Want to nearshore to Romania? You’re looking at the #4 nearshoring destination in the CEE region. With government-backed initiatives like the 5 Billion Plan for Digitalization and AI, the country is advancing rapidly in tech. But here’s a surprising stat: 79% of our respondents had no idea Romanian developers rank #1 in English proficiency across CEE. If that’s news to you, too, read on. Choosing Romania for nearshore software development offers even more.

I’m Diana Lepadat, Lead of Recruitment at Alcor. We partner with tech companies to build their software R&D centers in Eastern Europe and Latin America. Scaling from 10 to 100+ Silicon Valley-caliber engineers in a year is simple with us. No legal entity required. No buy-out fees.

In this article, you’ll gain a clear understanding of Romania’s tech market and discover why innovative companies are nearshoring to this location. You’ll explore how Romania compares to other Eastern European countries. Plus, you’ll find a more strategic option than nearshore IT outsourcing.

Already ranked 2nd in CEE for ICT services exports, Romania’s reputation is catching up to its results. Its IT sector has seen a 78.8% increase in innovative projects, particularly across AI, cybersecurity, and next-gen software development, positioning the country 6th in EE for innovation capabilities.

The local business landscape is equally robust, with over 48,400 tech companies, including 45,400+ with a focus on tech and nearly 3,000 on telecommunications. Romanian companies provide comprehensive services across various industries like healthcare, finance, and e-commerce.

What’s behind Romania’s growth in the tech sector?

Already ranked 2nd in CEE for ICT services exports, Romania’s reputation is catching up to its results. Its IT sector has seen a 78.8% increase in innovative projects, particularly across AI, cybersecurity, and next-gen software development, positioning the country 6th in EE for innovation capabilities.

The local business landscape is equally robust, with over 48,400 tech companies, including 45,400+ with a focus on tech and nearly 3,000 on telecommunications. Romanian companies provide comprehensive services across various industries like healthcare, finance, and e-commerce.

What’s behind Romania’s growth in the tech sector?

If you’re budgeting based solely on salary, then you’re only halfway there. To get the full financial picture of total employment cost, you need to factor in additional expenses.

What does this mean for you? Expect around 43% cost savings when hiring senior programmers from Romania. These numbers prove why choosing to nearshore software development in Romania continues to attract tech product companies looking for cost-efficiency without compromise.

Let’s make your expansion to Eastern Europe fast and compliant. Alcor will handle everything so you can focus on the product, just like Ledger and Dotmatics.

Let’s make your expansion to Eastern Europe fast and compliant. Alcor will handle everything so you can focus on the product, just like Ledger and Dotmatics.

Summing up: For tech companies looking to scale fast with broader expertise and smoother collaboration, building a nearshore tech team in Romania remains a strategic and optimal move.

Summing up: For tech companies looking to scale fast with broader expertise and smoother collaboration, building a nearshore tech team in Romania remains a strategic and optimal move.

With Alcor, you own the product, people, and vision. We take care of the hiring, compliance, payroll, and operations. No buy-out fees, no red tape.

Ready to scale your software R&D team? Then book a call with us & let’s do it.

With Alcor, you own the product, people, and vision. We take care of the hiring, compliance, payroll, and operations. No buy-out fees, no red tape.

Ready to scale your software R&D team? Then book a call with us & let’s do it.

Key Takeaways

- Romania’s ICT sector is projected to hit $1.3 billion in 2025, on track to contribute 10% of the national GDP within five years, driven by growth in AI, Fintech, and IoT.

- Product tech companies choose to nearshore and offshore software development to Romania for its skilled 250,000 talent pool, CEE’s highest English proficiency, Western work culture, and vibrant startup scene.

- Hiring senior nearshore developers in Romania can save you up to 40% compared to US salaries without compromising on quality.

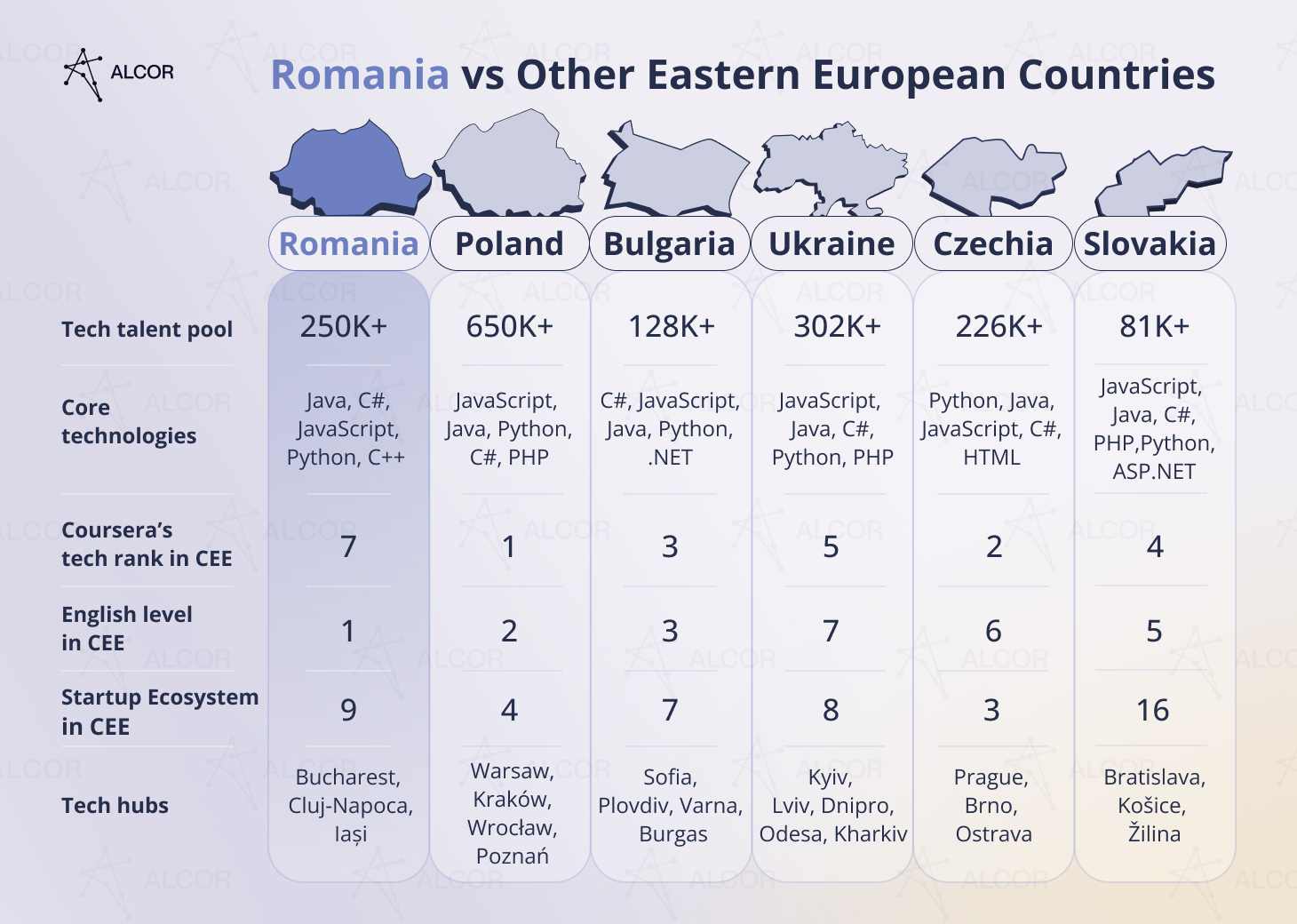

- Romania holds a strong position in the Eastern European tech scene alongside countries such as Poland, Bulgaria, Ukraine, Czechia, and Slovakia.

- To avoid legal and compliance pitfalls, it’s crucial to choose the right cooperation model when building a dedicated tech team in Romania. With Alcor’s all-in-one R&D solution, you skip the legal entity setup, hire 30 senior engineers in 3 months, and enjoy cost-effective scaling without hidden costs.

Romania IT Market & Business Landscape

Romania’s ICT sector is set to generate $1.3 billion in 2025. The industry is on track to make up 10% of the national GDP within five years. Thus, for tech product companies considering nearshoring software development to Romania, the opportunity lies in fast-paced growth. Already ranked 2nd in CEE for ICT services exports, Romania’s reputation is catching up to its results. Its IT sector has seen a 78.8% increase in innovative projects, particularly across AI, cybersecurity, and next-gen software development, positioning the country 6th in EE for innovation capabilities.

The local business landscape is equally robust, with over 48,400 tech companies, including 45,400+ with a focus on tech and nearly 3,000 on telecommunications. Romanian companies provide comprehensive services across various industries like healthcare, finance, and e-commerce.

What’s behind Romania’s growth in the tech sector?

Already ranked 2nd in CEE for ICT services exports, Romania’s reputation is catching up to its results. Its IT sector has seen a 78.8% increase in innovative projects, particularly across AI, cybersecurity, and next-gen software development, positioning the country 6th in EE for innovation capabilities.

The local business landscape is equally robust, with over 48,400 tech companies, including 45,400+ with a focus on tech and nearly 3,000 on telecommunications. Romanian companies provide comprehensive services across various industries like healthcare, finance, and e-commerce.

What’s behind Romania’s growth in the tech sector?

- AI & ML: With over 16,000 working in AI/ML, Romania’s AI market is projected to reach $686 million this year, with growth pushing toward $2.78 billion by 2031. The launch of the country’s first AI research institute is accelerating this shift.

- Fintech: In 2023, Romania’s fintech industry hit new records, reaching $74 million in revenue, with $10.9 million from digital investments. That figure is expected to more than double by 2028, hitting $179 million.

- IoT: The Romanian IoT market is projected to reach $2.4 billion in 2025, led by the booming automotive sector. With 37 IoT software companies already operating, this space offers real potential for foreign tech partners.

Why Nearshore Software Development to Romania

Rich tech talent pool

Businesses interested in IT nearshoring to Romania may rejoice. For the second consecutive year, the country ranks #1 in Europe and #6 globally for certified IT specialists per 1,000 people, outpacing even the US. In 2024, the country surpassed 250,000 competitive software engineers, skilled in Java, JavaScript, C#, and Python, as well as in such front-end frameworks as React and Angular. This technical talent pool continues to grow, with 10,000 ICT graduates entering the market each year from 33 universities, including Politehnica University of Bucharest, Politehnica University of Timisoara, and Technical University of Cluj-Napoca – all recognized in the QS World University Rankings 2025. According to the Coursera Global Skills Report, Romania holds the 7th place in CEE for tech savviness. The country ranks among the top 5 in CEE for talent competitiveness and remains one of the most attractive destinations for tech nearshoring in Eastern Europe.Western mindset

Romanian engineers don’t just write excellent code; they speak your language. Both literally and professionally. As you already know, ranked #1 in CEE and #12 globally on the EF English Proficiency Index, Romania offers strong communication skills that smooth collaboration with the US and Western European tech product companies. The only thing more polished than Romanian developers’ English… is their code. Their work ethic is equally compelling. Romanian developers blend formal discipline with personal accountability, reflecting values closely aligned with Western business values. They’re quick to adapt, easy to collaborate with, and strong in the soft skills that matter:- Critical thinking,

- Creative problem-solving,

- Emotional intelligence,

- Adaptability, and

- Clear, effective communication.

Cost-efficient salaries

Companies that nearshore IT services to Romania save over 36% on developer’s salaries alone. It’s the truth behind why so many tech companies are making the shift. Let’s be clear: the average software developer salary in Romania is rising, but they’re still nowhere near US levels. That’s a major win if you’re hiring senior talent with strong experience without burning through your budget. The table below puts Romanian vs US senior engineers’ salaries side by side.| Gross Annual Income, USD | ||

| Senior Position | Romania | USA |

| AI/ML Engineer | $78,000 | $132,000 |

| Cloud Engineer | $84,000 | $174,000 |

| Mobile Developer (iOS/Android/Xamarin) | $81,600 | $114,000 |

| DevOps Engineer | $54,000 | $126,000 |

| Blockchain Developer | $81,600 | $132,000 |

| Python Developer | $81,000 | $126,000 |

| C/C++ Developer | $78,000 | $114,000 |

| Automation Developer | $72,000 | $96,000 |

| Manual QA Developer | $66,000 | $84,000 |

| Product Manager | $60,000 | $120,000 |

Competitive employment cost

Going the B2B route with Romanian developers? Under this model, companies aren’t responsible for paying the developer’s taxes. Those fall on the contractors themselves. It means zero tax burden for you. If you’re hiring full-time employees, costs are still modest. For example, a $5,000 gross monthly salary comes with about 2.25% extra to Social Security Contributions (SSC):- Pension insurance contribution: 0%-8%*

- Labor insurance contribution: 2.25%

- Middle-level devs: ~15% of gross annual salary

- Senior-level talent: ~20%

- Lead or C-level experts: 25%+

- Medical insurance: $1,200

- Learning & Development: $900

- Corporate merchandise: $150

- Work equipment: $3,300

- Wellness & mental health support: $800

| Annual Senior Developer Compensation, USD | ||

| Senior Position | Romania | USA |

| AI/ML Engineer | 99,950 | 187,000 |

| Cloud Engineer | 107,150 | 241,600 |

| Mobile Developer (iOS/Android/Xamarin) | 104,270 | 163,600 |

| DevOps Engineer | 104,270 | 194,800 |

| Blockchain Developer | 104,270 | 187,000 |

| Python Developer | 103,550 | 179,200 |

| C/C++ Developer | 99,950 | 163,600 |

| Automation Developer | 92,750 | 140,200 |

| Manual QA Developer | 85,550 | 124,600 |

| Product Manager | 78,350 | 171,400 |

|

Gross Annual Salary + Recruitment Services + Standard Benefits Package |

||

Convenient location

Romania’s GMT+3 time zone and central position in Eastern Europe make it highly accessible for tech collaborations. Who benefits the most?- European tech businesses: Romania’s close flight distance – 2 to 4 hours from Western and Northern Europe – and shared time zones enable efficient live collaboration across teams.

- American tech companies: Thanks to a 7–8 hour time difference with cities like New York and Washington D.C., your Romanian team enables a round-the-clock development cycle, keeping projects moving overnight. Hence, you wake up to real progress.

Startup infrastructure

With over 1,660 startups, €19 billion in enterprise value, and 13% of all VC investment in CEE, Romania ranks 9th regionally in the Global Startup Ecosystem Index. Its standout sectors are AI, Fintech, Web development, and Gaming. 2024 highlights include:- The soonicorn FintechOS closed a $60 million Series B+ round.

- AI startups raised $68 million.

- Romanian startups collectively raised around $162 million.

- Bucharest commands 63% of national software development revenue and ranks 8th among Eastern European tech hubs.

- Cluj-Napoca, known as the “Silicon Valley of Eastern Europe,” is home to 15% of Romania’s startups and a key destination for the world’s tech product teams.

- Iași has emerged as a growing fintech and software center, supported by modern infrastructure and the combined revenue of the top three Software & Data startups exceeding $49.3 million.

Who Nearshores to Romania

Global tech giants are turning to nearshore software development in Romania. Accenture has been operating in Romania since 2006, Amazon since 2005, and Microsoft since 1992. Adobe Romania is acclaimed as the largest R&D center in the EMEA region. But it’s not just big tech players that choose to nearshore software development to Romania or broader Eastern Europe. S&M-sized businesses are doing it too. However, unlike tech giants, they usually lack the internal resources to set up a legal entity, hire locally, and manage day-to-day operations on their own. That’s why they partner with Alcor. Our all-in-one software R&D solution combines tech recruitment, Employer of Record services, and full operational support, so our clients can expand hassle-free. See yourself:- Ledger, a French cryptocurrency company, received a full legal package under our EOR solution. While our tech recruiters successfully hired 20 QA Engineers, Alcor’s legal experts handled tax processing, documentation, SLAs, and IP security. As a result, Ledger got a fully backed R&D team with all operations 100% compliant with both French and Eastern European legislation.

- Dotmatics, a US scientific software company, partnered with Alcor in 2021 to build its R&D center in Eastern Europe. We quickly assembled a tech team, with 15% of roles filled from the first CV, covering positions like Director of Engineering, Full-Stack, React, Node.js, QA, and DevOps. Dotmatics also received our full Employer of Record package, including payroll, compliance, onboarding, and benefits. We handled laptop procurement, too. The result: a dedicated team with no intermediaries, secured IP rights, and ongoing support from Alcor.

Let’s make your expansion to Eastern Europe fast and compliant. Alcor will handle everything so you can focus on the product, just like Ledger and Dotmatics.

Let’s make your expansion to Eastern Europe fast and compliant. Alcor will handle everything so you can focus on the product, just like Ledger and Dotmatics.

Romania vs. Other Eastern European IT Destinations

Romania vs Poland

Poland is Romania’s main competitor in the EE tech development market with 650,000+ software developers, the largest number of unicorns in the region, and well-known hubs such as Warsaw, Kraków, and Wrocław. Polish developers are strong in JavaScript, Java, Python, C#, and PHP, rank #1 for tech skills regionally, and their English proficiency level is second in CEE, right behind Romania. But the critical difference in favor of nearshore outsourcing in Romania concerns SSC: for a gross salary of $5,000, employers in Poland pay approximately 20% on top, while in Romania it’s just 2.25%.Romania vs Bulgaria

Bulgaria’s software development sector often mirrors Romania’s, especially in widely used technologies like C#, JavaScript, Java, and Python. Its startup ecosystem ranks 2 spots higher in CEE, but the talent pool – just over 128,000 developers – is nearly half the size of Romania’s. English proficiency ranks third in the region, slightly behind Poland and Romania.Romania vs Ukraine

Ukraine brings scale to the table with a talent pool of over 300,000 tech specialists, which is larger than Romania’s. Both countries share core development technologies like JavaScript, Java, C#, Python, and PHP, making the technical skill sets largely interchangeable. But when it comes to the business environment, Romania has the edge. Its ICT services export market is stronger, outpacing Ukraine’s $6.45 billion.Romania vs Czechia

Czechia’s software development scene holds strong with 226,000 engineers, slightly fewer than in Romania. They mainly work in the country’s top 3 tech hubs, which are Prague, Brno, and Ostrava. The Czech startup ecosystem ranks 3rd in CEE for the second year, indicating strong innovation. That said, Romanian devs come out ahead in English proficiency, placing five spots higher than their Czech counterparts regionally.Romania vs Slovakia

Slovakia brings solid engineering talent. About 81,000 developers are skilled in Python, PHP, ASP.NET, and Node.js. Bratislava, Košice, and Žilina anchor its tech scene, and the country’s business climate (A1) is ranked higher than Romania’s. Still, it trails Romania by 7 positions in the startup ecosystem. Summing up: For tech companies looking to scale fast with broader expertise and smoother collaboration, building a nearshore tech team in Romania remains a strategic and optimal move.

Summing up: For tech companies looking to scale fast with broader expertise and smoother collaboration, building a nearshore tech team in Romania remains a strategic and optimal move.

Proficiency of Romanian Software Development Companies

According to data from The Recursive, Romania’s IT market is on an upward trend, particularly in custom software development, wireless telecom, and IT consulting. Romanian software companies are steadily evolving. While 66% are satisfied with recent investment levels, a significant 30% still report funding gaps. Most firms continue to prioritize replacing outdated systems over expanding capacity, with 2023 seeing a sharper shift toward digital inventory tracking at rates outpacing EU averages. According to the EIB Investment Survey 2024, when it comes to digital adoption, 71% of Romanian firms are utilizing digital technologies, keeping pace with the EU. But where does Romania really pull ahead? IoT. Local firms adopt Internet of Things solutions 11% more frequently than their EU counterparts. While nearshoring to Romania offers many benefits, you still should take into consideration…Challenges & Risks of Nearshoring to Romania

Complex labor laws & legislation

There’s a reason more companies are choosing to nearshore software development to Romania, and it starts with smart tax incentives. As of 2025, Romania offers a 0% profit tax on R&D and innovation activities for the first 10 years of operation. That’s a significant draw for tech companies building long-term. However, tax regulations shift often. In 2024 alone, Romania updated its Fiscal Code, rolled out changes to micro-enterprise taxation, launched the RO e-invoice system, and revised VAT rates. If you’re planning to operate in Romania, staying up to date is crucial. Labor laws are another important factor. Romania follows a 40-hour workweek, with overtime paid at 175% of the base salary (or 200% on public holidays). Workers enjoy 20 vacation days, 17 national holidays, and a range of paid and unpaid leaves. Overwhelmed? Don’t be. As an Employer of Record service provider in Romania, Alcor handles the heavy lifting, ensuring 100% compliance with local labor laws, while managing outsourcing payroll to Romania and benefits.Tricky cooperation models

When it comes to nearshoring in Romania, one of the biggest challenges is choosing the right cooperation model. The wrong setup can lead to poor management, limited control, and costly missteps.- IT outsourcing in Romania works for non-tech companies with short-term projects. But if you prioritize dev team loyalty, code quality, and transparency, it falls short. You don’t manage the team directly. Instead, you go through a vendor’s project manager. That means limited control, minimal accountability on your end, markups, and hidden costs.

- IT Outstaffing in Romania offers more flexibility, but also complexity. You’re now responsible for day-to-day management, all without full ownership of the team. And if you ever decide to internalize the team, you’ll be hit with buy-out fees.

- Global EORs may promise a plug-and-play solution, but what you often get is surface-level support. Without tech specialization or in-house recruiting, their generic pricing, lack of customization, and limited local presence can leave you managing multiple vendors to cover the gaps.

Better than IT Nearshoring to Romania

At Alcor, we’re ready to back up more than just IT recruitment in Romania! Why so? Alcor’s all-in-one R&D solution helps you scale dedicated teams in Romania smarter, faster, and with zero buy-out fees. Here’s what you get:- Elite tech recruitment. We provide the top 10% of Eastern European & LATAM talent with your first hires ready in 2–6 weeks. Our 40 in-house recruiters specialize in the tech market, and our results speak for themselves: 98.6% of hires pass probation, with an average retention of 2.5+ years.

- Tech-focused Employer of Record. Forget legal entities, compliance stress, and pre-payments. We take care of it all – from payroll and tax handling to benefits and on/offboarding – with 100% focus on tech roles. Full-time or B2B, we handle both.

- 360° operational support. Need hardware? Office space? Local support on the ground? Consider you have it. Our team handles everything from procurement to in-country troubleshooting while our Customer Success Managers are always just a message away.

With Alcor, you own the product, people, and vision. We take care of the hiring, compliance, payroll, and operations. No buy-out fees, no red tape.

Ready to scale your software R&D team? Then book a call with us & let’s do it.

With Alcor, you own the product, people, and vision. We take care of the hiring, compliance, payroll, and operations. No buy-out fees, no red tape.

Ready to scale your software R&D team? Then book a call with us & let’s do it.

References on Romania for IT Nearshoring in 2025

- Statista

- International Trade Administration

- WIPO

- The Recursive

- EduRank

- QS World University Rankings 2025

- Coursera Global Skills Report 2024

- The Global Talent Competitiveness Index 2023

- EF English Proficiency Index

- Cultural Atlas

- Forbes

- Vestbee

- Dealroom Central and Eastern European Startups Report

- StartupBlink Global Startup Ecosystem Index 2025

- Romania Insider

- Reuters

- Kyiv Global Government Technology Centre

- Coface

- EIB Investment Survey 2024

How would you rate this article?

Alcor is Your Trusted Scaling Partner

All-In-One

platform for expansion

End-to-end

in-country support

Partnership

liability and commitment