Employer of Record Service in Romania

Build a team of senior software engineers in Romania without compliance risks and HR overloads:

- Exclusive tech industry-focused Employer of Record solution in Romania trusted by unicorns

- Local talent navigation from our in-country staff

- Get premium support from a dedicated Customer Operations Manager

- Manage payroll & operations via the AlcorOS™ platform

- More than EOR: tech recruitment, office lease, procurement & other ops

Tech Companies Prefer EOR with Alcor

Alcor’s EOR Solution in Romania is The Way If You’re

Expanding abroad

for the first time

- Full navigation in Romania’s talent pool for tech

- 100% compliance & legal shield

- Quick onboarding in 10 business days

Switching from

outsourcing

- Save up to 40% of costs – no markups & buyouts with Alcor

- Get 2-3 tiers better talent

- People finally become your strategic asset

Switching from

outsourcing

- Save up to 40% of costs – no markups & buyouts with Alcor

- Get 2-3 tiers better talent

- People finally become your strategic asset

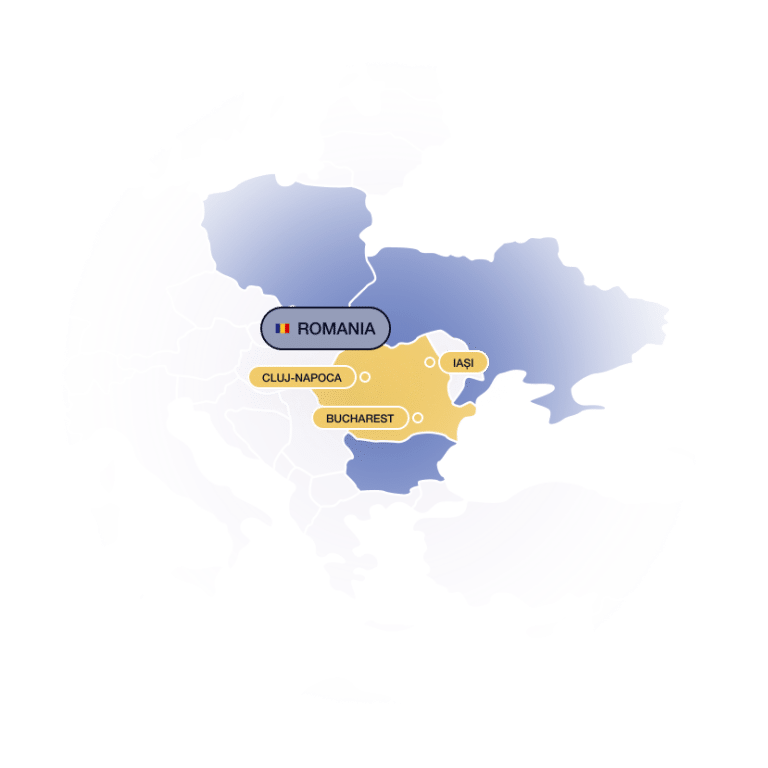

Romania for Tech Expansion via EOR

Alcor is Disrupting the Way EOR in Romania is Managed for Tech

- 100% tech focus We care about your IP and growing HR needs. Get the best practices proven by our other tech customers.

- In-House tech recruitment & ops Scale from 10 to 100 engineers in a year with our 40 tech recruiters. Get extra services in one place.

- 10-day onboarding We commit to onboarding talent in 10 business days.

- Flexible & predictable pricing No prepayment. Transparent invoices. The larger your team grows, the less you pay.

- Automation with quick reaction A platform for easy access. Contract tailoring. Error-free payslips.

- Key customer operations manager One key person to resolve issues & discuss opportunities. 93% of customers are happy. 99% stay for years.

Ordinary EOR

- One-size-fits-all Standard framework for any kind of business. No deep understanding of the tech industry’s needs.

- Partial recruitment & back-office Help you hire via job boards at best. Involve multiple intermediaries for ops.

- 1-month+ onboarding They promise to onboard talent in 7 days, but it takes them months.

- Fixed pricing & hidden fees Prepayment. One price for all, always increasing. Surprise FX & offboarding commissions.

- Automation without customization Automated platform. Generic contracts. Payslip errors.

- Customer support in words only Self-help videos & FAQs. Ping-pong emails among depts. Desire to offboard as soon as you’ve onboarded.

Employer of Record Services in Romania Include

HR Payroll

Accurate and timely salary calculations and payments for your team of developers

Benefits management

PTO, health insurance, parental leave, mental healthcare, WFH availability, gym membership, etc.

Legal framework

B2B & FTE employment options, compliance with the local law, preparation of NDAs and IP rights agreements (on request)

Onboarding/offboarding

Required employee/contractor information collection, employment & termination contracts preparation, payout of final settlements

Alcor – Package Deal for Tech Expansion

Source and hire abroad within weeks

Get recruitment & ops in one place

Pay less as your team grows

Enjoy automation with a human touch

Romania’s Labor Regulations at a Glance

Key Things about EOR Services in Romania

Benefits of expanding with EOR to Romania

No legal entity

An Employer of Record solution in Romania enables your tech business to expand into new markets without establishing a local legal presence and navigating the bureaucratic complexities of complying with local laws and regulations. Each employment, payroll, and HR aspect is handled by the EOR platforms, allowing you to focus on business growth.

Cost-efficiency

Expansion into new markets often requires juggling multiple providers for legal compliance, payroll, HR, benefits management, and other services. Global EOR platforms manage everything in one place, but Alcor’s EOR services in Romania raise the bar. It offers tailored pricing for tech companies and allows them to avoid hefty buyout fees and setup costs by building a loyal team of developers.

Compliant expansion

Offshoring locations come with their own unique legal intricacies that need to be addressed to ensure smooth business operations. Labor laws, tax regulations, and employment contracts are all covered by EOR solutions in Romania. Alcor’s EOR for tech goes a step further, also covering SLAs, NDAs, IP rights protection, and benefits management for developers—delivered by lawyers with IT law qualifications and experience in Romania.

Accurate & timely payroll

Wondering how to pay your global team accurately and on time? The answer is—via an EOR partner. With Employer of Record services in Romania, you can easily navigate local payroll rules, tax obligations, deductions, and currency conversions, ensuring timely and accurate paychecks. Hiring developers on different employment contracts? Alcor’s tech-focused EOR handles payroll processing, tax, and social security contributions for both FTEs and B2B workforce in Romania.

Is using EOR in Romania legal?

Absolutely! Employer of Record is your legal gateway to hiring software developers without the complexities of opening a legal entity abroad. Your EOR partner serves as the legal employer of programmers on your behalf, taking care of all the admin functions, like payroll, HR, legal, and benefits management. They also assume full liability for adhering to local labor laws, employment rules, and tax obligations, bearing any potential legal risks.

But make no mistake—you remain the one and only real employer of software engineers. From day one, you manage your team directly and integrate it into your culture and practices. All the bureaucracy? Gone. Legal risks and admin burdens? Off your shoulders. Instead, you focus on what matters the most—developing your software product.

So, an EOR service in Romania is simply a means for tech companies to swiftly expand into new markets and hire a development team compliantly. Exactly what tech companies like BigCommerce, People.ai, Dotmatics, and Sift did. With the help of Alcor, an EOR provider for tech, they have seamlessly and securely built fully backed teams of 30+ developers and fast-tracked their product growth.

Employment contract in Romania

There are two prevalent models for hiring Romanian developers: employment agreement (Contract de Muncă) and B2B contract (Contract Civil).

An employment agreement forms an employer-employee relationship governed by the Romanian Labor Code. For employers, this type of employment comes with tax obligations, including paying payroll taxes and social security contributions (SSC), as well as withholding income tax and SSC on behalf of the employee. Additionally, it is full of rigorous working terms and employee termination procedures. That’s where Alcor’s IT EOR in Romania can serve as your lifeline in the deep employment waters.

For employees, an employment contract serves as a safety net, securing their salary amount, benefits, working hours, paid time off (PTO), and termination terms. The downside? Their salary is paid in a local currency, which may be affected by inflation.

A B2B contract is signed between a hiring tech company and a software developer, establishing a contractor-client relationship under the Civil Code and Fiscal Code. The programmer must register as a sole trader to provide IT services.

Unlike an employment agreement, in B2B relations, the employer is free from tax obligations, while the contractors handle taxes and social contributions on their own or via an EOR vendor in Romania. The reward is paid in a foreign currency, so inflation and exchange rate swings are not an issue. However, benefits, PTO, and working terms are typically negotiated individually and are usually more restrictive than those outlined in the employment contract.

Taxes & payroll in Romania

An employment agreement typically entails tax obligations for both the employer and the employee.

What does the employer’s share include?

- Social Security Contributions in Romania consist of:

- Labour insurance contribution: 2.25%

- Pension insurance contribution: 0%-8%*

*0% — rate for normal working conditions; 4% — rate for particular working conditions, 8% — rate for special working conditions

Now, the employee’s share:

- Personal income tax constitutes 10% of the employee’s gross income.

- Social Security contributions on the employee’s side are higher compared to those of the employer, constituting a total of about 35%, including:

- Pension insurance contribution

- Health insurance contribution

The employer is responsible for calculating all taxes and deductions and paying them by the 25th of the month following the one in which they are due. An Employer of Record company in Romania, like Alcor, can take care of the taxes for you, so you wouldn’t have to worry about miscalculations or missed deadlines.

The second employment model is the B2B contract, which enables tech companies to hire Romanian software engineers as contractors. In this case, paying payroll taxes is not mandatory for the company. Developers, on their part, are responsible for covering:

- Personal income tax depends on the type of registration, whether SRL (Societate cu Răspundere Limitată) or PFA (Personă Fizică Autorizată).

The former refers to a Limited Liability Company, which means that a developer acts like a firm that provides IT services to a tech company. In this case, the programmer pays either a 16% income tax on net income or a 1%-3% micro-company tax if eligibility criteria are met.

The latter refers to an Authorized Physical Person, meaning that a developer acts as a sole trader and provides IT services to the company. In this case, the programmer pays 10% of their gross income.

- Social Security contributions include:

- Pension insurance contribution (for income over 24 minimum salaries, where the min. salary in Romania is $831): 25% or $4,986 per year.

- Health insurance contribution: 10% of the net income or around $4,986 per year. The rate is subject to a minimum threshold of 6 min. salaries, which is about $4,986, and a maximum threshold of 60 min. salaries, which is around $49,860.

Developer salaries in Romania

Romania is a goldmine of skilled software engineers, offering a competitive advantage without the Silicon Valley price tag. The average senior developer salary here constitutes about $73,880 per year, with the most in-demand tech talents, such as AI Engineers, Cloud Developers, and DevOps Engineers, earning between $78,000 and $84,000.

Even the highest-paid tech experts don’t break the bank in Romania. For instance, a senior Site Reliability Engineer gets about $81,600, while an Advocate Developer receives an annual salary of $108,000.

That’s about 42% savings compared to the US. See yourself:

| Senior Position | Romania | USA |

| AI Engineer | $78,000 | $171,600 |

| Cloud Developer | $84,000 | $146,400 |

| DevOps Engineer | $81,600 | $145,200 |

Annual developer employment cost in Romania

So, how much should you really budget to hire a software developer in Romania? To break down the total cost beyond just salary, you need to include:

- annual income of a software engineer,

- taxes, social contributions, and additional payments presupposed by the local labor laws,

- employee benefits package, which typically includes health insurance, professional training, hardware, and corporate merchandise, totaling about $6,350 in Romania and $15,400 in the US per developer/year,

- recruitment fee, which is typically 20% in Romania and 30% in the US of the senior developer’s gross annual salary.

Have a sneak peek at the figures:

| Senior Position | Romania | USA |

| AI Engineer | $99,950 | $238,480 |

| Cloud Developer | $107,150 | $205,720 |

| DevOps Engineer | $104,270 | $204,160 |

|

These calculations exclude taxes, SSC, payroll taxes, and other payments, as they differ depending on the employment model. |

||

Contact Alcor, your EOR service provider in Romania, to get precise payroll calculations for your tech positions and discover your true savings.

Employee benefits in Romania

When hiring software engineers in Romania, as an employer, you must comply with the statutory employee benefits outlined in the Romanian Labor Code. They are mandatory for tech specialists working on the employment contract. Failure to provide these benefits may lead to legal troubles, penalties, and fines.

So, what are these statutory employee benefits?

- Social security contributions, including health, disability, unemployment insurance, pension contributions, and others.

- Annual vacation consists of paid days off, which may increase due to seniority or special conditions.

- Leaves, including sick, maternal, paternal, and parental.

- National holidays, including Christmas Day, New Year’s Day, and Independence Day, are all set out in the Romanian Labor Code.

- Termination protection includes a notice period and just cause.

There are also supplementary employee benefits, which are optional but good to have if you want to attract top software engineers in Romania, like:

- Private medical insurance is a common addition to basic medical coverage, typically covering diagnostics, vision and dental care, emergencies, mental health services, etc.

- Tech courses & English classes to promote professional development;

- Gym membership is offered as a subsidized benefit or fully paid by the employer.

- WFH setup & Internet allowance, relevant for international dev teams working remotely;

- Stock options are predominantly offered to C-level experts.

Probation period, working hours & overtime

According to Romania’s Labor Code, the standard workweek in the country clocks in at 40 hours, with the possibility of overtime, which shouldn’t exceed 8 hours per week. The overtime compensation is generous—175% of the base salary in regular hours and 200% on national holidays.

When you hire a software developer in Romania, their probation period is typically 3 months, while for managerial roles, it extends to 4 months. Usually, this time is enough to test the skills and assess the performance of the new hire. We at Alcor guarantee only high-quality tech talent, with 98.6% of our hires passing probation with flying colors. In the rare case that someone doesn’t meet your expectations, we provide a replacement free of charge.

Types of leaves in Romania

Software developers working on an employment contract in Romania are entitled to the following paid time off (PTO):

Annual leave consists of 20 working days regardless of the employee’s years of working experience. It can only be compensated with money upon contract termination.

Sick leave: the first 5 days are paid at 75% of the employee’s salary by the employer. If it extends from the 6th to the 183rd day, then it’s covered by health insurance.

Maternity leave lasts for 126 calendar days, of which 63 days must be taken before childbirth and the other 63 after.

Extraordinary paid leave includes

- Paternity leave: 10 working days; can be extended by an additional 5 days under the childcare course;

- Marriage leave: 5 days;

- Blood Donation Leave: 1 day;

- Bereavement Leave: 3 days.

paid by the employer;

- Parental leave: available for both parents – 2 years (3 years in case of a child’s disability);

- Maternal risk leave: up to 120 days before and after maternity leave (in special cases);

- Adoption leave: 1 year;

- Care leave: 45 days for taking care of a sick child up to 7 y.o.

paid by the National Health Insurance House.

Public holidays in Romania include 17 paid days, as per the annual leave entitlements for the year 2025.

US visas for Romanian developers

When a US-based tech company hires software developers in Romania, it should consider visa requirements. To travel on a business trip to the United States, a Romanian programmer should obtain a B1/B2 visa, which permits a stay of up to 6 months. It allows business-related activities, such as attending conferences and meetings, participating in short-term training or team-building, and exploring partnerships, but not permanent work in the United States.

To get it, a Romanian citizen should

- Complete Form DS-160,

- Pay the application fee of $185,

- Schedule and pass the interview at the nearest U.S. embassy/consulate,

- Prepare the necessary documents, including a valid passport, proof of corporate ties, and financial documentation (such as bank statements and a sponsor letter).

But no need to stress over these visa challenges. Alcor, your Employer of Record service provider in Romania, can seamlessly handle all aspects of visas for your software engineers, just like we did for US tech company ThredUP.

Termination laws in Romania

The termination of an employee in Romania is governed by the labor code, which establishes strict guidelines for the termination process, thereby protecting workers’ rights and posing risks for employers. Luckily, there are EOR companies in Romania like Alcor that serve as your compliance buffer, ensuring a smooth employee offboarding process.

General termination rules:

Notice Period is 20 working days. No prior notice is required for disciplinary terminations or if the employee is under arrest for over 30 days.

Local requirements: Employment is typically concluded for an unlimited period and can only be terminated through specific procedures. Dismissal may be for cause (medical issues, professional unfitness, disciplinary reasons) or without cause (redundancy, collective layoff).

Termination payments:

- Compensation for all unused paid vacation days accrued, bonuses, or other benefits owed.

- Severance payments are not mandatory, except in cases of medical unfitness, then they are paid as per the employment contract or collective agreement.

Pregnant employees, those on maternity, paternity, or childcare leave, employees using the insertion incentive, on annual leave or medical leave, and union leaders are protected from termination.

Setting up a software company in Romania vs EOR services

Expanding your development team abroad often means establishing a local legal entity, which varies from country to country based on the local laws of business incorporation. Generally, you would need to navigate complex legal requirements, including selecting the type of entity, registering with relevant authorities, opening bank accounts, and ensuring compliance with local tax and social security laws.

The business incorporation process can drag on for months, draining tens of thousands of dollars in legal fees, registration, and insurance. What is even worse, failing to comply with local laws and practices can expose your tech company to hefty fines or even legal actions, putting your expansion plans at risk.

The EOR solution in Romania allows you to bypass the lengthy and expensive route of setting up your own entity abroad. For instance, with Alcor EOR for tech, you can hire developers through our readily established legal entities in LATAM or Eastern Europe, saving an average of 3.5 months on business incorporation. Plus, manage admin and legal complexities hassle-free. It’s a faster, safer way to expand your business compliantly without the financial burden.

Alcor EOR in detail

Alcor’s Employer of Record for Tech is a 360-degree solution devised for the compliant and seamless hiring of software engineers in Latin America and Eastern Europe. With no need to open a legal entity, it saves tech companies an average of 3.5 months and tens of thousands of dollars in setup costs. This means you can skip the red tape and build your own team of 30+ developers in just three months, accelerating your software development and unlocking faster growth.

With our Employer of Record solution in geo, you get more than just HR & payroll:

- Tech-focused services: from FTE or B2B employment options and tax incentives to R&D deductions and tailored benefits for developers.

- 100% compliance: get shielded with guidance from our lawyers, who have expertise in IT law.

- Customized pricing: volume discounts, no hidden costs or pre-payment.

- Ongoing in-country support: our Dedicated Customer Success Managers go above and beyond to simplify your business expansion.

- All-in-one place: manage everything in one place, no need for multiple vendors.

But EOR is just the beginning…

You can upgrade it to our software R&D center solution, which includes:

- In-house tech hiring is handled by our 40 recruiters, who headhunt the top 10% of the market developers across LATAM and EE. With our 80% CV pass rate and 2-6 weeks to fill a vacancy, you can scale your team from 0 to 100 engineers in a year.

- Operational support encompasses additional services, including leasing office or co-working space, procuring equipment, setting up IT infrastructure, and employer branding.

The result? A fully backed tech R&D center with a software development team that’s 100% yours from day one.

FAQs

What does an Employer of Record (EOR) in Romania do?

An EOR in Romania (Employer of Record) is a trusted third-party partner that legally employs software developers and tech specialists on behalf of international companies expanding to Romania. The best EOR services in Romania handle every aspect of local employment – from payroll and tax management to onboarding, benefits administration, and IP protection – enabling businesses to operate compliantly without establishing a local entity. A reliable Employer of Record company in Romania ensures smooth team scaling, transparent processes, and full compliance with Romanian labor laws.

At Alcor, we go beyond standard EOR solutions in Romania by combining legal employment with Silicon Valley–grade tech recruitment and comprehensive operational support – helping global product companies expand confidently, hire top local engineers, and stay 100% compliant.

What is the cost of EOR services in Romania?

The cost of EOR services in Romania varies depending on the provider and the level of support included. Most EOR companies in Romania charge a fixed fee of up to $599 per employee per month, covering payroll, legal compliance, and other operational functions.

At Alcor, our Employer of Record solutions in Romania follow a fully transparent pay-as-you-go model – no hidden fees, no deposits, and full cost control. Plus, as your development team grows, your EOR expenses can decrease thanks to our scalable and flexible pricing structure.

How secure is the EOR in Romania?

The security of EOR services in Romania depends on how effectively the provider safeguards your company’s intellectual property, employee data, and compliance with local regulations. A trustworthy Employer of Record company in Romania ensures full adherence to Romanian labor laws, GDPR, and data privacy standards, minimizing legal and financial risks. The best EOR service providers also include airtight IP rights transfer and NDAs in all employment contracts to keep your innovations secure.

At Alcor, we go beyond standard EOR solutions in Romania – our in-house legal team provides a full compliance and data protection framework, ensuring 100% transparency and security at every stage. With Alcor as your personal IT EOR in Romania, your operations remain legally protected and fully compliant – from hiring and payroll to offboarding.

How do you choose the right global Employer of Record for your business in Romania?

When choosing the right Employer of Record company in Romania for your tech business, several factors are crucial for ensuring a seamless and compliant global expansion:

1) Tech specialization: Your EOR services in Romania should have expertise in the tech industry, from hiring software engineers to managing developer contracts, IP rights, and stock options. This ensures they understand the needs of fast-growing IT businesses and meet them.

2) Legal entity availability: Verify that your EOR service provider in Romania has a registered entity to legally employ developers, handle payroll, taxes, and ensure compliance with local labor laws.

3) Compliance protection: Make sure your chosen EOR vendor in Romania has a solid in-house legal team capable of mitigating risks like worker misclassification and ensuring GDPR/CCPA data protection compliance.

4) Transparent pricing: Go for an EOR solution in Romania that provides clear invoices with no hidden fees or buyout costs; such tech EOR providers typically operate on a clear flat-fee or percentage-based structure.

5) Proven reliability: Check the Employer of Record service provider in Romania for case studies and client reviews on platforms like Clutch, G2, or Trustpilot to confirm reliability, responsiveness, and expertise in ability to handle real-world challenges and deliver measurable results for IT businesses expanding to Romania.

Who are the best Employer of Record (EOR) service providers in Romania?

Here’s a short list of the best Employer of Record providers in Romania:

1. Alcor – founded in 2017, this software R&D center accelerator provides tech-focused EOR services in Romania, ensuring full compliance with local labor and tax regulations for engineering teams, and preparing NDAs and IP rights agreements to protect source code, proprietary technologies, and product deliverables. The company also supports recruitment, payroll, and back-office operations for Western tech product companies. In addition, Alcor offers an automated platform, AlcorOS, which combines workflow automation with human-led support. Alcor helps you hire the right people and onboard them in days. Nearly 85% of your cost goes directly to your engineers, boosting motivation and retention. Your fee decreases as your team grows. And if one day you decide to insource the team, you can do so with zero exit fee.

2. Remote – a remote-first EOR platform that handles employment, payroll, benefits, and compliance in 90+ countries without requiring you to set up local entities.

3. Deel – founded in San Francisco (2019), Deel offers EOR, global payroll, contractor, tax, and compliance services in 100+ countries. Known for integrations with platforms like Workday, HiBob, BambooHR, SuccessFactors, finance stacks.

4. Rippling – combines EOR services with its HR/IT platform; suitable for tech firms that seek HR, devices, and payroll in one stack.

5. Pebl (formerly Velocity Global) – US-based EOR vendor offering global payroll, and workforce compliance in over 185 countries. In September 2025, Velocity Global rebranded to Pebl and launched an AI-first hiring/pay platform.

6. Papaya Global – a fintech-SaaS company offering payroll, workforce management, benefits, and EOR in 160+ countries.

7. Globalization Partners – a global EOR vendor, that operates in 180+ countries and combines EOR and contractor workflows with Gia, its AI help layer for compliance and HR questions.

8. RemoFirst – EOR platform that manages payroll, taxes, compliance, and benefits for both full-time employees and contractors across 185+ countries.

9. Oyster HR – EOR vendor, offering its services in 185+ countries. Supports hiring, onboarding, benefits, and localized compliance.

10. Multiplier – established in 2020, this EOR vendor covers 150+ countries and offers support in EOR, PEO, and HR consulting for startups and scale-ups.

But note: some companies don’t focus on the tech industry, which means they overlook important aspects like IP rights protection contracts, NDAs, and stock options as a benefit. They also offer a limited range of EOR solutions that exclude full-cycle recruitment, hardware procurement, office leasing, employer branding, and other operational support. In case they are vital for your business, you’d have to either provide them on your own or hire additional vendors. As a result, this additional workload might lead to more spending, coordination struggles, and deadline postponing.

So, are you looking for a better EOR alternative in Romania – but with real human cooperation and a true tech focus?

Alcor is not just a platform for managing HR & payments. We focus on tech only and have become an all-in-one long-term partner for People.ai, BigCommerce, Sift, Ledger, Franki, and many other tech companies scaling in LATAM or Eastern Europe.

Our solution is a software R&D center that combines:

1) Silicon Valley-grade recruitment of 10 to 100 developers per year with our in-house tech recruitment team of 40;

2) Comprehensive EOR services for tech companies that cover tech contracts – from IP rights protection to NDAs, as well as other legal support, payroll, and benefits administration;

3) Operation services – hardware procurement, office leasing, HR, and IT support.

With Alcor, you get the best of both worlds: the speed of automation and the care of real human collaboration.

Companies Scaling with Alcor

Alcor is a reliable partner that meets our hiring needs. We finally hired experienced software engineers in Eastern Europe with strong tech skills and business acumen. Account Managers are awesome!

With Alcor’s all-in-one solution, we got a software R&D office with 15 senior PHP devs and a compliant operational coverage. I really appreciated their transparent pricing structure and deep expertise.

We interviewed a lot of EoR platforms and companies, but Alcor was the only one that provides a combo package of EoR and Recruting offerings. Alcor helped us build a full stack team in 1.5 month.

We wanted to switch from our outsourcing provider, and Alcor has become really game-changing for us. Within a mere 6 months, we got a fully-fledged team of 30 engineers in our own R&D office.

Alcor’s R&D solution eclipses full-cycle recruitment, EOR service, and operational support for our offshore team. Their ‘all-in-one place’ approach is far more cost-effective than I could’ve imagined.

I value their commitment to going the extra mile. We evolved from an outstaff project into an independent company, and Alcor’s support was crucial. They hired and ondoarded 15+ professionals for us.

Expanding our engineering team outside the US with Alcor was a game-changer! They found 15 talented developers and provided seamless EOR & operational support. Great responsiveness to our needs!

Thanks to Alcor, we hired four engineers and a designer that strengthened our team. Beside stellar recruitment, Alcor flawlessly handled our payroll. Their approach was seamless and swift.

Alcor’s flexible model helped us scale from 0 to 30 devs in a year first, and then to 50! No buy-out fees, seamless hiring, and top-tier talent. A hassle-free way to grow without setting up a subsidiary!

Alcor helped us hire the top 5% of tech talent while building our employer brand. They were proactive, never compromised on quality, and delivered. Three years later, our hires are still thriving!

Thank you Alcor team for helping us to source these excellent candidates! We really appreciate all your efforts and timely response!