Want to know the average senior software engineer’s salary in Mexico? It’s $5,700. And in the US? It’s $11,600. That’s a difference of 52%, meaning you’ll spend almost twice as much hiring locally. No wonder that having its product development teams in Mexico allows US tech product companies to save tens of thousands of dollars every year.

I’m David Gomez, Head of IT Recruitment in LATAM at Alcor. If you’re stuck with slow hiring in Mexico, unclear developer salaries, and total cost of ownership, or the headache of opening and maintaining a local entity, here’s how we help you grow:

- We set up a software R&D center for you, with Employer of Record, and end-to-end operational support – helping you scale from 10 to 100+ engineers in 12 months on one transparent monthly fee across LATAM and Eastern Europe.

- Our in-house tech recruitment team of 40 starts hunting for top talent 2-3 days after signing and typically delivers you 5+ engineers in the first month.

- You receive Mexico-specific pay bands, TCO clarity, and market data across Latin America, ensuring your offers align with budget without overpaying.

In just 12 minutes, you’ll get a clear picture of the average software engineer salary in Mexico in USD for different roles and the reasons why tech companies choose to work with Mexican programmers. The article also covers the challenges of hiring them and an efficient solution to do it as simply as possible, considering recent US tariffs and the latest IT market data.

Key Takeaways

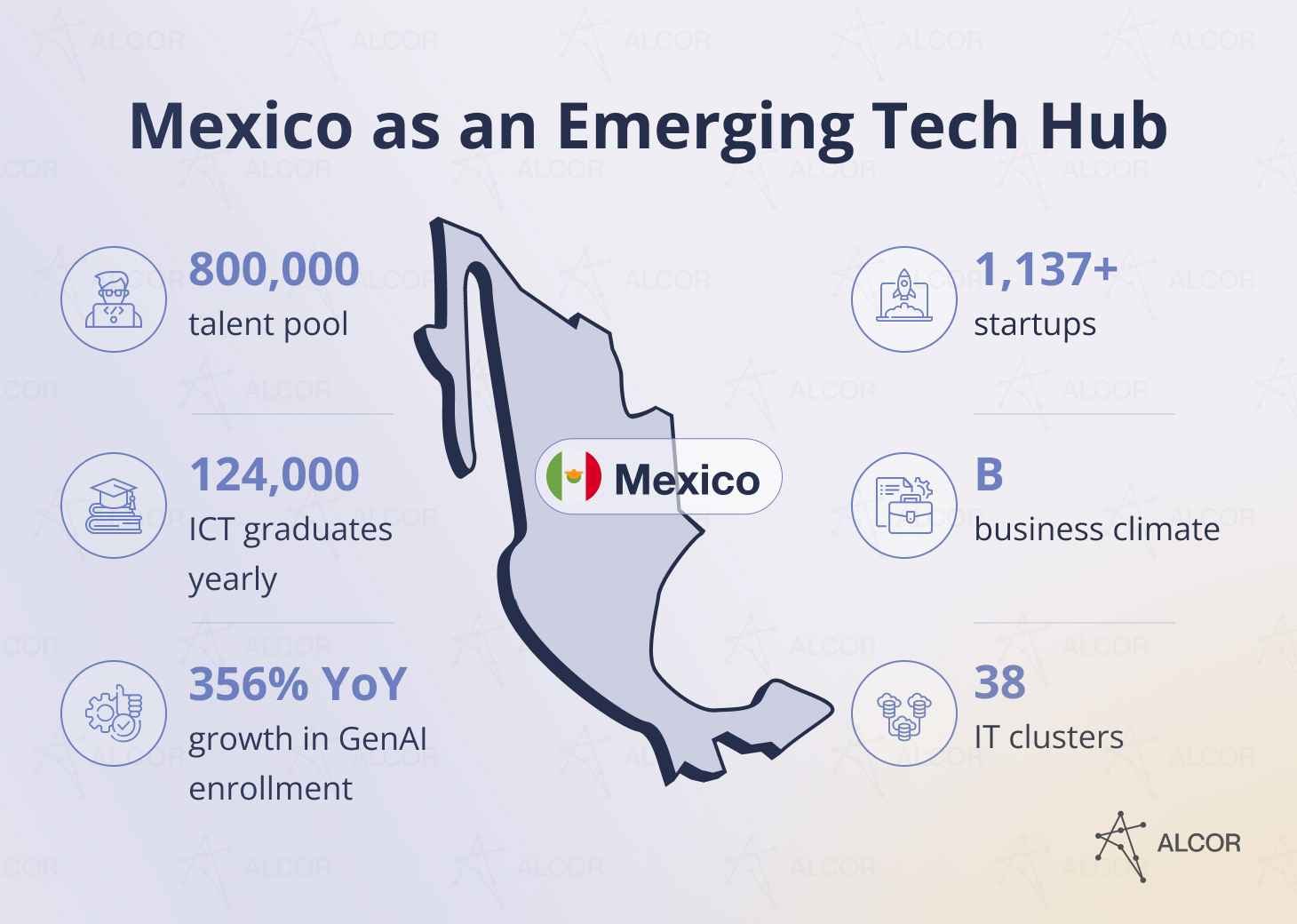

- Mexico boasts a talent pool of 800,000+ developers and ranks as the third most innovative tech economy in Latin America.

- The annual senior software engineer’s salary in Mexico is roughly 45% lower than the compensation of their US counterparts.

- When you factor in recruitment fees, benefits, and Aguinaldo, the total IT engineer’s salary in Mexico is still 49-68% lower than in the US.

- Although the 2025 US tariffs hit physical imports from Mexico, digital services like software development remain unaffected.

- With Alcor’s tech R&D solution, you can bypass legal hurdles while leveraging competitive salaries in software development in Mexico. We help you build a team of 30 elite engineers in just 3 months and get up to 40% cost savings.

Why Tech Companies Choose to Hire Developers in Mexico?

Mexico is a low-friction, high-value location to build product teams, offering fast growth, deep talent, near-US time zones, and cost savings.

- The tech market is projected to reach $20.04 billion by 2030, with outsourcing increasing from $6.05 billion to $8.44 billion.

- Companies can tap into the 800K+ tech talent pool, including full-stack, back-end, and software engineers.

- Universities produce ~124K tech grads each year, with Tec de Monterrey, UNAM, IPN, and UdeG being recognized globally.

- Proximity shortens travel time (2 hours from Houston, 4 hours from LA) and aligns workdays across overlapping US time zones.

- Compensation arbitrage is substantial, with senior developers earning $69K in Mexico versus $125K in the US, and notable gaps exist in comparison to Europe.

Flourishing IT market

In 2025, Mexico’s technology industry is projected to generate $16.16 billion in revenue, with consistent growth expected in the years ahead. By 2030, the market is forecast to reach $20.04 billion, growing at a stable annual rate of 4.40%. At the heart of this boom? Tech outsourcing which is a driving force that’s projected to go from $6.05 billion to $8.44 billion within five years. That’s a growth pace of 6.88% annually.

In 2025, the country ranks as the third most innovative tech economy in Latin America. Mexico City stands out with 526 active startups and the largest tech talent pool in LATAM – home to 320,000 tech specialists, surpassing São Paulo. And it’s not a solo act: Guadalajara and Monterrey are quickly climbing the ranks as regional tech hubs, securing the 6th and 7th spots in LATAM.

Big talent pool

For tech product companies, one of the strongest reasons for outsourcing to Mexico is its talent pool of 800,000+ Mexican tech specialists. Such a great variety of tech specialists lets foreign companies find even the rarest and most in-demand skills to boost their product development.

Developers in Mexico are proficient in widely used technologies like JavaScript, Python, C/C++, React.js, and Flutter. Full-stack developers are the most in-demand profile, followed closely by back-end developers and software engineers. Interesting to know that Mexico saw GenAI enrollments surge 356% YoY in 2025, while AI/ML skills took the top spot with 338% YoY growth.

Strong tech education

Every year, Mexico adds 124,000 skilled graduates in computer science, electronics, programming, and computer maintenance to its workforce. In addition, Mexican technology universities are globally recognized, with Tecnológico de Monterrey, Instituto Politécnico Nacional, Universidad Nacional Autónoma de México, and Universidad de Guadalajara listed in the Best Global Universities ranking.

Convenient location & time zone

If you’re a US tech product company, think of Mexico as your next-door tech neighbor. Flights to Mexico City take about 2 hours from Houston and 4 hours from Los Angeles, making it a relatively short journey. The country also offers another advantage: the shared UTC-6 to UTC-8 time zones with major US cities like Los Angeles, New York, Texas, and Chicago. Thus, Mexico’s nearshore location makes it much easier to plan calls, set deadlines, and organize business trips without the hassle of major time differences.

Competitive salary rates

Tech product companies choose to nearshore software development in Mexico due to its cost-effective labor. Here’s where things really get interesting. According to our internal data, the average gross salary for a senior tech developer in Mexico is around $69K per year, compared to $125K for developers in the United States.

The contrast in pay is just as sharp in Europe. According to Glassdoor, a senior front-end software engineer’s salary in Mexico City averages $43K/year, while in Berlin, it’s over $90K/year. These significant cost differences enable tech companies to cut operational expenses without compromising software quality or expertise.

As the local economy grows – 1.2% in 2025, 1.6% in 2026 – and with real wages rising more than 5.4% above pre-pandemic levels, IT developer salary rates in Mexico are expected to climb steadily. That’s why tech companies track compensation trends carefully, balancing savings with long-term talent retention.

Software Developers’ Salaries in Mexico vs in the US

Our internal data shows that Mexico’s senior maximum is about 45% below the US, and many roles are priced at roughly half; for example, Mexico City averages around $46K vs. around $165K in California. The gap widens on total cost: standard benefits are ~$6.5K in Mexico vs. ~$15.4K in the US, while mandatory items (aguinaldo, vacation premium, PTU) still keep Mexico cheaper overall. The employment model shifts the math: B2B puts a 0% tax burden on the company, while FTE adds ~24.1% plus ~3% state payroll tax in major hubs.

Can you imagine paying half the price for top-tier developers without cutting corners? That’s the magic of the average IT salary in Mexico.

The table below showcases our internal data on the average annual software developer salary range in Mexico vs the US for middle, senior, and lead positions, as well as different tech stacks.

|

Average Annual Developer’s Salary, Gross, USD |

||||||

|

Mexico |

USA |

|||||

|

Position |

Middle |

Senior |

Lead |

Middle |

Senior |

Lead |

|

AI/ML Engineer |

56,700 |

82,200 |

102,300 |

121,200 |

151,800 |

189,000 |

|

Cloud Engineer |

54,600 |

79,800 |

99,600 |

116,400 |

146,400 |

174,600 |

|

Mobile Developer |

42,000 |

76,200 |

75,600 |

129,600 |

165,00 |

202,500 |

|

Blockchain Developer |

43,800 |

79,800 |

94,200 |

132,000 |

156,600 |

177,000 |

|

C/C++ Developer |

51,000 |

75,000 |

94,200 |

96,000 |

114,000 |

138,000 |

|

Ruby Developer |

40,800 |

58,800 |

77,400 |

98,400 |

114,000 |

144,000 |

|

Python Developer |

48,000 |

60,000 |

78,000 |

130,800 |

132,000 |

169,800 |

|

React.JS Developer |

39,600 |

54,000 |

72,000 |

102,000 |

120,000 |

150,000 |

|

Automation QA Engineer |

47,400 |

69,000 |

87,000 |

93,900 |

123,000 |

159,000 |

|

Manual QA Engineer |

33,000 |

57,600 |

73,200 |

84,000 |

111,600 |

128,400 |

|

.NET Developer |

52,800 |

78,000 |

97,800 |

103,200 |

120,000 |

163,800 |

|

Salesforce Developer |

54,600 |

79,800 |

99,600 |

96,000 |

114,000 |

132,000 |

|

Java Developer |

49,800 |

61,200 |

79,800 |

98,400 |

110,400 |

132,000 |

|

Flutter Developer |

49,800 |

75,000 |

94,200 |

98,400 |

111,600 |

120,000 |

|

Product Manager |

45,000 |

69,000 |

87,000 |

93,600 |

120,000 |

147,600 |

The average maximum salary in Mexico for a senior software engineer with 5+ years of experience is about 45% lower than in the US. Interestingly, some roles follow global trends. For example, the AI/ML Software Engineer salary in Mexico remains among the highest locally, but Ruby and Manual QA roles sit on the lower end in both markets.

By the way, the average senior software developer salary in Mexico City is only $46K a year, while developers from California have an annual salary of $165K.

Check out the developer salaries in the Silicon Valley of Mexico, Guadalajara, to know your potential savings!

The software engineer’s salary in Mexico in USD varies depending on the tech stack and role seniority. However, Mexican tech salary alone doesn’t tell the full story. Let’s see what’s under the hood.

Payroll taxes

Hiring under the B2B model? In this setup, engineers handle their taxes, resulting in a 0% tax burden for the tech company.

For full-time employees, employers are required to cover social security contributions and local payroll taxes, or they can just outsource payroll in Mexico. For instance, if the monthly IT engineer’s salary in Mexico is $5,000, the employer would pay around 24.1% more.

These include:

- Social Security Contributions (federal):

- Sickness and Maternity – fixed rate: 20.40%*

- Sickness and maternity: 1.75%

- Sickness and maternity – additional fee: 1.10%

- Disability and Life: 1.75%

- Retirement: 2%

- Unemployment and Old-age Scheme: 6.422%

- Occupational risk: 0.54%-7.59% (depending on the risk category)

- Nursery and social benefits: 1%

- Housing Fund (INFONAVIT): 5%

*Sickness and Maternity fixed rate of 20.40% is based on the UMA (Unidad de Medida y Actualización). For 2025, the daily UMA is MXN 113.14, so the fixed contribution is 20.40% × MXN 113.14 = MXN 23.08 per day (around MXN 692 per month).

- Payroll taxes (local):

- Payroll tax: 3% for tech hubs such as Mexico City (CDMX), Guadalajara, Monterrey, and Querétaro.

Local peculiarities

For a full-time IT developer’s salary in Mexico, the employer’s budget should also include:

- Aguinaldo: A year-end bonus equal to 15 days of salary.

- Prima Vacacional: A 25% premium paid on vacation days.

- Profit-sharing (PTU): By law, companies must distribute 10% of their annual taxable profits among employees. The payout is calculated based on each employee’s salary and the number of days worked.

Recruitment fees

Hiring costs in Mexico depend on the role’s seniority:

- 15% of gross annual salary for mid-level tech specialists,

- 20% for senior-level positions, and

- 25% and more for leads and top-tier talent.

In comparison to the IT salary in Mexico, hiring the same specialists in the US would cost about 10% more, with recruitment fees ranging from 25% to 35%.

Standard benefits package

Tech companies in Mexico typically provide a standard benefits package valued at around $6,500 yearly, which includes:

- Medical insurance: $1,000,

- Learning & development: $1,500,

- Corporate merchandise: $100,

- Work equipment: $3,000, and

- Wellness & mental health support: $900.

This package is almost $9,000 cheaper than in the US, where the average cost of benefits reaches about $15,400 per developer each year.

The table below compares the average annual cost of hiring Mexican IT professionals with that of US-based ones.

|

Average Annual Developer’s Employment Costs, Gross, USD |

||||||

|

Mexico |

USA |

|||||

|

Position |

Middle |

Senior |

Lead |

Middle |

Senior |

Lead |

|

AI/ML Engineer |

74,065 |

108,565 |

138,635 |

166,900 |

212,740 |

270,550 |

|

Cloud Engineer |

71,565 |

105,585 |

135,150 |

160,900 |

205,710 |

251,110 |

|

Mobile Developer |

56,550 |

101,115 |

104,150 |

177,400 |

229,900 |

288,775 |

|

Blockchain Developer |

58,595 |

105,585 |

128,175 |

180,400 |

218,980 |

254,350 |

|

C/C++ Developer |

67,275 |

99,625 |

128,175 |

135,400 |

163,600 |

201,700 |

|

Ruby Developer |

55,120 |

79,510 |

106,475 |

138,400 |

163,600 |

209,800 |

|

Python Developer |

63,700 |

81,000 |

107,250 |

178,900 |

187,000 |

244,630 |

|

React.JS Developer |

53,690 |

73,550 |

99,500 |

142,900 |

171,400 |

217,900 |

|

Automation QA Engineer |

62,985 |

92,175 |

118,875 |

132,400 |

175,300 |

230,050 |

|

Manual QA Engineer |

45,825 |

78,020 |

101,050 |

120,400 |

160,480 |

188,740 |

|

.NET Developer |

69,420 |

103,350 |

132,825 |

144,400 |

171,400 |

236,530 |

|

Salesforce Developer |

71,565 |

105,585 |

135,150 |

135,400 |

163,600 |

193,600 |

|

Java Developer |

65,845 |

82,490 |

109,575 |

138,400 |

158,920 |

193,600 |

|

Flutter Developer |

65,845 |

99,625 |

128,175 |

138,400 |

160,480 |

177,400 |

|

Product Manager |

60,125 |

92,175 |

118,875 |

132,400 |

171,400 |

214,660 |

|

Gross Annual Salary + Recruitment Services + Standard Benefits Package + Aguinaldo |

||||||

Even with recruitment fees, benefits, and the Aguinaldo’s included, the total annual IT engineer’s salary in Mexico is, on average, 49-68% lower than in the US.

Mexican cloud developers are up to 55% more affordable than those in the US. The savings grow even steeper with roles like Blockchain Developer, where the difference climbs past 67%. And it doesn’t stop there. Python and Mobile developers often receive compensation 64% to 68% lower than their counterparts.

Software Engineer Salary in Mexico: Why There’s a Pay Gap With the US?

US engineers cost more because total compensation stacks higher (benefits + equity), while Mexico’s mandatory package (aguinaldo, vacation premium, PTU, local payroll tax) is cheaper in aggregate. Lower price levels and PPP keep Mexican engineer’s pay competitive without cutting quality. Yes, the US has an elite university cluster, but Mexico’s pipeline – led by Tec de Monterrey – delivers strong talent. English proficiency is routinely screened (CEFR B1–B2+) and rewarded; yet, total packages still fall short of US levels. Equity-heavy US offers and FX swings can widen the headline gap, but the structural cost advantage in Mexico remains.

Clear-cut causes

In the US, employers spend far more than the base salary on software engineers: benefits make up ~30% of private-sector compensation, according to the Bureau of Labor Statistics’ latest Employer Costs for Employee Compensation. So, not even the US and Mexico bases look really different – the US total cost lands even higher once healthcare, paid leave, and other benefits are added.

Now look at Mexico’s mandatory package. As I highlighted above, engineers receive a Christmas bonus (Aguinaldo), a vacation premium, profit sharing (PTU) equal to 10% of taxable profits – with a cap the Supreme Court confirmed as constitutional in April 2024. These items and other bonuses don’t inflate base pay, but they do shape employer cost models – and they remain less expensive than US-style healthcare and equity-heavy packages, keeping Mexico’s total cost comparatively lower.

Location inside Mexico matters too. The state payroll tax (ISN) is set locally, so two identical engineering bases can produce different employer totals. For example, Mexico City raised its ISN to 4% in 2025, while many states sit nearer to 1-3%. This dispersion enables you to optimize costs by hub without compromising quality.

Finally, price levels differ. Mexico’s lower cost of goods and services means a lower nominal MXN salary still buys strong local living standards. When comparing markets, normalize using purchasing power parity (PPP) and price-level indices. That’s why Mexico can deliver equivalent engineering output at a lower USD cost once you account for local prices.

Overlooked factors

As you well know, the US dominates the top Computer Science and Engineering rankings (MIT, Stanford, CMU lead QS’s 2025 subject lists), and that density lifts salary pressure at the top end. But Mexico’s Tecnológico de Monterrey has broken into the global Top-100 for Engineering & Technology – #58 – a sign of a strong local pipeline that feeds high-quality engineering teams at a lower cost base.

Then comes the English level. The national average for English proficiency is mixed, but in Mexico’s tech hubs, many engineers already work daily with US/EU teams, and employers cover the costs. In 2024, a leading Mexican tech-jobs study found that English proficiency can increase tech salaries up to fourfold, which is why companies commonly screen for CEFR B1-B2 or higher using workplace exams such as TOEIC or Cambridge. So you still get Silicon Valley-grade delivery at Mexico rates: the market’s salary premium for English is real, yet overall package costs remain well below US levels.

Another factor: equity inflates US totals far beyond the base. US tech offers routinely include stock (RSUs/options), and 2025 reports show equity remains a core part of compensation even as grant sizing evolves. Big Tech is also front-loading vesting (e.g., 40% in year one, 30% in year two), pulling more value early and increasing near-term total cost compared to Mexico’s cash-centric packages. Result: same code quality can cost more in the US, even before you add healthcare.

And finally, FX moves can change the USD picture overnight. When Banxico cut the policy rate to 8.0% in June 2025, the peso appreciated slightly; after the September 25 cut to 7.5%, USD/MXN traded around 18.38 on September 30, 2025. What do these numbers mean? MXN-stable salaries can appear cheaper or pricier in USD on a month-to-month basis, but the underlying Mexican cost advantage remains, as it’s driven by structural factors (benefits, taxes, price levels), not just exchange rates.

US Tariffs’ Impact on the Mexican Tech Sector and Local Developers’ Salaries

US tariffs won’t derail your Mexico hiring. The new duties focus on physical goods, not digital services, so building a remote R&D center or hiring engineers in Mexico remains unaffected by import fees. Hardware supply chains may slow, but the software labor market stays stable and cost-competitive – with senior engineer packages well below US levels.

In 2025, the Trump administration introduced new 25% tariffs on imports from Mexico, Canada, and China. The good news? These tariffs mainly target physical goods, not digital services. So, if you’re thinking of hiring engineers in Mexico or building a remote tech R&D center, your plans remain untouched by import duty fees.

Even with the added uncertainty in Mexico’s digital ecosystem, software roles remain shielded. In fact, as was already mentioned, the senior software engineer’s salary in Mexico ranges between $58K and $82K. This is still far below US averages.

Tariffs may slow hardware logistics, but the software talent market remains stable. For US tech product companies, Mexico is still a smart move. The average salary of a software developer in Mexico remains stable and highly competitive for remote hiring. And with a local partner like Alcor, navigating legal and operational complexities becomes hassle-free.

Portrait of a Mexican Software Developer

Meet the typical Mexican software developer: mid-30s, degree in CS/math/related fields, and part of one of the Americas’ largest STEM graduate pipelines. Many come from bilingual (Spanish-English) campuses, arrive with 6+ years of experience, and pair strong technical skills with teamwork, problem-solving, creativity, and attention to detail. They value growth, fair pay, learning opportunities, and a sane work-life balance.

Before hiring a software developer for your team in Mexico, it helps to know who you’re welcoming aboard.

Most developers in Mexico are in their mid-thirties and hold degrees in computer science, math, or related fields. Within the American continent, Mexico stands as the frontrunner in terms of the largest number of STEM graduates. Thanks to the proliferation of bilingual Spanish and English campuses, most developers in Mexico’s graduating pool are well-prepared for collaborating with international employers.

Over half of the local tech workforce has 6+ years of experience, typically at the semi-senior level or higher. But it’s not just technical skills that set software developers in Mexico apart, since they’re also known for their soft skills:

- teamwork,

- critical thinking,

- creativity,

- problem-solving, andd

- attention to detail.

Just like any seasoned professional, local tech talent highly values career growth opportunities, competitive salary, learning and development prospects, and work-life balance that doesn’t burn them out before Q3.

Challenges of Hiring Developers in Mexico

Hiring in Mexico is straightforward when you respect labor rules and pick the right hiring model.

- The standard workweek is 48 hours with overtime paid at 200% (225% on Sundays/holidays), probation is up to 1 month for most roles and 6 months for technical positions.

- The 2021 subcontracting reform restricts outsourcing core roles but does not ban compliant hiring; build an entity or use a compliant Employer of Record (EOR).

- Strong employer branding and localized, bilingual outreach lift speed and offer acceptance.

- If speed and compliance matter, an EOR handles payroll, benefits, taxes, and IP while you keep day-to-day control.

With the right partner, these “challenges” become a clear checklist – so you can scale senior engineering in weeks, not months.

Labor law peculiarities

Hiring software engineers in Mexico comes with legal and regulatory challenges, so tech product companies need to navigate carefully because they vary from one LATAM country to another. In Mexico, there are the following:

- Working hours: 48 hours per week.

- Overtime compensation: 200% of the regular rate during regular hours and 225% on a Sunday or holiday.

- Probation: 1 month for standard roles; 6 months for technical ones.

- Holidays: 7 official national holidays.

- Vacation: 12–30 working days off, plus a 25% salary bonus. Payouts only happen if the contract ends.

- Maternity leave: 84 calendar days, split evenly before and after birth. Starts at least 14 days before the due date.

- Profit-sharing: 10% of the company’s annual profit, roughly $100–$1,000 per employee.

Ban on sub-contracting

Tech product companies outsourcing software development to Mexico often raise questions about legal compliance, especially after the 2021 amendment to the Federal Labor Law, which remains in effect as of 2025. The reform tightened rules around subcontracting core business functions, which initially caused uncertainty about hiring offshore software developers in Mexico.

Here’s the reality: subcontracting hasn’t been banned outright. The goal was to curb tax evasion, not block foreign firms from building tech teams. With the right legal support or a trusted partner on the ground like Alcor, US tech product companies can confidently build teams and access top-tier developers in Mexico without risk.

Read our article on taxes for US companies doing business in Mexico to learn more!

Tips to Hire Developers in Mexico

Build a strong employer brand

Hiring elite tech developers isn’t just about offering a paycheck. Without a strong local employer brand, even the best companies risk being invisible to top talent. And when you’re a US company that is hiring in a foreign market like Mexico, understanding cultural nuances and the average salary in software development in Mexico is only the beginning.

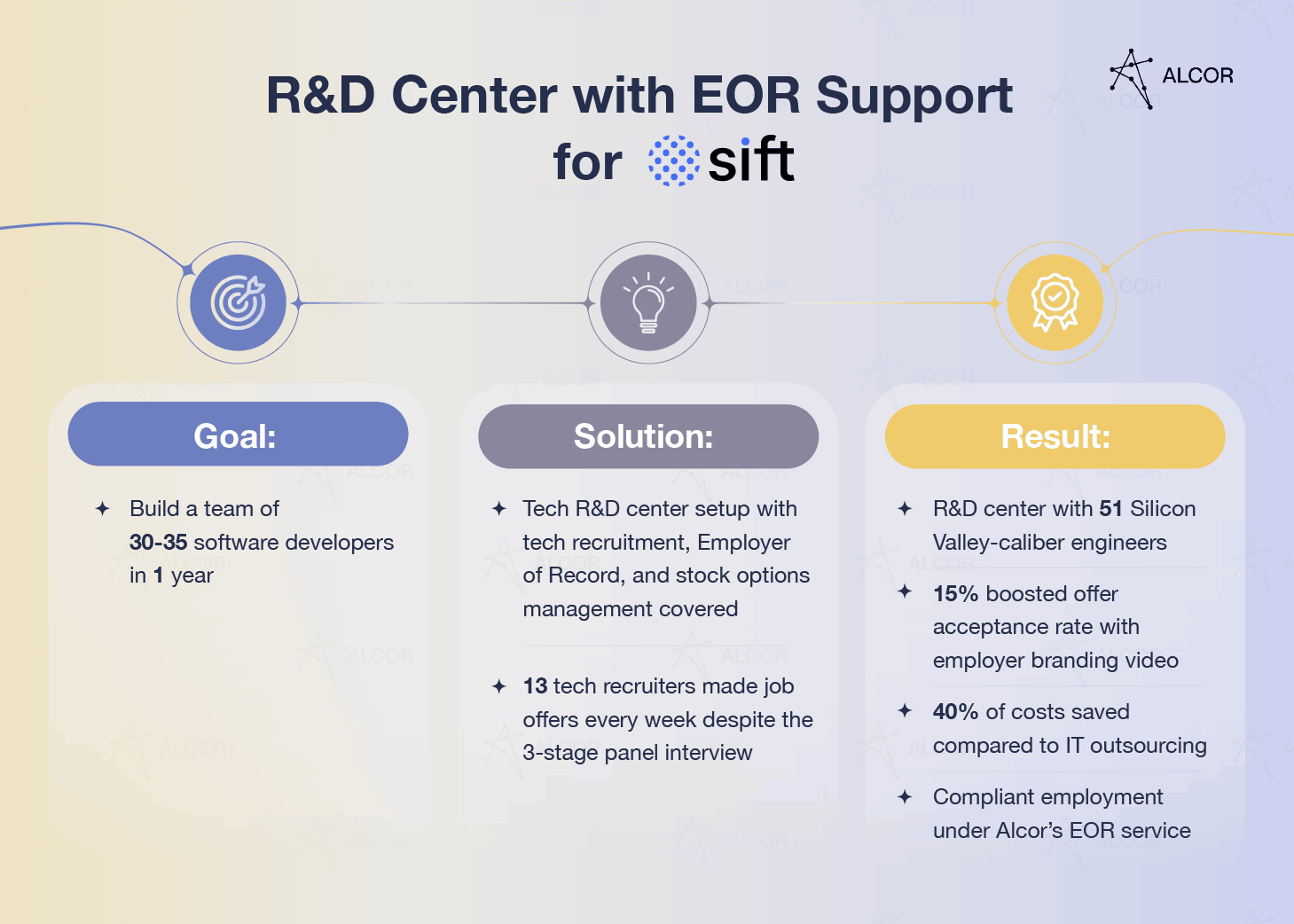

Sift, a fraud detection company in the US, nearly faced senior talent attraction challenges when they set their sights on building a team abroad. Had they gone it alone, they would’ve run into slow hiring, high offer rejections, low engagement rates, and fierce competition from better-known names – all while bleeding time and resources.

Instead, Sift partnered with Alcor, and we turned the tide. We helped them record a video interview featuring their Hiring Manager and ran a branded campaign. This gave developers a real, human connection to the company’s culture. And here’s the result: a 15% boost in offer acceptance rates and a flood of engaged candidates. In just one year, Sift built an R&D center of 51 engineers, closing 30 hires in record time.

On top of that, we ensured full legal compliance for Sift, covering everything from tax management and labor law to IP protection. Our recruitment team also impressed the client from day one, closing three critical tech roles in just a week and hiring a Senior Product Designer on the very first try.

Tackle legal compliance difficulties.

Hiring abroad without a partner can feel like trying to solve a Rubik’s Cube in the dark. Setting up a legal entity in Mexico to hire developers compliantly involves multiple steps: choosing the entity type, reserving a name, registering with tax authorities and Social Security, and opening a bank account. The process can take several months and cost thousands of dollars.

Thus, tech companies choose to partner with an Employer of Record provider to legally and efficiently hire a team of remote software developers in Mexico. With Alcor, you get support with payroll, tax management, 100% compliance, employee benefits management, and on/offboarding. This way, you can focus on your employees and product.

That was exactly the case with Franki, a California-based experience app company. To scale fast and stay compliant in Mexico, they partnered with Alcor. Within just one month, our recruiters helped them build a team of top-10%-of-the-market engineers.

With transparent income benchmarks, reliable headhunting support, and legal coverage across both the US and Mexico, Franki gained:

- Silicon Valley-caliber tech team

- 40% savings compared to tech outsourcing

- complete control through EOR.

Hire Developers in Mexico as Simply as Possible

Build a high-performing R&D center in Mexico – without outsourcing headaches. Alcor delivers elite engineers fast, keeps you 100% compliant via EOR, and handles ops end-to-end. You focus on product; we handle hiring, payroll, and setup – with up to 40% cost savings.

Thinking about working with nearshore software developers in Mexico? With Alcor, the process is smooth, strategic, and built for scale.

We don’t do typical outsourcing or temporary tech staffing. Instead, we help tech product companies build their tech R&D centers in Latin America and Eastern Europe. Our all-in-one model combines:

- Tech recruitment is handled by 40 in-house experts using advanced sourcing and hiring techniques. We deliver 30+ elite engineers in 3 months, with 80% CV approval and a 98.6% probation pass rate.

- Employer of Record in Mexico that keeps you 100% compliant, with no local legal entity needed.

- 360° operational support, including office rent, hardware procurement, and employer branding.

Just ask GoTransverse, a US company that builds cloud-based billing and revenue automation software. Set out to expand, they met with multiple EOR and tech recruitment vendors. None fit until they found us.

We assigned a full team of 10 tech researchers, headhunters, legal advisors, and a key account manager. Within five days, they received a shortlist of pre-vetted candidates.

What was our target? To fill 15% of roles from the very first CV and complete the hiring in 2-6 weeks.

And in reality? We averaged one week per hire, and the client approved every candidate.

Meanwhile, our EOR and operational support teams ensured smooth onboarding without requiring a legal entity. From payroll to infrastructure, we handled it all smoothly.

With Alcor, your focus stays on the product. We’ll take care of everything else. Elite tech talent, zero buy-out fees, and up to 40% savings – that’s how we do software R&D support.

Ready to write your success story in Mexico? Let’s talk!

References

- CodersLink Mexico Tech Salaries Report 2025

- Glassdoor

- Statista

- Worldostats

- StartupBlink

- CBRE

- Coursera Global Skills Report 2025

- Gobierno de México Mexican Talent report

- Best Global Universities U.S. News & World Report

- The White House

- Data México

- OECD

- Reuters

- QS World University Ranking 2025-2026

- Carta

- Business Insider