybersecurity, artificial intelligence, and robotics development.

- Czech Republic

Pros: Boasting the A2 business climate for the ICT sector, the Czech Republic is ranked 3rd in the region for the startup ecosystem, hosting over 700 startup companies. Another key factor that places Czechia on the list of top destinations for outsourcing is the rise in FDI inflows, which reached $9.8 billion in 2022, marking an 8.9% increase from the previous year and underscoring its strong investment environment.

Cons: Taxation system in Czechia is notably stringed, with one of the highest tax burdens in the CEE region. The corporate income tax rate stands at 21%, up from the previous 19%, while personal income tax rate ranges from 19% to 23%, which surpasses rates in most EE countries. This elevated tax environment presents additional challenges for tech businesses looking to expand into this market.

Future forecast: The Czech Republic’s ICT revenues are projected to reach over $24.3 billion by 2026, with software development, cybersecurity, and analytics becoming the sector’s primary focus.

- Slovakia

Pros: Slovakia offers substantial tax benefits for R&D companies, allowing a deduction of 100% of research and development costs from the tax base, making it a desirable option for innovation-driven businesses.

Cons: Six times smaller than in Poland and five times smaller than in the Czech Republic, the market size of the software development industry in Slovakia reached just $1.38 billion in 2024. As a result, it offers fewer opportunities for foreign businesses to scale up while entering the market.

Future forecast: The stable growth trajectory of Slovak tech service exports will lead to an increase from approximately $7.04 billion in 2023 to around $9.45 billion by 2028, putting the country on par with the biggest tech countries in Europe.

What 2025 Holds for Eastern European Tech Hubs

In 2025 the leading technology hubs in Eastern Europe will not only remain relevant for software development outsourcing but will also experience rapid growth and gain even more recognition. Rising number of skilled developers, increased investments, and supportive government initiatives create exciting opportunities for international businesses.

As a result, foreign tech companies will flock even more to the tech hubs in Eastern Europe, opening R&D centers that are the most up-and-coming technology and innovation drivers. As of 2024, Poland boasts about 420 operating R&D centers, while Ukraine is home to around 90, highlighting the EE’s appeal as a major location for software R&D hubs. This growing trend signals an ideal time to set up an offshore center in Eastern Europe in 2025.

Another notable trend fueled by the R&D centers in 2025 is the increasing demand for Big Data, virtual reality, and the Internet of Things. Additionally, it’s impossible to overlook the advancements in AI. Gradually, the CEE region is becoming a hub of innovation in this field, evidenced by the explosive growth of startups between 2015 and 2023, during which 694 companies focused on developing AI products emerged. According to the State of AI in CEE: Report 2023, among the most promising fields expected to be at the forefront in 2025 are Healthcare and Life Sciences, Cybersecurity, and Computer Vision, as well as Natural Language Processing (NLP), powering everything from chatbots to virtual assistants and translation services.

What Can be Better than Just IT Outsourcing?

As you can see, both giant companies and SMEs prefer R&D centers in top tech countries in Eastern Europe to software development outsourcing. Do you know why?

Whether it’s urgent projects or more long-term goals, traditional outsourcing models like staff augmentation in Eastern Europe cannot guarantee you high-quality product development, commitment from developers, or the ability to observe and manage the workflow fully. That’s where a more comprehensive solution comes in, and Alcor steps into action with its R&D center solutions.

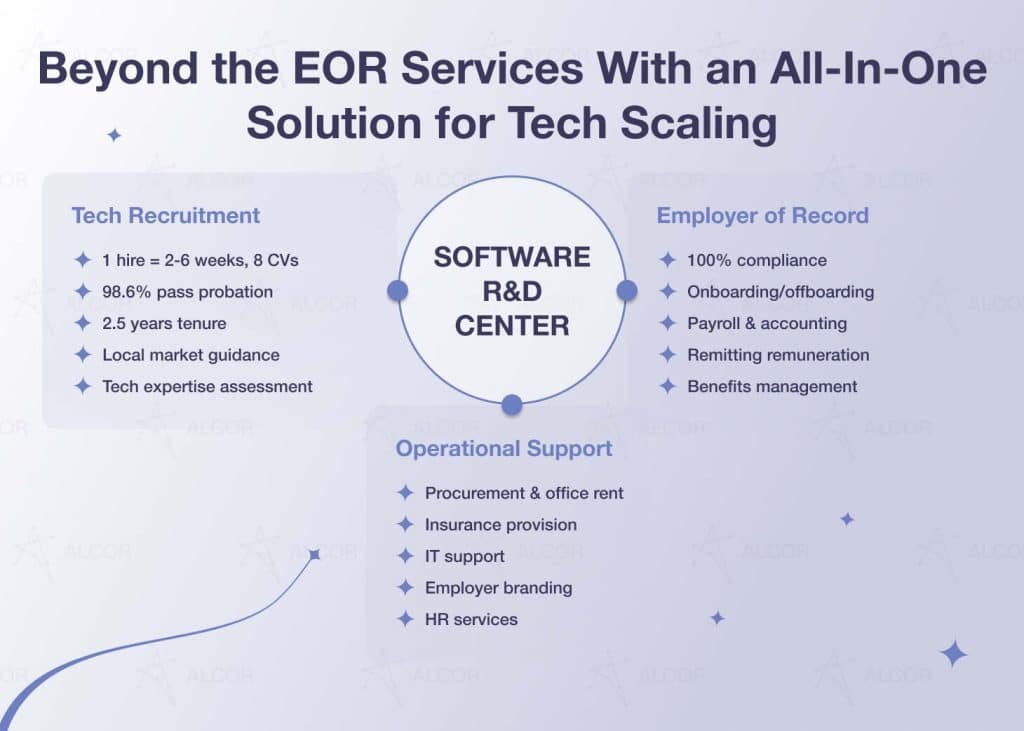

By providing a comprehensive mix of services, Alcor creates tailored solutions which include:

- Full-cycle tech recruitment ensures hiring of the Silicon Valley-caliber talent with 40% cost savings and zero buy-out fees compared to traditional outsourcing models;

- Employer of Record (EOR) services handle the onboarding and offboarding of your programmers, manage payroll and accounting, ensure legal compliance, and offer 24/7 support through dedicated account managers;

- Operational support covers everything from hardware procurement to office rentals and other back-office services.

There’s a saying: “Those who don’t take risks, don’t get to drink champagne.” But with Alcor’s solution, you face fewer risks and get more champagne to celebrate your success!

And we will help you build this success as we did for Tonic Health. In just 3 months, we set up an R&D office for them with 15 top-tier PHP engineers onboard. Plus, we ensured 100% coverage of back-office services and provided a comprehensive package of EOR services to help Tonic integrate into the Eastern European tech market seamlessly.

So, what will you choose: new opportunities with your own R&D center or stepping into the uncertain waters of outsourcing? Make your choice in favor of innovation and reliability!

Contact Alcor to start your expansion journey in Eastern Europe!