An Employer of Record in Colombia acts as the legal employer of your hires, handling payroll, benefits, and labor law compliance. It’s a part of a global shift – the EOR industry is expected to grow to $8.59 billion by 2030. No surprise, since using this model, you skip the months-long process of setting up a local entity, start hiring right away, and keep your focus where it belongs: on growing your business.

However, most Employer of Record service providers in Colombia deliver only compliance. Alcor delivers all-in-one expansion for tech. Our software R&D solution blends EOR with tech recruitment and full operational support. We address the challenges that most tech leaders encounter with outsourcing vendors and global platforms: a lack of visibility and industry focus, generic contracts, slow hiring processes, hidden markups, and zero accountability. With us, you lead the team – we make sure it runs like clockwork.

In this article, you’ll learn why global tech companies are choosing to hire in Colombia through EOR, explore the country’s economy and tech talent market, and understand local labor legislation, payroll, and taxation. As a bonus, you’ll also get practical tips on finding the right EOR partner for your business.

Key Takeaways

- An Employer of Record service in Colombia lets you start hiring in weeks, not months, since you don’t have to set up your own local legal entity.

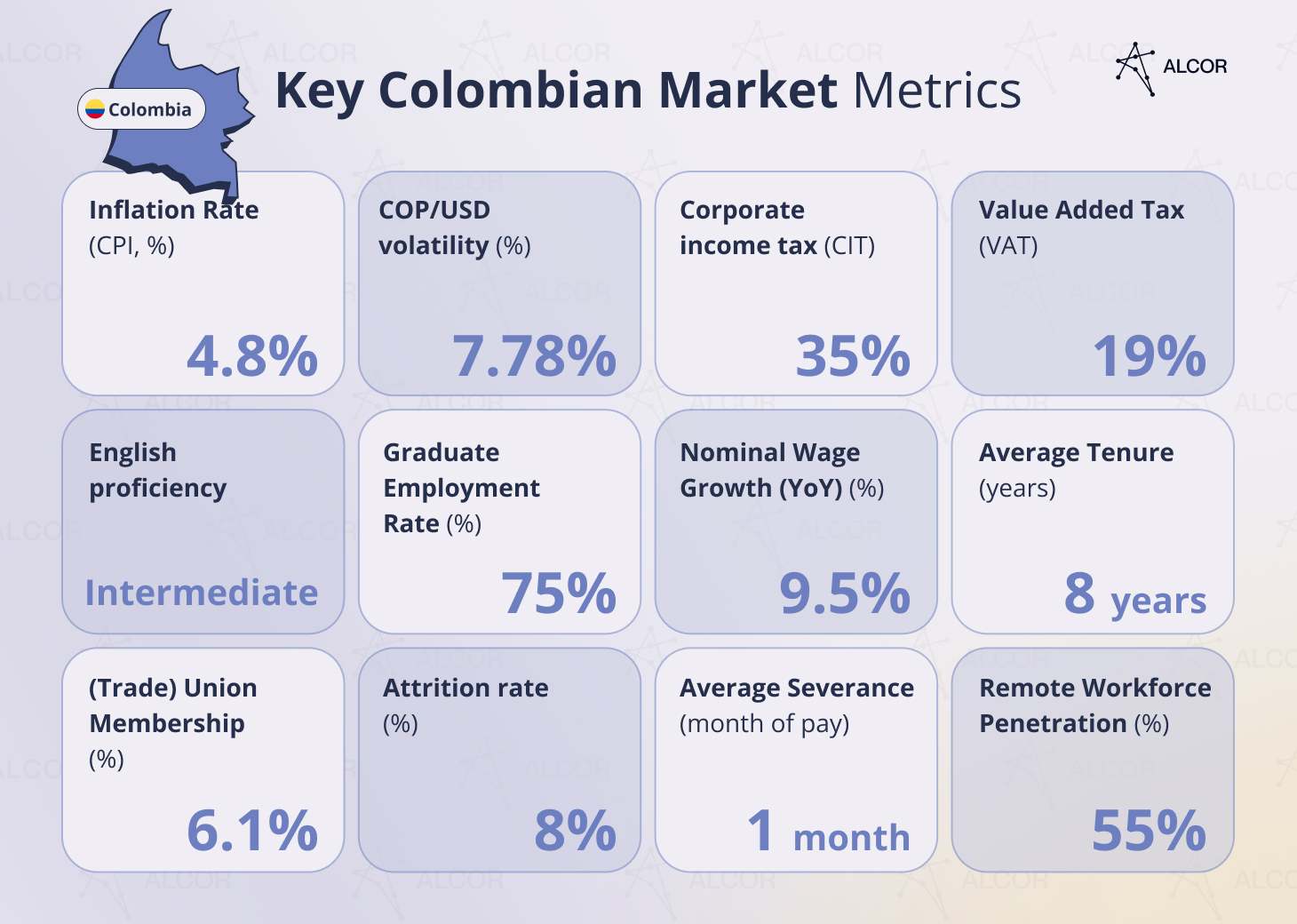

- Colombia’s legal and tax framework is detailed and predictable – a 35% corporate tax rate, 19% VAT, and clearly defined labor rules make it one of Latin America’s most structured markets for employers.

- The right EOR in Colombia keeps you fully compliant and supported on the ground. Look for a provider with a real local presence, specific sector expertise, and human-led operations, so your expansion runs smoothly from day one.

- Unlike classic EORs, Alcor combines tech-only expertise, transparent pricing, and real human support, giving you full control of your team and costs from day one.

- Alcor’s software R&D solution combines EOR with tech recruitment and operational support. With us, you can build a senior Colombian tech team of 30+ devs in 3 months – fully compliant, cost-efficient, and owned by you.

Why Hire in Colombia through EOR

An Employer of Record (EOR) in Colombia enables global companies to hire local professionals without establishing a local legal entity. The EOR becomes the official employer, handling payroll, taxes, contracts, and benefits, while the client company manages daily operations and performance. Modern providers also offer AI-driven HR tools, advanced benefits, risk management, and IP protection.

Alcor goes further – built exclusively for tech, it combines EOR with tech recruitment and 360° operational support under one roof. No hidden fees, no third-party handoffs, just fast, compliant scaling.

After modest growth of 0.7% in 2023, Colombia’s economy gained momentum with 1.7% growth in 2024, driven by steady private consumption and a gradual easing of inflation and interest rates. Forecasts indicate a 2.4% growth in 2025, with the economy on track to reach its potential growth rate of 2.9% by 2027.

And here’s the part that gets every US business leader’s attention: labor costs. The median annual income in Colombia sits around $12K, while in the US it’s roughly $62K. Even in the tech industry, the gap is striking: a senior software engineer earns about $63K in Colombia, compared to $125K in the US.

And just as the numbers make sense, so does the timing. The White House recently announced a $100,000 annual fee for the H-1B nonimmigrant visa program (effective September 21, 2025). While current holders in the US aren’t affected, new applicants and re-entries will face steep costs and longer processing times. In other words, while bringing global tech talent to the US has become more challenging, bringing your engineering team near the US has become more effective.

No wonder consultancies like ISG are already advising American businesses to pivot toward nearshoring in Colombia and LATAM in general.

How does EOR in Colombia work

Expanding into a new market sounds exciting, but then you’re hit with the paperwork: payroll, taxes, contracts, social security, labor laws, etc. That’s exactly why international companies turn to Employer of Record services in Colombia.

Here’s how it works in practice:

- You find talent. Your company selects the professionals you want to hire in Colombia.

- The EOR employs them locally. The provider becomes their legal employer, signs contracts under its Colombian entity, and registers them for pension, health, and labor-risk systems.

- You get comprehensive HR support. From payroll, tax withholding, and social security contributions to legally required benefits, such as a 13th-month salary. Even the work permits and visas. Your EOR provider also takes care of onboarding and offboarding aligned with Colombian law.

- You stay in control. Your company directs daily tasks, performance, and culture. At the same time, the Employer of Record service provider in Colombia ensures full compliance with the Código Sustantivo del Trabajo (Colombian Labor Code), DIAN (tax authority), and the General System of Social Security.

Beyond the basics, modern EOR providers in Colombia are getting smarter and faster. Many now deliver:

- Background checks and talent verification to meet industry-specific standards.

- Advanced employee benefits, expanding beyond standard health coverage to include private medical plans, stock options, and even relocation bonuses.

- AI-driven HR and compliance platforms that automate payroll, reporting, and contract management.

- AI-backed knowledge bases that give instant access to local labor insights without waiting for human support.

- Specialized services such as IP protection, invention rights management, and equity incentive planning.

- Risk management and insurance, ensuring proper coverage and reducing employer liability.

- Multi-language documentation, translation, and localization of employment contracts for seamless communication.

How Alcor is different from classic EOR

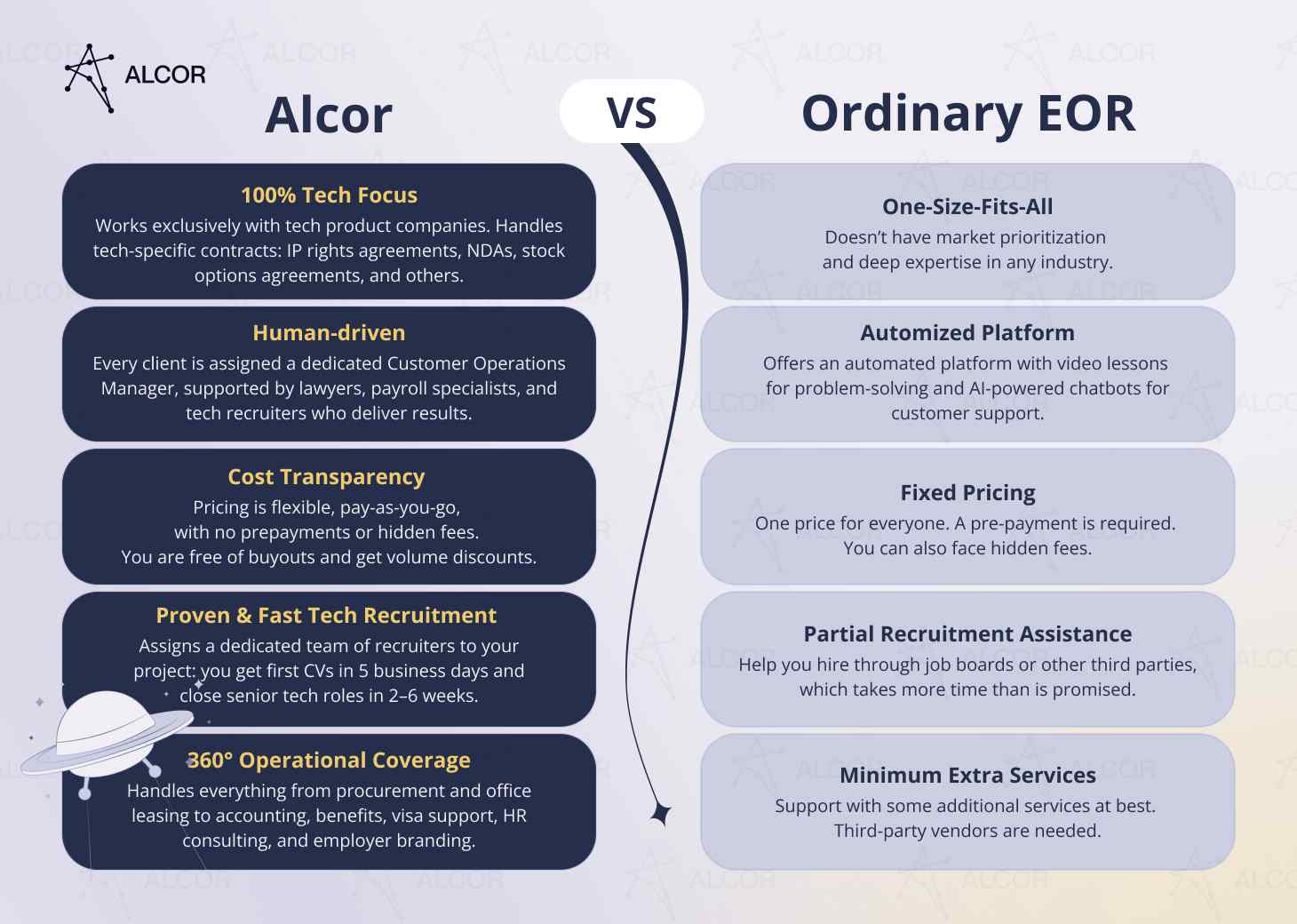

Many outsourcing vendors and Colombian EOR platforms promise ease, but you end up with chaos. That’s exactly the problem Alcor was built to solve. And this is how we differ from classic EOR in Colombia:

1. 100% tech focus

Most EOR providers spread their attention across every possible industry. We don’t. Alcor works exclusively with tech product companies, helping them hire top tech talent in key markets such as LATAM and Eastern Europe.

Alcor also handles tech-specific contracts, such as IP rights agreements, NDAs, stock options agreements, and others.

2. Human-driven, not only platform-bound

EOR platforms in Colombia automate processes that require easy customization. Need a clause changed in a contract, a pay raise processed, or IP protected? You’ll likely end up reading tutorials.

At Alcor, every client is assigned a dedicated Customer Operations Manager, supported by lawyers, payroll specialists, and tech recruiters who deliver results. We also offer the AlcorOS platform, which allows clients to track compliance, onboarding, and financial reporting, as well as receive automated payroll. It adds transparency and efficiency to workforce management.

Automation is there, but our partnership with clients is always guided by humans who care.

3. Transparency and control

You don’t need to play hide and seek with costs, because we don’t have hidden fees. Our pricing is flexible, transparent, and pay-as-you-go, with no prepayments. Moreover, your payment will actually decrease the more you hire with Alcor. You set individual compensations, approve every hire, and see where every dollar goes. Your team works directly with you, your rules, your culture, and your data. You can also insource your team anytime, free of buyout fees or offboarding compensation.

4. Proven, flexible, and fast

We don’t make loud promises like “hire anywhere in days.” Instead, we assign a dedicated team of recruiters to your project, ensuring you receive the first CVs within 5 business days and that senior tech roles are closed in 2–6 weeks each. And then we onboard them in 10 business days – all while staying 100% compliant.

5. 360° operational coverage

Alcor handles everything that keeps your remote operation running. From procurement and office leasing to accounting, benefits, visa support, HR consulting, and employer branding, we provide real, hands-on operational support.

That’s not just a promise – it’s what our clients experience every day. As GoTransverse’s VP of Engineering, Dmitrii Yermiichuk, shared:

“Alcor solved every problem, even crazy things like buying certified hardware in the middle of nowhere on Bali and shipping it to the EU.”

That’s the difference between an EOR vendor and a true business partner. We help you start or switch quickly and grow confidently with our tech R&D solution. And our Colombian software development center is always powered by real humans who understand tech, not bots that merely process forms.

Benefits of working through EOR

- Hire in days, not months. Bring new team members on board far faster than it usually takes to set up a local entity.

- Cut setup costs. Hence, avoid the heavy upfront investment of opening a legal entity. No office lease, no banking hurdles, you just get compliant hiring and predictable monthly costs. If you’re curious how EOR services compare to setting up your own legal entity, stick around, and I’ll break it down just below.

- Zero compliance risk. The Employer of Record service provider in Colombia becomes the legal employer, ensuring full compliance with local labor laws, tax rules, and social security requirements while assuming all related liabilities. It eliminates risks tied to misclassification, unpaid contributions, or labor disputes.

- Leverage local expertise. EOR companies from Colombia bring insider knowledge of the local job market, salary ranges, and cultural expectations to help you hire smarter and retain talent longer.

- Focus on what matters for your business. Let the EOR vendor manage payroll, benefits, and HR admin while your team stays focused on scaling and delivering results.

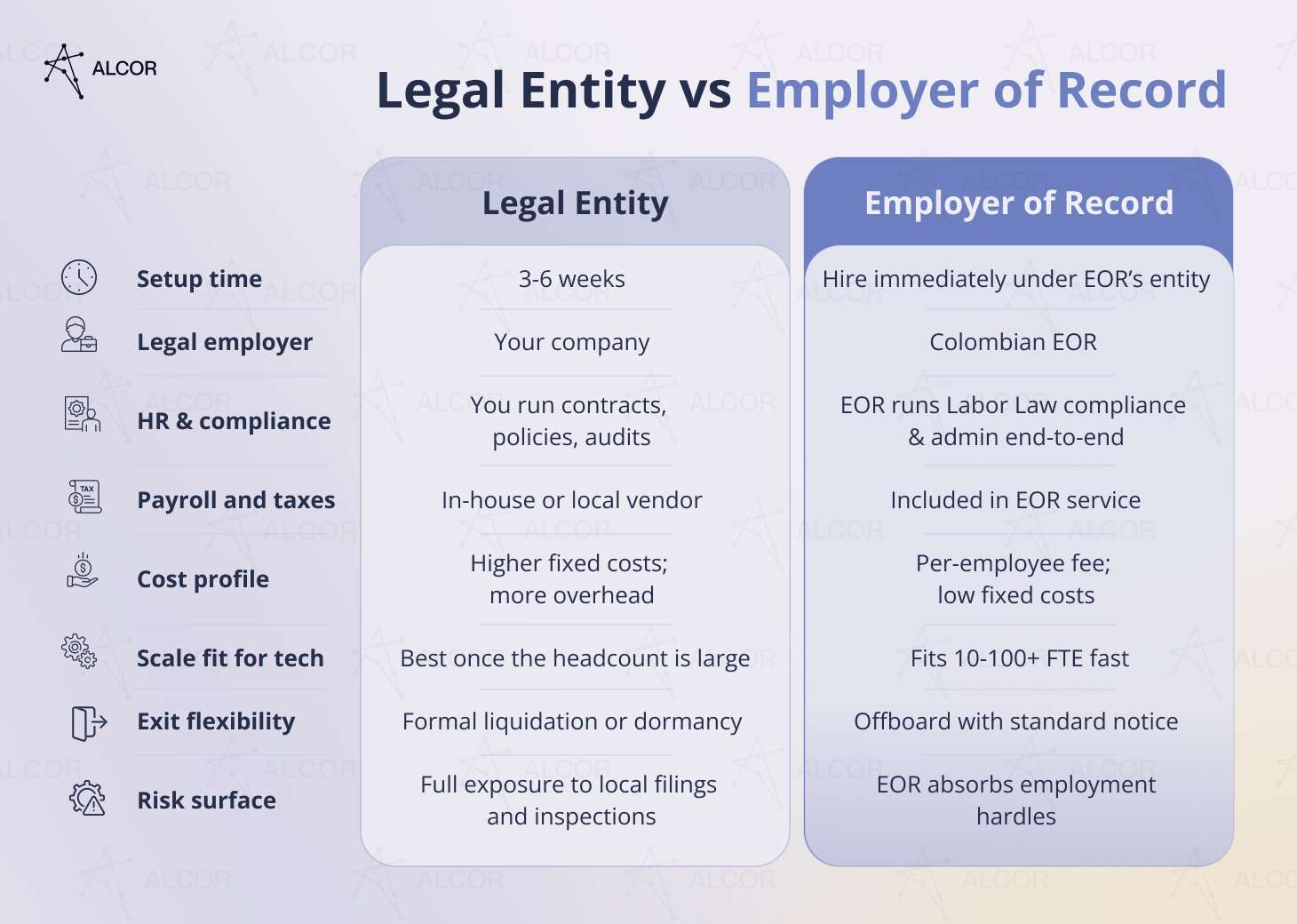

Employer of Record in Colombia vs a legal entity

If “hire in days, not months” and “cut setup costs” sound appealing, you’ve landed in the right section. So, what’s the real difference between using an EOR in Colombia and setting up your own legal entity?

In short, expanding through an Employer of Record in Colombia means you can hit the ground running, while setting up your own legal entity can feel like running uphill with a briefcase full of paperwork.

Local legal entity setup

If you decide to establish your own legal entity, be prepared for a lengthy process. You’ll become the official employer, which means full responsibility for:

- incorporation filings,

- tax registration,

- accounting,

- labor audits,

- social security setup,

- and a bank account that could take weeks just to activate.

This process can stretch three to six months and cost tens of thousands of dollars in legal and professional fees. One misstep in compliance? That’s when fines, back payments, or even legal action come knocking.

EOR services in Colombia

Choosing the EOR path removes red tape entirely. Your Colombian partner becomes your local legal employer, taking care of:

- HR compliance: Preparing employee contracts and SLAs, notice acknowledgments, and managing benefits.

- Payroll and taxes: Handling gross-to-net calculations, withholdings, and CIT accurately and on time.

- Onboarding: Organizing pre-hire medical checks, training, and standardizing all day-one documentation. EOR provider also handles the offboarding, too.

- Cost control: For example, with Alcor as your EOR partner, you pay only for what you use – no additional or hidden fees.

Colombian Economy in 2025-2026

- Colombia’s GDP grew 2.7% year-over-year by mid-2025 – the fastest pace since 2022, reaching an estimated $418 billion.

- Household consumption remains the primary driver of growth, accounting for 75% of GDP, with steady quarterly increases.

- Unemployment dropped to 8.6%, and in major cities, like Medellín and Cali, it’s even lower (6–7%), reflecting renewed hiring across sectors.

- Inflation cooled to 4.8% and is expected to stabilize near 4% in 2026, while the Central Bank maintained its rate at 9.25%.

- Imports rose 16.2%, led by machinery and manufactured goods; the US remains Colombia’s top trading partner.

- Fiscal discipline continues, with public debt at 61.3% of GDP and stable consumer spending growth.

By mid-2025, Colombia’s GDP expanded 2.7% year-over-year, the strongest pace since 2022. In value terms, the country’s economy stood at roughly $418 billion last year, according to the World Bank.

Behind these figures lies a familiar engine: consumption. Colombian households remain the key drivers of growth, accounting for approximately three-quarters of total GDP, and consumer spending continues to increase each quarter. In the second quarter of 2025 alone, consumer spending increased to 194,866 billion COP (~$50,459,985), a slight rise from 194,762 billion COP (~$50,431,983) in the first quarter. Consumption as a percentage of GDP reached 75%, up from 71.5% at the beginning of the year.

The labor market adds to this sense of resilience: unemployment has dropped to 8.6% as of August 2025, from nearly 10% a year earlier. In major cities such as Medellín, Cali, and Villavicencio, rates hover between 6% and 7%, signaling renewed hiring across services and manufacturing. Employment now exceeds 23.8 million people – slightly above the year’s average.

Inflation, long the main concern, is finally cooling. By mid-2025, annual inflation had fallen to 4.8%, dipping below the 5% threshold for the first time since 2022. Analysts expect inflation to stabilize around 4% in 2026. The Central Bank, cautious not to overcorrect, has maintained its benchmark policy rate at 9.25%, striking a balance between containing price pressures and supporting growth. The World Bank reports a real interest rate of 10%.

External trade also tells a story of cautious expansion. In 2023, the United States was Colombia’s largest trading partner, accounting for approximately a quarter of total imports, followed closely by China and Brazil. Imports rose 16.2% year-on-year in mid-2025 to $6.48 billion, mainly driven by manufactured goods, machinery, and chemicals. The country’s participation in over 15 international trade agreements, such as Mercosur, CAN, EFTA, and the Pacific Alliance, which includes Mexico, Chile, and Peru, strengthens its position as a regional connector rather than a bystander.

On the fiscal side, Colombia remains disciplined. The government debt-to-GDP ratio, being at 61.3% in 2024, is expected to gradually decline toward 2030 through consistent management and moderate economic growth. Meanwhile, the Consumer Price Index (CPI) reached a record 150.99 points in August 2025, marking stability rather than volatility, and consumer spending continued to rise slightly between the first and second quarters of the year.

Colombian Tech Industry in 2025-2026

Colombia has become one of Latin America’s top tech destinations, boasting a 165,000-strong tech workforce and the third-largest talent pool in the region. Local engineers rank #4 for coding skills and thrive in collaborative, US-compatible work cultures. The country has over 15,000 ICT graduates annually, supported by globally ranked universities. English proficiency is increasing, particularly in major cities such as Bogotá and Medellín. From a financial standpoint, Colombia offers up to 60% cost savings compared to the US: a senior AI Engineer earns around $95K versus $238K in the United States.

Skilled tech talent pool

As Colombia steadies its economic footing, one sector continues to take center stage – technology. This year, the country has over 165,000 tech specialists in the overall workforce, forming the third-largest talent pool in Latin America. Local engineers rank #4 in the region for coding skills, excelling in JavaScript, Python, Ruby, SQL, HTML, and CSS. With 1,582 top startups, Colombia also holds the #2 spot in South America’s startup ecosystem.

Cost savings

Spoiler alert: CFOs are going to love this part.

Colombia isn’t just competitive due to the quality of its talent. It’s twice as cost-efficient as the US in terms of developer salaries. Hiring senior offshore developers from Colombia means accessing the same Silicon Valley-caliber delivery without the Silicon Valley price tag.

|

Tech Experts’ Annual Salaries: Colombia vs the US |

||

| Position | Colombia | US |

| AI Engineer | $69,000 | $171,600 |

| ML Engineer | $75,000 | $132,000 |

| Cloud Developer | $54,000 | $146,400 |

| Blockchain Developer | $78,000 | $156,600 |

| Mobile Developer (iOS/Android/Xamarin) |

$79,200 | $165,000 |

| Automation QA Engineer | $46,200 | $123,000 |

| Python Developer | $79,800 | $132,000 |

| Java Developer | $66,600 | $110,400 |

| DevOps Engineer | $72,000 | $145,200 |

| C/C++ Developer | $57,600 | $114,000 |

That’s not a typo: DevOps Engineers’ salaries in Colombia are about 50% less than in the US. Even the most in-demand roles, such as AI and Blockchain Engineers, also come in at 50–60% lower.

But salary is just one side of the equation. To see the real hiring cost, let’s do what every financial department does – the math. For a senior dedicated development team in Colombia, here’s how the total employment cost breaks down:

- Base salary

- 20% recruitment fee

- Benefits package ($6,500 per year)

- Annual “13th month” bonus (known as Prima)

Additional costs may sound discouraging at first, but they’re part of the hiring equation everywhere. In the US, for instance, hiring a senior developer means paying a 30% recruitment fee and covering $15,400 in annual benefits.

For context, here’s a full breakdown of total employment costs across both countries:

|

Tech Experts’ Annual Employment Cost: Colombia vs the US |

||

| Position | Colombia | US |

| AI Engineer | $95,050 | $238,480 |

| ML Engineer | $102,750 | $187,000 |

| Cloud Developer | $75,800 | $205,720 |

| Blockchain Developer | $106,600 | $218,980 |

| Mobile Developer (iOS/Android/Xamarin) |

$108,140 | $229,900 |

| Automation QA Engineer | $65,790 | $175,300 |

| Python Developer | $108,910 | $187,000 |

| Java Developer | $91,970 | $158,920 |

| DevOps Engineer | $98,900 | $204,160 |

| C/C++ Developer | $80,420 | $163,600 |

Even after factoring in fees and benefits, the difference is striking: hiring an AI Engineer in Colombia still saves over 60%. In comparison, a Blockchain Developer’s salary is more than 51% less than in the US.

And if running these calculations isn’t your favorite part of the day, we’ll happily do it for you. Alcor can prepare a tailored salary report that breaks down Colombian software developers’ salaries. All you need to do is book a quick call and let us know which roles you’re exploring.

English proficiency & cultural compatibility

What makes Colombia stand out is how its professionals collaborate with other countries. The country ranks #6 in South America for English proficiency, with the highest levels found in Bogotá, Medellín, Cali, Armenia, and Bucaramanga.

Culturally, Colombians are highly achievement-driven yet deeply team-oriented. It’s a mix that translates into competitive spirit without the ego. They thrive in collaborative settings, value collective success, and bring the kind of motivation that fits naturally into international teams. This work culture here mirrors the American style, which makes remote cooperation smooth and efficient.

Exceptional tech education

The country’s universities are another cornerstone of its tech rise. Each year, over 15,000 graduates enter the job market with degrees in ICT, ensuring a steady inflow of skilled professionals. Twelve Colombian universities now feature among the Best Global Universities in Latin America, while thirteen institutions hold places in the QS World University Rankings.

Hiring in Colombia

Colombia’s labor system is structured yet flexible. The country is transitioning to a 42-hour workweek by 2026, with overtime capped at 12 hours and premium pay for nights and holidays. Employers contribute approximately 30% in taxes and benefits on top of salaries and are required to provide a 13th-month bonus (Prima). The average annual salary is around $44,500, and 18 public holidays affect scheduling. Companies can hire employees or contractors, striking a balance between long-term stability and short-term agility. EOR partners like Alcor simplify hiring, compliance, and payroll in Colombia, enabling companies to scale quickly without establishing a local entity.

|

Employment in Colombia: Key metrics |

|

| Standard working time (hours/week) | From 15 July 2025: 44 hours/week; from 15 July 2026: 42 |

| Labor Force Participation Rate | 58% |

| Unemployment Rate | 8.6% |

| Average gross wage | 184,717,053 COP/44,469 USD per year |

| Overtime premium | 25% over regular hourly payment;35% for night hours (from 09:00 p.m. to 06:00 a.m);75% for Sundays and/or public holidays. |

| Replacement cost (% of annual salary, tech industry example) | ~50%-200% of the yearly wage per departure (recruiting, onboarding, lost productivity) |

To help you navigate Colombia’s hiring landscape with confidence, here’s what you need to know before bringing new talent on board:

- Labor laws are set by the Ministry of Labor (Ministerio del Trabajo), and companies can engage both employees and independent contractors.

- Colombia is gradually moving toward a 42-hour workweek by July 2026, with the current limit set at 44 hours per week as of 2025. Overtime is limited to 12 hours per week and must be approved through the Ministry of Labor’s SUIT portal. Work performed at night or on public holidays qualifies for higher pay rates.

- Employers are responsible for mandatory payroll deductions and social security contributions. For instance, hiring a tech specialist with a monthly salary of $5,000 results in approximately 30% in employer contributions for taxes and benefits, in addition to the base salary.

- Colombia operates under a 13-month salary system, known as Prima.

- Spanish is the official language of Colombia, though English proficiency is increasing in major tech hubs.

- Some sectors are covered by union or collective bargaining agreements. Understanding these frameworks helps ensure fair hiring practices and avoid potential disputes.

- The average annual gross salary in Colombia is approximately 184,717,000 COP (about $44,500), though wages vary significantly by industry and experience.

- To minimize legal and administrative risks, consult with local HR or legal professionals familiar with Colombian labor law. Assign a dedicated point of contact to oversee employee/contractor relations, ensuring transparent communication throughout your organization.

But there’s an easier way to do it. You don’t have to navigate Colombian regulations alone – Alcor handles it all for you. When Intel 471, a global cybersecurity company, sought a partner to expand its engineering team abroad, it turned to us. Without establishing a legal entity, they successfully relocated 20 developers from Ukraine to Poland and onboarded them in just four weeks with our assistance. Our team guided Intel 471 through every stage of local market entry, handling B2B contracts, taxes, payroll, and accounting. They focused on what mattered most: accelerating product development.

Hiring full-time employees vs contractors

You can hire both full-time employees and independent contractors in Colombia. Each model offers distinct advantages depending on your goals, and with the right partner, you won’t have to compromise between flexibility, compliance, and control:

- Full-time employees are ideal for long-term product work, where commitment, loyalty, and consistency are essential. You get stronger IP protection, higher retention, and smoother management without the HR burden. When hiring under this model, full compliance with Colombian labor law is non-negotiable. There’s no room for shortcuts; every requirement must be met. You’ll also need to handle all employer taxes, and remember that salaries are paid in the local currency, not in dollars or euros. An Employer of Record company in Colombia, such as Alcor, can hire employees on your behalf, allowing you to focus on innovation instead of administration. Unlike other vendors that add layers between you and your team, Alcor gives you direct management and transparent pricing.

- Contractors (B2B) work best when you need to move fast or scale specialized roles. Under this model, the company and contractor negotiate their own terms, giving both sides plenty of flexibility – from payment methods to benefits. As the employer, you don’t have to handle payroll taxes since contractors manage those on their own. Their compensation is usually pegged to the dollar or euro, helping them safeguard income against local currency inflation. This model brings flexibility and quick onboarding, but can create compliance risks if not managed properly. That’s why Alcor also acts as a Contractor of Record, ensuring every engagement stays legal, IP-secure, and aligned with your business goals.

Remote vs hybrid vs on-site format

Picture this: it’s Monday morning in Bogotá. Half your offshore team is starting their stand-up from home, coffee in hand; a few are on-site testing prototypes; others are meeting midweek at a shared workspace for sprint planning. That’s Colombia – flexible, connected, and fully in sync with the US East Coast (GMT-5):

- Remote format. You can reach beyond the big-city scene, hire faster, and keep your hires exactly where they thrive. With secure systems, VPNs, and clear performance metrics, your team can stay productive from day one, whether they’re coding from Medellín or San Francisco.

- Hybrid format. Offices act more like magnets than mandates. This format draws teams together for retros, demos, and planning sessions before everyone returns to their preferred focus space. Collaboration stays sharp, but burnout doesn’t.

- On-site format. For projects that demand secure environments, testing labs, or direct client interaction, Colombia’s major cities have you covered. Modern infrastructure, controlled access, and well-planned office capacity make on-site work here a strategic advantage.

Challenges of Hiring in Colombia and Cultural Nuances

Expanding into Colombia requires more than just compliance – it’s about understanding people and culture. Business runs on relationships, trust, and respect for hierarchy, with family values shaping loyalty and balance. Communication is warm and indirect, making personal connections key to successful hiring. Yet, challenges persist: complex labor laws, regional nuances, currency shifts, and intense local talent competition. Local expertise is crucial to navigate regulations, payroll, and visas seamlessly.

Expanding into Colombia can feel a bit like stepping into a new rhythm. It’s familiar enough to move with, but full of local beats you need to learn to dance to. Many global EOR providers promise to handle it all, yet few truly understand the tempo of Colombian business life.

Most large providers cover over 100 countries, but this broad reach often comes at the cost of local nuance. What looks simple on paper – payroll, contracts, compliance – can turn tricky without someone who speaks the country’s legal and cultural “language.”

In Colombian workplaces, relationships come first. Building personal connections and earning trust is the foundation of successful hiring and long-term collaboration. Hierarchy is respected, so understanding reporting structures and showing deference to senior leaders goes a long way. Family values play a strong role, shaping work-life balance and employee/contractor loyalty. Communication tends to be indirect but warm, with small talk serving not as a formality but as a gateway to business.

In short, doing business here is as much about people as it is about process. And while Alcor can help you navigate every legal, operational, and HR detail, we also help you blend into Colombia’s business culture seamlessly with the right tone, structure, and approach.

The other side of the hiring challenges in Colombia is that labor laws are detailed and dynamic. Add in currency fluctuations, regional hiring differences, and the occasional banking delay, and you start to see why having local legal expertise is a necessity.

From work permits and visas to benefits, taxation, probation, and termination rules, every aspect comes with its own nuances. Having a local expert on your side makes all the difference, but for your own clarity, I’ll walk you through each of these in the next chapters.

Challenges like talent competition, retention, and regional disparities add another layer of complexity. Top candidates often receive multiple offers, and the best employers know how to stand out.

Take the tech sector, for example. Brand visibility plays a major role in attracting senior engineers. Skilled software developers in Colombia tend to join companies they recognize and trust, which means that without a visible local presence, even the most competitive offers can slip through the cracks. That’s where employer branding makes all the difference.

When we partnered with Sift, for instance, a targeted social campaign featuring their Hiring Manager increased offer acceptance rates by 15%, proving that recognition and authenticity can be just as powerful as salary figures.

Legislation, Payroll, and Taxes in Colombia

- Colombia’s labor system is governed by the Código Sustantivo del Trabajo (CST), updated to align with international standards. Recent reforms introduced higher Sunday pay, stricter contract rules, and hiring incentives for women and older workers.

- Employers can use indefinite, fixed-term, or service contracts, with written agreements and NDAs strongly recommended.

- Foreign hires require employer-sponsored visas, such as Migrant (M) or Digital Nomad. Payroll is processed monthly, includes a 13th-month bonus (Prima), and mandates about 25–30% in employer contributions for pensions, health, and payroll taxes.

- The corporate income tax is 35%, VAT is 19%, and municipal tax ranges from 0.2% to 1%, ensuring a transparent but tightly regulated business environment.

Labor legislation in Colombia

Colombian labor law is regulated by the Código Sustantivo del Trabajo (CST), established in 1950 and updated regularly to align with current labor standards and international practices. Several key reforms shape the country’s current employment landscape:

Labor Reform (Law 2466 of 2025): Enacted in June 2025, it modifies several aspects of the labor framework:

- Sunday pay increases progressively – 80% (2025), 90% (2026), and 100% (2027).

- Daytime hours are defined as 6:00 a.m.–7:00 p.m.; nighttime hours are defined as 7:00 p.m.–6:00 a.m.

- This policy introduces additional costs for employers, such as higher severance obligations and restrictions on fixed-term contracts.

Employment incentives: Companies with up to 50 employees, or those with sales growth equal to or below the Consumer Price Index (CPI), may receive a subsidy of up to 25% of one monthly minimum wage for six months when hiring women, young people, or workers over 50.

Types of employment contracts

Colombian law recognizes three main employment structures, each with its own rules, benefits, and implications:

- Indefinite-term contracts are the default option. They don’t have a set end date and continue until either party terminates them under the conditions defined by law. These contracts provide stability for both sides and are ideal for long-term roles.

- Fixed-term contracts must be in writing and cannot exceed four years, including extensions. Once that limit is reached, the agreement automatically becomes indefinite. These are often used for project-based roles or temporary staffing needs.

- Service contracts apply when you’re engaging independent contractors rather than employees. Contractors work autonomously, manage their own taxes and benefits, and are paid fees rather than salaries. However, misuse of this model can lead to misclassification risks and back payments, so legal precision is key.

While verbal agreements are technically valid, written contracts are the gold standard, especially for fixed-term, probationary, or integral salary arrangements. A proper contract should outline job title, compensation, benefits, schedule, confidentiality terms, and termination conditions.

Non-disclosure agreements (NDAs) are also essential when protecting intellectual property. In Colombia, they’re enforceable if they’re specific, time-bound, and bilingual (Spanish–English). Trade secrets are further safeguarded under Decision 486 of 2000 and Law 256 of 1996.

Work permits and visas

Colombia offers several options depending on the worker’s purpose and duration of stay. At the most basic level:

- Visas allow foreign nationals to enter and stay in Colombia.

- Work permits validate their right to perform a specific job legally.

The Colombian Ministry of Foreign Affairs regulates both, and in most cases, the employer must sponsor the application to ensure full compliance with local labor and immigration laws.

Main visa categories are:

| Visa category | Purpose | Duration |

| Visitor “V” type visa | Tourism, business, or medical treatment | up to 90 days |

| Migrant “M” type visa | Work or family reunification | up to 2 years |

| Resident “R” type visa | Establishing in Colombia permanently | 5 years (renewable) |

Work authorization typically falls under the Migrant “M” visa, but there are several specific variations that cover different professional scenarios. Some of them are the following:

| Visa category | Purpose | Duration |

| Work visa (Visa TP-4) | For foreign professionals hired by a Colombian employer | Up to 3 years (renewable) |

| Temporary work visa | For short-term technical assignments, urgent work, or startup-related projects | Up to 1 year |

| Intra-company transfer visa | For multinational employees relocating to a Colombian branch or affiliate (requires 1 year with the company before transfer) | Up to 3 years |

| Technical visa | For specialists providing technical services to public or private entities | up to 2 years (max. 180 days per year) |

| Digital nomad visa | For specialists providing technical services to public or private entities | up to 2 years |

Payroll in Colombia

Colombia runs on a monthly payroll cycle, with payments usually made on the last working day. Some industries pay bi-weekly (on the 15th and at the end of the month).

Payroll in Colombia includes:

- Calculating gross pay;

- Deducting mandatory health, pension, and tax contributions;

- Adding employer costs such as social security, leave accruals, and severance funds is necessary.

Each cycle requires precise time tracking, accurate withholdings, and the issuance of compliant payslips for every employee/contractor.

Every worker in Colombia is entitled to a 13th-month salary, known as Prima, paid in two halves: one in June and the other in December. Beyond that, payroll involves:

Social security contributions (federal)

- Pension fund contribution: 12%

- Health insurance contribution: 8.5% (Only applicable when salary exceeds 10 min. monthly wages)

- Labor risks system: 0.522%

Payroll taxes

- Institute for Family Welfare contribution: 3%

- National Apprenticeship Service (SENA) contribution: 2%

- Family Compensation Fund: 4%

All payroll documentation, including payslips, must be issued in Spanish and submitted electronically to Colombia’s tax authority (DIAN).

Taxation in Colombia

Colombia’s tax landscape is straightforward once you get the basics. Local companies, which are incorporated under Colombian law, pay taxes on their worldwide income, while foreign entities are taxed only on income earned within Colombia. The fiscal year runs from January 1 to December 31.

The corporate income tax (CIT) rate currently stands at 35%, with an additional 5% surcharge through 2027 for certain financial institutions, such as banks, insurers, and brokerage firms with annual taxable income above roughly $1.39 million.

Beyond national taxes, businesses also face a municipal industry and trade tax, applied to revenue from industrial, commercial, or service activities. Rates vary by city, typically ranging from 0.2% to 1%, and are fully deductible for CIT purposes.

Finally, Colombia’s value-added tax (VAT) is 19%, though some goods and services qualify for reduced rates of 5% or 0%.

Employment in Colombia in Details

- Colombia provides strong employee protections and benefits. Workers receive social security, annual leave includes 15 paid vacation days, and 18 public holidays. Employers cover 12% for pension, 8.5% for health, and 0.5% for risk insurance. Maternity leave lasts 18 weeks, paternity leave lasts 14 days, and sick leave lasts up to 180 days. Non-statutory perks often include health plans, bonuses, and transport allowances. The tech sector adds stock options and learning budgets.

- DEI policies prohibit discrimination and, from 2026, require hiring people with disabilities.

- Probation lasts up to two months, while severance varies by tenure and salary, ensuring fair treatment and compliance under Colombian labor law.

Employee benefits

- Statutory benefits. Social security coverage, severance pay (Cesantías), 13th-month salary (Prima), minimum wage (COP 1,300,000 (~$335) per month.

- Annual Leave. Employees receive 15 paid working days of vacation per year after 12 months of service.

- Public holidays. Colombia observes 18 national public holidays annually, which are fully paid.

- Sick leave. Up to 180 days of paid leave: first 2 days paid by the employer, then covered by the health system at the same rate.

- Parental leave. Maternity leave (18 weeks fully paid), Paternity leave (14 calendar days fully paid). Parents may share up to 6 weeks of maternity leave.

- Insurance. Health (employer 8.5%, employee 4%), pension (employer 12%, employee 4%), and occupational risk insurance (around 0.5%, depending on risk level).

- Non-statutory benefits. Supplemental private health plans, extra pension schemes, meal and transport allowances (COP 162,000 (~$41) for lower-income employees), performance bonuses, education aid, and life insurance.

- Benefits in the tech sector. Common perks include remote-work stipends, stock options, learning budgets, flexible schedules, and wellness programs.

Diversity, equity, and inclusion policy

Colombia’s approach to diversity, equity, and inclusion (DEI) combines legal mandates with cultural awareness and corporate responsibility. While there’s no single overarching DEI law, a mix of labor reforms and human rights policies shapes how employers operate. And what international companies should keep in mind when hiring locally.

- Inclusive hiring. According to Baker McKenzie, at the beginning of June 2026, companies will face a labor inclusion quota requiring them to hire employees with disabilities: two for every 100 workers (for companies up to 500 employees) and one more for every additional 100 beyond that threshold.

- Anti-discrimination standards. Colombian labor law strictly prohibits discrimination based on gender, age, race, religion, disability, political opinion, or health condition. Pregnant employees are protected from hazardous tasks, and no one can be dismissed due to gender identity or physical or mental health status.

- Legal framework. Laws like 1496 of 2011 enforce equal pay for men and women, while the National Action Plan for Corporations and Human Rights outlines businesses’ duty to uphold equality and protect human rights.

- Corporate DEI. Many Colombian and multinational employers now create internal DEI policies to mitigate risks and strengthen brand reputation.

Despite steady progress, a gender participation gap persists: as of 2024, 51.7% of women participate in the labor force versus 76% of men. Still, the trajectory is positive. Women’s participation has grown dramatically since the 1950s, driven by education reforms and shifting social norms.

Employee probation & onboarding

The probation period functions as an evaluation phase for both the employer and the employee, ensuring alignment before long-term commitments are made. It must be stated in writing within the employment contract. Under Colombian law, the maximum probation period is two months for indefinite contracts, and up to one-fifth of the total contract term for fixed-term agreements (but never exceeding two months).

Once the agreement is signed, onboarding begins. And while not legally mandated, it’s considered a best practice among reputable employers. A well-executed onboarding process typically includes:

- Formal documentation: delivery of the employment contract, job description, and internal policies.

- Social security registration: immediate enrollment in health and pension systems.

- Orientation: a structured introduction to company values, compliance standards, and operating procedures.

- Training and integration: tailored sessions to align expectations and performance goals.

- First-day coordination: a clear schedule, workspace access credentials, and welcome communication.

Employee termination & severance package

Under Article 62 of the Colombian Labor Code, employers can terminate an employee with or without cause, but each scenario carries different implications.

If the dismissal is with cause, the employer must provide a written explanation outlining the reason and give the employee a chance to respond. No severance is owed in this case.

For terminations without cause, compensation is mandatory. The severance package depends on the contract type, salary, and length of service:

- For employees earning less than 10 times the minimum wage: 30 days of salary for the first year, plus 20 days for each additional year.

- For employees earning more than 10 times the minimum wage: 20 days of salary for the first year, plus 15 days for each additional year.

- For fixed-term contracts, severance equals the salary owed through the end of the contract or a minimum of 15 days’ pay, whichever is higher.

Even during probation, employees are entitled to payment for unused vacation, pending salary, and a prorated 13th-month bonus.

Certain workers, including pregnant employees, union members, and those with medical restrictions, have job stability that can only be reinforced and dismissed with Ministry of Labor approval.

How to Choose an EOR Provider in Colombia

Choosing the right Employer of Record (EOR) in Colombia is crucial for smooth expansion. Pick a provider with a local presence, proven compliance expertise, and transparent pricing without hidden fees. For tech companies, sector knowledge is essential. A reliable EOR ensures accurate payroll, benefits management, and full compliance with DIAN and labor laws, while offering dedicated local support to keep your operations stress-free.

Picking the right Employer of Record company in Colombia can make or break your expansion. Here’s what to look for before you sign anything:

- Local presence matters. Make sure your EOR actually operates in Colombia, not just through third parties. They should have a legal entity and expertise in local labor law.

- Compliance shield. Your EOR must protect you from worker misclassification, tax risks, and social security pitfalls. Ask how they handle DIAN and Ministry of Labor compliance.

- Transparent pricing. Demand itemized invoices, no hidden markups, and no buyout or termination fees. A trustworthy EOR will offer a clear per-employee/contractor rate and flexible terms.

- Sector expertise. If you’re a tech company, choose a partner that specializes in managing contracts for software developers, not a generic global HR platform. IP rights agreements, NDAs, and stock options agreements must be a breeze for them.

- Dedicated support. Expansion isn’t just about paperwork. A responsive operational support manager who can answer all your questions in real time is essential.

- Benefits management. Check if they handle statutory and private benefits: from health insurance and pensions to bonuses and paid leave.

- Payroll precision. Your EOR should guarantee on-time salary payments, correct deductions, and bilingual payslips that comply with DIAN requirements.

Alcor: More than an Employer of Record in Colombia

Alcor offers a smarter alternative to outsourcing and classic EORs. Our software R&D center model unites tech recruitment, EOR, and full operational support under one roof – handled by real experts, not bots. With deep expertise in LATAM and Eastern Europe, we deliver custom, compliant, and fast team setups. Since 2017, tech leaders like People.ai, BigCommerce, Dotmatics, and Franki have trusted Alcor to build 30+ dev teams in 3 months and 100+ in a year.

Let’s be honest, most “one-stop-shop” providers promise simplicity, then quietly pass you from one subcontractor to another. Alcor does things differently.

We built a software R&D center model where everything happens under one roof – tech recruitment, Employer of Record services tailored for the technology industry, and 360° operational support. All of it is handled by people who know your business, not AI chatbots. You get a fully managed, human-driven experience with automation where it counts and a dedicated Customer Operations Manager where it matters.

Here’s why engineering leaders trust our model:

- All in one place. No third-party handoffs or hidden markups. From hiring to payroll and benefits, we manage every process internally for transparency and speed.

- EE & LATAM-native expertise. We know these markets inside out, constantly track salary trends, legal shifts, and talent availability, so you always scale where it makes sense.

- Custom over cookie-cutter. Forget rigid frameworks. We adapt our contracts, benefits, and policies to match your business model while staying fully compliant.

- Speed with compliance. Contracts, payroll, taxes – all are ready on day one.

Just ask Franki, a California-based experience app that needed senior mobile developers with niche RxSwift skills to scale fast in LATAM. In just 4 weeks, Alcor hired 2 iOS and 3 Android Engineers, plus 2 Quality Control Engineers – handpicked from the top 10% of local tech talent.

We didn’t stop there: our team handled B2B contracts, payroll, full compliance with local labor law, benefits, and even hardware procurement. Franki got a complete tech R&D center solution, ready to deliver from day one.

Since 2017, we’ve helped tech unicorns, startups, and scale-ups like People.ai, BigCommerce, and Dotmatics launch and run fully owned R&D centers across Mexico, Colombia, Poland, Romania, and beyond, by building teams of 30+ engineers in 3 months and of 100+ in a year.

For today’s engineering leaders, Alcor’s tech R&D center is the smarter alternative to outsourcing or traditional EORs: you keep your culture, transparency, and control. And we handle the entire operational backbone.

That’s the Alcor model: built for tech, run by humans, designed to scale.

References on Employer of Record Services in Colombia

- Verified Market Research

- U.S. Bureau of Labor Statistics

- The White House

- ISG

- BBVA Research

- World Bank Group

- Trading Economics

- The Global Economy

- Statista

- TopCoder

- StartupBlink

- EF English Proficiency Index 2025

- The Culture Factor

- U.S. News & World Report

- QS World University Rankings 2026

- ColombiaOne

- Cultural Atlas

- PwC

- Baker McKenzie

- Gov.Colombia

- World Population Review

- Función Pública

FAQ

Is hiring developers in Colombia through EOR faster?

Yes. Hiring developers in Colombia through an Employer of Record is significantly faster than setting up your own legal entity. Instead of spending 3 to 6 months on incorporation, tax registration, and compliance procedures, you can start building your team right away. With Alcor’s EOR model, for instance, senior tech roles are usually closed within 2–6 weeks and fully onboarded in about 10 business days.

What’s the difference between EOR and PEO in Colombia?

The main difference is legal responsibility. An EOR in Colombia becomes the official employer, allowing you to hire local talent without setting up a legal entity. A PEO, on the other hand, operates under a co-employment model, meaning you must already have a local entity and share employment liabilities with the provider. In short, EOR enables fast, compliant hiring abroad, while PEO supports HR management for companies already established in Colombia.

How much do EOR services in Colombia cost?

EOR service costs in Colombia usually reach up to $599 per employee per month, depending on the provider and included services like payroll or legal compliance. At Alcor, we don’t use flat fees or prepayments. Our pricing is fully customized to each client’s needs. You only pay for what you use, with volume discounts as your team grows. And there’s also no hidden charges.

Book a call, and we’ll prepare a personalized estimate for your case.

What are the consequences of contractor misclassification in Colombia?

- Labor law consequences. If authorities determine that contractors were effectively employees, your company may be forced to reclassify them and pay retroactive employment benefits, including social security, vacation pay, and severance.

- Financial and tax penalties. Misclassification can trigger fines from labor authorities, tax penalties, and liability for unpaid social security contributions, all of which can quickly add up.

- Reputational and operational risks. Companies may face labor lawsuits, potential unionization issues, and even blocked local contracts, which can damage trust with both workers and regulators.