The IT market in Colombia stands out in fintech, healthtech, agritech, telecom, and e-commerce, supported by 165,000+ tech experts, 15,000 annual STEM graduates, and a vibrant startup scene ranked 2nd in South America. With such strong fundamentals at home, Colombia is well-positioned to address the global tech talent gap, which is 74%.

And nowhere is this shortage more evident than in the US IT market. Despite massive layoffs, the US IT market is experiencing a boom, with over 400,000 active job postings. But here’s the kicker – about 200,000 are just sitting there, unfilled! According to Gartner, the struggle to find and retain skilled IT talent is expected to persist.

So, what’s to do? Go nearshoring! And Colombia might be the ideal destination you’ve been looking for.

I’m David Gomez, Lead IT Recruiter in LATAM at Alcor. We provide a software R&D center as a service that encompasses IT recruitment in Latin America and Eastern Europe, Employer of Record services, and comprehensive operational support – everything needed to build top teams from 10 to 100 developers for US tech product companies within a year.

In this article, you’ll get insights about the technology industry in Colombia and explore its emerging trends and nearshoring benefits. As a cherry on top, you’ll also discover a workable approach to scaling your development team with Colombian coders. So, let’s get started!

Key Takeaways

- The Colombian technology market combines a skilled tech workforce of over 165,000 with a top-ranked startup ecosystem, placing it #2 in South America.

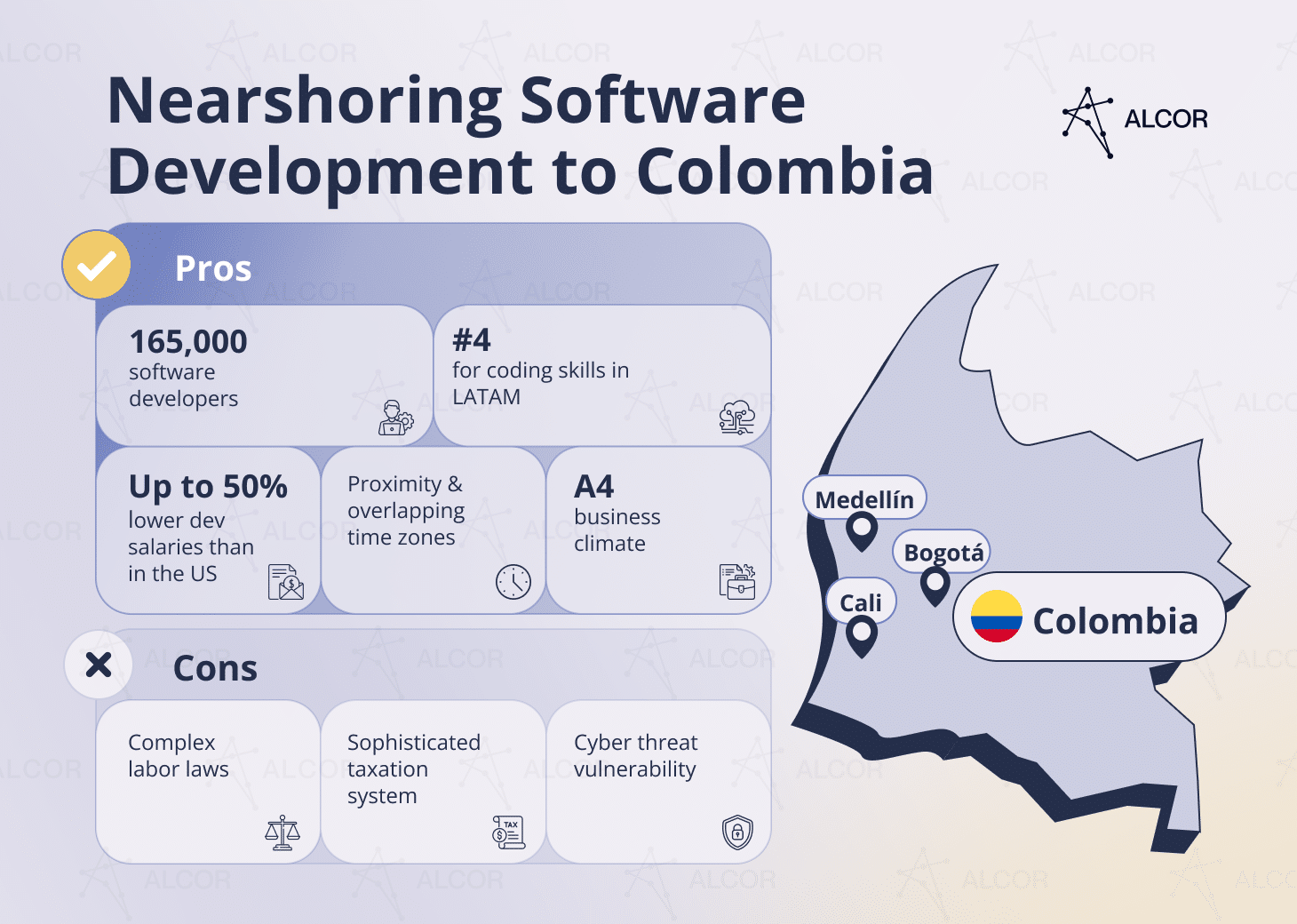

- Hiring senior engineers in Colombia can cut employment costs by up to 50% for US tech product companies, with savings reaching 60% for AI and 51% for blockchain roles.

- Colombia has emerged as a prime nearshoring tech hub for US tech product companies, with IT outsourcing revenue in Colombia projected to exceed $803 million in 2025, and top players such as Google, Microsoft, and Amazon already establishing teams there.

- With massive cloud adoption, digital transformation strategies, and a fast-growing IoT sector, Colombia is positioning itself as a regional hub for smart, connected innovation.

- Alcor replaces the headaches of slow hiring, weak retention, and a lack of control with a dedicated tech R&D center model that delivers 30+ elite engineers in just 3 months, transparent pricing, and long-term team stability.

Colombia IT Industry: Overview

- The IT industry in Colombia is one of Latin America’s fastest-growing markets, projected to reach $2.87 billion by 2030, with $1.9 billion in exports in 2024.

- Its strengths include fintech, healthtech, agritech, telecom, and e-commerce, supported by 165,000+ tech experts, 15,000 annual STEM graduates, and a vibrant startup scene ranked 2nd in South America.

- Major tech hubs: Bogotá, Medellín, Cali, Barranquilla, and Cartagena.

- In 2024, startups attracted $358.6 million in VC, while FDI rose by $3.1 billion in early 2025.

- Challenges remain around AI regulation, cross-border data flow, IP bureaucracy, and rural infrastructure, but ongoing reforms, incentives, and global events like Colombia Tech Week strengthen its position as a leading LATAM tech destination.

Want a more detailed overview? Then keep reading.

One of the sparkling gems of the Latin American region is undoubtedly the IT industry in Colombia. It’s a vivid example of the ITSM market in Latin America, which has been steadily evolving and showing stable year-over-year growth. And guess what? Once seen as an emerging market, the Colombian tech industry is not slowing down, with a predicted CAGR of 4.27% to soar past $2.87 billion by 2030, compared to $2.33 billion in 2025.

Talking exports, the technology industry in Colombia has been on the rise, reaching $1.9 billion in 2024. The demand for tech services is sky-high in sectors like fintech, healthtech, agritech, oil and gas, energy, telecommunications, blockchain, and e-commerce. And if you want more details on that, then stay with me!

Some of the main consumers of Colombian information technology services are the United States, Mexico, and Spain. Meanwhile, the locals are also stepping up their game, with application development and system infrastructure software topping the charts in IT spending.

Behind the numbers of the Colombian ICT market is a skilled talent pipeline: tech experts rank #4 for coding skills and #6 for English proficiency in South America. The startup ecosystem of the Colombian tech sector also delights with the bright colors of success, thanks to multiple initiatives supporting entrepreneurship and increased investment. StartupBlink ranks Colombia 2nd in South America and 36th globally for its startup scene. There are a total of 1,582 startup companies in the country, with the majority operating in the fintech, retailtech, and healthtech sectors. Among the stars are Rappi, ADDI, Bold, Platzi, Habi, and LaHaus, which prove that Colombian technology can scale far beyond local borders.

Colombian key tech hubs

The country is also the birthplace of the top tech hubs of Latin America:

- Bogotá is the tech capital of Colombia, with 50% of all the country’s startups headquartered here. In 2024, the Bogotá region drew 105 new foreign investment projects (an 11.7% jump year-over-year), with the US taking the lead. The city also supplies the largest share of talent, accounting for 57% of Colombia’s total.

- Medellín. Together with local government, Medellín’s former mayor (a software developer himself) coined the term Valley of Software to capture the city’s tech-focused evolution. Fast-forward to today, Medellín is a recognized hub for CleanTech and IT innovation, and its local Medellín Software Valley initiative continues to attract global players, positioning the city as a LATAM development hub.

- Cali is Colombia’s third-largest technology hub with big FinTech ambitions. The city’s 2024–2027 digital transformation strategy aims to modernize infrastructure, expand e-tech services, and make technology a core of public life. In short: Cali wants to go from underrated to unavoidable.

- Barranquilla. Known as “La Arenosa” and the “Golden Gate of Colombia,” it is fast becoming a data powerhouse. The city already hosts 52 startups and recently caught headlines when President Petro announced plans for a major data center set to position Barranquilla as a future center of artificial intelligence in Latin America.

- Cartagena. Traditionally famous for its history and tourism, it is now carving a place on the tech map with growing international ties. In 2025, its collaboration with Spain’s Zona Franca de Cádiz and local incubator Econova spotlighted Cartagena as an emerging bridge between European and Colombian tech ecosystems.

Foreign investment boom

Colombia is quickly proving itself as a serious destination for global capital. In 2024, startups secured $358.6 million in VC funding, according to StartupBlink. Overall, FDI grew by 1.5%, according to the UNCTAD’s World Investment Report 2024. The government has made it clear that foreign investors are as welcome as domestic ones, introducing incentives like a special tax regime for mega-investments. The payoff is visible: in the first quarter of 2025, Foreign Direct Investment increased by $3.1 billion.

That pro-investment mindset is on full display at Colombia Tech Week (CTW), the country’s flagship technology and innovation event, which spans Bogotá and Medellín. With over 15,000 attendees and more than 300 global investment funds represented, CTW is where startups, investors, and ecosystem builders connect to shape the future of the Colombian technology industry. The program blends investment roundtables, hands-on workshops, and high-value networking opportunities.

Local tech market challenges: AI regulations, cross-border data flow, and more

Colombia’s rise as a LATAM tech powerhouse is undeniable, but a few speed bumps remain. For example, regulations around artificial intelligence. While the government has released ethical AI guidelines and even suggested privacy-impact studies for AI systems handling personal data, the country still lacks enforceable, sector-specific laws. For startups experimenting with generative AI, that uncertainty can slow down decision-making. However, continue reading to discover how the AI sector in Colombia is evolving and addressing these issues.

Another sticking point is cross-border data flow. Colombia’s data protection framework (Law 1581 of 2012) is stricter than most in Latin America, requiring local data residency in certain sectors. That creates friction for SaaS and cloud companies looking to scale globally or partner seamlessly with US and EU clients. But here’s good news: a Statutory Bill (214/2025C) has been filed to modernize Law 1581 of 2012. This modernization aims to align Colombia with international data protection standards, clarify the legal bases, strengthen oversight, regulate international data transfers, and introduce new obligations relevant to the processing of emerging technologies.

Add in slow bureaucracy for IP registration and patchy digital infrastructure in rural areas, and you’ve got challenges that can frustrate founders and investors alike. Although the country is transitioning from an uncertain regulatory environment to a structured, binding, and modern legal framework, this transition has not yet been fully established.

Still, as you can see, all these issues are solvable. Smarter regulation, stronger public–private cooperation, and continued infrastructure investment would go a long way toward cementing Colombia’s role as a central player in the Latin American tech industry.

Here’s one more nuance many tech product companies overlook – brand visibility. Skilled Colombian engineers prefer to join employers they actually recognize, which means that without local presence, even strong offers may fall flat. It is where employer branding becomes critical: when my company worked with Sift, our social campaign with their Hiring Manager boosted offer acceptance rates by 15%.

If nearshoring to Colombia, power up your dev team via IT recruitment in Medellin!

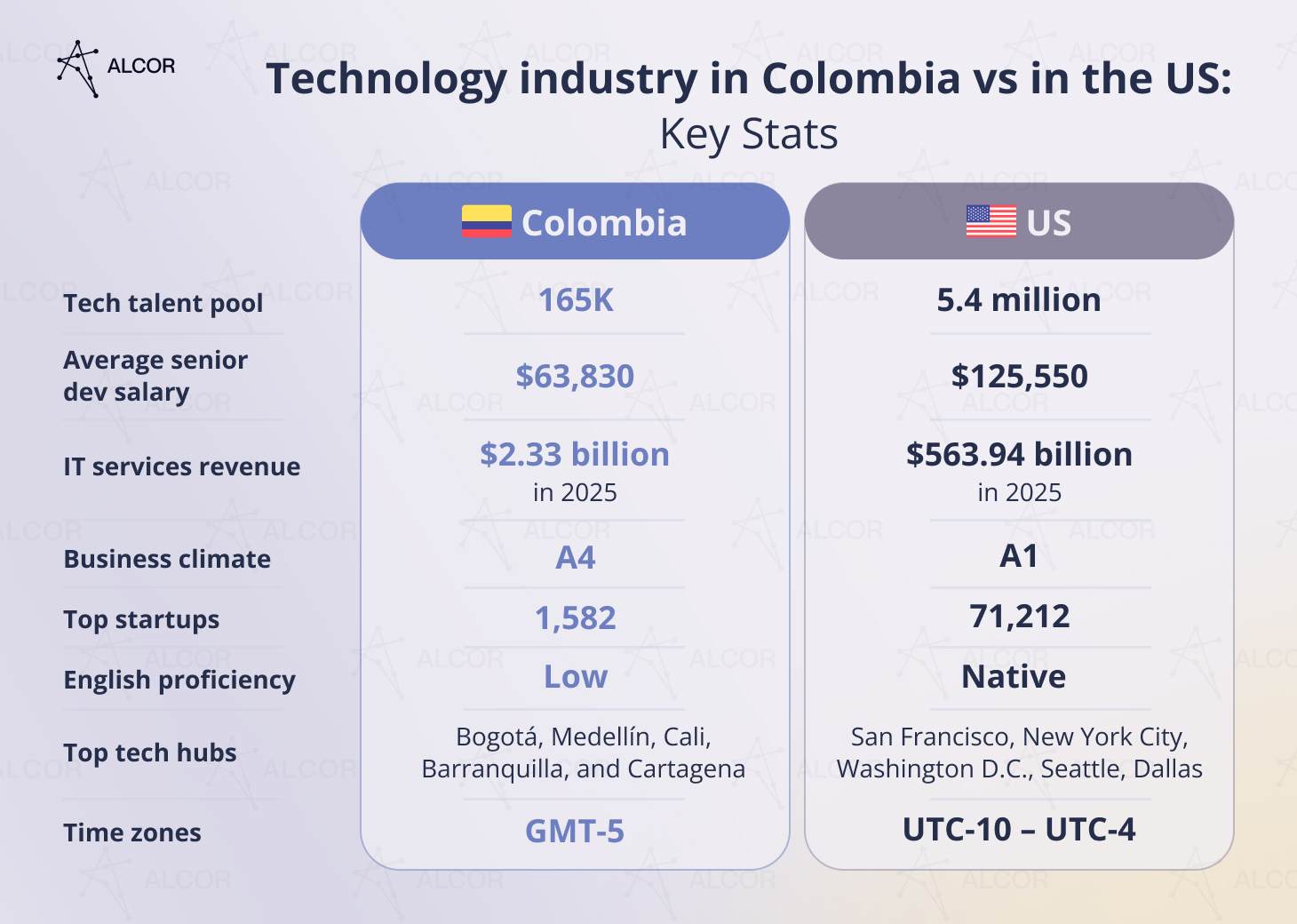

Tech industry in Colombia vs the USA

The global IT market is projected to reach $9.61 trillion by 2025, with the US leading the way with 582,000 tech firms, 9.9 million employees, and $563.94 billion in IT services revenue. The ICT market in Colombia is forecasted to reach $163.99 billion (2023–2028), supported by Connect ICT 360 and modernization laws that bridge the digital gap. Colombia hosts 12.8% of LATAM’s digital firms, just behind Brazil and Mexico.

For US companies, Colombia offers major savings: senior engineers’ salaries are 49% lower.

The global information technology market is projected to constitute $9.61 trillion in 2025, with the United States leading the charge, making it the largest tech market in the world. The country boasts a whopping 582,000 tech businesses that employ over 9.9 million people – a drastic technology market difference between the US and Colombia.

The US market for IT services is much bigger than the Colombian one, with a revenue of $563.94 billion in 2025. The local vendors primarily offer digital transformation services, with key players including IBM, Accenture, DXC, and Cognizant.

When it comes to tech industry trends, the US and the IT sector in Colombia are quite in sync. The US tech industry is rapidly adopting cloud computing to save money and resources on information storage and artificial intelligence, particularly in the healthcare field. Among other burning trends are integration of business intelligence, data security and privacy protection, 5G technology, Blockchain, and AR.

What about Colombia vs Uruguay for nearshore technology outsourcing? Discover their differences!

Regarding tech talent, the technology market in the US compared to Colombia is like night and day. The former is home to over 5.4 million IT experts, with a large portion of them being software developers. Recent market analysis forecasts indicate that this turbulent trend will slow down, driving more tech companies to outsource software development to Colombia and other LATAM countries.

Which raises the next question: how is Colombia building the infrastructure to back its ambitions? The answer lies in the rapid expansion of the ICT market.

The ICT market in Colombia

- Over the 2023–2028 period, cumulative revenues for Colombian ICT market providers are expected to exceed $163.99 billion.

- The Ministry of ICT (MinTIC) is driving connectivity through programs like Connect ICT 360, aiming for 85% internet coverage by 2026, in addition to the ICT Sector Modernization Law, which seeks to close the digital gap, particularly in rural regions.

- Colombia ranks just behind Brazil and Mexico in the digital economy of LATAM, hosting 12.8% of regional digital firms.

- The rising adoption of AI, data analytics, and automation is reshaping industries such as finance and healthcare, driving efficiency and creating opportunities for SaaS and cloud solutions.

Labor cost in Colombia vs the US

For American product companies, nearshore tech talent in Colombia offers a compelling mix of quality and savings. Take salaries: a senior engineer in the US earns around $125K per year, while in Colombia, the same expertise costs about $63K. That’s nearly a 49% difference.

It’s fair to ask: Does the base salary reflect the real cost of hiring a developer?

Not quite. Factor in:

- benefits ($6,500 in Colombia vs $15,400 in the US);

- recruitment fees (20% for senior IT positions in Colombia vs 30% in the US);

- an extra month of pay that Colombian engineers receive as a statutory bonus.

That’s exactly why my team ran the numbers in Colombia’s Tech Talent Market Research: 2025. We factored in all the extras and still found that hiring senior engineers in Colombia saves US tech product companies, on average, up to 50%.

To put more numbers on it: the employment cost for an AI developer in Colombia is 60% lower, while for a Blockchain developer it’s 51% compared to the US. And if you want the full breakdown, our research is ready for download at the top of this page.

Nearshoring to Colombia – a Trend?

US companies are increasingly hiring Latin American developers, particularly those from Colombia, due to cost savings, proximity, and the anticipated shortage of over 7 million tech professionals by 2034. Colombia’s IT outsourcing sector is experiencing rapid growth, with projections indicating revenue will exceed $803.10 million in 2025. Leading US tech product companies in Colombia include Google, Microsoft, Amazon, IBM, and Oracle, each with dedicated software engineering teams.

Keep reading for more details!

US companies are turning to nearshoring to Latin America due to cost savings, proximity, and the expected shortage of over 7 million tech professionals in the country by 2034. In fact, the yearly hiring of developers from LATAM has already surged by 50%. These numbers paint a clear picture: IT outsourcing to Latin America, particularly to Colombia, is a growing trend among US tech firms seeking to expand their business capabilities.

Colombia’s IT outsourcing sector is experiencing rapid growth as one of the go-to destinations for software development nearshore outsourcing in Latin America. Projections indicate that its revenue will surpass $803.10 million in 2025, according to Statista. Moreover, the technology sector in Colombia is fueled by its skilled tech experts, who excel in custom software development, mobile app and web development, AI/ML, blockchain – you name it.

So, what are the pros and cons of nearshore outsourcing to Colombia? Take a sneak peek at the picture below to find out.

Recognizing the benefits of the information technology market in Colombia, numerous foreign tech businesses are tapping into its potential. Among the leading US tech companies in Colombia engaged in software development are Google, Microsoft, Amazon, IBM, and Oracle, each with dedicated teams of software engineers.

Up next: a practical solution for assembling teams for software development in Colombia with a model that gives you control from day one.

Compare Colombia vs Argentina for nearshore technology outsourcing and Colombia vs Peru for nearshoring!

Software Team from 10 to 100 – Possible?

Alcor’s R&D center model helps US tech companies expand to Colombia, de-risking software development in South America with direct team control, while combining:

- Tech recruitment: 40 in-house headhunters handle sourcing, screening, HR interviews, weekly reporting, and job offer management.

- Employer of Record in Colombia: no need for a legal entity. Alcor ensures compliant hiring, payroll, taxes, and benefits – covering 100% of fines if mistakes occur.

- Operational support: brand promotion, office lease, procurement, insurance, visas, legal, tech support.

Now, it’s time for details.

Yes, if you opt for Alcor’s unique solution for building software R&D centers. It’s explicitly devised for tech product businesses seeking ways to expand in countries (like Colombia) with high talent availability and up to 50% lower rates.

So, what does this comprehensive solution include?

Tech recruitment

Many tech leaders struggle with endless hiring cycles, unpredictable candidate quality, and the risk of high turnover that stalls product delivery. Others get lost in unfamiliar markets, not knowing salary benchmarks or how to attract top engineers.

With Alcor, you’ll never get to experience that.

With our dedication to filling vacancies within 2-6 weeks, we guarantee only high-quality candidates, as clients approve 80% of them. Moreover, 98.6% of our hires successfully pass probation and stay with clients for an average of 2.5 years, so you avoid costly mis-hires and constant replacements. Plus, with our guidance on regional salaries and talent availability, you won’t overspend or waste time navigating the market blind.

Our 40 tech headhunters provide a full-cycle tech recruitment that includes:

- composing ideal candidate profiles and attractive EVP;

- sourcing, headhunting, and pre-screening candidates;

- conducting HR interviews;

- providing weekly reports;

- managing job offers and working with counteroffers;

- consulting you on the region’s salaries, talent availability, and overall tech hiring landscape.

Check out Colombian developers’ salaries to know how much you can save!

Employer of Record

Expanding into a new country often means months of paperwork, unexpected compliance risks, and the expense of hiring a law firm just to get started. Many companies end up distracted by payroll errors, tax missteps, or benefits management, rather than focusing on building their product.

But hiring abroad shouldn’t feel like a legal maze. You don’t need to establish a legal entity abroad with Alcor’s comprehensive Employer of Record in Colombia. Plus, we take all the administrative burden off your shoulders:

- employment of software developers;

- compliance with all local laws;

- tax payments;

- onboarding/offboarding;

- payroll in Colombia;

- employee benefits coverage.

In the event of a fine resulting from our mistake, we provide 100% compensation.

Full operational support

Most companies expanding abroad quickly realize that building a tech team is just the beginning. Suddenly, you’re stuck negotiating office leases in a foreign market, figuring out insurance policies, or chasing reliable vendors for laptops.

To save you from these distractions, you can also get additional services as part of our R&D solution:

- your employer’s brand promotion in the local market;

- hardware procurement for your development team;

- office lease, plus negotiations of the best price and contract terms;

- insurance assistance;

- background verification;

- legal services (stock option plans (SOP), migration services);

- visa support;

- tech support.

Plus, we allocate a dedicated account success manager to guide you through the expansion journey, so you get human assistance instead of the robotic answers of AI chatbots. You’ll enjoy our pay-as-you-go approach, keeping all expenses under your control.

Tech Trends in Colombia for 2026-2030

- Cloud adoption: Colombia ranks among LATAM’s top 3 spenders, with public cloud adding $17.3 billion to GDP and $30.6 billion in output. Initiatives such as SENA–AWS training (10,000 students) and Oracle’s Bogotá Cloud Region drive digitalization.

- Digital transformation: Programs like Vive Digital, the National Digital Strategy, and Colombia 4.0 expanded internet access, promoted entrepreneurship, and positioned Colombia as host to 12.8% of LATAM’s tech firms.

- IoT growth: The market is projected to grow to $2.32 billion in 2025 and $3.35 billion by 2030, and is led by automotive IoT. Smart city projects in Medellín, Bogotá, and Santa Marta showcase real-world applications.

Cloud technologies adoption

With Colombian businesses adopting new technologies and the need for online operations skyrocketing, cloud computing is the name of the game. No wonder Colombia ranks among LATAM’s top three spenders on cloud computing.

The impact of public cloud adoption is massive, as it injects about $17.3 billion into the national GDP and produces a staggering $30.6 billion in economic output. The Colombian Department of Labor has rolled out IT training initiatives to maintain the pace. For instance, the National Training Service (SENA), in collaboration with AWS, aims to train 10,000 students in cloud technology and IT in Colombia. Meanwhile, another leading cloud provider, Oracle, announced the opening of an Oracle Cloud Region in Bogotá. It will turbocharge the Colombian technology industry’s digitalization, spark innovation, and modernize local companies.

Digital transformation

Since 2010, Colombia has been on a digitalization path spurred by the “Vive Digital” initiative. It aimed to expand internet access, digital literacy, and modern infrastructure nationwide. Notably, Colombia now ranks among the top 70 countries in the Global Innovation Index 2023.

Moreover, the government rolled out the “National Digital Strategy” and “National Development Plan.” They aim to further promote the digitalization of the Colombian technology industry, particularly in sectors such as education, healthcare, government services, and the economy. The primary objectives are to achieve 100% internet access, implement modern regulatory frameworks, and ensure a secure digital environment. One standout result of these efforts is the Cédula Digital, an ID app that simplifies identity verification and public service usage.

In the business realm, programs like “Colombia 4.0” and “Digital Business Development” have bolstered digital entrepreneurship through funding schemes, incubators, accelerators, and networking events. Thanks to them, Colombia has already emerged as a leading player in the digital landscape of Latin America and the Caribbean, hosting 12.8% of the region’s technological companies.

Internet of Things (IoT)

The IoT market in Colombia is evolving rapidly, integrating hardware, software, and networking to create a connected ecosystem that drives digital transformation. From smart sensors and edge computing to cloud platforms and blockchain integration, IoT solutions are becoming smarter, more secure, and more scalable.

The numbers tell the story. In 2025, Colombia’s IoT market is projected to generate $2.32 billion, with the automotive IoT sector leading the way at $621.5 million. From connected vehicles to logistics optimization, this segment highlights how IoT is reshaping industries on the ground. And the growth won’t stop there, so at a 7.61% CAGR through 2030, the market is set to hit $3.35 billion by the end of the decade.

The Colombian government actively supports the growth of IoT through MinTIC’s National IoT Plan, which promotes digital transformation in sectors such as agriculture, healthcare, and smart cities. By funding R&D and partnering with industry players, the state fosters innovation, investment, and wider adoption of IoT solutions nationwide.

Colombia is steadily positioning itself on the smart city map, and IoT technologies play a central role in this shift. Cities like Medellín are already using IoT sensors to manage traffic flows, monitor air quality, and optimize public utilities, while Bogotá integrates connected systems to improve mobility and security. New projects in Santa Marta aim to transform entire urban environments with AI- and IoT-powered solutions for transport, environmental monitoring, and digital connectivity services.

State of Different IT Sectors in Colombia

The Colombian AI market is projected to reach $3.38 billion by 2031, supported by government ethics frameworks, AI Centers of Excellence, and Microsoft’s AI Lab, which is training 1,200 experts. Fintech is booming with 369 startups, $1 billion in recent funding, and a new Central Bank low-value payment system. Blockchain adoption spans land registration, cross-border payments, and medical logistics, with the crypto market projected to reach $956.7 million in 2025. Healthtech addresses limited access via telemedicine and 93 startups. Cybersecurity is projected to grow to $1.12 billion by 2025, while SaaS is forecast to reach $1.45 billion by 2030. In Agritech, precision farming, AI, and biotech strengthen sustainable agriculture.

AI

Colombia sees endless potential in AI technology, unleashing its growth across various sectors like healthcare, finance, agriculture, defense, and beyond. The country’s AI market is set to skyrocket to $3.38 billion in 2031, growing at a CAGR of 26.28%.

That is why the Colombian government is tackling key issues on multiple fronts, from policy to education to entrepreneurship. They already published a set of policy initiatives, including the AI strategy, the first-ever AI ethics framework in the region, and an international AI council.

But that’s not all. Colombia’s MinTIC is doubling its investment by over $25 million in constructing two “AI Centers for Excellence” in Bogota and Zipaquira. These centers will serve as hubs of research and development, focusing on a range of technologies, including data analytics, cloud computing, robotics, and quantum technologies, while also fostering tech education.

Speaking of talent, Microsoft is launching its AI Laboratory in Colombia. With plans to train over 1,200 AI experts within the next three years, this initiative is expected to drive growth in businesses throughout the country. Currently, the tech industry in Colombia is buzzing with about 165 AI startups, including Wipro, Treble.ai, DataGran, Datawifi, and Kite.

Find out more by comparing Colombia vs Mexico for nearshore technology outsourcing or Colombia vs Brazil for nearshore tech outsourcing!

Fintech

Colombia stands out as the third-largest fintech hub in Latin America. According to Finnovista, Colombia had a robust 369 fintech startups in 2023, with numbers climbing steadily at an average annual rate of 19.7% since 2019. With a whopping $1 billion attracted into the industry over the past three years, Colombia’s “fintech adoption” rate is now one of the highest in LATAM.

Behind these achievements lies the government’s dedication to fostering fintech businesses and promoting financial inclusion in the country. They’ve established agencies like iNNpulsa to train entrepreneurs and simplify the business startup process. Moreover, the government is championing a transparent financial ecosystem, exploring initiatives like bank account portability and launching the new low-value payment system developed by the Central Bank of Colombia in September 2025.

Blockchain & cryptocurrency

With economic instability and a population’s limited access to banking services, blockchain and cryptocurrency technologies have emerged as game-changers in Colombia. Here are some groundbreaking developments:

- Land registration. The Colombian National Registry and blockchain company RSK have introduced the “Registro de Propiedad” platform. Harnessing blockchain technology, this platform records and verifies property transactions, thereby enhancing transparency and security.

- Payment system upgrade. Colombia’s Central Bank has launched an initiative to integrate blockchain technology, aiming to streamline cross-border payments, reduce costs, and decrease processing times.

- Medicine logistics. The Ministry of Health has launched a blockchain platform to track medicines from manufacturers to consumers, thereby reducing the risk of counterfeit drugs entering the market.

With over 2.5 million Colombians already holding cryptocurrency, blockchain, and digital currencies are increasingly viewed as alternatives for wealth preservation. As adoption rates soar and more blockchain companies establish a presence in Colombia, the cryptocurrency market revenue is forecasted to hit nearly $956.7 million in 2025.

Healthtech

Access to healthcare has long been a pressing issue in Colombia, worsened by the global pandemic. With only half of the population effectively accessing medical services, the need for technological innovation in the national healthcare system has become more urgent than ever.

Telemedicine is leading the charge in transforming healthcare accessibility, particularly for rural areas. Colombian healthtech startup doc-doc is one of the prominent players in the market, aiming to create Latin America’s largest virtual hospital. With a hefty $1 million investment, doc-doc is already making waves and transforming lives.

Colombia’s healthtech landscape boasts a robust ecosystem of 93 startups – a solid 7% of the country’s startup environment. Among the standout players are 1Doc3, SaludTools, and LentesPlus.

Beyond telemedicine, the integration of electronic health records, mobile health apps, and healthcare analytics is reshaping Colombia’s healthcare sector, making it more efficient and personalized.

Cybersecurity

In 2023, Colombia suffered a massive cyberattack, affecting 34 Colombian entities and 762 LATAM companies.

The Colombian government has implemented stringent laws and regulations to bolster the country’s resilience against cyber threats. The Law on Data Protection regulates the collection, processing, and storage of personal data, aiming to enhance privacy and security. The Ministry of ICT has also introduced a draft Decree to establish a governance structure focused on digital and cybersecurity. Additionally, creating a Cyber Police unit underscores the government’s commitment to investigating cybercrimes and apprehending perpetrators.

Local tech companies are encouraged to contribute to cybersecurity innovations, further fortifying Colombia’s defenses against cyber threats. Consequently, the cybersecurity market in Colombia is estimated to reach $1.12 billion in 2025, with a projected CAGR of 10.95% over the next five years.

SaaS

The SaaS market in Colombia is expanding at one of the fastest rates in Latin America, driven by a young, digital-native population, strong government backing for technology, and an economy heavily leaning into digital transformation. Its revenue is projected to reach $579.7 million by 2025 and expand to US$1.45 billion by 2030, reflecting a strong 20.1% CAGR. The Saas sector now represents 11% of all startups in Colombia.

A clear legal framework under SAS makes it easier for companies to operate, although most SaaS sales are subject to a 19% VAT rate. The ecosystem already includes notable players such as Talentu, Lizit App, Modelo GeO, B2Chat, TiendAPP, and Loggro S.A.S., offering solutions in FinTech, AI, and enterprise management.

Agritech

Colombia’s Agritech sector thrives on collaboration between universities, government programs, startups, and farming communities. Research institutions lead advances in biotechnology, soil management, and pest control, while initiatives like Agro Colombia 2030 provide funding and policy support.

Precision agriculture has emerged as a standout strength, with GPS-guided sensors, satellites, and data analytics enabling farmers to monitor soil fertility, water usage, and pest risks in real-time. Alongside this, biotechnology innovations such as resilient seed varieties, biofertilizers, and biopesticides are offering sustainable alternatives to traditional inputs. Artificial intelligence adds another layer, enabling predictive models for weather, crop performance, and pest outbreaks.

Companies like Fungi Technology, Lombriabonos de la Costa, and WSEEDS are proving how local innovation can scale globally.

Colombia as an Invention & Innovation Powerhouse

Colombia’s technology sector drives technological advancements with a global impact, among them are: Grability Software, Solar Vehicle Primavera, Liftit, and Conceptos Plásticos.

More detailed insights are available below.

Colombia’s technology sector is generating innovations that resonate on a global scale:

- Grability is a patented, mobile-first e-commerce platform built in Bogotá. Its swipe-to-shop interface redefined the mobile shopping UX, inspired the rise of Rappi, and helped spark the delivery superapp boom across Latin America.

- Primavera is the country’s first solar-powered vehicle. Developed in 2013 by Universidad EAFIT and Empresas Públicas de Medellín, the car featured 1,600 solar cells, hit speeds up to 120 km/h, and became the first Latin American entry to complete Australia’s World Solar Challenge.

- Liftit is a SaaS platform used by companies such as Nestlé, MercadoLibre, and Falabella to streamline last-mile deliveries. With $39 million in VC funding, Liftit addresses a critical bottleneck in Latin American supply chains.

- Conceptos Plásticos is transforming plastic waste into LEGO-style bricks for affordable housing. Already deployed in Colombia, Côte d’Ivoire, and Kenya, the model won the UNICEF/UNHCR Innovator Award for combining recycling, social housing, and environmental impact.

We Fuel Innovations With LATAM R&D Center Solutions

Alcor offers a new alternative to traditional tech outsourcing. We help nearshore technology to various countries, including Mexico, Colombia, Chile, Argentina, Poland, Romania, Ukraine, and Bulgaria. Our tech R&D center solution includes EOR for tech, full-cycle tech recruitment, and 360° operational support. Alcor’s solution has worked for tech companies like People.ai, Dotmatics, ThredUp, and BigCommerce, allowing them to establish their own tech R&D hub in LATAM or Eastern Europe.

Here’s a closer look.

Alcor offers a refreshing alternative to traditional IT outsourcing and outstaffing. Instead of leasing software developers, we hire them in your team, eliminating buyout fees, hidden costs, rate cards, and common risks associated with outsourcing practices. This way, you avoid the usual pain points of slow hiring, poor retention, lack of transparency, and losing control over your own product delivery.

We help nearshore technology to Uruguay, Mexico, and Chile, hire software developers from Colombia, Poland, Ukraine, Romania, and even provide IT recruitment services in Argentina. Our R&D center solution also includes EOR for tech and operational support, ensuring a smooth expansion of your innovative business.

Discover how this solution worked for a similar tech company to yours:

When expanding abroad, the US-based tech company People.ai decided to hire EE software engineers for balanced price-to-quality reasons. For tech recruitment and the establishment of their R&D center, they turned to Alcor. Within just a month, our team performed a whole spectrum of operational and EOR services, from legal compliance and payroll to office leasing and hardware procurement, and set up a fully functioning tech R&D office. Additionally, we hired 25 software developers who perfectly matched the requirements of our client and subsequently became part of their core team.

Achieve comparable results to People.ai, Dotmatics, ThredUp, BigCommerce, and other tech companies by establishing your own R&D hub in LATAM or Eastern Europe!