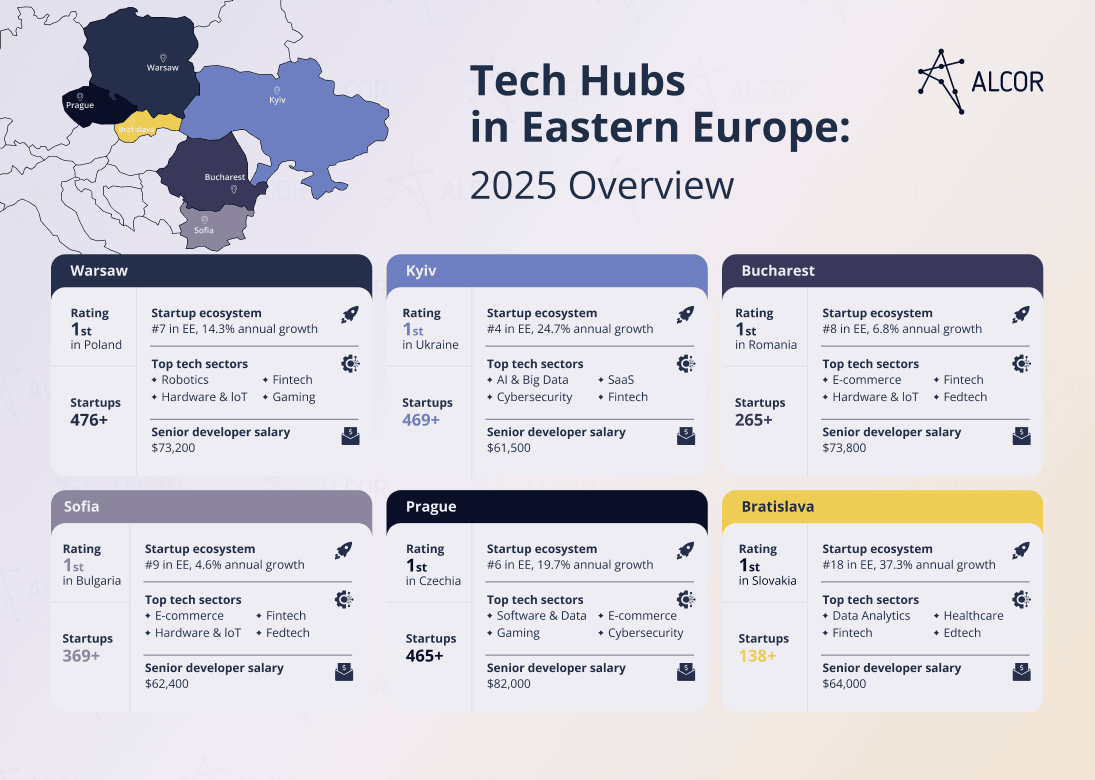

Tech hubs in Eastern Europe named rising stars include Kyiv (Ukraine), Warsaw (Poland), and Prague (Czechia). Ranking in the top 25 in the Dealroom Ecosystem Index, they show the fastest tech transformation and innovation. Other tech centers that attract global companies and investors include Bucharest (Romania), Sofia (Bulgaria), and Bratislava (Slovakia), solidifying Eastern Europe as an innovation hotspot.

I’m Dmytro Ovcharenko, the CEO and founder of Alcor. We disrupt traditional outsourcing models with our all-in-one tech R&D center solution in Eastern Europe and Latin America. Tech companies can enjoy 40% savings and zero buyout fees while expanding their development teams from 10 to 100 Silicon Valley-caliber talents in just one year!

So, are Eastern European tech hubs worth considering? Explore the region’s ICT market dynamics and future forecasts, key reasons for doing software development in EE, as well as the pros and cons of its major innovation centers. You’ll also discover how to gain a competitive edge through a tech-focused expansion model.

Key Takeaways

- The Eastern European software market is booming, projected to nearly double in size over the next five years. Its main drivers are state-led digital initiatives, generous foreign investment, and an expanding tech talent pool.

- Warsaw, Kyiv, Prague, Bucharest, Sofia, and Bratislava are recognized as top tech hubs in Eastern Europe, largely due to their high concentration of tech talent, moderate labor costs, IT infrastructure, and convenient location.

- Tech countries in Eastern Europe are a frequent pick among expanding US tech companies due to their well-versed tech workforce, up to 46% lower developer salaries, and appealing business incentives.

- Enhanced by cutting-edge technologies, the EE region is expected to see an upward trend in R&D center innovation in 2025 and the years to follow. You can catch the wave and build your own R&D team of 30 developers in just 3 months with Alcor, no vendor lock-in and no markups.

Eastern European IT Market Dynamics

The Eastern European IT market is rapidly expanding, driven by digital programs, growing foreign investment, a developing startup ecosystem, and a solid pool of tech talent. With these combined forces, technology hubs in Eastern Europe solidify their position as go-to locations for building cutting-edge innovations.

The software market in EE is expected to hit $9.8 billion by the end of 2025. With an impressive annual growth rate of 11.63%, it’s set to almost double in size, reaching a projected $17.08 billion in volume by 2030.

Here are quick figures on how its key segments are projected to grow:

- Enterprise software is expected to generate $4.44 billion in 2025; at a 13.23% CAGR, to reach $8.27 billion by 2030.

- Application development software is projected to grow from $3.03 billion in 2025 to $5.73 billion by 2030, at a 13.60% CAGR.

- Public cloud market is projected to reach $8.61 billion in 2025, exhibiting a CAGR of 14.30%, resulting in a market volume of $16.80 billion by 2030.

But what’s driving the rapid development of the tech industry in Eastern Europe? Let’s have a look at the core factors and trends.

State-led tech transformation

By following the Digital Decade Policy Program 2030, the EE countries have been actively implementing government initiatives and investing in the digital landscape, promoting digital skills and inclusion, developing their ICT infrastructure, and digitalizing the public sector. Some of the prominent examples are:

- Romania’s National Recovery and Resilience Plan, launched in 2021, focuses on digitalization, promotion of digital education, startup and business support, R&D investing, and more.

- Digital Bulgaria 2025 focuses on the IT sector modernization by implementing educational programs, increasing the number of programmers, and enhancing the nation’s tech skills.

- The European Funds for a Modern Economy 2021-2027 program, initiated by the Polish government in partnership with the European Union, aims to support innovation, research, and increase the competitiveness of Polish businesses.

- Ukraine’s Ministry of Digital Transformation has launched the nation’s flagship digital transformation hub, Diia Ecosystem, which is already globally recognized for its innovative approach. It unites the e-government services, an IT-friendly legal framework, business support, and education platforms.

Investment waves in tech

- Foreign investment

Another exciting trend is that technology is becoming a key driver of investment in the Eastern European market. In 2023, Poland attracted over $7.4 billion in FDI, including Intel’s $4.6 billion investment in a semiconductor facility near Wroclaw.

In 2022, FDI flows to Romania totaled $11.2 billion, representing a 6.6% increase from the previous year. The leading investors were from Germany, Austria, and France. Additionally, the US tech giant Google plans to invest up to $2 billion in a data center set to open in the country.

Ukraine draws significant interest from foreign companies in its DefenseTech industry, having secured $59 million last year, which is 13% of total investments.

- VC investment

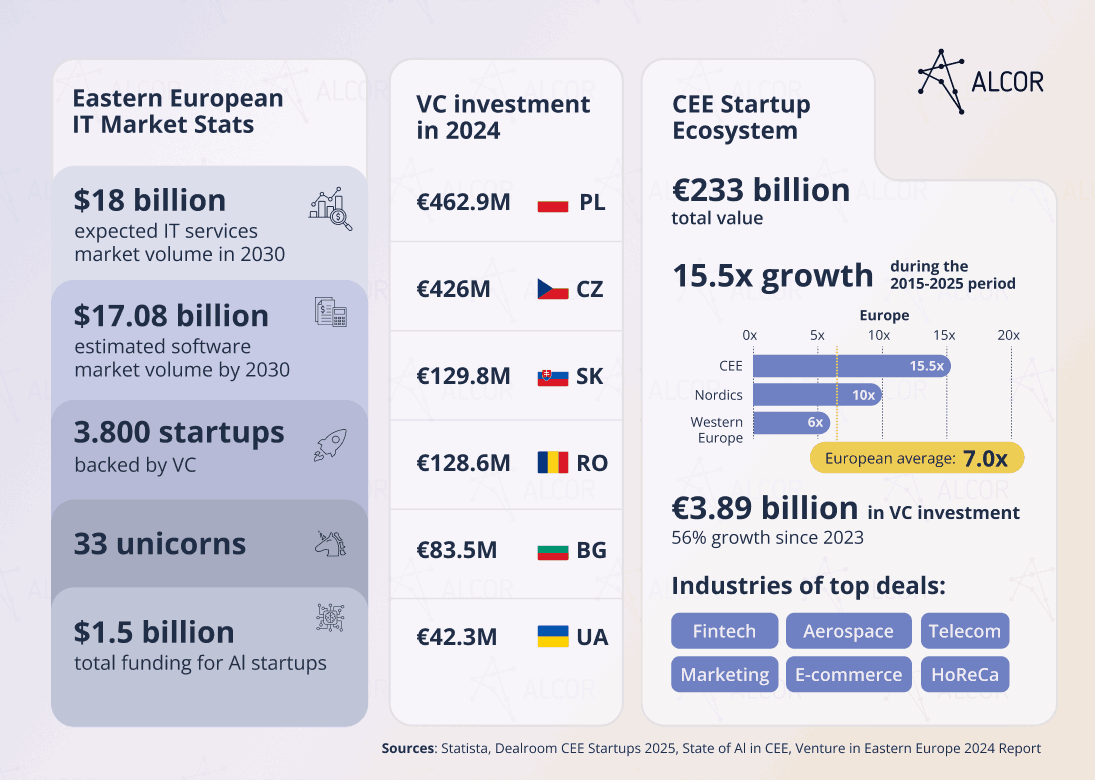

The global tech community sees great potential in the Central and Eastern European innovation market, which already houses 3,800 VC-backed startup companies, 57 unicorns (33 in EE), and 275 scaleups. With a total worth of over $273 billion, the CEE startup ecosystem has grown faster than the Western European one over the last decade, at a rate of 15.5 times versus 6 times.

Regarding VC investment, Central and Eastern Europe received €3.76 billion, representing a 56% increase since 2023. Poland (€592.1 million), Czechia (€426 million), and Romania (€130.7 million) got the largest pieces of the investment pie in EE.

Expanding tech talent pool

Another positive trend is the surge in technical graduates in the region. Over 300 higher education institutions dish out a variety of STEM programs. Universities in Poland, Ukraine, Romania, and Bulgaria have earned recognition in the World University Rankings 2025, showcasing the high quality of education. They produce over 125,000 ICT graduates annually, with Ukraine and Poland collectively accounting for about half of this talent.

Now, moving on to the most exciting part – exploring the main tech hubs in Eastern Europe.

Key Tech Hubs in Eastern Europe

Warsaw (Poland) is known for its large talent pool of over 156,000 software developers, IT competitiveness, mature startup scene, and thriving fintech and AI ecosystems.

Kyiv (Ukraine) is recognized as the most promising tech city in Eastern Europe by Dealroom Ecosystem Index. A go-to hub for a workforce skilled in AI, blockchain, and DefenceTech.

Prague (Czechia) has the most favorable ICT business environment in Eastern Europe, according to the 2024 Future of IT Report.

Bucharest (Romania), a vibrant center for software development and innovation, fueled by educated tech talent and developed IT infrastructure.

Sofia (Bulgaria), an EE tech hub with the lowest CIT, PIT, and senior developer salaries, as well as political stability and a bilingual tech workforce.

Bratislava (Slovakia), a growing Eastern European tech center with a convenient location for nearshoring software development.

Warsaw, Poland

- Startup ecosystem: 7th in EE, 476+ startup companies

- Top tech sectors: Robotics, Fintech, Hardware & IoT, Gaming

- Senior developer salary: $73,200

- Top universities: University of Warsaw, Warsaw University of Technology

- Other tech hubs: Krakow, Wroclaw, Katowice, the Tri-City (Gdansk, Gdynia, Sopot), and Poznan

Interested in IT recruitment in Krakow? We’ve got you covered!

Kyiv, Ukraine

- Startup ecosystem: #4 in EE, 469+ startup companies

- Top tech sectors: AI & Big Data, SaaS, Fintech, Cybersecurity

- Senior developer salary: $61,500

- Top universities: Taras Shevchenko National University of Kyiv, National Technical University of Ukraine, Kyiv Polytechnic Institute

- Other tech hubs: Lviv, Dnipro, Kharkiv, and Odesa

Bucharest, Romania

- Startup ecosystem: #8 in EE, 265+ startup companies

- Top tech sectors: Software & Data, Hardware & IoT, E-commerce, Fintech

- Senior developer salary: $73,800

- Top universities: Politehnica University of Bucharest, University of Bucharest

- Other tech hubs: Cluj-Napoca, Timișoara

Sofia, Bulgaria

- Startup ecosystem: #9 in EE, 369+ startup companies

- Top tech sectors: Fintech, Software & Data, Edtech

- Senior developer salary: $62,400

- Top universities: Sofia University “St. Kliment Ohridski,” Sofia Technical University

- Other tech hubs: Burgas, Plovdiv

Prague, Czechia

- Startup ecosystem: #6 in EE, 465+ startup companies

- Top tech sectors: Software & Data, Gaming, E-commerce, Cybersecurity

- Senior developer salary: $82,000

- Top universities: Charles University, Czech Technical University in Prague, University of Chemistry and Technology

- Other tech hubs: Brno, Ostrava

Bratislava, Slovakia

- Startup ecosystem: #18 in EE, 138+ startup companies

- Top tech sectors: Data Analytics, Fintech, Healthcare, Edtech

- Senior developer salary: $64,000

- Top universities: Slovak University of Technology in Bratislava, Comenius University in Bratislava,

- Other tech hubs: Košice, Trnava

Curious about nearshore software development? Discover what leading tech hubs in Latin America have to offer!

Is Outsourcing to Tech Hubs in Eastern Europe a Good Idea in 2025?

Eastern Europe is a highly attractive region for doing software development. Its large and mature talent pool helps US tech companies fill open tech positions about twice as fast, giving them a competitive edge.

EE programmers combine solid STEM education and hands-on experience across a wide range of technologies, while enabling expanding companies to slash costs. Developed IT infrastructure and generous business incentives add to the appeal of the EE tech hubs.

Now, let’s look at all those reasons to hire European developers in greater detail:

1. Large talent pool

With a huge human capital, bigger than in Western Europe or the Nordic countries, leading IT hubs in Eastern Europe already boast over 1.8+ million software developers, with Poland and Ukraine leading the pack, boasting 607,000 and 302,000 tech experts, respectively.

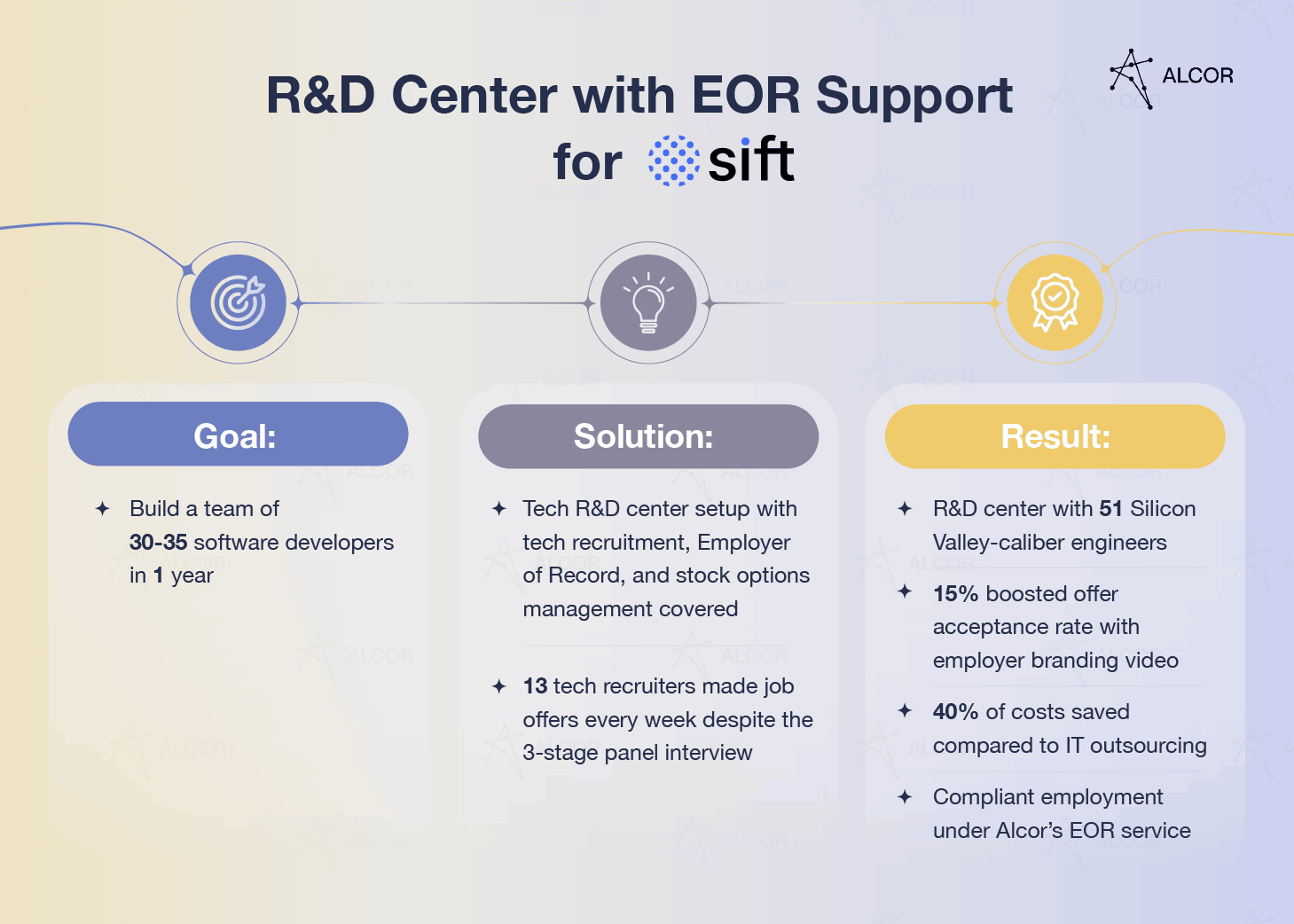

This was one of the decisive factors for the US tech company Sift, which set its sights on expansion. With the local guidance from Alcor, they received:

- An R&D team of 51+ devs in Ukraine and Poland

- Full compliance with European and US legislation

- 15% offer acceptance rate boost via employer branding

- Stock options and visa support for developers

- Equipment procurement & dedicated assistance

With their own Eastern European team of developers, Sift accelerated the time-to-market of their fraud prevention updates, cut their salary budget by half, and gained a competitive edge, turning expansion into measurable ROI.

2. Top-tier skills

2. Top-tier skills

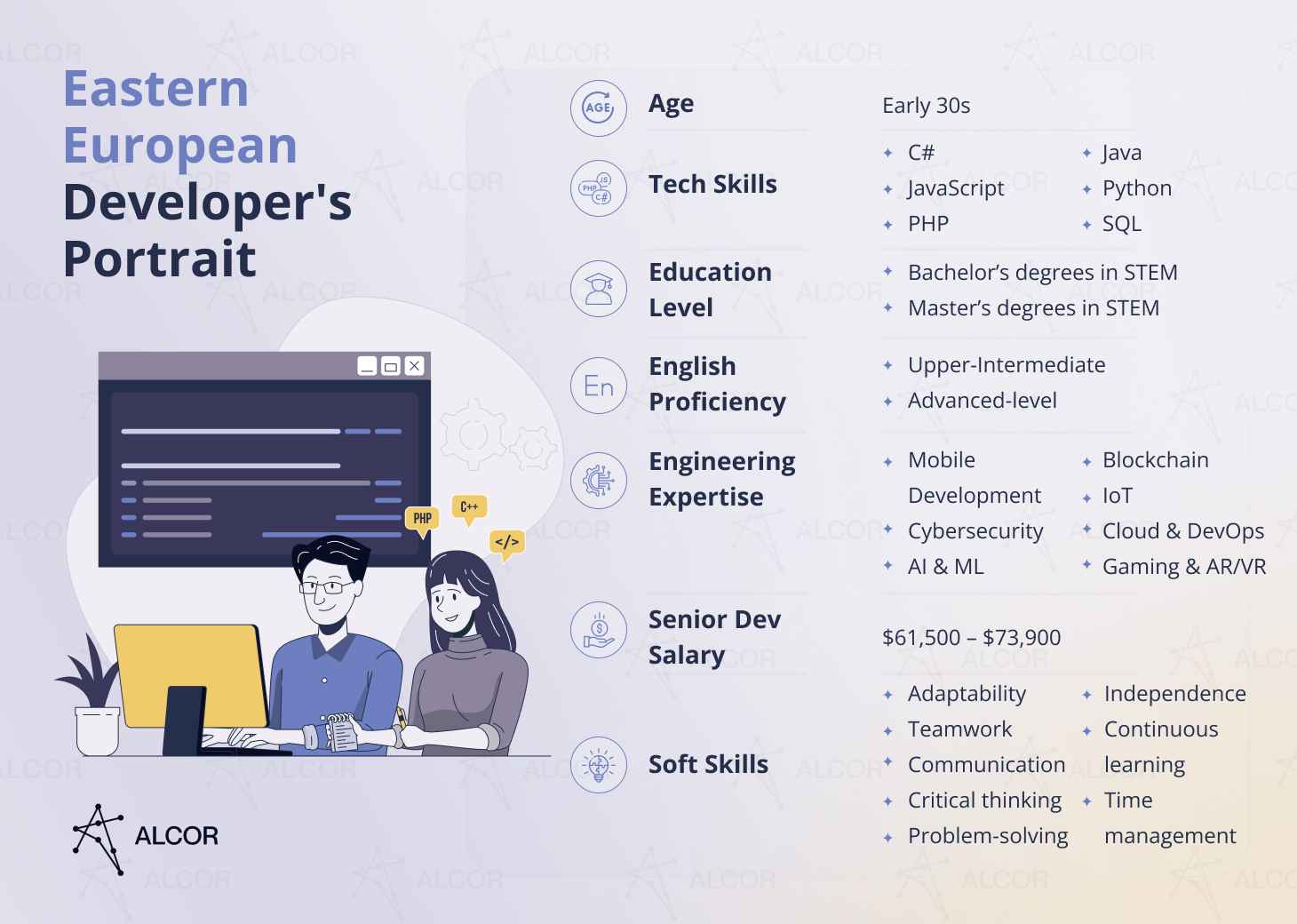

- Hard skills: Eastern European tech talents possess strong expertise in the popular programming languages and technologies, with Poland, Czechia, and Slovakia ranking among the top 35 countries globally for tech skills. Meanwhile, Ukraine ranks 4th out of 174 countries for its contribution to global technological development. So, by hiring Eastern European developers, you, as a tech entrepreneur, can expect high-quality software products.

- Soft skills: Strong adaptability, independence, and problem-solving skills make Eastern European developers highly effective in fast-paced environments, such as innovation. They’ll become the drivers of teamwork and your product development.

- English proficiency: Most engineers from Eastern Europe possess a high command of English, with Romanian, Polish, and Bulgarian talents leading in the region. This ensures smooth and productive communication at every stage of your collaboration.

Below you can find a profile of an Eastern European programmer and a potential member of your future development team!

3. Cost-effective salaries

Outsourcing software development in Eastern Europe can save you about 46% on a senior developer’s remuneration. For example, the annual salary of a senior Mobile Developer in Poland is $78,000, and in Romania, it is $81,600, while in the US, it reaches $165,000. An AI Engineer of the same expertise level in Bulgaria earns $75,600 per year, and in Ukraine, $69,000, compared to $171,600 in the US.

4. Business incentives

Many EE countries are implementing various perks to attract tech companies:

- In 2023, Bulgaria adopted the Start-Up Visa, which opened its market to foreign businesses aiming to develop high-tech projects and contribute positively to the local economy.

- Ukraine stands out with its tax policies. Despite martial law, the Ministry of Digital Transformation fully supports the tech sector through Diia City, a special economic zone with simplified regulations. As employees, tech companies pay a reduced PIT of 5% and social security contributions of about 0.8% for the salary of $5,000 per month.

- The IP Box in Poland offers a preferential 5% tax rate on income from qualifying intellectual property (IP) rights, significantly lower than the standard 19% corporate tax rate. This incentive, combined with Poland’s tax relief for R&D costs of up to 200%, makes it an attractive destination for IT outsourcing in Eastern Europe.

5. Time flexibility

Western European tech companies benefit from a 1-hour time difference with Ukraine, Bulgaria, and Romania, and have no time difference with Poland, the Czech Republic, and Slovakia when working with their remote teams. Meanwhile, American companies have the opportunity to establish a round-the-clock product development.

Top Tech Countries in Eastern Europe

Poland, Ukraine, Romania, Bulgaria, Czechia, and Slovakia are all go-to locations for expanding tech businesses and IT recruitment in Europe. With fast-growing ICT markets, thriving startup scenes, and supportive tech environments, the region gives US tech companies multiple pathways to scale. For businesses seeking to enhance their engineering capabilities, accelerate product development, and optimize budget, Eastern Europe offers both the talent and the runway to succeed globally.

So, let’s explore what these top tech countries in Eastern Europe have to offer.

-

Poland

Pros: As the 1st country in the region for the number of skilled developers, Poland already boasts Europe’s 7th most potent tech market, unlocking a vast reservoir of talent ready to fuel your business growth.

Cons: The 2023 Global Business Complexity Index ranks Poland 4th in Europe for difficulty due to complex reporting standards, ever-changing regulations, legal hurdles for investment, and intricate HR/payroll rules.

Future forecast: The dominance of IT outsourcing is projected to drive Polish market growth to nearly $6 billion by 2030, making offshoring or nearshoring to Poland an increasingly compelling option for tech companies seeking high-quality tech solutions.

Need an IT recruitment agency in Warsaw? Alcor’s tech R&D solution gives you the full package – from hiring top engineers to handling operations.

-

Ukraine

Pros: Ukraine offers the 2nd largest talent pool in the EE region, with expertise in JavaScript, Java, C#, Python, PHP, Typescript, Swift, and Xamarin. Additionally, lower developer salaries compared to Poland and Romania ensure that outsourcing to this country not only guarantees high-quality output for your product but also benefits your business overall.

Cons: Despite the resilience of Ukrainian developers and improvements in infrastructure like building reliable shelters and ensuring constant Internet connectivity, security concerns still pose potential obstacles for foreign tech businesses to enter Ukraine’s tech market.

Future forecast: Despite the war, the Ukrainian startup ecosystem has seen a tripling in value since 2020, surpassing 2,600 active startups in 2024, and adding a new unicorn, Cretio. Last year alone, they secured $462 million. This strong investment activity demonstrates that foreign companies continue to have confidence in Ukrainian IT and view it as a potent hub for innovation.

Exploring team extension in Eastern Europe? See how US tech company BigCommerce went public with their R&D team in Ukraine!

-

Romania

Pros: Offering access to over 240,000 tech talents, Romania stands out as the leader in Europe and 6th globally for the number of certified developers per 1,000 inhabitants.

Cons: Romania provides attractive tax incentives for tech companies. But frequent legislative changes, like the 2024 Fiscal Code updates, make it crucial to stay up to date with local regulations when expanding to this vibrant EE hub.

Future forecast: Thanks to foreign investment and companies entering the local market, the Romanian tech industry is projected to continue its steady growth, with the IT services market volume expected to exceed $1.73 billion.

-

Bulgaria

Pros: With the lowest tax rates in Europe – 10% on both personal income and corporate profits – Bulgaria creates an ideal A3 business climate that’s hard to beat. Combined with a skilled workforce and competitive developer rates, it’s a magnet for international tech companies looking for quality and cost-effective development.

Cons: Despite Bulgaria’s favorable tax policies, navigating its complex legal framework, particularly in relation to establishing B2B contracts with your future employees, poses a challenge for businesses aiming to maximize benefits.

Future forecast: The Bulgarian ICT market size is expected to reach $10.78 billion by 2030, mainly driven by high Internet penetration, digital transformation initiatives, and a great emphasis on cybersecurity, AI, and robotics development.

-

Czech Republic

Pros: Boasting the A2 business climate and the best ICT business environment in EE, the Czech Republic ranks 3rd in the region for its startup ecosystem. Another key factor that places the Czech Republic on the list of top destinations for software development is the rise in FDI inflows. It reached $9.8 billion in 2022, marking an 8.9% increase from the previous year and underscoring its strong investment environment.

Cons: The taxation system in Czechia is notably stringent, with one of the highest tax burdens in the EE region. The corporate income tax rate stands at 21%, up from the previous 19%, while the personal income tax rate ranges from 15% to 23%. This elevated tax environment presents additional challenges for tech businesses looking to expand into this destination.

Future forecast: The Czech Republic’s ICT market size is projected to reach $32.4 billion by 2030, with software development, cybersecurity, and analytics becoming the sector’s primary focus.

-

Slovakia

Pros: Slovakia offers substantial tax benefits for R&D companies, allowing a 100% deduction of research and development costs from the tax base, making it a desirable option for innovation-driven businesses.

Cons: With a projected market size of just $1 billion in 2025, the software development industry in Slovakia is still in its early stages of development compared to its counterparts, such as Poland or Romania. As a result, it offers fewer opportunities for foreign businesses to scale up while entering the market.

Future forecast: The stable growth trajectory of Slovak tech service exports is expected to lead to an increase from approximately $7.04 billion in 2023 to around $9 billion by 2028, bringing the Slovak ICT hub closer to the largest tech countries in Europe.

What 2026 Holds for Eastern European Tech Hubs

In 2026, the leading technology hubs in Eastern Europe will not only remain relevant for software development outsourcing but will also experience rapid growth and gain even more recognition. A rising number of skilled developers, increased investments in the region, and supportive government initiatives create exciting opportunities for international businesses.

Foreign tech companies will flock even more to the tech hubs in Eastern Europe. Whiteline Research has found that approximately 35% of businesses in Western and Nordic Europe plan to increase their use of nearshore outsourcing over the next two years. This will make nearshore software development in Eastern Europe a growing trend.

Meanwhile, another trend is on the horizon – setting up global in-house centers (or, in other words, R&D centers) as opposed to traditional outsourcing, as found by Deloitte. This is the most up-and-coming technology and innovation driver. As of 2024, Poland boasts about 420 operating R&D centers, while Ukraine is home to about 90, highlighting the EE’s appeal as a major location for software R&D centers. This growing trend signals an ideal time to set up an offshore center in Eastern Europe in 2025 and beyond.

Another notable trend, which is enhanced by the R&D center innovation in 2025-2026, is the increasing demand for Big Data, virtual reality, and Internet of Things. Additionally, it’s impossible to overlook the advancements in AI. Gradually, the CEE region is becoming a hub of innovation in this field, evidenced by the explosive growth of startups between 2015 and 2023, during which 694 companies focused on developing AI products emerged.

According to the State of AI in CEE Report 2023, among the most promising fields expected to be at the forefront in 2025-2026 are Healthcare and Life Sciences, Cybersecurity, Computer Vision, and Natural Language Processing (NLP), which powers everything from chatbots to virtual assistants and translation services.

What can be Better than just IT Outsourcing?

Alcor’s tech-focused R&D center solution is a smarter alternative to traditional software development outsourcing. It combines the most essential components of successful and hassle-free expansion – tech recruitment, Employer of Record, and operational support – at 40% less cost, with full control, and zero buyouts.

Whether it’s urgent projects or long-term goals, traditional outsourcing models like staff augmentation in Eastern Europe cannot guarantee high-quality product development, commitment from developers, IP protection, or the ability to fully observe and manage the workflow. That’s where a more comprehensive solution comes in, a tech R&D center solution, which includes:

- Full-cycle tech recruitment: A complete recruitment service that ensures hiring of the Silicon Valley-caliber talent with 40% cost savings and zero buy-out fees compared to traditional outsourcing models.

- Employer of Record (EOR) services: Handle the onboarding and offboarding of your programmers, manage payroll, ensure legal compliance, and offer 24/7 individual support. And allows you to save 3.5 months on opening a legal entity abroad.

- Operational support: Covers everything from hardware procurement to office renting and other back-office services.

There’s a saying: “Those who don’t take risks, don’t get to drink champagne.” But with Alcor’s solution, you face fewer risks and get more champagne to celebrate your success!

And we will help you build this success as we did for People.ai. During our cooperation, they hired over 25 software developers with rare skill sets, received full EOR service, including payroll, tax, and benefits management, and achieved 100% compliance with both US and Ukrainian laws. Just look at what their CEO has to say about working with us:

So, what will you choose: expansion and new opportunities with your own R&D center or stepping into the uncertain waters of outsourcing? Make your choice in favor of innovation and reliability!

Contact Alcor to start your expansion journey in Eastern Europe!

2. Top-tier skills

2. Top-tier skills