European countries with the lowest taxes can offer significant relief for tech product companies, especially compared to the US corporate flat rate of 21%. Some tech businesses may be seeking zero-tax countries in Europe, but such locations just do not exist. Still, the good news is that nations like Hungary and Bulgaria keep corporate tax rates as low as 9–10%, setting up a professional offshore development team and saving costs.

I’m Viktoriia Keliar, COO at Alcor, a full-cycle partner that specializes in building software R&D as a service, with tech recruitment and Employer of Record support, hiring 10 to 100 developers in 1 year across Latin America and Eastern Europe. With us, you don’t have to struggle with hidden markups or losing control over your team. Instead, we cover everything from legal compliance and payroll to taxes, office space, and day-to-day operations, so your energy stays on growing the business.

In this article, you’ll discover the lowest income and corporate tax European countries for setting up offshore development offices, as well as their tech market and taxation system overviews. So, keep reading to determine countries with the lowest taxes in Europe and select the perfect destination for your tech business expansion in 2025.

Key Takeaways

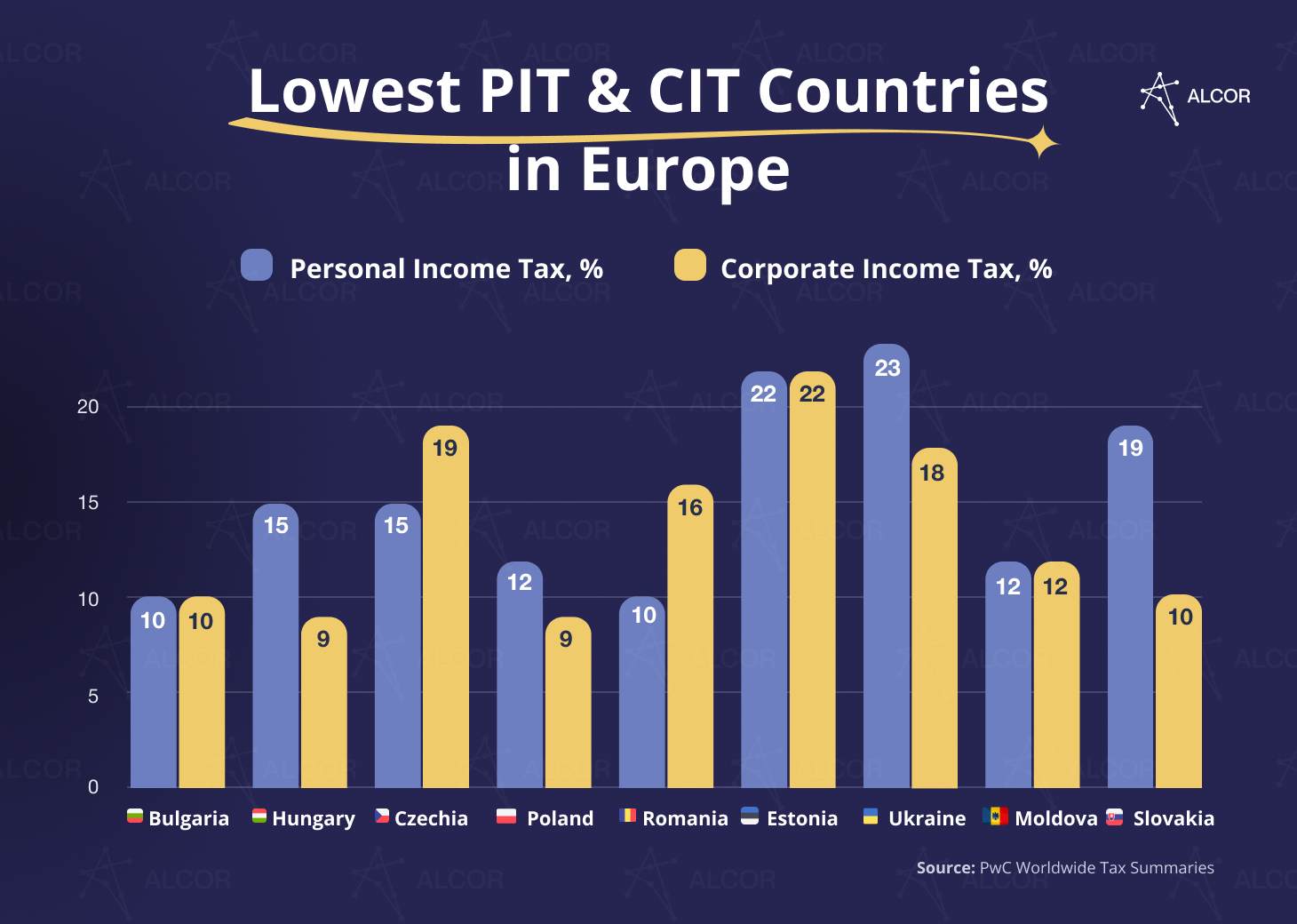

- Top low-tax destinations in Europe include Bulgaria, Hungary, Czechia, Poland, the UK, Romania, Cyprus, Estonia, and Ukraine.

- Compared to the US, the corporate taxes in Bulgaria and Hungary are approximately 50% lower.

- Other popular European tech destinations are Portugal, Lithuania, Latvia, Moldova, and Slovakia.

- Alcor’s all-in-one solution enables you to focus on product development, while we manage tech recruitment, payroll, legal compliance, taxes, and operational support across Eastern Europe and Latin America.

Rating Criteria

Our research provides reliable information on the IT market overview, taxes, advantages, and challenges for foreign tech businesses establishing a software team in Europe, aiming to help them choose the right location.

Find more details below.

To prove that our research is trustworthy and covers all the requirements that usually disturb foreign employers who want to establish a software team in Europe, we’ve gathered information and statistics on:

- market overview (availability of tech experts and local IT market stats);

- taxes (corporate, personal income, and social security tax rates);

- advantages of cooperation with residents of those countries for foreign tech businesses;

- challenges and pitfalls of collaboration with local developers for American employers.

I hope this information will be very helpful when choosing the right location for managing your product tech business in Europe.

Lowest Corporate Tax Countries in Europe

Europe offers attractive corporate tax rates, with Hungary (9%) and Bulgaria (10%) being the lowest. Poland also offers 9% for small companies and 19% for others. However, each market has drawbacks: Hungary and Estonia have small talent pools, Bulgaria demands heavy tax administration, and Romania’s booming IT sector drives wages up. The UK and Czechia impose higher tax rates (25% and 21%) alongside challenges like high wages or limited English skills. Ukraine’s competitive 18% tax is overshadowed by wartime risks.

| Country | Tax, % | Pitfalls of cooperation with US companies |

| Bulgaria | 10 | A lot of time required to fulfill tax obligations |

| Hungary | 9 | Limited tech talent pool |

| Czech Republic | 21 | Average English proficiency |

| UK | 25 | Higher developer wages, compared to other countries on the list |

| Poland | 9 or 19 | High demand for talented developers |

| Romania | 16 (1% for micro-companies) | Breakneck IT industry development rate, rising wages |

| Cyprus | 12.5 | Lack of tech experts, bureaucracy |

| Estonia | 22 | Small tech talent pool |

| Ukraine | 18 | Ongoing war |

Lowest Personal Income Tax Countries in Europe

Bulgaria and Romania stand out with tax rates of just 10%, while Hungary and the Czech Republic range from 15% to 23%. Poland applies a 12% or 32% rate, and Estonia has a flat 22% rate. The UK and Cyprus have higher tax bands (20-45% and 20-35% respectively) but also higher salaries. Ukraine offers one of the lowest average gross salaries overall, but maintains strong developer pay.

| Country | Tax, % | Average Salary, USD/per year | Average Gross Developer Salary, USD/per year |

| Bulgaria | 10 | 19,000–20,000 | 30,680–51,850 |

| Hungary | 15 | 23,000-25,000 | 5,000–75,000 |

| Czech Republic | 15-23 | 24,000-28,000 | 50,000–75,000 |

| UK | 20-45 | 44,000–50,000 | 55,000–83,000 |

| Poland | 12 or 32 | 22,000–27,000 | 45,910–62,140 |

| Romania | 10 | 22,000–23,000 | 39,120–61,920 |

| Cyprus | 20-35 | 30,000–32,000 | 60,000–70,000 |

| Estonia | 22 | 26,500–27,000 | 45,000–65,000 |

| Ukraine | 23 | 6,500–7,000 | 30,470–51,530 |

Tax Rates in Europe Compared to the US

Compared to the US, many European countries offer lower corporate tax rates, making them attractive to American tech companies. Hungary (9%), Bulgaria (10%), and Cyprus (12.5%) stand out with the lowest rates, versus 21% in the US. Personal income taxes vary widely, ranging from 10% in Bulgaria and Romania to as high as 45% in the UK. Social security contributions can be significantly higher in Europe, often exceeding 30% of wages, compared to 12.4% in the US. This tax mix shows why outsourcing decisions weigh both lower corporate taxes and higher labor-related contributions across different countries.

Need a more detailed overview? Then stay with me.

If you wonder why many American tech product companies opt for IT outsourcing to Europe, then take a look at the table below and compare EU taxes vs US:

| Country | Corporate Tax, % | Personal Income Tax, % | Social Security Taxes, % |

| US | 21-32.5 | 10-50.3 (including both federal and state taxes) | 15.3-16.2 (employer’s share – 7.65%) |

| Bulgaria | 10 | 10 | 24.7-25.4 (employer’s share – 14.12-14.82) |

| Hungary | 9 | 15 | 31.5 (employer’s share – 13%) |

| Czech Republic | 19 | 15-23 | 45.4, including state health insurance (employer’s share – 33.8%) |

| UK | 25 | 20-45 (with no tax under a certain threshold) | Employee pays 10% of earnings between £12,571 (≈ $17,127) and £50,270 (≈ $68,491) and2% of earnings above £50,270 (≈ $68,491).Employer pays 13.8% of the employee’s weekly earnings above £5,000 (≈ $6,811). |

| Poland | 19 (reduced rate of 9% is also available for small taxpayers, with certain exceptions) | 12 for income not over PLN 120,000 (≈ $33,369), and 32% + PLN 10,800 (≈ $3,003) applies on the portion of income that exceeds PLN 120,000 (≈ $33,369); as well, 4% an additional solidarity surcharge applies to the portion of income that exceeds PLN 1 million (≈ $278,073)) | 32.92-36.12 (employer’s share – 19.21-22.41; employees also are required to make a 13.71% healthcare contribution) |

| Romania | 16 (1% if the company’s revenue is below €250K (≈ $295K) and it has at least one full-time employee and meets other criteria established by local law). | 10 | 37.25 (employer’s share – 2.25%) |

| Estonia | 22 | 22 | 37.4 (employer’s share – 33%) |

| Cyprus | 12.5 | 20-35 | 17.6 (employer’s share – 8.8%) |

| Ukraine | 18 | 23 (18% personal income tax plus 5% military tax) | 22 |

*Please note that while the chart is designed to highlight key differences of the European tax rates vs the US, it doesn’t capture every nuance or exception due to the complexity of tax systems, and should be treated as a general reference for 2025.

List of Countries with Lowest Taxes in Europe

European countries with the lowest taxes are Bulgaria, Hungary, Czechia, Poland, the UK, Romania, Cyprus, Estonia, and Ukraine.

Bulgaria

Bulgaria is a promising player in the European tech industry, with a large talent pool and projected revenue of $464.76 million by 2025. The country has one of the lowest tax rates in Europe, with a flat rate of 10% for both personal and corporate income taxes. Bulgaria’s favorable climate for tech companies and ranking 37th in the Global Innovation Index make it an attractive location for businesses. However, fulfilling tax obligations can be time-consuming, with companies spending up to 500 hours per year.

Market overview

Bulgaria is a fresh and prospective player in the IT industry, and it has already become a popular choice for Eastern European software development. With a large talent pool of 128K candidates, the Bulgarian operating revenue of the IT market is expected to rise to $464.76 million by 2025, and in 5 years, it is projected to hit $583.76 million.

Taxes

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country’s 10% flat rate of both personal income and corporate income taxes is among the lowest in the European Union. The social security tax rate in Bulgaria is 24.7-25.4% of the employee’s gross salary. It is divided in a ratio of approximately 3:2 between employer and employee, making it a European country with very low taxes.

Benefits of starting a business in Bulgaria

Besides taking off the significant tax burden, Bulgaria has much more to offer. The country has a favorable climate for tech companies and is placed 37th out of 139 in the Global Innovation Index.

Risks of starting a business in Bulgaria

One of the main drawbacks of starting a local company and hiring Bulgarian developers is the significant amount of time required to fulfill their tax obligations. In fact, paying social security contributions and VAT in Bulgaria remains time-consuming – it took companies up to 500 hours in 2012, up to 441 in 2019. Although the country has a highly competitive fiscal policy, companies still need to put in a lot of effort to benefit from this system.

Solutions

You may find a trusted partner specialized in carrying your operational and legal support to help with staff augmentation in Bulgaria or other aspects. Alcor is one of those. Not only are we able to hire you the best software developers, but you can take advantage of our lawyers and accounting team to help you with payroll and contracts.

Hungary

Hungary is a tax haven for tech hubs, with over 253K specialist talent pool and a 5.28% annual growth rate in the IT sector revenue. With a 15% tax system, Hungary offers well-educated programmers and is ranked #17 out of 113 in English proficiency. However, there is a tech talent scarcity compared to other Eastern European countries, with most developers located in Budapest. Operational hardships include adhering to legal compliance and navigating local taxes.

Market overview

Hungary is another attractive player among the best tax havens of the biggest tech hubs in Europe. With a 253K specialist talent pool, Hungarian software developers took second place in Eastern Europe in the latest Coursera Global Skills ranking, scoring 77% in technology and 69% in data science. It is anticipated that there will be a 5.28% annual growth rate in the IT sector revenue this year, which will lead to a market size of a solid $2.67 billion by 2030.

Taxes

The country’s personal income tax of 15% is among the lowest in Europe. It applies to all income earners, regardless of their income level. The corporate income tax rate in Hungary accounts for 9%. The social security tax is 31.5%, with the employer’s share at 13% and the employee’s share at 18.5%.

Benefits of starting a business in Hungary

Besides the tax system, Hungary is well-equipped to offer you well-educated programmers, as more than 70 higher education institutions prepare approximately 2,700 ICT and 12,000 STEM students annually. Additionally, Hungary ranks #15 out of 35 European countries in English mastery, so it won’t be a problem for Hungarian software developers to communicate with native speakers.

Risks of starting a business in Hungary

The major pitfall of choosing Hungary as a location for hiring offshore developers or team augmentation in Eastern Europe is the scarcity of tech talent compared to other countries in the region. In fact, the majority of software developers are located in Budapest, so the tech ecosystem across the country is not as developed. Additionally, you are likely to face operational hardships in terms of legal compliance, dealing with local taxes (including payroll taxes), etc. Just like it would be in any foreign country you discover for your business.

Solutions

Not to miss a chance of starting a software R&D office in one of the best tax havens in Europe, you can turn to a reliable all-in-one place company that will guide you through an unfamiliar environment, helping to choose between IT staff augmentation vs IT outsourcing models, prevent unpredictable expenses, and ensure a smooth workflow.

Czech Republic

The Czech Republic’s market volume of $7.42 billion is expected to grow by 3.86% from 2025 to 2030. The country has a skilled workforce of 226K software developers, ranking #3 regionally for its tech expertise. The taxation system in Czechia is flat, with a corporate income tax of 21% and a 15% personal income tax starting from 2024. Prague is the 4th top city for online work, offering benefits such as jurisdiction, digital communication options, living expenses, and business rules. However, the country’s English proficiency is #25, which may limit communication speed and quality. To overcome this, businesses can offer English language courses and speaking clubs.

Market overview

The Czech Republic is not as well-known or loud when it comes to outsourcing tech specialists, but it has a couple of options to offer. For example, a solid talent pool of 226K software developers, who earned worldwide respect for their skills in coding in C++, C#, Java, PHP, C, Python, Ruby on Rails, and Swift. Thus, they are placed #3 regionally for their tech expertise. In fact, the Czech Republic’s IT market is expected to experience a 3.86% compound annual growth rate from 2025 to 2030, resulting in a market volume of $7.42 billion. This growth presents an excellent opportunity for businesses seeking high-quality, for example, generative AI development services, Java development solutions, and other innovative tech solutions in a competitive landscape.

Taxes

The Czech Republic is famous for Wolfgang Amadeus Mozart, medieval castles, and some of the lowest tax in Europe. The taxation system in the Czech Republic implies a flat corporate income tax of 21%. When it comes to personal income tax, starting from 2024, annual income up to CZK 1,676,052 (≈ $81,548) is subject to a tax rate of 15%. Income that exceeds this amount will be subject to a higher tax rate of 23%. The employer contributes 9% of the employee’s gross salary to the state health insurance funds and 24.8% to state social security funds. In turn, an employee contributes 11.6% of their gross income (contribution rates for social security and health insurance are 7.1% and 4.5%, respectively).

Benefits of starting a business in the Czech Republic

What can attract you to the Czech Republic besides being among the most tax friendly countries in Europe? The capital city, Prague, is positioned as the 4th top city in the world for online work, meaning that jurisdiction, digital communication options, living expenses, and business regulations all contribute to enhancing the effectiveness of remote work.

Risk of starting a business in the Czech Republic

One thing to note about developers in the Czech Republic is that they are not as keen on learning English, compared to their Central and Eastern European neighbors. Thus, the country ranks #25 in Europe in terms of English proficiency skills, which may lower the speed and quality of communication.

Solution

There are a couple of approaches you can try, such as offering English language courses and establishing speaking clubs with native speakers, but be prepared to invest a substantial amount of time to achieve the desired outcome.

Learn about Build Transfer Operate in Europe and nearshore outsourcing to LATAM to choose the best model for starting a business abroad!

Poland

Poland is a significant market for IT outsourcing, with a projected 5.16% growth between 2025 and 2030. Having a large talent pool of 650K programmers, Poland offers a low-tax environment: a 19% corporate tax rate and a 12% personal income tax. The country ranks 1st in the world for coding skills and 3rd regionally in data science competencies. Polish developers earn half as much as US-based tech specialists, making them attractive to tech giants and unicorns. However, hiring Polish Senior, Lead, and C-level developers can be challenging due to intense competition and time differences. Partnering with specialized local recruiting experts, such as Alcor, can help secure top talent and ensure round-the-clock software development.

Market overview

Poland is a true treasure on the European map for IT outsourcing and is also representative of low tax countries in Europe. With the largest talent pool in its economic region of 650K programmers, software development outsourcing in Poland is projected to rise by 5.16% between 2025 and 2030, resulting in a market volume of $14.5 billion over a five-year period.

Taxes

Poland offers a 19% corporate tax rate that can be reduced to 9% for small taxpayers, while personal income tax is 12% for annual income that doesn’t exceed PLN 120,000 (≈ $33,369), and 32% + PLN 10,800 (≈ $3,003) applies on the portion of income that is up to PLN 120,000 (≈ $33,369). Additionally, a solidarity surcharge of 4% applies to the portion of income exceeding PLN 1 million (≈ $278,073) per year. Additionally, the social security tax ranges from 32.92% to 36.12%, with the employer’s share varying from 19.21% to 22.41%. Employees are required to contribute an additional 13.71% on top of that.

Benefits of starting a business in Poland

There are numerous benefits to be found in IT recruitment in Poland, from elite technical skills to high-standard working ethics. The country takes a solid 1st place in the world coding skills ranking and is ranked 3rd regionally in terms of data science competencies. At the same time, the salaries of Polish developers are half those of US-based tech specialists. It is no surprise that Poland attracts both tech giants and tech unicorns.

Risks of starting a business in Poland

Considering that the number of tech businesses in Poland now amounts to 153K, it might be challenging to hire Polish senior, lead, and C-level developers without local professional recruiters. Why? As all these businesses actively compete to recruit top-tier talent and consider nearshoring/offshoring to Poland, they intensify the competition in the Polish tech hiring sector. Additionally, US tech product companies often worry about the time difference when managing cross-border teams.

Solutions

That’s where partnering with a specialized local recruiting expert like Alcor makes the difference. Our team knows how to cut through the noise and secure the top 10% of tech talent, building teams of 30+ developers in just three months.

Additionally, Polish developers working for US tech product companies typically adjust their schedules and usually sync up in the afternoon, making it possible to conduct calls and stay in touch. What’s more, offshore developers ensure round-the-clock software development – so your business never stops!

Sift, a tech product company headquartered in the USA, turned to Alcor to establish its R&D branch with 20 software developers from Eastern Europe, particularly Poland. We promptly assigned a recruiting team to deliver qualified tech recruitment services. After setting up their tech R&D office, we took over legal support and payroll management for their offshore engineering team. To strengthen hiring results, Alcor launched a local employer branding campaign with Sift’s Hiring Manager, which boosted offer acceptance rates by 15%.

A major benefit: Sift’s Eastern European tech team had its timetables aligned with those of its US counterparts, enabling seamless collaboration and uninterrupted, 24/7 software delivery.

The UK

The UK’s IT sector, with over 1.69 million professionals, is growing rapidly at a rate of 4.71%, with a projected market volume of $142.82 billion by 2030. The country offers low-tax offshore companies, with corporate tax increasing from 19% to 25% since April 2023. UK tech companies can benefit from R&D relief, especially for small and medium-sized enterprises (SMEs). However, the UK’s leading position in the global tech industry results in high competition for tech talent. To attract top developers, companies should offer better working conditions, invest in employee education, provide competitive salaries, and develop a strong employer brand.

Market overview

The United Kingdom is mostly known for being a popular outsourcing location rather than being one itself. However, the country has a very promising IT sector with more than 1.69 million software development professionals. And the industry is growing at a rate of 4.71%, resulting in a market volume of $142.82 billion by 2030. But one thing that really allures foreign investors is the possibility of establishing a relatively low-tax offshore company.

Taxes

The corporate tax in the UK has increased from 19% to 25%, starting from April 2023, while the personal income tax stayed the same:

- For annual earnings between £12,571 (≈ $17,127) and £50,270 (≈ $68,491), you will be charged a basic rate of 20%;

- For annual earnings between £50,271 (≈ $68,495) and £125,140 (≈ $170,507), a higher rate of 40% will apply;

- For annual earnings of £125,140 (≈ $170,507) and above, a high tax of 45% will be charged.

When it comes to social security, the UK can be a bit tricky as the employee pays 12% of annual earnings, between £12,571 (≈ $17,127) and £50,270 (≈ $68,491), and 2% of earnings above £50,270 (≈ $68,491). Additionally, an employer pays 5% of the employee’s earnings above £5,000 (≈ $6,811).

Benefits of starting a business in the UK

UK tech companies that invest in innovation can greatly benefit from research and development (R&D) relief. In particular, small and medium-sized enterprises (SMEs) that meet certain criteria established by local law can receive an additional 186% deduction on R&D investments, in addition to the normal deductions.

Risks of starting a business in the UK

The United Kingdom is a top player in the global tech industry. In fact, its sector is in a leading position compared to the biggest representatives from Western Europe. This eventually results in high competition for tech talent, which is already extreme in the UK, where 75% of employers report a shortage.

Solutions

Need the best developers? Then offer better conditions, invest in the working environment and education, offer high salaries, and develop your employer brand. Also, go beyond traditional hiring methods like unique referral programs, internships with the perspective of employment, or cooperation with tech recruitment professionals. In case you don’t have a sufficient budget for that, take a look at cheaper European destinations.

Wondering about nearshoring software development to Eastern Europe and IT recruitment in Europe? Contact us for more details!

Romania

Romania is a growing Eastern European tech hub with the largest number of certified tech specialists per 1,000 inhabitants. The country has a business-friendly tax regime with a corporate income tax rate of 16%. Personal income tax is 10%, making it one of the lowest in Europe. Tech companies must also make security contributions of 35%, with the employer’s part at 2.25%. Romania offers tax benefits for developers, including a 10% tax exemption for programmers with a diploma.

Market overview

Romania is a flourishing Eastern European tech destination for innovative companies. With a relatively small population, their software developers’ database reaches out to 250K specialists. The International Trade Administration reported that Romania achieved the largest number of certified IT specialists in Europe per 1,000 inhabitants, exceeding even the US numbers.

Taxes

Maybe Romania is not a representative of tax free European countries, but it definitely deserves to be on the list of tax havens in Europe due to a few incentives that make its tax system stand out. The standard corporate income tax is 16%. When it comes to personal income tax, its rate is 10%, making it one of the lowest income tax in Europe. In addition, tech companies in Romania must make security contributions, which amount to 35%, where the employer’s part is 2.25%.

Benefits of starting a business in Romania

The country provides tax system benefits for developers in Romania, including a salary tax exemption. This feature applies to tech businesses and developers who use an employment contract as their cooperation model and meet the criteria outlined in Romanian law No 1168/2017. The law offers a 10% tax exemption for programmers, provided they hold a diploma after completing short-term or long-term academic studies, or a baccalaureate diploma in specific fields of study.

Risks of starting a business in Romania

One drawback of outsourcing to Romania is the growth rate of IT industry development, which is 4.88%, resulting in a market volume of $1.73 billion by 2030. It is accompanied by an increase in software developers’ salary rates. In a few years, the job market will likely become overheated, and the country is to adjust its price tags to those represented by its competitors in the Western European region.

Solutions

The optimal approach in this situation would be to nearshore to Romania without delay. This is because the current market conditions are favorable, with a considerable pool of skilled technology professionals available at a reasonable cost. Furthermore, competition in the industry is relatively low, making it easier to recruit top-quality programmers or, even better, launch your own Global Capability Center setup.

Cyprus

Cyprus, with a population of 1.2 million, offers a low corporate tax rate of 12.5% for resident companies and a special tax treatment for non-resident companies. Personal income above €19,500 per year is taxed at 20%, while earnings over €36,300 are taxed at 30%. Employers and employees must contribute 8.8% of their gross salary. Cyprus offers minimal taxation, a comfortable business environment, and a pleasant climate. However, the bureaucratic system and lack of tech specialists can hinder startup success.

Market overview

With a 1.2-million population, Cyprus can’t surprise you with a big tech talent pool. In fact, there are only about 9,418 people engaged in software development in Cyprus, as of 2025. Yet, the country is among the most tax free countries in Europe.

Taxes

Cyprus is an attractive location for businesses due to its low corporate tax rate of 12.5% for resident companies and offers a special tax treatment for non-resident companies, which are exempt from paying taxes on income arising outside of Cyprus. Personal income above €19,500 (≈ $23,068) per year is taxed at 20%, which increases to 25% for earnings over €28,000 (≈ $33,123), to 30% for earnings over €36,300 (≈ $42,942), and to 35% for earnings over €60,000 (≈ $70,975). An employer must make social insurance contributions equal to 8.8% of an employee’s gross salary. As well, an employee is required to make social insurance contributions at 8.8% of their salary.

Benefits of starting a business in Cyprus

As was mentioned before, Cyprus is mostly known for its minimal taxation, comfortable business environment, and pleasant climate. If these three conditions fully satisfy you and the absence of a pool of qualified developers doesn’t bother you, then this destination is a perfect fit.

Risks of starting a business in Cyprus

Firstly, the bureaucratic system in Cyprus is quite tough, requiring weeks of procedures, extensive paperwork, and multiple approvals to establish a company. Add to that the lack of tech specialists, which makes it very difficult to create a tech team, and these things turn many companies off.

Solutions

Take a look at European countries with a bigger talent pool and consider providing a relocation option for your tech team members. In case you decide to build a team in Cyprus, find reliable lawyers who will be knowledgeable about the legislation system in Cyprus and preferably have respectable experience in establishing a tax guide for tech companies on the island.

Estonia

Estonia, the leading Baltic tech market, is expected to experience a 4.63% year-over-year growth, reaching $349.57 million by 2030. The country has 1,500 startups, including 12 unicorns. Estonia is tax-friendly, with corporate and personal income taxes at 22% and social security taxes at high rates. Employers pay 33%, while employees pay 1.6%. The corporate income tax system allows companies to reinvest profits non-taxably.

Market overview

Estonia, the leading Baltic territory in tech, will experience a year-over-year growth at the rate of 4.63%, hitting $349.57 million by 2030. At the same time, Estonian Startup Database documented 1,500 startups, among which there are 12 unicorns.

Taxes

You might be surprised that in 2024, the Tax Foundation placed Estonia #1 in the list of most tax-friendly countries. Corporate and personal income taxes in Estonia are 22%, although I would admit that their social security tax is pretty high. The employer is charged a rate of 33%, which includes 20% of public pension insurance contributions and 13% of public health insurance contributions. Employers are required to contribute 0.8% toward unemployment insurance, while employees pay 1.6%, dedicated solely to unemployment coverage. Additionally, if an employee has joined the funded pension system, a contribution of 2% is withheld from their gross salary payments and allocated to their pension account.

Benefits of starting a business in Estonia

The best part about the Estonian tax system is that the corporate income tax system in Estonia allows companies to reinvest their profits in a non-taxable way, while corporate income tax is only applied to profits that are distributed. Therefore, Estonia does not impose any corporate income tax on profits that are reinvested and retained by the company.

Risks of starting a business in Estonia

Despite comfortable tax planning, the relatively small talent pool may make it difficult to start an offshore dev center in Estonia, and because of it, the demand for technical talent, including software developers, consultants, and ICT engineers, is constantly increasing.

Solutions

One thing you should do is to create a strong employer brand for your tech product company in the local job market, as this will bring more attention to your company in the tech community, attract developers, and win out against the competition.

That’s exactly what Alcor did for Tonic Health, a US patient intake and contactless check-in platform serving large enterprise health systems. By building up Tonic’s employer brand, we not only streamlined their hiring process but also made the company stand out among local engineers, resulting in zero offer rejections. What started with senior PHP developers quickly expanded to top DevOps, FrontEnd, Security Engineers, and QA Leads, all eager to join a brand they recognized and trusted.

Ukraine

Ukraine is a key player in the Eastern European tech market, with 302,000+ tech professionals, 66% based in safer regions. With IT revenue rising 8.2% annually and new companies growing nearly 6% since 2024, Ukraine offers resilient talent. Taxes in Ukraine include a flat 18% corporate profits tax, 18.5% personal income tax, and an additional 1.5% military tax. The country offers a special legal and tax regime, Diia.City, which offers low effective tax rates, robust IP protection, and predictable regulations. Despite the ongoing Russian-Ukrainian war, 52% of tech companies have retained all contracts, and 85% of Ukrainian developers continue to work full-time.

Market overview

Ukraine stands out in Eastern Europe with 302,000+ tech professionals, 66% now based in safer northern and western regions of the country. For US tech product companies, strong English skills are a major plus: 63% of tech specialists operate at Upper-Intermediate or Advanced levels, up 8% since 2019. IT revenue rises 8.2% annually, adds 4.4% to GDP, and new companies are up nearly 6% since 2024. With the market projected to hit $4.95 billion by 2030, Ukraine offers resilient, English-proficient talent.

Taxes

Ukraine levies a flat 18% corporate profits tax, while personal income is taxed at 18% plus an additional 5% military tax, bringing the total to 19.5%. Employers must also contribute to the Unified Social Contribution (USC) at a basic rate of 22% of an employee’s gross remuneration. The USC is subject to a monthly cap, which in 2024 was set at 15 times the minimum wage (UAH 106,500 (≈ $2,579) as of January 1 and UAH 120,000 (≈ $2,906) as of April 1).

Check out our article on offshore software development in Ukraine!

Benefits of starting a business in Ukraine

Ukraine has become one of Europe’s most business-friendly tech destinations, thanks to its special legal and tax regime, Diia.City. Tailored for tech companies, it offers some of the lowest effective tax rates in Europe, robust IP protection, and predictable regulations – all designed to help startups and global players scale with confidence. Companies can engage engineers flexibly through employment contracts, gig contracts, or B2B agreements, making it easier to match hiring models with business needs.

Risk of starting a business in Ukraine

The key risk of starting a business in Ukraine is the ongoing russian-Ukrainian war, which creates geopolitical uncertainty for foreign investors. While the tech sector has shown resilience, companies must factor in potential disruptions when planning long-term operations.

Solutions

Despite the war, it is worth noting that even in 2022, 52% of tech companies retained all of their contracts, while 32% of businesses retained between 90% and 99% of their contracts, finding IT offshoring and IT nearshoring to Ukraine to be useful. The Ukrainian startup ecosystem has tripled in value since 2020, reaching over 2,600 active startups by 2024, and has celebrated the emergence of a new unicorn, Cretio. At the same time, 85% of Ukrainian devs continue to work full-time.

What about other popular IT destinations?

Portugal has 230K tech experts and a flexible taxation system, ranking sixth in Europe and overall. Its IT services market is expected to grow to $3.61 billion in 2025, with IT outsourcing accounting for $1.2 billion. Lithuania has over 70K tech specialists but faces challenges in growth. Latvia has a talent pool of 50,000, with a projected market value of $292.33 million in 2025 and a growth rate of 4.86%. Moldova offers the lowest taxes of 12% and a pool of over 20K tech talent, but many aim for higher salaries in Eurozone countries. Slovakia has an 81K tech talent pool with one of the lowest personal income taxes.

Portugal

Portugal has 230K tech experts and a flexible taxation system, depending on the company’s profit. According to the 2025 EF English Proficiency Index, Portugal has outstanding English proficiency, ranking sixth both in Europe and globally. Portugal’s market for IT services is anticipated to grow to $3.61 billion in 2025, with the leading segment – IT outsourcing – expected to account for about $1.2 billion of that total.

Lithuania

Lithuania boasts over 70K employed tech specialists, but they are still not enough to grow the industry. Most top-tier experts are employed abroad and are open to relocation. However, the taxes here are lower than average. The corporate tax rate is 16%, but smaller companies qualify for a 0% or 6%. A personal income tax is 20%, applied to income not exceeding €126,532 per calendar year in 2025 (≈ $149,648) annually and 31% for the exceeding part.

Latvia

The talent pool is equal to 50,000 in Latvia – one of the smallest in Eastern Europe. The IT services market in the country is projected to generate $292.33 million in 2025 and is forecast to expand at a 4.86% growth rate, reaching $370.58 million by 2030. However, the taxes are affordable – a 20% CIT for profits that are distributed as dividends or deemed to be distributed and a 25.5% PIT for income up to EUR 105,300 (≈ $123,849) annually, while any income over this threshold is taxed at a 33% rate. What is more, 700 computer science graduates yearly stimulate the growth of the sector in the area.

Moldova

Moldova offers the lowest personal and corporate income taxes of 12%, and a pool of over 20K tech talent with 4,000 engineering graduates yearly. However, they usually aim at relocation to Eurozone countries in search of higher salaries. Judging by the English proficiency, the Moldova is at the #39th place, which is also a little lower than average.

Slovakia

Slovakia boasts an 81K tech talent pool with the lowest personal income tax of 19% and corporate income tax of 10%-24%. In Slovakia, the IT industry contributes 4.6% of all jobs, and Slovakia’s ICT sector revenue reached €2.6 (≈ $3) billion in Q2 of 2025. Remarkably, Slovak coders speak English well, ranking 18th in Europe. However, Slovakia has a smaller pool of tech talent than its neighbors.

| Country | Corporate Tax, % | Personal Income Tax, % | Social Security Taxes, % |

| Portugal | 14 or 20 | 12.50 – 48 | 34.75 (11 – for employee, 23.75 – for employer) |

| Lithuania | 16 | 20 (income up to €126,532 (≈ $149,697) per year);32 (for more than €126,532 (≈ $149,697) per year) | 33 (19.5 – for employee) |

| Latvia | 20 | 25.5 (income up to €105,300 (≈ $124,590) per year); 33 (income over €105,300 (≈ $124,590) per year) |

34.09 (23.59 – employer; 10.50 – employee) |

| Moldova | 12 | 12 | 24 (for employer) |

| Slovakia | 10 (income up to €100,000 (≈ $117,459) in the tax period);21 (income is in the range from €100,000 (≈ $117,459) to €5 million (≈ $5,873,400));24 (income over €5 million (≈ $5,873,400)) | 19 | 25.2 – for employer, 9.4 – for employee. |

Final Thoughts

Alcor offers a flexible and low-tax outsourcing alternative for US and European tech product companies. With 40 recruiters, we can source professional software developers in Poland, Romania, Ukraine, or Bulgaria in just 2-6 weeks. Alcor provides a comprehensive software R&D center solution, including creating ideal candidate profiles, sourcing candidates, managing interviews and onboarding, and providing an Employer of Record service. We also manage payroll, taxes, local laws, and employee benefits..

Want more details? Keep reading!

Many foreign tech entrepreneurs mistakenly associate Europe with high-tax countries, such as France or Denmark. I hope that this article has revealed another side of outsourcing to this continent – flexibility and relatively low taxes compared to those in the US.

With 8 years of experience, Alcor knows how to hire a dedicated development team in Eastern Europe. Our team of 40 recruiters is ready to source professional software developers in Poland, Romania, Ukraine, or Bulgaria within 2 to 6 weeks. For US and European tech product companies, we offer a comprehensive software R&D center solution.

You’ll get salary benchmarks, talent analytics, and blind CVs on the call. Then, we commit to hiring 5 developers within the first month, and 30+ within 3 months. 15% of vacancies are closed with the first CV. Besides, we provide Employer of Record services. For the clients, it means they don’t have to worry about setting up a legal entity in the country, as we employ developers on the client’s behalf. Then, our team manages NDAs, service-level agreements, and all the employee legal documentation. We onboard them, handle monthly payroll, pay local taxes, comply with local laws, and manage employee benefits (health insurance, education/training, PTO, etc.).

We offer full operational support to the client’s office. It includes your brand’s promotion in the local market, hardware procurement for your team, office lease, insurance assistance, background verification, legal services, visa support, and tech support.

For example, one of our US-based clients, Dotmatics, chose Eastern Europe as its hiring outsourcing destination. With the help of Alcor, the tech company achieved its goal to close 24 complicated vacancies for Node.js, Java, C++, React, JavaScript, AWS, and Cypress tech stack within just 1.5 years.

Building a dedicated offshore team in Eastern Europe helped Dotmatics stay aligned with its internal business practices while reaching key milestones – culminating in a $5.1 billion acquisition by Siemens in July 2025. Importantly, Dotmatics engineers also received stock options, underscoring the real value of this benefit.

Want to get assistance from a reliable Eastern European service provider? Then don’t hesitate and drop us a line now to move one step forward to your dream tech team!

FAQ

⭐ 1. Which country has the lowest tax rates in Europe?

Even though there are countries with lower taxes, Bulgaria sets perfect conditions for tech companies with the lowest corporate and personal flat tax rate of 10% and a skilled talent pool of programmers.

2. Is there a fully tax-free country in Europe?

Unfortunately, there are no countries in Europe that are completely tax-free.

⚖️ 3. What are tax rates in Europe compared to the US?

Europe has a very diverse tax system, from the highest tax countries, like France and Denmark, to low-tax countries like Bulgaria, Romania, and Hungary, which makes it a good destination for US-based tech companies.