Only 34% of tech companies outsourced software product development in 2024 – a significant drop from 70% in 2020, as shown by Deloitte. Talent quality is now more crucial for evolving businesses, making Latin American tech talent stand out. Could nearshore software outsourcing in Mexico in 2025 benefit your tech product company? And if so, what’s the best way to do it?

I’m Maryna Panchuk, Head of Recruitment at Alcor, your software R&D accelerator in Latin America and Eastern Europe. We help tech product companies open a software development center in Mexico from 10 to 100+ software engineers in a year – with top 10% tech talent and up to 40% saved costs.

In this article, you’ll learn what makes tech product companies nearshore to Mexico, see median local software developers’ rates in comparison to the US ones, and discover how to leap over the challenges of outsourcing Mexican developers. Plus, you’ll get the inside scoop on engagement models, including tech recruitment in Mexico with Alcor – so you can pick the one that fits your tech business like a glove.

Key Takeaways

- Mexico is emerging as a global tech hub, with an IT market growing by 11.3%, ranking 4th in the region for its startup scene, and recording a record-high level of foreign investment in 2024.

- Mexico offers a cost-effective, well-educated, and time zone-aligned talent pool of over 800,000, ideal for nearshore software development.

- Navigating bureaucracy and legal compliance requires local expertise to avoid delays, fines, and reputational damage.

- Hiring developers in Mexico can cut costs by over 50% compared to the US, even including all employment-related expenses.

- Building dedicated development teams and launching a software R&D center in Mexico are the most scalable engagement approaches for long-term tech product success.

Mexican IT Market Overview

The tech industry in Mexico has turned it into a top destination for nearshore programming. Let’s look at the data:

- The ICT market in Mexico is anticipated to grow by 11.3% during the next 4 years.

- IT outsourcing is the largest segment of software development in Mexico, placing it in the global top 15.

- In 2028, Mexico’s software development market volume is expected to rise to $7.9 billion, with mobile app development, fintech, and cybersecurity solutions driving the rise.

A US-based mobile application, Franki, leveraged Mexico’s continuous growth and chose it as a key location for its nearshore mobile app development, turning to Alcor as a partner.

#Results: A 7+ team of top-10% of the market mobile devs, 40% costs saved in comparison with traditional outsourcing to Mexico, and zero legal hassle thanks to Alcor EOR.

Back to the IT market, what keeps Mexico’s position so solid?

Shining in startup rankings

In 2025, Mexico maintained its 4th position in Latin America (LATAM), according to StartupBlink. On top of that:

- 16 Mexican cities are in the global top 1,000;

- Mexico comes 1st in LATAM and 10th globally in the Marketplace industry;

- Mexico City is the 2nd strongest regional tech hub and 5th in Marketplaces;

- Monterrey, Guadalajara, and León are among the top 100 globally in Food & Beverage, Financial Services, and Agtech, respectively.

Attracting foreign investment

In 2024, Mexico reached a record high of $36.7 billion in foreign direct investment (FDI), with the United States, Japan, Germany, and Canada as the main investors. Primary beneficiaries? Mexico City, Nuevo León, Jalisco, Guanajuato, and Querétaro.

Nearshore outsourcing to Mexico continues to boost investment. In the very first quarter of 2025, Mexican FDI totaled $21.37 billion, representing a 5% increase compared to the same period in 2024.

Riding the industry wave

Offshore software outsourcing from Mexico is soaring not only thanks to a stable FDI influx. The Mexican IT market follows the trends in Fintech, AI, and Edtech, suggesting the following projections for 2025 and beyond:

- Fintech in Mexico has grown by 18.4% over the past few years, and the number of companies will soon surpass 1,000.

- The Mexican AI industry benefited from an AI fund launched by HiVentures. The AI market brought $3.42 billion in 2025 and is expected to reach $13.84 billion by 2031.

- EdTech in Mexico is concentrated in Mexico City, with 84 companies and $70 million in funding over the last decade.

Boosting top tech hubs

Apart from Mexico City, there are such prominent tech states as:

- Nuevo Leon. With its main hub in Monterrey, it is a magnet for nearshore software outsourcing to Mexico, notably in AI and Robotics.

- Jalisco. Its capital, Guadalajara, also known as Mexico’s Silicon Valley, shines in the spheres of Electronics, IT Services, and Software Development. Overall, the state accounts for 70% of the country’s semiconductor industry.

- Queretaro. Famous for its IT Cluster and 80 aerospace companies, this state is the go-to destination for Aerospace and Data Centers.

- Puebla. Home to Audi Smart Factory, this state shows promise in IoT and Automotive Tech, expecting to attract $1 billion for EV manufacturing.

Why Nearshoring to Mexico is a Good Choice?

Growing talent pool

Nearshore software development in Mexico stands on two pillars:

- 800,000+ tech talent pool;

- 124,000 STEM+ graduates joining the workforce every year.

And when it comes to education, they’re not just good – they’re top-tier, so you won’t go wrong if you hire developers from Mexico. Rightfully considered the most educated in LATAM, they study at highly regarded universities – six of which are ranked in the top 50 in Latin America, including the National Autonomous University of Mexico, Tecnológico de Monterrey, and Universidad Autonoma de Nuevo Leon (UANL).

What’s more, Mexican programmers excel in embedded systems, PHP, Java, C#, Python, and Ruby, so if you’re looking for a similar skill set, hiring IT professionals from Mexico is your way to go.

Cost-effective labor

The US IT market offers some of the highest developer salaries globally, prompting many nearshoring software development to Mexico. With average salaries around $55,500 – nearly half of the U.S. average of $109,000 – nearshoring helps reduce labor costs without compromising quality. Keep in mind, though, that pay varies by location: tech talent in Mexico City typically earns more than in Tijuana.

Here is an example of the nearshore IT services salaries for senior positions in Guadalajara vs San Francisco to paint you a clearer picture when considering Mexico for nearshore software development:

| Positions | Guadalajara | San Francisco |

| Full Stack Developer | $66,600 | $162,000 |

| JavaScript Developer | $52,800 | $147,000 |

| C++ Developer | $60,000 | $159,000 |

| .NET Developer | $60,000 | $159,000 |

| Product Manager | $63,600 | $144,000 |

| Engineering Manager | $100,800 | $210,000 |

Strategic location

Another key advantage of nearshoring software development to Mexico is its proximity. Just a 4-hour flight from San Jose to Guadalajara makes face-to-face meetings easy and strengthens cross-team collaboration.

Bonus – Mexico is your gateway to South American IT markets.

And here’s why: if you go for nearshore outsourcing in Mexico and plan to continue your tech expansion, it’d be easier to continue with nearshoring software development to Colombia, Chile, or Argentina.

Similar time zones

Nearshoring software development to Mexico is easier thanks to overlapping US time zones (UTC-6, UTC-7, UTC-8). For example, the American tech hub of San Francisco has no time difference from the Mexican tech center, Tijuana, and is 2 hours behind Guadalajara and Mexico City. This way, remote teams can reduce ramp-up time and address arising issues quickly and effectively, sustaining an uninterrupted software development workflow.

Developed tech infrastructure

This is how Mexico’s government approaches upgrading local tech infrastructure and popularizing outsourcing software development to Mexico:

- Launching a 5G mobile network in 2021;

- Streamlining software development with AI-based technologies;

- Building 20+ modern tech parks, including Guadalajara Software Center, Creative Digital City, Apodaca Technology Park, and Monterrey Technology Park;

- Investing in 3 main tech hubs – Guadalajara, Monterrey, and Mexico City – and 2 emerging ones – Tijuana and Mérida.

Vibrant Business Environment

Out of plenty of reasons, these five matter the most:

- Global economic shifts favor Mexico. Due to the US-China trade war, multinational companies relocated their engineering centers to Mexico. Why? The USMCA still provides Mexico with preferential access to the US market.

- USMCA IP rights protection, which makes IT outsourcing to Mexico not only cost-effective but also safe

- Top 10 score for ease of doing business. So, US tech product companies use the services of nearshore software engineers in Mexico for the country’s political stability and low business climate risk.

- Governmental grant programs like 500 Startups LATAM and Fondo Nacional Emprendedor encourage local tech entrepreneurs to consider nearshore IT solutions.

- Ongoing startup boom. Mexico City, for instance, has 450 startups and 7 unicorns – Kavak, Bitso, Clip, Konfio, Merama, Clara, and Plata. In 2024, funded ventures also received $525 million in the spheres of fintech, healthcare, B2B software, Cloud, and Blockchain & AI.

Peculiarities of Nearshoring Software Development to Mexico

Until recently, many employers avoided taxes by hiring software engineers as outsourced workers through a legal loophole. To address this, Mexico passed the 2021 Labor Law Amendment, which bans subcontracting workers for core business activities.

To nearshore outsourcing in Mexico legally, tech companies must:

- Register with the Ministry of Labor and Social Welfare to ensure they can meet Mexican social security and tax obligations;

- Submit quarterly reports to Mexico’s Social Security agency;

- Pay 10% of taxable income in profit sharing;

- Provide contractors with the registration certificate copy and tax receipts.

Non-compliance can lead to fines or legal action.

The solution for your nearshoring to Mexico?

Build your own team – either by hiring IT headhunters or partnering with a BPO agency that handles tech recruitment, HR, payroll, and management of taxes for businesses that move to Mexico from the US.

Challenges & Risks of Nearshoring to Mexico

Bureaucracy and compliance

Despite Mexico’s push for digitalization, key processes like registering a business, signing contracts, and handling taxes for nearshore development still require in-person visits to government offices. Bureaucratic delays, unclear decision-making, and complex paperwork can slow things down and lead to compliance issues.

#Tip 1: Work with professional legal advisors to avoid setbacks, ensure legal protection, and receive guidance through nearshore technology-specific tax and labor regulations.

#Tip 2: A professional BPO agency that specializes in offshore IT recruitment in Latin America can become your Employer of Record, so opening a legal entity for outsourcing payroll in Mexico will no longer weigh on you.

Protracted hiring

Every labor market has its nuances, and Mexico is no exception. Many tech companies underestimate the preparation required to hire developers when doing nearshore software development in Mexico. The result? Wasted time and money that could go into product development.

#Tip 1: Conduct thorough market research to understand local talent trends, salary benchmarks, and the benefits that attract developers.

In Mexico, the top 5 desired perks are a savings fund, paid training, performance bonuses, family benefits, and paid overtime.

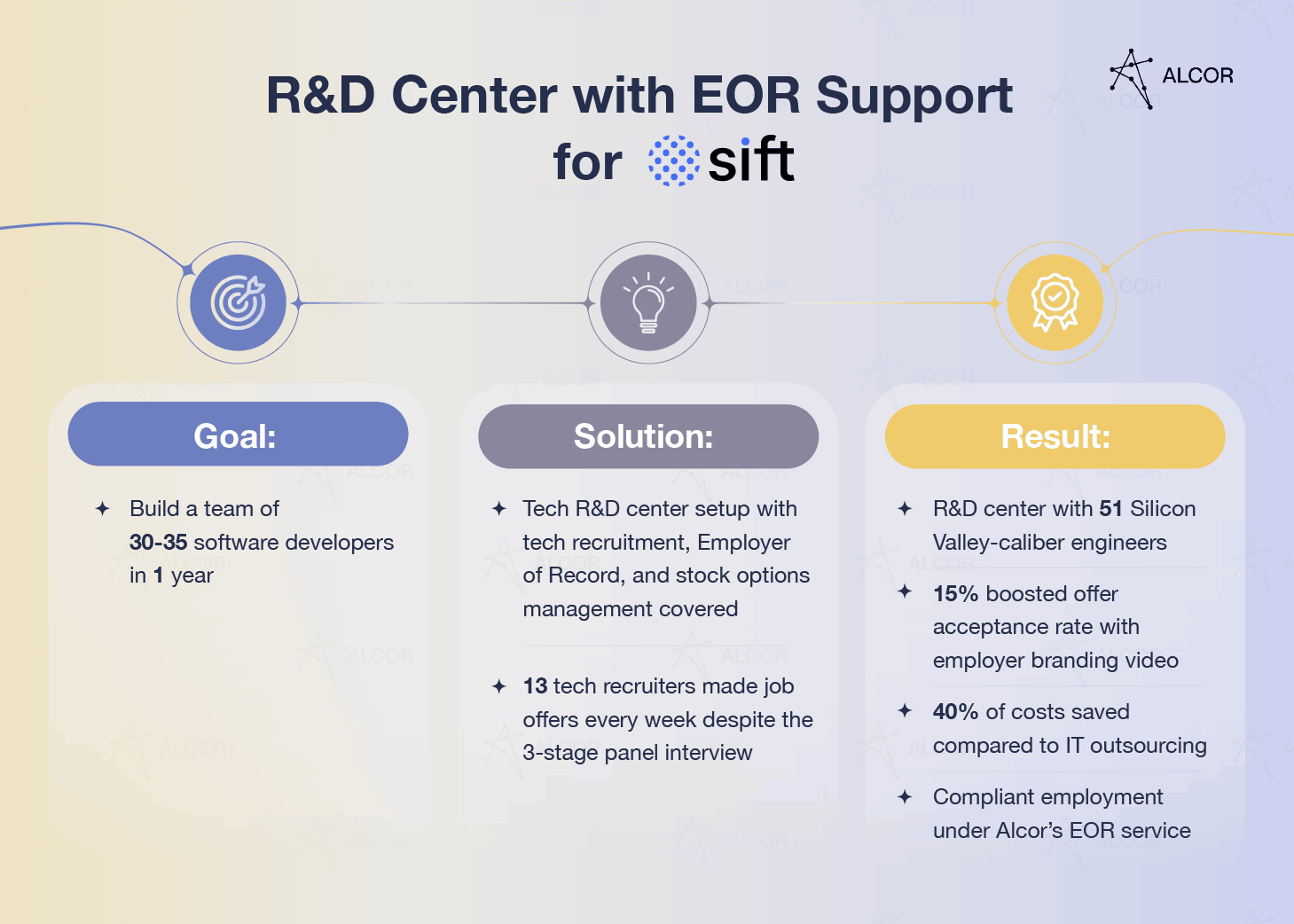

#Tip 2: Build a strong employer brand in Mexico to speed up hiring. When Alcor provided employer branding for Sift, the company’s offer acceptance rate increased by 15%.

The Cost of Nearshoring to Mexico vs Local US Developers

Average software developer salaries

Mexico’s IT market offers salaries 1.8 times lower than those in the US, making outsourcing software development to Mexico a significant cost advantage.

In the table below, you’ll get a glimpse into more salary comparisons of American and Mexican coders.

| Positions | Middle | Senior | Lead | |||

| Mexico | USA | Mexico | USA | Mexico | USA | |

| Java Developer | $44,400 | $102,000 | $66,000 | $114,000 | $75,600 | $132,000 |

| Python Developer | $42,000 | $106,800 | $62,400 | $126,000 | $75,600 | $156,000 |

| React Native Developer | $42,000 | $102,000 | $62,400 | $114,000 | $78,000 | $132,000 |

| Mobile Developer | $44,400 | $102,000 | $62,400 | $114,000 | $75,600 | $144,000 |

| Blockchain Developer | $48,000 | $108,000 | $68,400 | $132,000 | $75,600 | $168,000 |

| Data Science Engineer | $33,600 | $108,000 | $42,000 | $126,000 | $56,400 | $156,000 |

| DevOps Engineer | $48,000 | $108,000 | $72,000 | $138,000 | $84,000 | $156,000 |

| AI Developer | $42,000 | $108,000 | $62,400 | $132,000 | $78,000 | $168,000 |

| Cloud Engineer | $54,000 | $132,000 | $68,400 | $174,000 | $78,000 | $192,000 |

| Mexican salaries converted to US dollars at the relevant exchange rate for May 2025 | ||||||

Just look at the numbers: you’ll pay a hefty $114K per annum if you hire a Mobile App Developer in your immediate area, while the compensation of the same specialist in Mexico amounts to only $62,4K.

Curious about developer wages in other Latin American countries? See our article on software development outsourcing in Colombia!

Average employment cost

In addition to salaries, you’ll need to factor in other employment costs, such as:

- Aguinaldo: A Mexican annual bonus equal to 15 days of salary.

- Prima Vacacional: A local 25% premium paid on vacation days.

- 10% Profit-sharing (PTU) out of annual taxable income.

- Recruitment fee: 20% for senior-level roles in Mexico and about 30% in the US.

- Standard benefits package: $6500 per year in Mexico and $15,400 in the US.

If you add recruitment fee, standard benefits package, and aguinaldo to a senior Python Developer’s gross annual salary, you’ll pay a range of $69,080–$98,880 in Mexico and $163,600–$194,800 in the US. So, even with local employment costs, you can save an average of 53%.

Nearshoring Software Development to Mexico: Engagement Types

Using freelance services

Finding a coder on freelance platforms will do for short-term cooperation and inexpensive IT services in Mexico. This option allows you to cut labor costs, benefits, and tax expenses since freelancers work as sole entrepreneurs. Moreover, you won’t have to deal with all IT recruitment stages but get down to business once you contract the right software developer.

#Where’s the catch? Freelancers might not bring the dedication you crave for your project, so take advantage of alternatives, such as nearshore outsourcing in Mexico.

Getting an outstaffed team

Getting software developers from an outstaffed service provider is similar to IT staff augmentation in Mexico and is a temporary fix to your in-house expertise gap. Based on your business needs, a vendor provides you with coders who possess the required skill sets. You can quickly scale up or down the outstaffed tech team whenever your project changes.

#Where’s the catch? External developers may lack commitment, as they need a sense of ownership over your product. Plus, brace yourself for additional expenses, such as commissions and buy-out fees.

Building a dedicated development team

The most cost-effective and safe option for tech companies is nearshoring BPO services to Mexico. With an all-in-one solution, you can hire Mexican developers into your tech team and retain full control over software development and expenses. An experienced IT recruitment company will also handle back-office functions for you, including accounting, payroll management, legal compliance, etc.

Software R&D center

Alcor’s software R&D center accelerator is a 360-degree solution consisting of Employer of Record in Mexico services, tech recruitment of Silicon Valley-caliber talent with no insource fees, and full operational support.

This is what the US-based company Sift opted for when they were expanding abroad with an ambitious goal to build a team of 30+ developers. Here’s how it happened:

- Sift’s concern: facing time-consuming tech recruitment if performing it independently, without an IT recruitment company.

- Alcor’s solution: a team of 10 researchers, 3 tech recruiters, dedicated account managers, and lawyers conducting employer branding, crafting ideal candidate profiles and appealing EVP, and checking all legal and payroll aspects.

- Sift’s results: an R&D office with 30+ programmers in one year, with 100% business compliance for all Sift’s locations.

- WOW factors: Alcor hired a Senior Product Designer from the 1st CV and closed 2 roles – Infrastructure Engineer and a Ruby on Rails Developer – in just 7 days.

Eager to try professional IT recruitment in Colombia, Mexico, or Eastern Europe? Alcor is your ally! Give our 40 local recruiters only 2-6 weeks to close a senior position, and expect the best from our 253,000+ candidate network.

References

- Deloitte Global Outsourcing Survey 2024

- Global Data

- World Bank

- Statista

- Global Startup Ecosystem Index Report 2025

- Mexico News Daily

- Fintech Nexus

- Contxto

- Tracxn

- LATAM Republic

- Centro Internacional de Casos

- Clúster Vórtice IT Querétaro

- Mexico Business News

- Reuters

- Ease of Doing Business Index 2025

- Growthlist

- Ogletree Deakins

FAQ

1. Is Mexico a good choice for nearshore software development outsourcing?

American tech companies can largely benefit from nearshoring to Mexico. This destination boasts over 800,000 programmers, has a convenient location, similar time zones to the US, and developed tech infrastructure. Check other Mexico’s nearshoring advantages in the article.

2. What are the challenges of hiring software developers from Mexico?

Expanding to new markets is not a walk in the park – you may face multiple issues, such as ineffective tech recruitment or labor law peculiarities. In this article, you can find both challenges and workable solutions to overcome them when hiring programmers in Mexico.

3. How much does it cost to outsource a software developer in Mexico?

The average salary of a software developer in Mexico is approximately $55,500, while in the USA, it reaches $109,000. Thus, by hiring software engineers in Mexico, American tech companies can save over 50% on labor costs.

4. What is the optimal way of getting Mexican programmers for IT companies?

Since software outsourcing to Mexico is legally complex, the best way to scale up in this nearshoring destination is by cooperating with a tech R&D accelerator. Alcor will establish a software R&D center in accordance with Mexican legislation, and you won’t even need to open a legal entity.