Employer of Record in Romania is a licensed company that becomes the legal employer of your hires, allowing you to build a tech team without opening a legal entity. In plain terms, the EOR issues compliant employment contracts in REGES-Online (the national labor register), runs payroll, withholds taxes and social security, and enforces Romanian law on minimum wage, leave, and benefits. As of 2025, the gross minimum wage is EUR 814 (~USD 948) using today’s USD/EUR rate.

If you’re facing entity setup delays, months-long hiring, or scattered vendors, our all-in-one tech R&D center model is the fix. Alcor is an Employer of Record service provider in Romania, Poland, and Ukraine that also covers tech recruitment and ops. This allows you to build a team of 30+ developers in just 3 months with ease, fully focusing on your tech product.

You’ll get a step-by-step vision of how EOR services in Romania work, when it beats opening a subsidiary, and how to model total cost. You’ll see 2025-2026 Romanian market signals, labor laws, and hiring tactics for remote, hybrid, and on-site workers. And what else? See for yourself in the article.

Key Takeaways

- Romania is a low-friction market for building teams: an EOR becomes the legal employer, signs the contract, files REGES-Online, and runs payroll/tax, while your company directs day-to-day work for each employee/worker.

- Funding and cost signals are favorable: EU €21.6 billion through mid-2026 creates steady demand, and Romanian wage levels keep senior engineering 41% more affordable vs the US market.

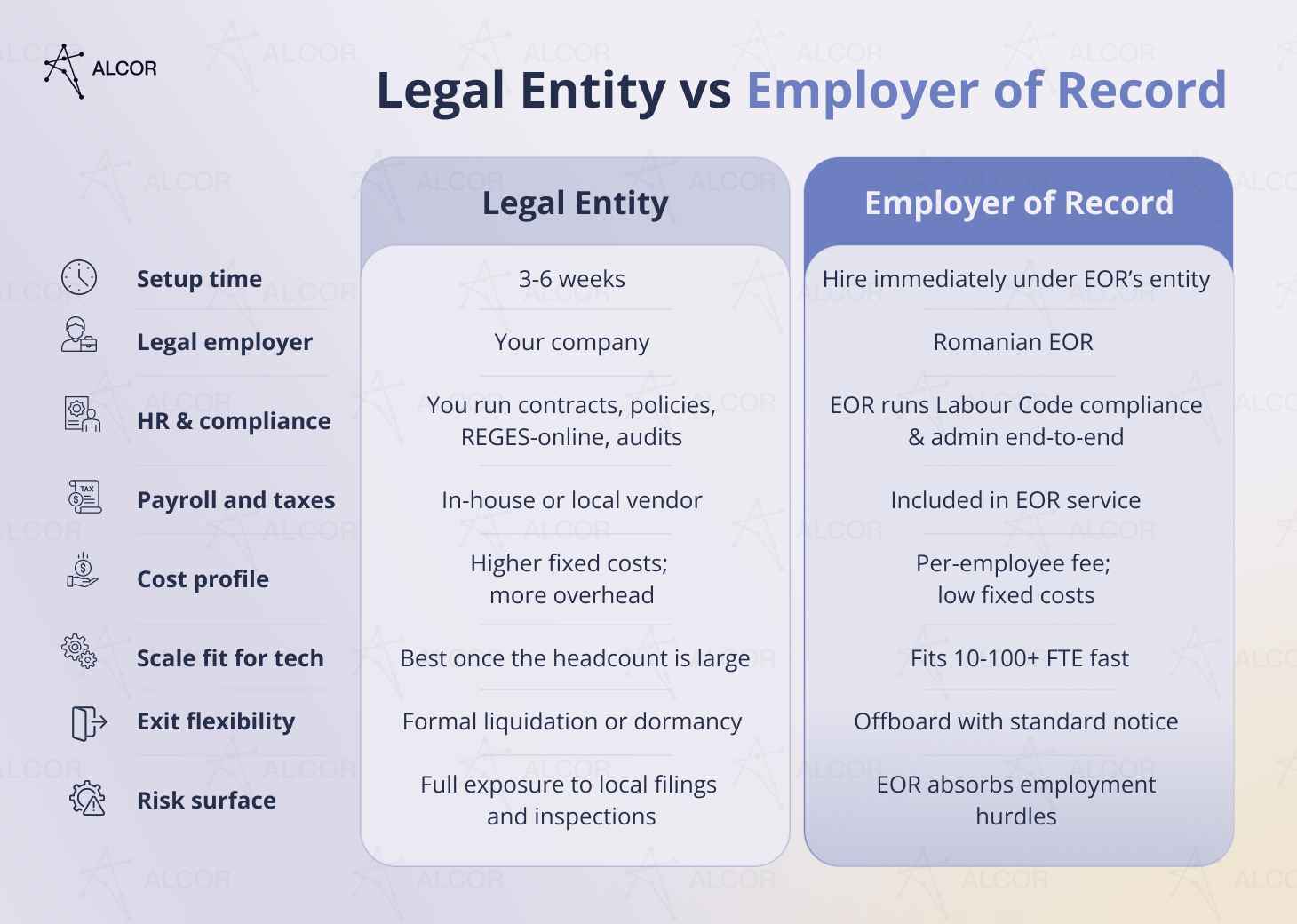

- EOR beats entity setup: opening a subsidiary can take 15-30 business days (~6 weeks with VAT), while classic EOR hiring and onboarding of employees lands in 3-4 weeks. Alcor EOR takes even less – roughly 10 business days.

- Compliance is clear and digital: 40-hour weeks, ≥20 days’ paid leave, structured notices, D112 filings by the 25th, and headline taxes (PIT 10%, CAS 25%, CASS 10%, CAM 2.25%).

- FTE is the norm, contractors are the flex layer; pick remote, hybrid, or on-site and lock it into the contract – and mind misclassification risk for employees/workers.

- Alcor’s edge is the all-in-one model – tech recruitment in Romania + EOR + ops under one roof – proven effective by the US companies like Sift, People.ai, ThredUP, and others.

Why Hire in Romania through EOR

Romania is a low-friction way to stand up product teams: steady public demand from EU funds, predictable regulation, and a cost base that lets you hire senior employees without blowing the budget.

- EU €21.6 billion through mid-2026 means stable projects you can plug into via an EOR company instead of opening a local entity in Romania.

- Romanians average ~RON 9,187/month ≈ ($2,103), with senior dev pay far below US levels – efficient mixes of core and stretch roles.

- Alcor’s EOR in Romania delivers tech-first hiring, 10-business-day onboarding, and all operations under one accountable partner, so you don’t waste time on opening a legal entity, and stay focused on building your tech product.

|

Inflation rate – 9.9% YoY in Aug 2025 |

RON/USD volatility

– +2.3%; 4.97-5.12 (52-week) |

Corporate income tax

– 16% |

Value-added tax (VAT)

– 21% standard |

|

English proficiency – #12 |

Graduate employment rate

– 75% (2024) |

Nominal wage growth (YoY)

– 7.2% (Jul 2025) |

Average tenure – ~3 years (business services sector benchmark) |

| Union membership

– ~25% (union density) |

Turnover rate

– ~16% (business services, 2024) |

Average severance

– No statutory; commonly 1-3 months by policy/CBA |

Remote workforce penetration – Usually WFH 1.2%, sometimes 2.1% (2023) |

Sources: Trading Economics, ECB, KPMG, EF EPI, Eurostat, EURES, ABSL Report

As a starting point, Romania’s Recovery & Resilience Plan totals €28.5 billion and earmarks 21.8% specifically for the digital transition. In practice, that funds things like the Government Private Cloud (Romania’s largest state-funded IT project, >$530 million), which should make e-IDs, filings, and audit trails more automated. So it will be easier for businesses to operate and stay compliant, especially via an Employer of Record in Romania. My team believes this pairs well with the Commission’s view that inflation should ease to ~5% in 2025 and <4% in 2026, taking pressure off salaries and operating costs.

With that said, another factor to consider is the Romanian average salary. For non-tech roles, it reaches RON 9,187 (~$2,103) in 2025. For context, the US median for employees of all occupations is $49,500 annually – roughly $4,100/month. And what about wages in tech? According to our internal data, the US senior software developer earns on average $125,550/year. By comparison, a Romanian software developer salary sits well below the US at $73,882/year, which is already 41% of slashed labor expenses! See yourself:

|

Gross Senior Developer’s Annual Salary, USD |

||

|

Position |

Romania |

USA |

| AI Engineer | 78,000 | 171,600 |

| Cloud Engineer | 84,000 | 146,400 |

| Blockchain Developer | 81,000 | 156,600 |

| Python Developer | 81,000 | 132,000 |

| .NET Developer | 78,000 | 120,000 |

Employer of Record in Romania vs legal entity

Setting up a legal entity in Romania typically takes 15-30 business days (often 6 weeks with VAT) and piles of paperwork: bank account, VAT/ANAF filings, REGES-online, payroll tools, HR policies, office lease, and ongoing tax/labor checks. With EOR in Romania, you start hiring in days on one compliant employment contract via a single partner – no subsidiary, less admin, full control over delivery.

Benefits of working through EOR

I dare say the great part of success hides in speed: with an Employer of Record Romania, you move from hiring intent to first employee in days, not months.

- Hire Romanian talent in key hubs without establishing your own legal entity: one company-EOR agreement saves you months of time.

- Your EOR partner owns liability across labor and tax law, so audits, filings, and statutory leave/benefit rules don’t become compliance risks.

- You focus on your core business, while the EOR service handles all that gives you an admin headache.

How does EOR in Romania work

EOR company from Romania signs a compliant employment contract (agreement), registers each employee in REGES-Online (formerly REVISAL), and handles monthly payroll, tax withholdings, social security, and filings to ANAF (National Agency for Fiscal Administration).

The key responsibilities of a professional EOR include:

- Correct onboarding under Romanian law;

- Statutory benefits and paid leaves each employee is entitled to (40-hour week; ≥20 days’ vacation/holiday; minimum wage rules);

- Clean records for audits, including REGES-Online entries;

- Work permits for non-EU citizens;

- Insurance administration aligned to local requirements and company policy;

- HR administration (probation, notice, termination) with compliant documentation.

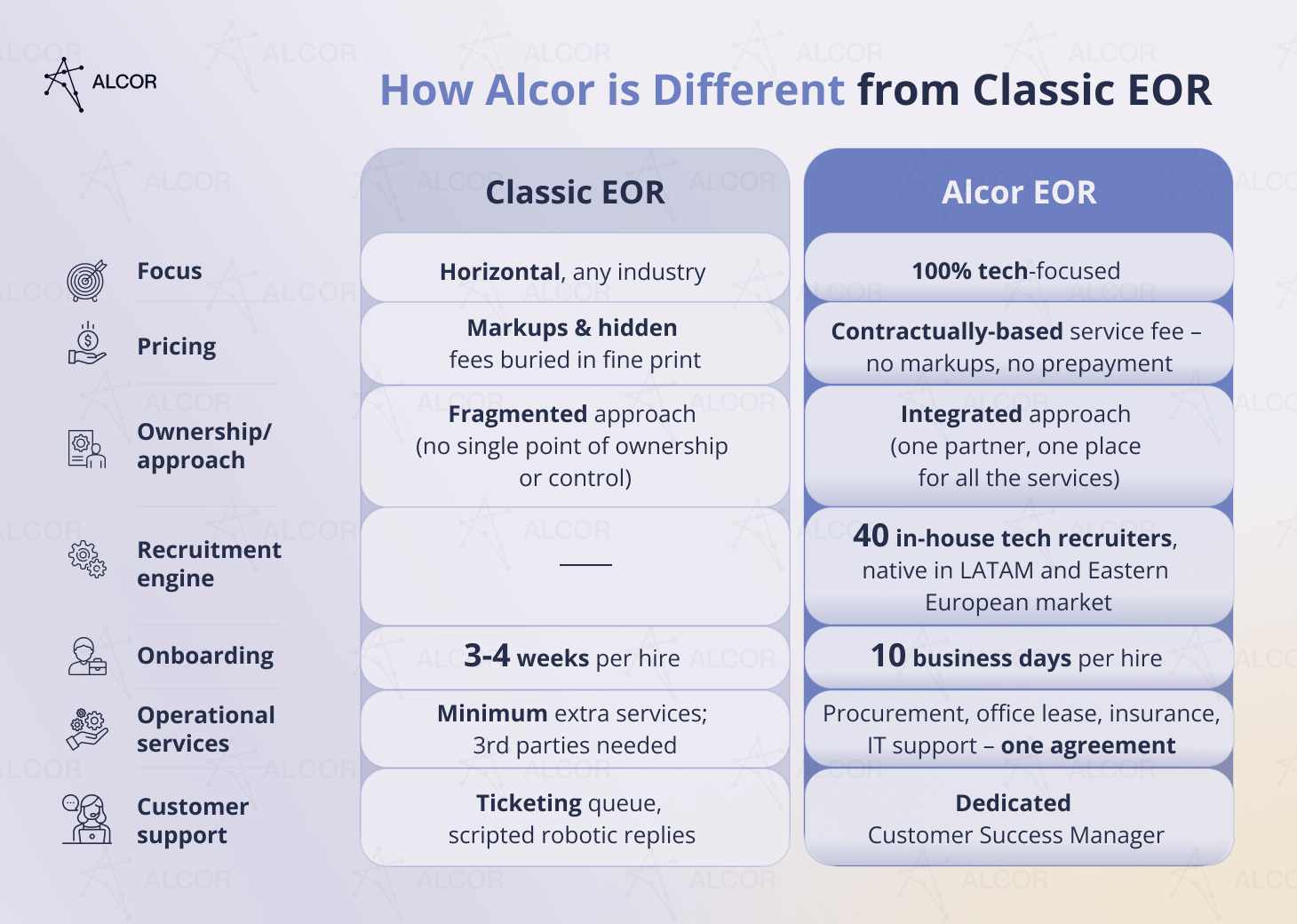

How Alcor is different from classic EOR

Popular Romania Employer of Record companies claim that they provide a “one-stop-shop” solution, then hand off everything beyond payroll to third parties. Alcor is different. And here’s how:

Here’s how our EOR works in practice. The US-based tech company Sift was looking for a clear, compliant way to scale in Eastern Europe – and Alcor became their go-to choice. Our team handled 100% legal compliance end-to-end: labor and contract law, payroll and taxes for offshore candidates, and airtight IP. We also issued stock options for developers and arranged visas and travel for 12 teammates to the Sift Summit in California – all under one EOR platform umbrella with zero friction.

Romanian Economy in 2025-2026

Growth in Romania looks steady into 2026, while 2025 still carries a higher CPI and a 6.50% policy rate – so keep a financial cushion for payroll indexation and utilities. Unemployment near 5.9% keeps pressure on senior roles, but hiring won’t stall. The trade gap narrowed – treat FX as a planning item. Public finances mean tighter paperwork – keep Romanian records, contract terms, and files audit-ready. Ultimately, lock in talent now, then scale as demand firms – ideally via an Employer of Record company Romania, so you stay fully compliant.

As we read the latest outlooks, growth is modest but steady: the European Commission sees Romanian GDP at +1.5% in 2025 and +2.4% in 2026, with investment – including already mentioned EU funds – doing more of the heavy lifting while consumption rebuilds.

Prices flared in late summer after regulated-tariff and tax changes, with the CPI rising 9.9% y/y in August 2025. The central bank kept the policy rate at 6.50% on 8 Aug 2025. But what does it mean? 2025 budgets should include a cushion for pay indexation and utilities – relief looks more like a 2026 story.

Next, the labor market is holding: seasonally adjusted unemployment edged to 5.9% in August 2025 (adults 25-74 at 4.7%). That’s tight enough to keep pressure on senior employee roles, but not so hot it breaks hiring plans, I would say.

On the external side, the balance of trade narrowed in July 2025 to €2.64 billion. For procurement, this simply means FX deserves a line on your risk register, and staggered purchases can smooth volatility.

Public finances are the watch item. Government debt was ~55.8% of GDP (Q1 2025) – below the EU average – but the deficit is still high. The European Commission projects 8.6% ease in 2025 and 8.4% in 2026 and has stepped up legal disciplinary action under the Excessive Deficit Procedure. Practically, expect occasional tax tweaks and stricter documentation on funded projects – clean record-keeping, payroll files, and contracts matter.

Lastly, consumer spending should gradually recover into 2026 as inflation cools and financing conditions ease – both the OECD and EC point in this direction. I believe that’s your window to lock talent and space now, then scale delivery as tailwinds arrive.

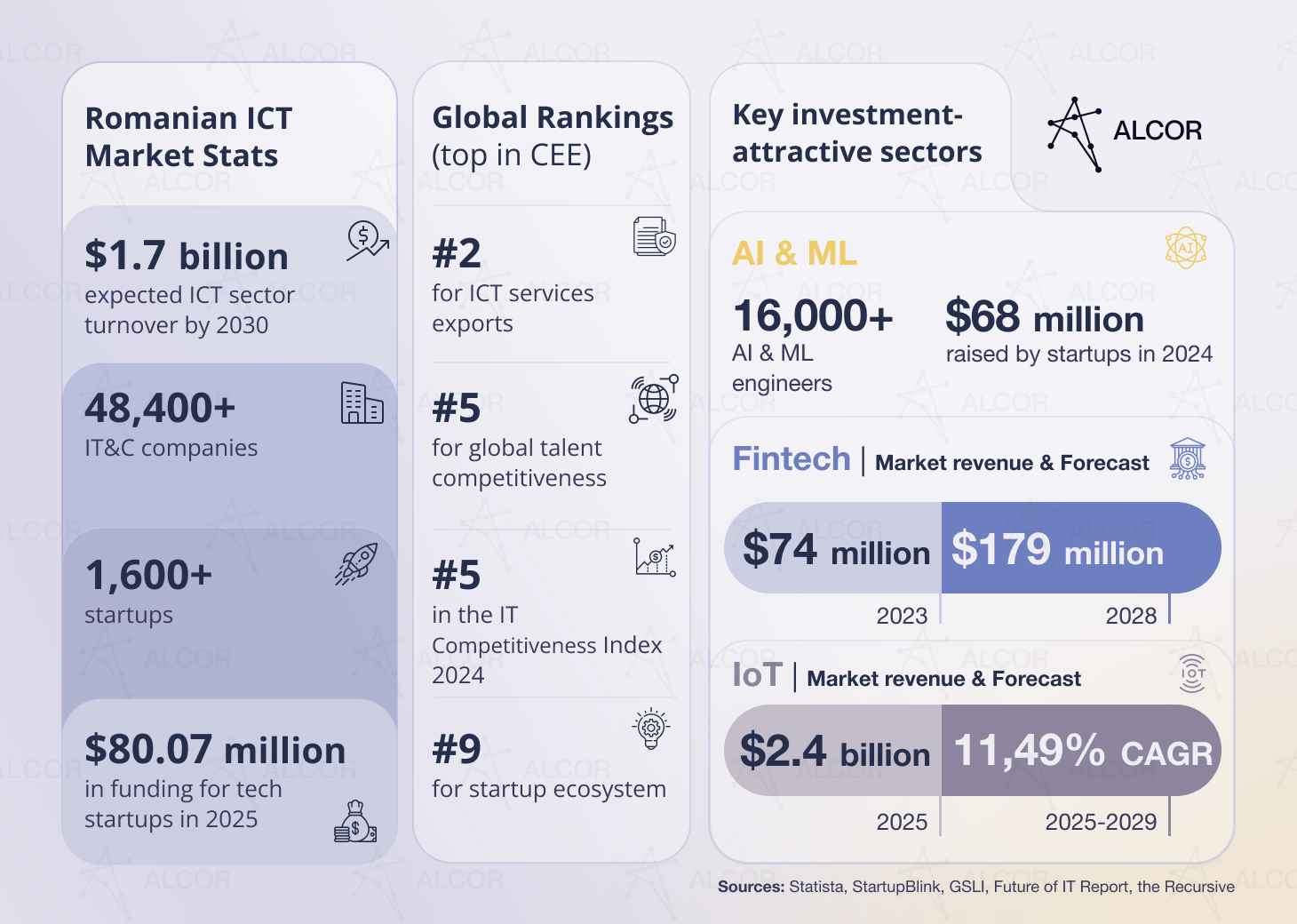

Romanian Tech Industry in 2025-2026

Romania offers depth with a broad pool of 250,000 tech specialists across Bucharest, Cluj-Napoca, Iași, and other hubs. Additionally, steady demand: ICT exports $11 billion in 2024, ~€80 million H1-2025 startup rounds, and €12.8 billion e-commerce in 2025. Runway is real, too: EU cyber programs (€145.5 million calls) and a live AI strategy.

- Tech talent pool: 250,000

- Tech skills in Eastern Europe: #6

- Skill stack: Java, JavaScript, C#, Python

- English level: #12 globally

- Innovation Index in Eastern Europe: #6

- Business climate: A3

- Time zone: GMT +3

- Tech hubs: Bucharest, Cluj-Napoca, Iași

Two signals matter the most for planning: demand and runway. On demand, ICT service exports reached $11.0 billion in 2024. Additionally, H1-2025 startup rounds totaled ~€80 million led by DRUID AI, and B2C e-commerce is projected at €12.8 billion (~3.5% of GDP) in 2025. Put together, that’s steady digital spend and enough venture activity to keep experienced PMs, data, and security talent circulating – without significant price spikes.

On the runway, Bucharest’s European Cybersecurity Competence Centre opened €145.5 million in calls (Digital Europe/Horizon); Romania’s National AI Strategy 2024-2027 is live, and fresh analysis suggests gen-AI could add €30-50 billion to GDP by 2040 if adoption stays on track. In practice, expect more funded projects, stricter paperwork, and real incentives to ship cloud-plus-AI features that stick in production.

Consider differences between software outsourcing in Romania vs your own tech R&D center – fully backed with expert tech recruitment, EOR, and operational support!

Hiring in Romania

Hiring in Romania is straightforward if you plan the basics: labor rules (40-hour week), clear employment terms for employees/workers, and realistic payroll bands. Budget on gross pay and full payroll burden; unemployment sits near 5.9%, average gross is ~9,200 RON (~$2,000). In tech, FTE is the norm (B2B contractors ~13%); pick remote, hybrid, or on-site and bake it into the contract. Need speed? An Employer of Record in Romania lets your company hire each employee/worker compliantly.

- Set expectations to a 40-hour work week with overtime paid or time off as per law.

- Track gross wages, not just net, and index offers sensibly.

- Watch participation/unemployment to time searches for scarce skills.

- Price overtime and backfills (replacement in tech isn’t cheap).

On culture, teams value clarity and reliability. Be punctual, document decisions, and keep scopes tight – Romanian employees appreciate direct, respectful feedback and well-structured plans. Relationship-building matters, but so does work-life balance: reasonable meeting hours and realistic sprint commitments go a long way.

|

Employment in Romania: Key metrics |

|

| Standard working time | 40 (5 days/week) |

| Labor force participation rate | 67.3% (Q2 2025) |

| Unemployment rate | 5.9% (Aug 2025) |

| Average gross wage | ~9,200 RON/month (~$2,000) |

| Overtime premium | ≥ 75% wage increase if paid (or compensatory time off) |

| Replacement cost | ~80% of annual salary for tech |

Sources: Trading Economics, SeeNews, Gallup

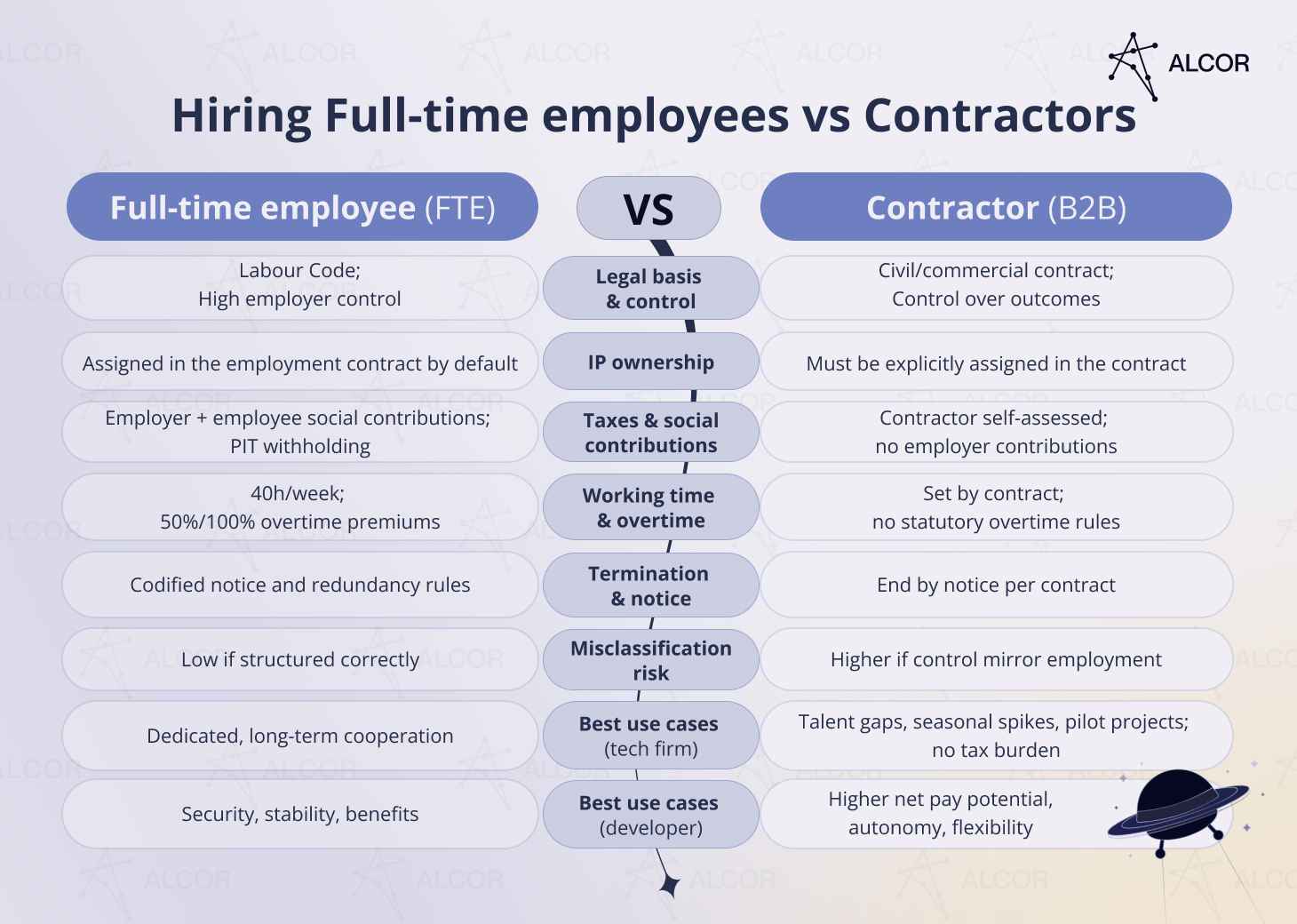

Hiring full-time employees vs contractors

In tech, full-time employment still leads. Recent surveys show B2B contractors at ~13% of the developer market, with the rest on standard employment contracts. So FTE in Romania feels more like a norm, and B2B is the flex layer for spikes and niche skills.

Remote vs hybrid vs on-site format

Pick what fits delivery, then write it into the employee’s contract, workplace policy, and schedule so everyone’s clear.

- Remote. The biggest talent pool and lean office cost. Set KPIs, security, and home-office allowances.

- Hybrid. Team rhythm plus flexibility. Define in-office days, probation routines, and cadence.

- On-site. Best for labs/secure work. Budget commuting perks, space SLAs, and tighter day-one onboarding.

Challenges of Hiring in Romania

If you plan the bumps, Romania is pretty smooth, especially when navigating with a local EOR provider. Here’s what you need to consider:

- Compliance & admin. Labor rules are precise: REGES-Online filings, airtight employment contracts, monthly payroll and tax. Miss a step and fines follow. Build a simple checklist, assign owners, and keep the audit trail clean for every employee/worker.

- Compensation & benefits. Market expects clear salary bands, meal vouchers, private insurance, and clear leave policies. Publishing ranges and benefits up front speeds offers and reduces renegotiation with employees later.

- Notice & probation. Longer notice periods and formal probation routines add time to replacements. Plan role overlap, pre-brief successors, and start backfills before the clock starts.

- Contractor vs FTE. B2B shines for spikes and niche skills, but if a contractor’s day looks like an employee’s (fixed hours, direct control), misclassification risk rises. Define scope, autonomy, and hours in writing – or hire Romanian developers via an EOR platform in Romania to stay compliant.

Legislation, Payroll, and Taxes in Romania

Romania runs a clear, digital framework – easy for a company to follow when the contract and filings are done right.

- File every employment contract in REGES-Online: update hires, changes, exits.

- Working time 40h/week; ≥20 paid leave days; overtime = time off or ≥75% pay – reflected in payroll.

- Contracts: indefinite (default), fixed-term (limited), part-time, telework (Law 81/2018), temporary agency work (EOR base in Romania).

- Payroll: monthly; D112 by 25th; PIT 10%; CAS 25% + CASS 10%; CAM 2.25%; min gross RON 4,050.

- B2B worker handles own taxes (income tax, CAS/CASS, VAT if applicable).

Labour legislation in Romania

Worth mentioning that hiring formalities are fully digital now. Every employment contract must be recorded in the national register (REGES-Online) and kept up to date – new employees and workers, changes, and terminations all go through this system. It’s the audit trail inspectors look at, so clean entries and timely filings matter.

Leave and working-time rules are straightforward for employees: standard working time is 40 hours/week, at least 20 working days of paid annual leave, with public holidays separate from that quota. Night work, rest periods, and special categories have extra protections, which your payroll and scheduling should reflect.

Exits are structured, not ad hoc. For employer-initiated dismissal, the minimum notice is 20 working days (longer if agreed in the contract). For resignations of employees, the maximum notice is 20 working days for non-management and 45 working days for management roles; employers can choose to waive it.

Types of employment contracts

Under Romanian labor law, the default is the open-ended employment contract (fixed terms are the exception and tightly regulated).

- Indefinite (open-ended). The standard employment model – strongest fit for core teams and retention.

- Fixed-term. Allowed only in specific cases; typically capped at 36 months, with limits on successive renewals (no more than 3 with the same employer).

- Part-time. Same contract framework, fewer hours.

- Telework/remote. Governed by Law 81/2018; requires a written addendum covering location, schedule, and equipment/security duties.

- Temporary agency work (TAW). The licensed agency is the legal employer and assigns the employee to a user organization – this is the compliant framework most EOR models rely on in Romania.

Work permits and visas

Let’s say EU/EEA citizens work in Romania without a permit. Non-EU hires need an employer to sponsor a work permit with the General Inspectorate for Immigration (IGI), then apply for a long-stay D visa and, after entry, a residence permit. Typical timing: ~30 days for the permit (extendable by 15), then ~10–14 days for the visa.

There are two fast lanes worth knowing. The EU Blue Card (for highly qualified roles) requires a higher salary threshold set by law and offers better mobility inside the EU. The ICT route covers specialists moving within a group. Both sit on top of a regular employment contract and must meet documentation rules.

A few pragmatics from Alcor’s experience: appointments at IGI can book out 4-6 weeks ahead, permits are employer-specific, and minimum pay rules apply (e.g., updated minimum gross wage from 2025). If you want speed with clean compliance, an EOR in Romania acts as the legal employer, sponsors the right route, and can organize even US visas and work travels – just like we did for ThredUP.

Payroll in Romania

Payroll runs monthly – employers file the consolidated return (Form D112) and pay withholdings by the 25th of the following month via the ANAF portal.

- Income tax (employee): flat 10%.

- Social contributions (employee): 25% pension (CAS) + 10% health (CASS).

- Employer contribution: 2.25% labour-insurance (CAM); extra 4-8% only for special-conditions roles.

- Minimum gross wage (2025): RON 4,050 per month (national floor), useful as a compliance check for offers.

If you’d rather not juggle filings and deadlines, an Employer of Record from Romania runs the payroll, tax, and leave stack end-to-end, lifting this burden from your shoulders.

Taxation in Romania

Here’s a short view of the main 2025 tax items you’ll use for budgeting. Rates reflect Romania’s current framework and mid-2025 updates.

|

Tax |

2025 rate |

| Corporate income tax (CIT) | 16% (standard company rate (worldwide income; treaty relief applies)) |

| Micro-enterprise tax | 1% if revenues ≤ €60k and not in listed CAEN sectors; 3% if >€60k or in certain sectors (incl. IT CAEN 62/63); eligibility cap €250k revenue in 2025 (falls to €100k in 2026) |

| Personal income tax | 10% flat |

| Employee social contributions | 25% CAS + 10% CASS |

| Employer contributions (CAM) | 2.25% (Labor insurance; extra 4–8% for special conditions) |

| VAT / TVA | 21% standard; 11% reduced (from 1 Aug 2025) |

| Dividends (WHT for non-residents) | 10% (EU directives / treaties may reduce; scheduled to rise from 2026 per new law) |

| Building (property) tax | 0.08–0.20% res.; 0.2–1.3% non-res |

| Returns & payments | Monthly D112 filing and payments by the 25th via ANAF |

Sources: Tax Summaries

Also note that B2B contractor handles its own taxes: income tax (e.g., flat 10% for PFA after allowable expenses or micro‑enterprise 1%/3% where eligible), plus social contributions, and VAT registration where applicable.

Employment in Romania in Details

Romania keeps benefits and people ops clear when you write them into the contract and stick to the basics.

- Statutory benefits (employee): ≥20 days paid annual leave, separate public holidays, sick leave, maternity/paternity, and mandatory insurance via social contributions handled in payroll.

- Non-statutory (tech): meal vouchers, private health/dental, extra vacation, learning budget, flexible work.

- DEI: bias-free hiring, documented rubrics, published bands, reasonable accommodations, so practice matches Romanian records.

- Probation & onboarding: set 60-90 days in the contract.

Employee benefits

Think in two buckets: statutory (required by law) and non-statutory (market practice). Statutory employee benefits include:

- paid annual leave (minimum 20 working days)

- public holidays (separate from leave)

- sick leave (doctor certified; cost shared between employer and fund)

- parental leave (maternity/paternity)

- mandatory insurance via social contribution

Non-statutory employee benefits in tech often add meal vouchers, private health/dental, extra vacation, education budgets, and flexible work. In practice, benefit depth expands with seniority.

Diversity, equity, and inclusion (DEI) policy

Teams expect transparent hiring, equal pay for equal work, and accessible workplaces. Keep job descriptions bias-free, document interview rubrics, publish salary bands in offers, and provide reasonable accommodations. With EOR in Romania, your DEI policy lives inside local HR and record-keeping, so audits match what you practice.

Employee probation & onboarding

Set probation in the contract (common 60-90 days for tech). Use week-one checklists: equipment, security access, data/privacy brief, and KPIs for sprint two. Assign a buddy, schedule 30/60-day reviews, and map training budget early. Good onboarding shortens time-to-first-merge and lowers attrition.

Employee termination & severance package

For performance or redundancy, build the paper trail (objectives, feedback, selection criteria), respect notice (often 20 working days; managers may have longer), and pay all dues on exit (salary, unused leave, agreed severance where applicable). Redundancy requires objective economic grounds and consultation steps. When risk is unclear, switch to mutual agreement with clean IP/return-of-property terms.

How to Choose an EOR Provider in Romania

Choose an EOR in Romania that proves compliance (REGES-online, payroll, tax, leave, notice), runs one contract with clear pricing, and supports exits – clean offboarding, IP, no buyouts – for every Romanian employee/worker.

- Native navigation: consultations on talent availability, salary benchmarking, and local peculiarities of the market.

- Tech focus: sourcing for engineering roles, tailored FTE & B2B contracts, NDAs, IP agreements.

- Proven compliance: ask how the Employer of Record in Romania handles REVISAL, payroll, tax, leave, notice, and termination – with audit trails.

- Single agreement: one partner for tech recruitment, HR ops, insurance, equipment, and security – not a web of subcontractors.

- Transparent pricing: total wage cost, employer burden, and pass-throughs; no hidden fees.

- Exit paths: clean offboarding, IP, and no buyouts if you decide to insource.

Alcor – More than Employer of Record in Romania

You don’t need another vendor – you need a partner who scales with you. Our turnkey model offers a blend of tech recruitment in Romania, Employer of Record, and day-one operations, creating a fully-fledged tech R&D center. We build your software development team in Romania and other locations, and provide you with the full support of a dedicated Customer Support Manager.

Why this works for product teams:

- Tech-first hiring. Our 40 in-house recruiters hire senior engineers with Valley-caliber skills in just 2-6 weeks.

- No operational headaches. Our Employer of Record services in Romania, and other locations has your back.

- One accountable partner. Ops, payroll, and legal under one roof – clean audit trails, predictable costs, no surprise fees.

- No lock-in. Start via EOR, scale, then you can convert to your own entity later – your IP and team stay yours.

93% of engineering leaders and unicorns like People.ai are highly satisfied with our tech R&D solution and strategic cooperation with Alcor. Try it out yourself!

References on Employer of Record Services in Romania

- Trading Economics

- ECB

- KPMG

- EF EPI

- Eurostat

- EURES

- European Commission

- Romania National Institute of Statistics

- Agerpres

- SeeNews

- Romania Insider

- Reuters

- OECD

- The Recursive

- Business Review

- ECCC

- McKinsey & Company

- Gallup

- Auraxess

- Tax Summaries

FAQ

Is hiring developers in Romania through EOR faster?

Yes. Opening a legal entity takes ~15-30 business days (often 6 weeks with VAT). With an Employer of Record in Romania, like Alcor, you can skip legal incorporation and onboard developers in about 10 business days, since the EOR is the legal employer, who runs payroll, and files REGES-online while you manage day-to-day work.

What’s the difference between EOR and PEO in Romania?

A PEO is a third-party that works on a co-employment. They cover HR, payroll, and benefits. An EOR in Romania acts as the legal employer (licensed temporary work agency), signs the employment contract, withholds tax/social contributions, and keeps you compliant; you direct scope, IP, and performance.

How much do EOR services in Romania cost?

EOR pricing in Romania varies by service scope and model. Some providers offer a flat $599 per employee/month, others take a % of annual compensation, or bury extras in markups. Always check what’s included – legally required filings, local obligations, and who handles changes when you employ in the country.

At Alcor, our Romanian Employer of Record is transparent and scalable: one service fee, no hidden fees. As your romanian team grows, unit costs can decline, so you keep a predictable runway while staying fully compliant on contracts, payroll, and statutory duties for every worker.

What are the consequences of contractor misclassification in Romania?

If a B2B contractor is found to function like an employee (fixed hours, direct control), authorities can reclassify the role. Expect back taxes and social contributions (CAS/CASS), interest/penalties, updates in REGES-Online, and potential labor fines – often assessed for up to 5 years. Using clean role definitions – or routing the role via an Employer of Record service provider in Romania like Alcor – mitigates that risk.