According to Statista, in 2025, Colombia and Mexico together are boosting the $7.5 billion tech outsourcing market. Why? Because today’s overall tech talent shortage has reached 76%, pushing companies to turn to LATAM for top talent, lower costs, and specialized expertise. So—two giants, two top destinations, one question: Colombia vs Mexico for nearshore technology outsourcing?

I’m David Gomez, Alcor’s Lead IT Recruiter in Latin America. With Alcor, you can get your software development center in Colombia, Mexico, Argentina, or Chile. We help US technology companies grow and go global, providing Silicon Valley-caliber software development teams from 10 to 100 devs in a year and beating traditional nearshore outsourcing for long-term scaling goals.

In this article, you’ll discover the similarities and differences between nearshoring in Colombia and Mexico, including market stats, talent comparison, cost and savings, and more.

In this article, I’ll unveil the similarities and differences between nearshoring in Colombia and Mexico, including market stats, talent comparison, cost and savings, and more. Let’s dive in!

Key Takeaways

- Colombia and Mexico are among the top nearshore locations in Latin America: they boast the largest talent pools, with 165,000 and 800,000 developers, respectively, lead in technology skills like JavaScript, Python, C++, and PHP, and offer ideal time zone proximity to the US — with a time difference ranging from 0 to a max of 3 hours.

- However, there are notable differences: while Mexico has a larger number of specialists and a bigger tech services market, Colombia is renowned for its top startups in foodtech, energy, and environment, as well as lower salaries, allowing employment cost savings of up to 55% compared to the US.

- Another difference lies in taxation: Mexico has tax treaties with the US and Canada, whereas Colombia offers favorable tax incentives for tech, scientific, and innovation businesses.

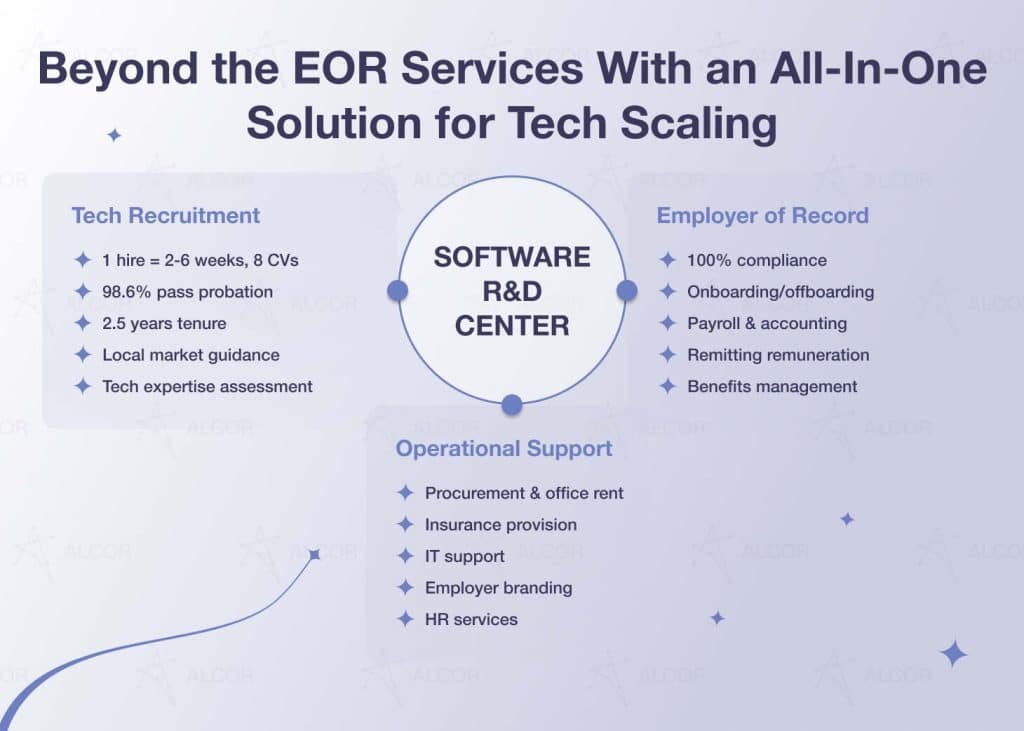

- Regardless of which country you choose, the key is the cooperation model you adopt. Building your own R&D center with Alcor gives you 100% compliant expansion, 40% savings compared to IT outsourcing, and full operational coverage. Best of all, you get a dedicated nearshoring team of top 5 developers in the first month, along with the opportunity to scale to 100+ coders within a year.

Why Choose Between Colombia and Mexico

Why pick Colombia or Mexico for IT nearshoring to Latin America? What about nearshoring software development to Argentina or Chile, for instance?

In a nutshell, these nearshore outsourcing countries…

- Are perfect for US tech companies that are turning to outsourcing to increase their staff close to home offices. Mexico has three overlapping time zones with the United States, and Colombia is in the GMT-5 zone, just one hour behind EST.

- Benefit from the biggest nearshore talent pools of 800,000 and 165,000 developers, respectively, and the largest numbers of ICT graduates: 124,000 in Mexico and 15,000 in Colombia.

- Outperform Argentina by one position and Costa Rica by seven positions in tech skills, according to Coursera.

- Are buzzing with startups and unicorns, attracting a total of 1$.14 billion in VC funding in 2024.

Colombia and Mexico Tech Sector: Key Statistics

For insights into nearshore technology outsourcing stats, let’s compare these two locations in greater detail.

| Criteria | Nearshoring Locations | |

| Colombia | Mexico | |

| Market potential | $2.1 billion of revenue in IT Services in 2024; projected to reach $2.77 billion by 2029 Growth rate—6.2% Tech outsourcing dominates the market by 34% | $18.8 billion of revenue in IT Services in 2024; projected to reach $23.2 billion by 2029 Growth rate—5.4% Tech outsourcing dominates the market by 35.7% |

| Business climate | A4 | B |

| Startup Ecosystem | Hubs: Bogotá, Medellín, Cali #2 in South America, #36 globally in Startup Ecosystem Index | Hubs: Mexico City, Monterrey, Guadalajara, Merida #1 in Central America, #43 globally in Startup Ecosystem Index |

| Government initiatives | MinTIC and INNpulsa grants | Fondo Nacional Emprendedor and 500 Startups LATAM |

| Software development companies | 11,000 | 12,900 |

| Startups and unicorns | 1,300 startups Unicorns: Rappi, Habi, Lifemiles | 1,153 startups Unicorns: Kavak, Clip, Bitso, Nowports, Merama, Clara |

| Talent pool | 165,000 | 800,000 |

| Coursera rating | #5 in technology skills #4 in data science Rank highly in operating systems and computer networking | #3 in technology skills #3 in data science Rank highly in data visualization and statistical programming |

| Tech skills | JavaScript, Python, C++, PHP, Java, and Ruby | Python, SQL, C#, JavaScript, React.js, and Angular |

| English language proficiency | 17th in Latin America | 20th in Latin America |

| Average annual salary | Middle: $37,500 Senior: $54,800 | Middle: $40,000 Senior: $57,800 |

| Сultural traits | Open, adaptable, excel at time management, value trust and show initiative and dedication | Assertive, expressive, famous for passion for excellence, teamwork, and continuous learning |

| Sources: Statista on IT Services in Colombia, Statista on IT Services in Mexico, English Proficiency Index 2024, Coursera Global Skills Report 2024, Coface, Nearshore to Guadalajara, Startup Ecosystem Index | ||

Growing tech services markets

Mexico’s tech services sector generates nine times higher revenues. At the same time, Colombia’s market is experiencing a more rapid growth rate—4.18% against 3.43%. For both countries, tech outsourcing generates a sizable revenue share, with the US being their biggest IT export partner. Overall, both business climates are equally conducive to nearshoring software development.

Buzzing innovation

When it comes to nearshoring for innovation, are Colombia and Mexico neck and neck? Mexico takes the lead in fintech, ranking #29 worldwide with 1,104 fintech startups. The Mexican startup scene is also strong in e-commerce, energy, transportation, and healthtech, and boasts twice as many unicorns as Colombia.

Colombia, meanwhile, excels in the transportation industry, boasting 488 startups to date, and it also shines in foodtech, energy, and the environment. As a result, Mexico wins as a more innovative destination: in the Global Innovation Index, it ranks 3rd in Latin America, and Colombia comes 4th.

Alcor’s operational support: To succeed in Colombia’s growing startup ecosystem and set your nearshoring operations, you need a partner who can assist with market entry and employer branding. That’s exactly what we did for Sift — thanks to an employer branding video, the company experienced a snowball effect: the more candidates watched it, the higher Sift’s response and offer acceptance rates grew by 15%, which enabled the company to scale its R&D team to 51 people.

Wondering how Colombia stacks up against some other LATAM locations? Compare Colombia vs Uruguay for tech nearshoring, Colombia vs Argentina for technology outsourcing, and Colombia vs Brazil for nearshoring technology to find out!

Extensive talent pools

Mexico’s software development talent pool is about 5 times larger. Still, both countries are recognized for top-level tech skills in Latin America: Colombian talent is unparalleled in web development, cloud computing, and data analysis, as well as JavaScript technology thanks to its 3,000 JS community and regular meetups in 8 cities; Mexican talent stands out in data science, mobile development, fintech, and Python.

Regarding English proficiency and cultural similarities, both nearshore destinations are comparable. Software developers from Mexico share similar traits of openness and collaboration with software developers in Colombia. As for the differences, nearshore Mexican programmers tend to be more assertive, while Colombian devs are celebrated for dedication.

Alcor’s top-notch recruitment: With our database of 253,000+ pre-vetted tech candidates, we’ll find your perfect match and deliver the first CV within just 5 days. Expect to hire 5 developers in the first month of cooperation and scale your team to 30+ engineers over the next 3 months.

Slashed costs

The average software engineer salary in Mexico is slightly higher than the software engineer salary in Colombia. The annual average wage cost makes a big difference when you nearshore and build software development teams. For example, hiring a Senior DevOps Engineer will cost $72,000 per year in Mexico, compared to $69,600 in Colombia. In the United States, expect to pay at least $138,000 a year for the same expertise, a staggering 48% higher!

| Annual Senior Software Engineers’ Salaries. USD | |||

| Position | Colombia | Mexico | USA |

| AI/ML Engineer | 60,000 | 61,200 | 132,000 |

| Cloud Engineer | 54,000 | 68,400 | 174,000 |

| Blockchain Developer | 62,400 | 68,400 | 132,000 |

| Mobile Developer (iOS/Android/Xamarin) | 62,400 | 62,400 | 114,000 |

| C/C++ Developer | 57,600 | 66,000 | 114,000 |

| Java Developer | 60,000 | 66,000 | 126,000 |

| Python Developer | 60,000 | 62,400 | 126,000 |

| Manual QA Engineer | 45,600 | 50,400 | 84,000 |

| Automation QA Engineer | 54,000 | 54,000 | 96,000 |

| Product Manager | 51,600 | 60,000 | 120,000 |

Whether you’re outsourcing a dedicated development team in Mexico or Colombia, always keep in mind that salaries are just the beginning. You’ll also need to factor in taxes, benefits, and recruitment fees—all of which depend on the engagement model you choose for working with your developers.

When hiring developers in Latin America, you’ll typically choose between a full-time employment contract and a B2B contract. For example, in Mexico, a full-time employment contract typically includes an income-dependent tax of 1.92%–30%, which the employer pays on behalf of the employee.

It also requires the employer to pay:

- 3% payroll tax,

- 24%–43% in social security contributions based on the employee’s base salary.

Meanwhile, if your business performs R&D activities, you may qualify for a tax deduction of 56%–89%. By contrast, a B2B contract typically involves a 1%–2.5% personal income tax rate for developers, with fewer employer-side obligations—but it may not offer the same long-term retention benefits.

In Colombia, a full-time employment contract includes the following components:

- An income-dependent tax of 19%–41%, paid by the employer on behalf of the employee

- 9% in payroll taxes

- 21% in social security contributions, based on the employee’s base salary.

If you choose the B2B employment model, you’ll encounter a 5.9%–14.5% personal income tax paid by the contractor, along with approximately 30% in social security contributions.

Here’s a quick overview my team prepared on how much an average senior developer will cost you if you choose to do nearshore software development in Colombia, Mexico, and the US and hire engineers via a B2B model.

| Annual Developer Employment Cost | |||

| Colombia | Mexico | USA | |

| Senior developer’s average annual salary | $52,000 | $57,700 | $117,600 |

| Recruitment fees | 20% of gross yearly wage | 20% of gross yearly wage | 30% of gross yearly wage |

| Benefits | $6,500/year | $6,500/year | $15,400/year |

| Additionally | 13th-month salary ($4,500) | A year-end 15 days salary | not required |

| Total | $73,400 | $78,110 | $168,280 |

Thus, when hiring one senior specialist in the US, you’ll need to pay an average of $195,700, while in Colombia, the total cost of an engineer amounts to $78,700.

What you get: 60% savings when hiring in Colombia and 54% when nearshoring to Mexico.

Alcor’s EOR for tech: With us, you don’t have to worry about payroll, tax payments, or benefits management. We handle it all—with 100% legal compliance and accounting—saving you tens of thousands of dollars and freeing your teams from extensive paperwork. Need an Employer of Record in Mexico, Colombia, or another LATAM country? We are ready to deliver!

Conclusion: Both Mexico and Colombia offer solid incentives for US product tech companies to nearshore, including considerable talent pools, high-quality education and software developers’ expertise, booming technology services markets, government technology initiatives, cultural and geographical proximity, and more.

Key Differences of Tech Nearshoring to Colombia and Mexico

Trends in Technology

By now, you should no longer doubt the nearshore potential for software development innovation in Colombia and Mexico. However, the countries focus on different spheres of technology. Depending on which trails you want to blaze, you will either offshore software outsourcing in Mexico or Colombia.

Let’s break it all down:

Tax Nuances

Mexican and Colombian taxes are not for the faint-hearted. What are the main things to know if opting for nearshore outsourcing?

Mexico offers tax relief thanks to the Canada-US treaty, but the crucial nearshoring choice concerns employment models. Unlike Mexico, Colombia does not have a treaty with the US, resulting in less favorable tax rates for foreigners and a higher risk of double taxation. On the other hand, while outsourcing to Colombia, remember that this country supports research and development activities much more seriously. For instance, software development companies can obtain a 30% tax credit for tech, scientific, and innovation projects.

Labor laws

Significant differences in labor laws must also be considered when outsourcing product development or building your own nearshore team.

For example, in Mexico, you should take into account:

- Overtime work: paid at 200% of the regular rate during weekdays and 225% on Sundays or public holidays; must not exceed 9 hours per week.

- Public holidays: 7 official national holidays.

- Vacation: 12–30 working days, plus a 25% vacation bonus on top of the regular salary.

In Colombia, key labor considerations include:

- Overtime work: paid at 125% of the regular rate on regular weekdays and 175% during night hours; higher rates apply if performed on Sundays or public holidays and must not exceed 12 hours per week.

- Public holidays: 18 official national holidays.

- Vacation: 15 working days.

Alcor excels at both tech recruitment & Employer of Record services in Mexico. Learn how we built 100% compliant dev teams for People.ai, Ledger, Sift, and other clients.

Secret Tip to Ease the Process

It’s easy to get lost in the Latin American tech ocean while nearshoring vital technological processes. That’s why Alcor is here to propel you forward to Silicon Valley-caliber talent and savings. We’ll shield you from the legal & cost undercurrents while you’re expanding to either Mexico, Colombia, Chile, or Argentina.

Put briefly, our tech R&D center model beats IT staff augmentation in Mexico or Colombia and all other types of outsourcing.

Here’s why:

- We combine tech recruitment, Employer of Record, and full operational support to help you scale compliantly and hassle-free.

- You’ll save more than when you outsource: pay 40% less for the same talent or get top-10% of the market devs for the same price.

- You’ll get transparent pricing without markups, only direct salaries.

- Zero buy-out fees: your team belongs to you from day one and can be insourced at any time for free.

If you nearshore to the LATAM region with us, we guarantee you a software development team in 2-6 weeks. Moreover, our hires stay with clients for an average of 2.5 years.

Do you know who else is already in the Latin American tech market? The US-based experience app Franki. By choosing to nearshore their development processes to Mexico, the company partnered with Alcor and received:

- 7 senior hires — 2 iOS Engineers, 3 Android Engineers, and 2 Quality Control Engineers — with an average time-to-hire of just 4 weeks,

- Deep navigation concerning local employment laws, benefits, bonus salaries, and PTO,

- Full operational support with delivery and installation of testing equipment.

Ready to set sail towards hiring developers in Colombia or Mexico? Describe your specific needs, and we’ll weigh up all the pros and cons to suggest the best market for you.

Contact us and get salaries, team setup time estimates, and more!