Ranked among the top 6 innovative destinations in Latin America, Colombia and Costa Rica have young and promising tech markets. When comparing Colombia vs Costa Rica for nearshore technology outsourcing, Colombia has a larger tech talent pool and lower salaries, while Costa Rica stands out for its simplified taxation and political stability. But which country is the most suitable for expansion among tech product companies?

I’m David Gomez, the Lead IT Recruiter in LATAM at Alcor—an all-in-one tech nearshoring alternative for enterprise businesses. Our company has created a unique software R&D as a service model for Western product companies, enabling them to expand from 0 to 100 Silicon Valley-caliber developers within a year in Latin America or Eastern Europe. This solution covers tech recruitment, Employer of Record, and 360° operational support, so our clients forget about legal entity setup, payroll & tax management, and other back-office functions and focus on their core business.

In this article, I’ll delve into the specifics of the tech markets in Colombia and Costa Rica, outlining their key differences and the pros and cons of IT nearshoring to these locations. And here’s a little bonus at the end— the best swap for traditional outsourcing, helping you save up to 40% and navigate either the Colombian or Costa Rican tech market!

So, no time to waste—let’s dive in!

Colombia and Costa Rica Tech Sector: Key Statistics

Tech market

Both countries differ in IT services market revenue figures, though not in growth dynamics: Colombia’s market is projected to generate $2.05 billion, while Costa Rica’s is expected to reach $448.2 million in 2024, with both markets forecasted to grow at an average 6.5% through 2029, surpassing the global average market growth rate.

The lion’s share of all tech industry revenue in both countries comes specifically from IT outsourcing. In Colombia, this market is projected to reach $690.8 million, and in Costa Rica, $215.4 million in 2024,—solidifying their positions as some of the most attractive nearshoring destinations in LATAM.

Tech services exports

As the fourth-largest market for ICT in Latin America, Colombia’s total ICT service exports alone hit $1.63 billion in 2023—more than the entire GDP of the Seychelles! The main export categories included telecommunications, computer software, cloud computing, and data storage services, primarily directed to the USA, Mexico, Costa Rica, Uruguay, and Spain.

In turn, the export of ICT services brought Costa Rica $2.1 billion, doubling over the past 5 years, with large companies accounting for 90% of the volume. The most in-demand services were management, administration, and back-office support, followed by tech and software development. The leading importers of these services were the USA and some European and Central American countries.

Tech industries

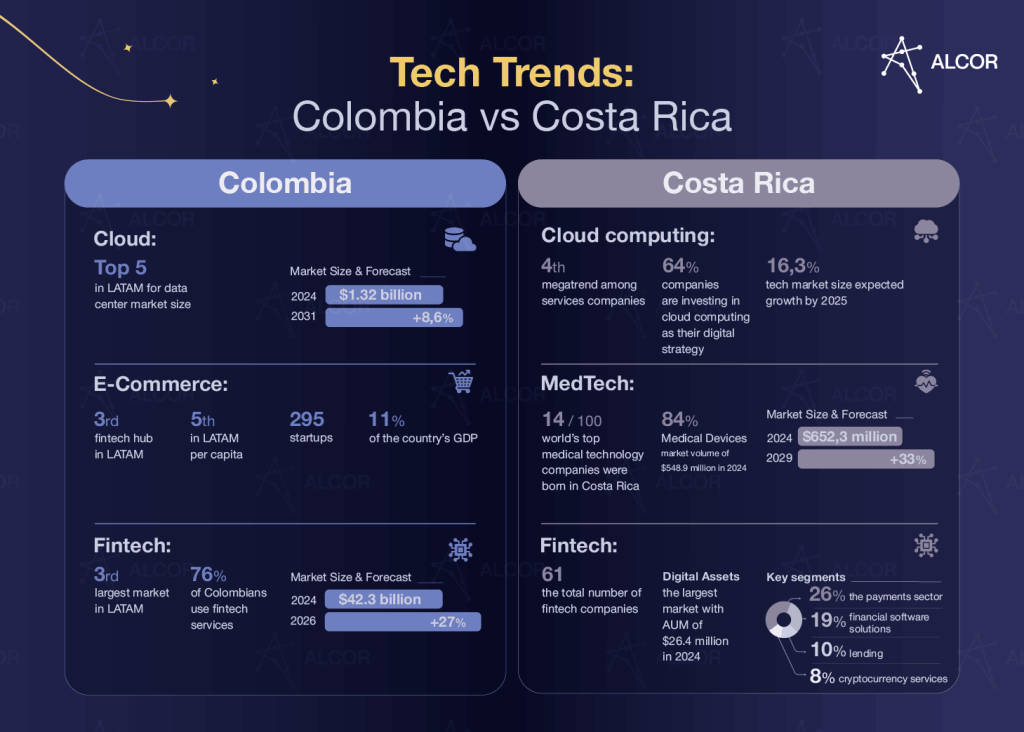

The Colombian software development landscape is led by a thriving fintech industry, ranking 3rd in LATAM with over 295 startups. The country is also a significant player in cloud technology, contributing $1.2 billion in 2023. Meanwhile, AI and e-commerce are steadily expanding, with e-commerce now ranked as the 3rd-largest market in the region. Emerging sectors like Proptech and blockchain are also gaining traction, positioning Colombia among the most dynamic and evolving LATAM tech hubs.

Like Colombia, Costa Rica keeps pace with regional trends, such as cloud computing and AI. Cloud computing ranks as the #4 megatrend among service companies, with nearly 64% of all market players investing in cloud technology as a core part of their digital strategy. Additionally, its focus on developing software solutions for specific industries, such as MedTech, fintech, and edtech, offers great opportunities for those looking to nearshore to Costa Rica. Need proof? Costa Rica is home to 14 of the world’s top 100 medical technology companies, with all the resources to become a leader in this sector in the region.

Eastern Europe is also a strong player in the tech arena.

The Polish technology industry is the strongest in this region!

Government initiatives

National Digital Strategy (NDS) for 2023-2026 aims to drive economic growth, elevate tech skills across the population, build secure data and technological infrastructure, and promote digital security and AI adoption. As part of this plan, the government aims to reach $71 million in fixed and mobile internet access, up from $38.6 million as of 2021, to build up to 300 AI innovation centers focused on computing, gaming, and data technology and along with other initiatives.

The Colombia Bring IT On campaign creates a positive image of Colombia’s tech sector, attracting foreign investment, promoting Colombian tech services, and boosting digitalization efforts. During events such as the Colombia 4.0 Softic Summit, the program attracted $43 million in business expectations, showcasing Colombia’s rising role as a critical player in the global IT sector and one of the top destinations for nearshoring software outsourcing.

Costa Rica, in turn, is actively implementing programs to support the tech sector and enhance digital education across the population. The initiative “The Power of Data,” launched in May 2024, focuses on advancing data collection and analysis technologies for economic growth while also supporting startups in developing innovations in healthcare, education, and environmental sectors.

Additionally, since 2021, the government has been collaborating with the iQ4 platform to boost cybersecurity skills within the workforce, allowing students, business owners, and government officials to transform and strengthen the country’s cybersecurity jointly. As of 2022, more than 270 Costa Rican citizens, both students and adults, have completed the programs and benefited from the iQ4 programs.

Business climate

Last but not least, a favorable environment for establishing and running a business contributes to the popularity of LATAM outsourcing. Colombia ranks third in the region for ease of doing business, as evidenced by an impressive number of 1,720 startups and three innovative unicorns—Rappi, Habi, and Lifemiles—renowned in Latin America and globally.

Costa Rica ranks 5th in LATAM on the Doing Business index and has an A3 business environment. Costa Rica’s accession in 2021 to the Organization for Economic Cooperation and Development (OECD) has had a positive impact, pushing the country to overcome its economic weaknesses, namely its high inflation and fiscal deficit, and create a favorable landscape for business and, especially, nearshoring software development in the country.

| Criteria | Nearshoring Locations | |

| Colombia | Costa Rica | |

| Tech sector dynamics | $2.05 billion of revenue in IT Services in 2024; projected to reach $2.77 billion by 2029 CAGR—6.21% | $448.2 million of revenue in IT Services in 2024; projected to reach $625.4 million by 2029 CAGR—6.89% |

| ICT service exports | $1.6 billion USA, Mexico, Costa Rica, Uruguay, Spain | $2.13 billion USA, Panama, Europe |

| Tech expertise | fintech, cloud, AI, e-commerce, proptech | MedTech, fintech, edtech |

| Talent pool | 150,000 13,000 annual STEM graduates | 45,000 7,000 annual STEM graduates |

| Median gross annual salary | $42,000—$78,000 | $48,000—$80,000 |

| World ratings | #61 in Global Innovation Index | #70 in Global Innovation Index |

| Government initiatives | Colombia Bring IT On, National Digital Strategy, MinTIC and INNpulsa grants | “The Power of Data”, Costa Rican government and iQ4 platform cybersecurity and innovation training programs |

| Business climate | A4 | A3 |

| Doing business | #3 in LATAM #67 globally | #5 in LATAM #74 globally |

| IT hubs | Bogotá, Medellín, Cali | San Jose, Heredia, Escazu |

| Software development companies | 11,000+ | 1,200+ |

| Startup Ecosystem Index | #2 in South America #38 globally | #8 in Latin America #75 globally |

| Startups and unicorns | 1,720 startups Unicorns: Rappi, Habi, Lifemiles | 50 startups |

| Foreign tech giants | Google, Microsoft, Amazon, Oracle, IBM, Cisco | IBM, Microsoft, Amazon, Intel, HPE, and VMware |

Why Choose Between Colombia and Costa Rica

Let’s start with the benefits that both locations offer to American tech companies:

Closeness to the US

Geographic proximity and similar time zones to the US provide opportunities for effective, productive collaboration and easy meeting planning with your remote teams. Located in the GMT-3 time zone, Colombia is only 2 hours ahead of New York, Washington, Atlanta, and Miami, while Costa Rica shares the same time as Chicago, Dallas, and Houston in the GMT-6 zone.

Cultural similarities

This proximity adds another vital advantage and shared characteristic: cultural affinity with the American business environment. Hard work and time management, creativity, adaptability, proactivity, and dedication, along with a balanced work-life culture, will contribute to the easy integration of the nearshore AI engineers, and software team in overall with your in-house staff.

Emerging tech hubs

And most importantly, each of these destinations has its fast-growing tech hubs advancing toward Silicon Valley standards. Like the Guadalajara tech hub in Mexico, Bogotá in Colombia and San José in Costa Rica are emerging as centers of innovation and development within their countries.

Moving on, let’s look at the treasures and pitfalls distinguishing Colombia from Costa Rica in terms of nearshore technology outsourcing.

Pros of nearshoring to Colombia

Highly skilled tech workforce

Outsourcing software development to Colombia provides access to over 150,000 developers and 13,000 new STEM graduates entering the workforce each year. Additionally, Colombia boasts extensive expertise in JavaScript, Python, C++, PHP, Java, and Ruby and ranks #1 in data science in Latin America, making it an ideal location for complex, data-driven projects, and advanced tech solutions.

Greater government support

The Colombian government is going all-in to support its growing tech sector. By offering significantly more initiatives and resources than Costa Rica, it is enabling businesses to ride the wave of Colombia’s digital transformation, expanding the country’s tech ecosystem and infrastructure at a rapid pace.

Lower developer salaries

By cooperating with Colombian developers, you can save up to 53% of the cost compared to the USA. While the gross median annual salary for a mid-to senior-level Java engineer falls between $102,000 and $114,000 in the US, developer’s salary in Colombia spans $42,000 to $60,000, offering more competitive rates. Moreover, the overall cost per tech professional—including compensation, hiring, and benefits—is more than twice as high in the US compared to Colombia and other LATAM countries.

Also curious about the average salary of a software developer in Mexico?

Read more in our latest article!

Cons of nearshoring to Colombia

Cybersecurity concerns

One of the country’s significant challenges is security concerns and cybersecurity. Colombia was among the top 5 countries in the region regarding the number of cyberattacks in 2023 and is still facing increasing cyber threats due to growing digital transformation, just like its neighbors. On top of that, outsourcing significantly increases the risk of data leakage and IP rights compliance. But how do foreign tech companies that have been operating in the Colombian market for a long time cope with this?

Solution—maintain in-house control

Instead of choosing to outsource the development of the product, they keep control of this process in-house. That’s exactly what you get when you work with a trusted partner like Alcor: tech support as part of our software R&D accelerator solution, which will help you protect your data even more efficiently and ensure smooth and secure operations.

Сomplex taxation system

Despite the numerous tax incentive programs for R&D-focused businesses, paying taxes is still challenging. The payroll tax is 9%, but employers must pay income tax withheld at source if a developer earns below ten minimum salaries. Both employers and employees are also required to contribute to social security. Additionally, managing cross-border payments and indirect taxes adds another layer of complexity.

Solution—find your perfect local expert

This is where local law experts who know the peculiarities of the Colombian tax system come into play. If you do not have in-house lawyers in Colombia, you can contact Alcor. An essential part of our software R&D accelerator model is EOR in Colombia, which means you do not need to register your legal entity in this tech hub. In addition, this service eliminates the need to sign contracts with local developers and deal with their payroll and taxes, as we will easily do it for you.

Pros of nearshoring to Costa Rica

High English proficiency in LATAM

Ranking 3rd in LATAM for English proficiency, Costa Rica stands out with high language skills. This factor makes outsourcing software development significantly easier, increasing the chances of having no communication barriers within your team.

Lower taxes

Law 7799 promotes competition and innovation by offering tax incentives for R&D companies in Free Trade Zones (FTZs). Under regular conditions in Costa Rica, the corporate tax rate for companies is 30%, which is 5% lower than in Colombia. However, for companies in FTZs, the corporate tax rate can be reduced to 0% for the first 8-12 years, with a further increase to just 15% in the following years.

Cons of nearshoring to Costa Rica

Fewer tech developers

A limited tech talent pool and a smaller market create additional challenges in finding highly skilled developers. With around 7,000 STEM graduates annually, which is not a very high number, Costa Rica struggles to meet the growing demand for tech professionals, making it crucial for companies to adopt effective recruitment strategies.

Solution—cooperate with experienced headhunters

By reaching out to the best and most educated tech researchers and recruiters, you can find your ideal developers even among a relatively small talent pool.

Higher developer salaries

Another drawback is the higher salaries compared to Colombia. Geographical proximity to the US is one of the reasons for this, resulting in $2,000-$3,000 higher compensation. In addition, outsourcing provider fees can reach up to 50% of developer compensation, often cutting into their pay, and charging for junior and mid-level tech talent as you would pay for senior engineers.

Solution—maximize talent savings

However, this salary difference will not be noticeable, and you won’t have to deal with such high fees if you’re hiring through a software R&D accelerator model. Senior, lead, and C-level tech talent joins your team for the same price you would pay for junior and mid-level engineers in outsourcing agencies, offering you significant cost savings and maximizing your investment while nearshoring tech outsourcing to Costa Rica.

Key Differences of Tech Nearshoring to Colombia and Costa Rica

Thus, by comparing Colombia vs Costa Rica for nearshore outsourcing, we can see that both countries offer different yet unique opportunities for your business.

If you are looking for a larger talent pool, a better-developed business ecosystem, and additional government benefits for growing your own enterprise, Colombia will be your ideal match.

On the other hand, if you are more attracted to the super proximity to the US, lower taxes, and a relatively small but rapidly growing tech market focused on MedTech and FinTech, Costa Rica is at your service!

However, it’s always important to remember that, aside from location, the chosen cooperation model is also crucial.

- In-house development: Requires hiring full-time developers directly onto your team, giving you complete control over the product and internal processes. However, this model comes with high operational costs, including recruitment, salaries, and training. Additionally, you’ll need to pay higher taxes as you’ll be hiring developers on contracts, which can significantly increase your expenses.

- Outsourcing: This one allows you to delegate software development to external companies or freelancers, typically located in different regions. This model offers flexibility and reduced costs but often leads to challenges with communication, quality, and IP rights control. While outsourcing can lower overall costs, you may still face unpredictable expenses related to the provider’s fees and hidden charges.

- Software R&D accelerator: This model offers a solution that combines flexibility, scalability, and cost-effectiveness by allowing you to hire individual entrepreneurs, reducing overall tax burdens while nearshoring your software development. With this model, you can scale your team quickly without the overhead of traditional in-house hiring or outsourcing fees.

So, the choice is yours, but we have an offer you definitely won’t be able to refuse.

Secret Tip to Ease the Process

And this is creating your own research and development center! Alcor is ready to help you expand in Latin America or Eastern Europe using:

- High-quality tech recruitment: by building top-10% tier teams with an average tenure of 2.5 years for our hires.

- Full EOR package: by onboarding and offboarding your employees, managing their salaries, and providing 24/7 support through our Dedicated Account Managers.

- Comprehensive operational support: by renting office space for you, handling the procurement of laptops and equipment, and providing any other type of back-office support.

And all this without the need to register your legal entity or pay any buy-out fees!

Many companies worldwide have already benefited from our unique solution, and businesses like Sift, ThredUp, and People.ai are successfully operating their R&D centers and creating unique products!

Want to hear more about how Alcor can help you? Fill out the contact form, describe your needs, and await our developed timeline regarding setting up your personal R&D center in your chosen location.

So, don’t waste time—contact us and address the key question: ‘Which country should you bet on?’