An Employer of Record in Poland lets global companies hire local talent without opening a Polish entity. The EOR acts as the legal employer – handling payroll, taxes, and social security – while you manage day-to-day work. As leaders shift their priority from headcount to results, 67% now use outcome-based services, and EOR fits that playbook. It lifts red tape and admin weight off your shoulders while keeping you in charge of product strategy, delivery, and performance.

Worried about entity setup delays, Poland’s Labor Code, or months-long hiring bottlenecks? With EOR in Poland from Alcor, you keep product development on track while we remove the friction:

- Start hiring almost immediately after signing – typically within 2-3 days – on one transparent monthly fee, no local entity to open or maintain.

- Stay protected under our legal shield, since we act as a legal employer of your devs, run payroll, handle OHS/medical and GDPR, and keep audit-ready records.

- Unlike most EORs, Alcor brings 40+ in-house tech recruiters and ops support to build a fully backed team of 5+ Valley-caliber devs in just a month.

All of this is available under our end-to-end tech R&D center solution, which spans Eastern Europe and LATAM.

Ready to see how a Polish EOR de-risks your first hires while you validate market fit? As a preview, here’s a snapshot of the Polish market metrics:

Inflation Rate | PLN/USD volatility 52-week range: 3.566-4.205 USD/PLN | Corporate income tax 19% standard flat rate9% small tax payers | Value-added tax (VAT) 23% standard rate 8/5% reduced rate |

| English proficiency #15 globally | Graduate employment rate >90% | Nominal wage growth (YoY) 6.2% in 2025 (forecast) | Average tenure 10.9 years |

| Union membership 10.5% | Attrition rate 18% | Average severance Statutory 1-3 months’ pay by tenure;capped at 15× minimum wage (PLN 69,990 cap in 2025) | Remote workforce penetration |

Sources: Statista, Eurofound, European Commision, EURES, EF EPI, Statistics Poland

Key Takeaways

- An Employer of Record in Poland lets you hire in days, cut setup overhead, and stay compliant with the Labour Code. You manage your dev team and software development while a Polish Employer of Record handles payroll, benefits, and filings.

- Blend FTE for core work and B2B for workload spikes under one onboarding checklist, so your workforce scales predictably across Poland. Avoid misclassification and hire where talent lives – Warsaw, Kraków, or other tech hubs.

- Remote‑work rules are now codified, GDPR is enforced, and post‑employment non‑competes require pay. A seasoned EOR service provider standardizes contracts, documentation, and notices to lower disputes and talent attrition.

- EOR guarantees speed and predictable cost under an existing entity. A local entity/HQ offers maximum control with a heavier spend lift. Start with IT EOR in Poland, and incorporate when scaling justifies.

- Taxation in Poland includes social contributions, standard CIT 19% (9% small taxpayers), progressive PIT 12%/32%; contractors manage their own taxes under B2B.

- With Alcor’s R&D center solution, you hire senior tech engineers in 2-6 weeks, get one transparent per-employee invoice, and no buyouts. You own the team and IP while we handle compliant EOR and ops.

Benefits of Using an Employer of Record in Poland

An Employer of Record in Poland lets you hire fast, stay compliant, and keep costs predictable – without opening a local entity. Polish EOR providers handle contracts, payroll, Social Insurance Institution in Poland (ZUS) contributions, and statutory benefits, aligning with the Polish Labour Code, while your company focuses on your tech product. You cut incorporation overhead, reduce misclassification and GDPR risk, and scale teams in Warsaw, Kraków, and other Polish hubs in days rather than weeks.

There is an obvious benefit for you: you get the outcome – a productive Polish squad – without juggling lawyers, bank onboarding, benefits brokers, and payroll tables. According to our team’s research, most delays come from banking and document legalization – problems an EOR removes from your expansion path.

Cost-efficiency

First, let’s look at the total employment cost in Poland, prepared by our researchers for expanding tech companies like yours:

Senior Developer’s Annual Employment Cost | ||

| Position, USD, Gross | Poland | USA |

| AI Engineer | $103,550 | $238,480 |

| ML Engineer | $103,550 | $187,000 |

| Cloud Engineer | $103,550 | $205,720 |

| Blockchain Developer | $107,150 | $218,980 |

| Mobile App Developer | $99,950 | $229,900 |

| DevOps Engineer | $110,750 | $204,160 |

| Java Developer | $103,550 | $158,920 |

| Python Developer | $104,270 | $187,000 |

| Angular Developer | $91,310 | $171,400 |

| .NET Developer | $91,310 | $171,400 |

Note: the employment cost includes a developer’s salary + recruitment fee (for Poland – 20%, for the US – 30%) + benefits package (for Poland – $6,350, for the US – $15,400). It doesn’t include local taxes and SSC. So keep in mind that the final total cost per employee will be higher.

At first glance, it’s simple: cover salary and contributions in Poland (which are 42% lower than in the US, by the way). The catch is overhead. Setting up your own entity adds notary/KRS filings, translations, monthly accounting and payroll tools, and ongoing compliance.

The good news? An Employer of Record in Poland replaces that mess with a clear per‑employee fee and one invoice. Your company skips setup costs and starts onboarding tomorrow.

Reduced risks

A Polish Employer of Record handles contracts, payroll, ZUS filings, benefits, and compliant terminations – so you don’t trip over the Polish Labour Code. That lowers the chance of misclassification claims, back social contributions with interest, or GDPR exposure, while you operate without a local entity. One might say that the best risk is the one you never take – this is where EOR quietly pays for itself.

Scalability

Poland’s business-services engine is built to scale: the sector contributes 5.7% of GDP, exports $42.3 billion, and employs 488,700 people across 2,081 centers – deep benches in Warsaw, Kraków, and beyond. Poland also drew $12.7 billion of FDI inflow in 2024, alongside $14.4 billion in announced greenfield projects. In H1 2025, PAIH logged EUR 2.4 billion in supported investments in Poland, underscoring ongoing demand for tech and services footprints in Warsaw, Kraków, and other hubs.

Speed-to-market

Our team’s experience shows that setting up a Polish entity typically takes 3-6 weeks end-to-end (banking alone can add up to two weeks). With an EOR in Poland, you can issue offers and onboard in days – contracts, payroll, and benefits are ready out of the box. You start shipping features, while we handle the paperwork. It’s the difference between losing a candidate to a competing offer and having them in your stand‑up next Monday. No red cards from regulators, either.

Hiring and Employment in Poland

Poland offers predictable labor rules, competitive salaries, and deep talent across major hubs. You can blend full-time hires and contractors, choose remote/hybrid/on-site formats, and keep compliance tight with a Polish Employer of Record. Together, these options give you speed, cost control, and flexibility without sacrificing legal footing in the EU.

Hiring and employment statistics in Poland | |

| Standard working time | 40 (5 days/week) |

| Labor force participation rate | 58.6% (ages 15+) |

| Unemployment rate | 5% |

| Average gross wage | PLN 8,920 (USD 2,370) |

| Overtime premium | 50% standard; 100% nights/Sundays/holidays |

| Replacement cost | ~50%-200% of annual salary per departure (recruiting, onboarding, lost productivity) |

Sources: Trading Economics, Reuters, Statistics Poland, gov.pl

Working time and overtime are codified in the Labour Code, and pay indicators are updated quarterly by Statistics Poland. Job-market signals are also constructive, with Q1-2025 vacancies up 11% q/q, suggesting steady demand for skilled roles.

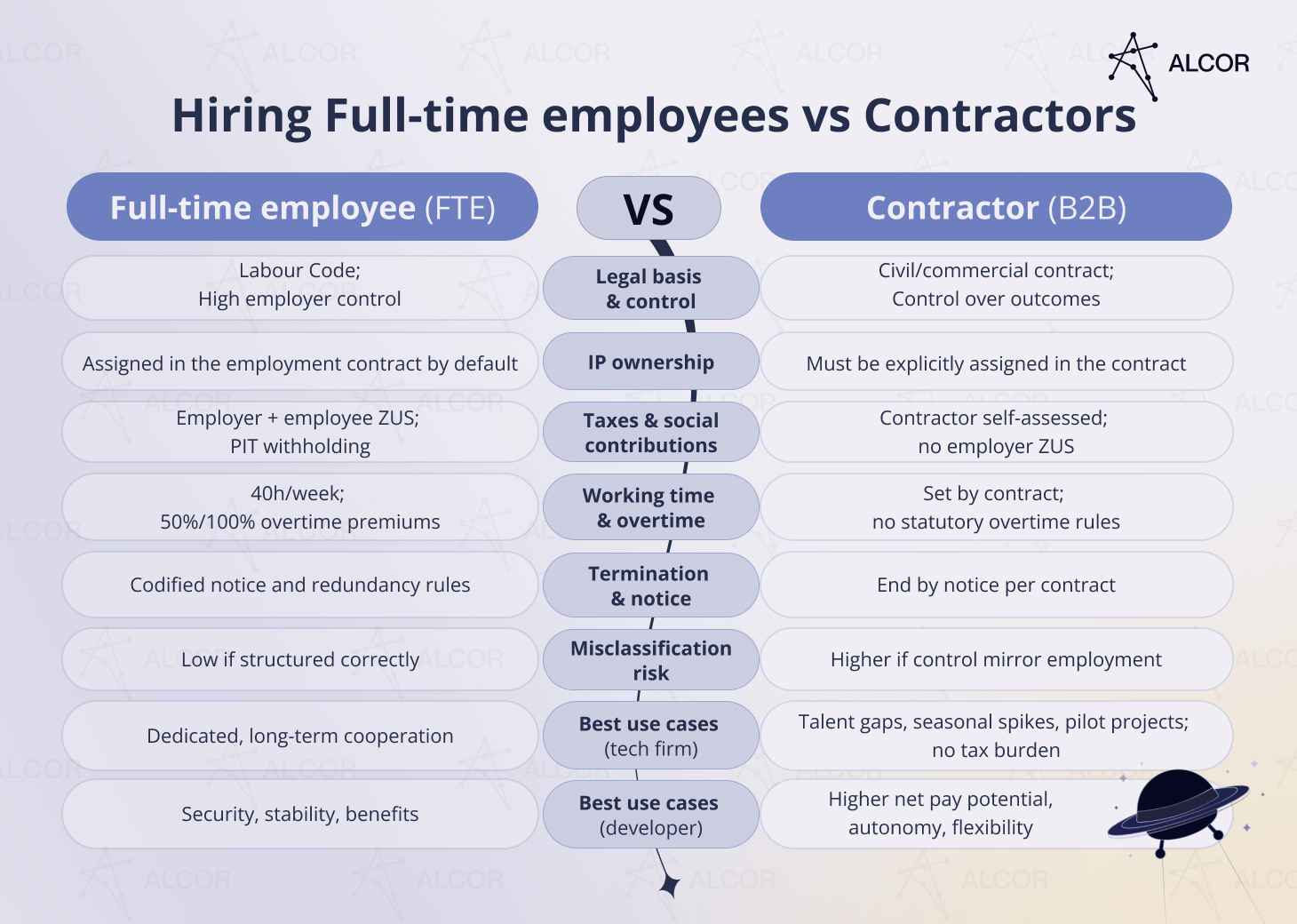

Hiring full-time employees vs contractors

In the Polish tech market, full-time employment (FTE) still edges out B2B: 53.8% FTE vs 38.5% B2B in 2025. The mix varies by seniority and role, but both paths are mainstream in the software industry.

- Full-time employment fits core, long-horizon product work. Employers gain higher retention and simpler day-to-day control but assume full payroll, social contributions, and termination procedures under the Polish Labour Code. Employees get continuity, strong IP assignment inside the employment contract, and statutory benefits (PTO, sick pay, parental leave, social insurance). A Polish Employer of Record like Alcor can hire FTE on your behalf – EOR in Poland keeps payroll, ZUS, contracts, and terminations compliant while you focus on delivery.

- Contractors (B2B) excel in elastic capacity or niche skills. A technology contracting approach keeps rates and scope flexible, and the start of cooperation is fast, plus contractors manage their own taxes and insurance. But if day-to-day control mirrors employment (fixed hours, direct control), misclassification risk rises – potentially triggering back ZUS and penalties. A Contractor of Record centralizes compliant contracts, IP assignment, and payments, letting your company scale specialists without opening a Polish entity.

Remote vs hybrid vs on-site format

Poland’s hubs support all three working formats, with a CET time zone that syncs with Europe and overlaps with US mornings.

- Remote. Hire beyond the big-city bubble, move faster on scarce roles, and keep seniors happy. With secure devices, VPN, and outcome‑based KPIs, teams hit stride from day one.

- Hybrid. Use the office as a magnet, not a mandate. Two or three anchor days for sprint planning, demos, and workshops keep collaboration sharp without killing focus time.

- On-site. Ideal for secure workloads, labs, or customer-facing teams. Plan capacity, access controls, and hub-city perks so onsite feels like an advantage, not a tax.

Types of Employment Contracts

Poland offers four common ways to engage talent: the Labour Code employment contract – including indefinite, fixed-term, and probationary forms – plus civil-law contracts, and B2B/self-employed arrangements popular in the IT industry. Fixed-term employment is capped (33 months/3 contracts), remote work is now codified in law, and ZUS/social charges differ across civil-law vs B2B forms – so picking the right contract is key for cost, control, and compliance.

- Employment contract – the default, full-protection route under the Polish Labour Code. Can be indefinite, fixed-term, or probationary. A fixed-term hire converts to indefinite if employment exceeds 33 months or a 4th fixed-term is signed (3-contract limit). Works best for core teams needing stability, statutory benefits, and clear notice rules.

- Mandate contract – a civil-law contract suited to task-based work with more flexibility than employment. ZUS contributions often apply (depending on the individual’s overall insurance situation).

- Specific-task contract – for a defined deliverable (e.g., a discrete software module). Typically, no ZUS for the contractor (with limited exceptions), which lowers cost but provides no sick leave or paid vacation.

- B2B contract – common in the software industry for tech specialists who invoice monthly. Flexible rates and fast starts; courts can reclassify to employment if the relationship meets Labour Code tests.

Legislation in Poland

The Labour Code in Poland governs working time, overtime, leave, documentation, and terminations. Since 2023, remote work has been fully regulated. GDPR is actively enforced, and post-employment non-competes are also enforceable when paid. An Employer of Record in Poland helps you apply these rules correctly while your company scales in an EU jurisdiction.

Poland’s Labour Code sets a 40-hour work week, defines overtime premiums, and prescribes notice periods and documentation standards for employment. Remote and hybrid work have been expressly integrated into the Code since April 7, 2023, replacing legacy telework rules and requiring clear agreements and policies between employer and employee.

GDPR is not a formality: the Polish Data Protection Authority (UODO) issues guidance for HR processing and plans sector inspections; fines for breaches can be significant, as recent enforcement actions show. Ensure lawful basis, minimization, secure systems, and breach-response procedures across recruitment and payroll.

Two areas in Labor Law require special care:

- documenting remote-work arrangements (who provides equipment, H&S, cost reimbursement)

- tracking time and overtime in line with Code requirements – even for hybrid teams.

The 2023 amendments gave employers six months to align policies; if you’re entering now, bake these into your onboarding.

NDAs are recognized and work best when they are written, specific, and time-bound. Tie them to your data-handling obligations and pair them with explicit IP assignment in the employment or B2B contract. This approach protects trade secrets and avoids ambiguity.

Non-compete duties during employment follow directly from the Labour Code. After employment, a non-compete is valid only if the former employee receives compensation. By law, it must be at least 25% of prior pay for the duration of the restriction. Keep scope, territory, and length proportionate to improve enforceability.

Employee Misclassification & Penalties

In Poland, treating someone like an employee while paying them as a contractor can trigger fines, back social contributions, interest, and contract reclassification. The safest path is to align the working reality with the contract type – or use an Employer of Record in Poland to keep engagements clean.

Misclassification happens when a contractor works under employee-style control: fixed hours, a set workplace, ongoing duties, and supervision. If a labour inspector or court finds an employment relationship exists, the contract can be reclassified. That can mean unpaid ZUS contributions, holiday/sick pay, overtime, and PIT corrections – plus a fine. The Labour Code allows penalties of PLN 1,000-30,000 (USD ~250-7,500) for concluding a civil contract where an employment contract should apply.

Document roles clearly, tie B2B work to deliverables, and avoid employment-style controls for contractors. When in doubt, have a Polish Employer of Record hire core staff on compliant employment contracts, and use a Contractor of Record to standardize B2B terms and IP.

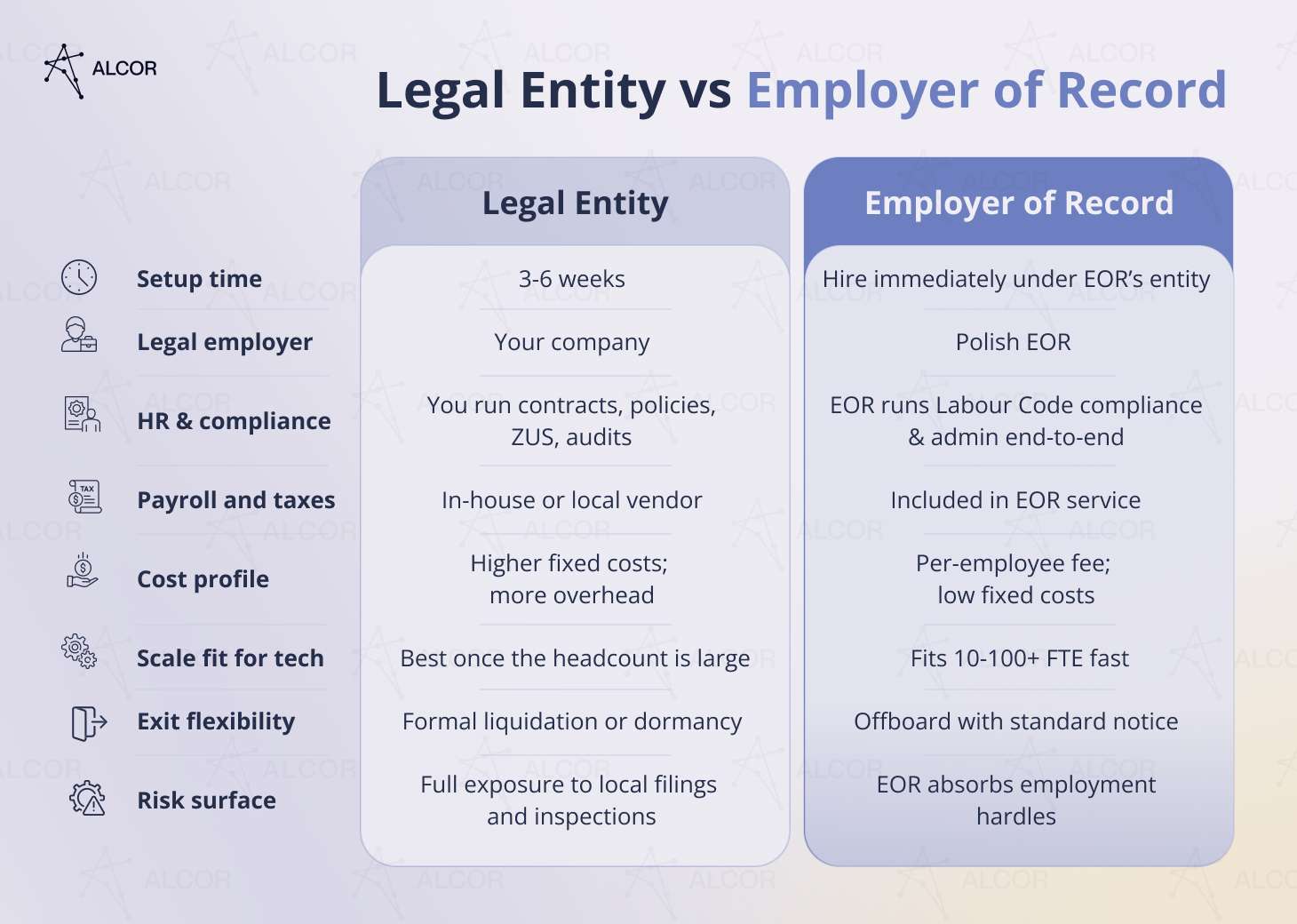

Employer of Record in Poland vs Legal Entity

An Employer of Record in Poland lets you hire fast without incorporation, while a local entity offers maximum control, but at higher cost and complexity. A Polish EOR keeps your company compliant and moving:

- Manages HR compliance: Issues Labour Code-ready contracts, tracks working hours, and administers statutory benefits (health insurance, paid leave).

- Handles payroll & taxes: Runs gross-to-net, withholds PIT, and remits ZUS for employer and employee – accurately and on time.

- Facilitates onboarding: Arranges pre-hire medical checks and OHS training, then standardizes day-one paperwork.

For most tech teams, an Employer of Record company from Poland delivers speed-to-market and predictable costs now.

A legal entity makes you the employer of record, so you run HR, payroll, ZUS, tax, and audits yourself. A Polish Employer of Record becomes the legal employer, delivering the same lawful contracts and benefits under the Labour Code while your company focuses on your tech product. A Contractor of Record (COR) centralizes compliant B2B engagements when your company needs flexibility.

When Sift needed to build a senior engineering team in Eastern Europe without pausing product development to open an entity, they reached out to Alcor. We hired a total of 51 talented engineers in Ukraine and Poland. We also acted as the Employer of Record partner: drafted Labour Code-compliant contracts, ran payroll and benefits, as well as managed ops. The result was a fully compliant R&D team, with Sift retaining full IP control and the option to insource talent free of charge later.

Payroll in Poland

Payroll in Poland is predictable but rule-dense. Employers must pay at least monthly, run gross salary-to-net with PIT withholding, and remit ZUS on time. Pension and disability contributions stop at the annual base cap (30× average pay), while health insurance has no cap. Overtime premiums are defined in the Labour Code. An Employer of Record in Poland standardizes pay cycles, filings, and benefits, so finance teams see one compliant, line-itemed invoice each month.

Payroll frequency

Polish law requires wages to be paid at least once a month, on a fixed date, no later than the 10th day of the following month. If that date is a public holiday, payment must be made earlier. Most employers align the month-end close with payment in the first week of the next month.

Payroll processing cycle

A typical cycle includes:

- time and absence capture

- gross-to-net calculation

- payslips

- PIT withholding

- ZUS DRA filing and remittances

- year-end reconciliations.

A minimum wage of PLN 4,666 (USD ~1,280) updates cascade into related allowances (e.g., night work) and bases, so tables must be refreshed when the state changes rates. An Employer of Record in Poland keeps these steps on schedule and adjusts as thresholds move.

Social contributions

Poland’s social contributions are shared by the employer and the employee. Employers typically pay ~19-22% of gross pay for pension, disability, accident insurance (risk-based), plus the Labour Fund (2.45%) and Guaranteed Employee Benefits Fund (0.10%).

Employees pay 13.71% for pension, disability and sickness, and 9% health insurance – so roughly ~23% in total. Worth mentioning, that as of 2025, Poland applies an annual basis cap for pension, and disability insurance equal to 30x the projected average annual wage: the social contribution cap rose to PLN 260,190 (USD ~71,690). Health, sickness, accident, and fund contributions are not capped. Contributions are withheld and remitted monthly to ZUS.

Types of Bonuses

Poland sets overtime premiums by law and leaves most other bonuses to policy or collective agreements.

- Performance bonus. Tie it to KPIs and write the rules down – ambiguity becomes entitlement quickly.

- Discretionary award. One-off awards are common in the IT industry: document manager discretion to avoid disputes.

- Legal overtime / night / Sunday premium. 50% supplement for standard overtime; 100% for night, Sundays, and public holidays not scheduled as workdays. Time off in lieu is possible.

- Sign-on / retention bonuses. Contractual and often claw-back linked to tenure (align with notice rules).

- Holiday benefit. Not a common “13th salary,” but employers with ≥50 staff may operate a Company Social Benefit Fund.

Taxation in Poland

Poland’s employment tax setup is straightforward for hiring: employees are paid via monthly PIT withholding and ZUS social contributions; companies pay CIT (19% standard, 9% for small taxpayers). Contractors on B2B handle their own PIT and ZUS. What makes Poland attractive for tech is the mix of practical payroll rules plus strong incentives and treaty protection that can meaningfully improve your after-tax results.

In addition to social contributions, Polish employers face:

| Corporate income tax (CIT) | A flat 19% standard rate;Small taxpayers: 9% (with certain exceptions) |

VAT and withholding may apply separately depending on your business model, but payroll for FTEs is typically handled via monthly withholding.

Under the B2B model, you engage Polish engineers as independent contractors. The company doesn’t pay payroll taxes – contractors handle their own. Most IT pros choose the 12% lump-sum PIT (or a flat tax on profit). ZUS: $0 for the first 6 months after PE registration, then ~$109/month for 24 months, then ~$436.17/month.

On the employees’ side, beyond social contributions, they pay personal income tax (PIT) at progressive rates: 12% on annual income up to PLN 120,000, and 32% on the portion above that threshold. A 4% solidarity surcharge applies to income over PLN 1,000,000. Employers calculate and withhold PIT with each payroll run.

Poland also offers meaningful reliefs for tech-driven companies. It lets you double-deduct R&D: eligible R&D costs can be expensed and then deducted again – up to 200% for many cost types (notably R&D salaries). That lowers your tax base fast. For monetizing code, the Innovation/IP Box taxes qualifying IP income – including copyrighted software – at 5% if you meet nexus and documentation rules.

Cross-border payments also benefit from Poland’s broad double-tax treaty network, which can reduce withholding on dividends, interest, and royalties and prevent the same income from being taxed twice.

Employee Benefits in Poland

Poland combines clear statutory benefits with a mature perks market. Employees receive paid annual leave, sick pay, parental entitlements, and social insurance. Employers often add private healthcare, sports cards, and learning budgets. An Employer of Record from Poland standardizes all of this, so your offer is both compliant and competitive in the software industry.

Statutory benefits

- Annual leave. 20 days with <10 years’ service and 26 days with ≥10 years; prorated for part-time.

- Public holidays. National holidays are fully paid days off when they fall on workdays.

- Sick leave. Employers fund the first 33 days per year (14 days if 50+); ZUS pays sickness benefits thereafter. The usual rate is 80% of pay, 100% for pregnancy or work injury.

- Parental leave. Up to 41 weeks for a single birth (43 for multiples), with 9 non-transferable weeks reserved for the second parent.

- Insurance. Employment includes social insurance and state health coverage; contributions are split between employer and employee.

Non-statutory benefits

Most Polish tech offers a layer in private medical plans (family options are common), dental, sport or similar fitness cards, life insurance, meal cards, extra paid days, training budgets, and occasional home-office stipends. These perks materially influence acceptance and retention in Warsaw, Kraków, Wrocław, and other hubs.

Benefits in the tech sector

Engineering teams expect remote-friendly policies, flexible hours, high-grade hardware, conference/training budgets, English classes, and clear promotion frameworks. Senior candidates often negotiate ESOP/phantom shares or performance bonuses. A Polish Employer of Record (EOR) can procure and administer private healthcare, sport cards, and learning allowances alongside payroll – so you present one clean, competitive package to candidates while staying fully compliant.

Work Permits and Visa Regulations

A US tech company hiring in Poland should plan for two tracks: Polish work authorization so engineers can be employed locally, and US business-travel permissions for occasional trips stateside. An Employer of Record in Poland keeps both moving quickly and compliantly.

Engineers working in Poland typically need local work or residence authorization tied to a Polish employer, plus compliant contracts and payroll.

For business travel to the US of up to 90 days, Polish nationals usually use ESTA under the Visa Waiver Program (VWP), which requires an e-passport and a clean travel history. For longer stints – around six months – or when ESTA isn’t available, they apply for a B1/B2 employment visa. This covers meetings, conferences, brief training, and partnership discussions, but not long-term employment in the US.

A Polish EOR coordinates local work permits and supplies HR documents that support US travel applications (invitation letters, employment confirmations).

Fundamental Employee Rights in Poland

Poland’s Labour Code guarantees clear employee rights that every employer must respect: written terms of employment, equal treatment, safe working conditions, regulated working time and rest, paid leave, parental protections, due process in termination, data protection, and freedom of association. Building your policies around these guardrails keeps teams compliant from day one.

- Written employment terms. Employees must receive a written contract and key employment information in a timely manner.

- Equal treatment & anti-discrimination. Employees have the right to equal pay for equal work and protection from discrimination or harassment.

- Health & safety. Employers must ensure a safe workplace, provide mandatory training, and conduct risk assessments.

- Working time & rest. Daily and weekly limits, rest breaks, and weekly rest are guaranteed; overtime is regulated and compensated.

- Paid annual leave. Employees have a statutory right to paid vacation, with accrual and usage rules set by law.

- Sick and parental protections. Employees are entitled to sickness benefits and protected maternity/parental rights, including job protection during leave.

- Termination due process. Dismissals must follow legal grounds and written notice.

- Data protection & privacy. Personal data processing must follow GDPR principles.

Diversity, Equity, and Inclusion (DEI) Employment Policies

In Poland, DEI starts with hard law: equal treatment, anti-discrimination, and safe-work requirements under the Labour Code and EU rules. It also extends to company practice: fair hiring, accessible workplaces, and inclusive culture. An Employer of Record in Poland helps embed these standards in contracts, policies, and day-to-day HR so your software industry team stays compliant and competitive.

Polish and EU law prohibit discrimination in hiring, pay, promotion, and termination based on sex, age, disability, race/ethnicity, religion or belief, sexual orientation, fixed-term/part-time status, and union membership. Employers must prevent harassment, ensure equal pay for equal work, and provide reasonable accommodations for disability.

Use structured interviews, consistent scorecards, and job ads free of biased language. In the Polish market, publishing ranges and leveling increase trust and speed acceptance. A Polish Employer of Record operationalizes DEI by issuing compliant policies, tracking leave and accommodations correctly, applying equal-pay rules in payroll, and capturing the right documentation.

Employee Probation & Onboarding

In Poland, probation for full-time employees is typically set at up to 3 months, giving both sides time to confirm fit. Onboarding is structured and compliance-heavy: contracts, payroll data, social insurance (ZUS), OHS training, and pre-employment medical checks must be completed before day one.

Probation in Poland usually lasts for 1-3 months with clear feedback checkpoints with 30/60/90-day goals. Before day one, the paperwork is done: signed contract and key terms, GDPR/IT consents, pre-employment medical exam, and initial OHS/BHP training. HR also gathers payroll data and registers the hire with ZUS so contributions start in the first pay cycle.

On the start date, the employer provides equipment and access, confirms any remote-work policy, and kicks off a ramp plan (buddy, codebase walkthroughs, OKRs).

As the full-scale russian invasion escalated in Ukraine, Alcor helped Intel 471 relocate 20 developers to Poland and onboard them in just 4 weeks. We acted as the local employer, completed all compliance steps, and enabled a seamless handoff to their engineering leads – proof that EOR in Poland can turn urgency into orderly execution.

Employee Termination & Severance Package

In Poland, terminations must follow Labour Code rules on form, notice, and cause. Standard notice for indefinite or fixed-term contracts is 2 weeks, 1 month, or 3 months, depending on tenure. Unused vacation is paid out at exit. Severance package for employer-driven layoffs is typically 1-3 months’ pay and is capped at 15× the statutory minimum wage.

What engineering leaders usually ask: When can we cut scope mid‑notice?

Answer: You can release the employee earlier by mutual agreement, but you will still pay out the remainder and any unused PTO.

For indefinite and fixed-term employment, the legal notice is 2 weeks (<6 months’ service), 1 month (≥6 months), or 3 months (≥3 years). During probation, notice is shorter (3 business days, 1 week, or 2 weeks, depending on the probation length). Employers may place an employee on paid “garden leave” during notice.

If you dismiss for reasons not attributable to the employee (e.g., role liquidation) and your Polish operation employs at least 20 people, statutory severance applies: 1 month (<2 years’ service), 2 months (2-8 years), or 3 months (>8 years). The maximum is 15x the monthly minimum wage (about $17k at recent rates).

Employees are protected from dismissal during maternity/parental leave, with limited exceptions. Any unused paid annual leave must be cashed out at termination. Many employers align payout with the final payroll date to keep records clean.

Polish Corporate Culture Blueprint

Polish corporate culture blends European structure with pragmatic, delivery-oriented teamwork. Expect clear roles, punctuality, and documented decisions – tempered by collaborative problem-solving and strong engineering craftsmanship. Teams value trust, fairness, and steady communication cadence, which suits product work in the IT industry.

- Communication & decision-making. Meetings start on time and stick to agendas. Decisions are data-driven and documented.

- Leadership & management. Managers are expected to be prepared, specific, and fair. Public praise and private course-correction are appreciated.

- Work cadence & collaboration. Polish engineers favor deep-work blocks and well-run sprint rituals. Hybrid setups are common: office days are used for workshops, whiteboarding, and customer sessions, not status updates.

- Quality & compliance mindset. Security, documentation, and test coverage are taken seriously – helped by EU standards and mature local practice.

Interesting to know that Polish software developers are trusted for complex enterprise work. Poles also bring a calm, “play the next point” approach when incidents happen – exactly what you want in the final minutes of a release window.

Checklist for Choosing an EOR Provider in Poland

The right Employer of Record from Poland should make hiring fast, compliant, and predictable. Use this checklist to vet any Polish EOR on legal coverage, payroll accuracy, benefits administration, talent support, and transparent pricing – so your team scales smoothly in Warsaw, Kraków, Wrocław, or Gdańsk.

- Choose the offshoring destination wisely. Confirm the EOR’s real footprint in Poland (entity, local payroll, ZUS interfaces) and ability to operate across key hubs.

- Assess country remoteness & ops readiness. Check time-zone overlap, language support, and a practical onboarding checklist (contracts, OHS/medical, ZUS, GDPR, equipment) to ensure day-one readiness.

- Validate the tech talent market fit. Ask for current salary benchmarks, notice norms, and hiring lead times by role (e.g., senior backend, cloud, mobile). A strong Polish EOR brings market data, not guesses.

- Decide on an on-the-ground partner. Shortlist reputable EOR service providers in Poland, and require named Polish counsel/payroll accountants, sample employment templates, and proof of data protection. An EOR service partner in Poland, like Alcor, should pass a light vendor risk review.

If you’re growing a tech product team, a PEO model can be paired with a later entity or a Build‑Operate‑Transfer model in Poland.

- Clarify the scope of EOR services. Look for end-to-end coverage: employment contracts, payroll & taxes, benefits administration (NFZ + private health), expense policies, probation/termination support, and bilingual HR.

- Confirm the cooperation model & pricing. Prefer transparent, per-employee fees with itemized payroll, no hidden markups, and flexible terms.

Real Cases of Partnering With an Employer of Record in Poland

Alcor’s tech R&D center model blends three pillars: tech recruitment, Employer of Record services, and operational support – so you scale an owned, insource-ready tech team in Poland without standing up an entity. You get compliant employment contracts, payroll, benefits management, and optional office, procurement, and IT support – plus no buyouts or hidden markups if you later insource.

Since 2017, we’ve helped tech unicorns, leading startups, scale‑ups, and product firms expand to Eastern Europe and later in Latin America. Our team of 40 experienced IT headhunters hires in 2-6 weeks, our Employer of Record in Krakow, and other Poland’s strongest tech hubs like Warsaw or Wrocław, lets you get rid of operational headaches and focus on your tech product.

Why our model works for engineering leaders:

- All‑in‑one, not “brokered.” Big EORs say one‑stop shop, then hand you off to third parties. Alcor, on the other hand, runs the ops in one place with automation + human touch (your dedicated Customer Operations manager).

- Eastern Europe/LATAM‑native. We continuously analyze talent markets, economic signals, and regulatory changes across Eastern Europe and Latin America to steer you to the best fit.

- Customization over rigidity. No “my way or the highway.” We tailor our contractual framework to your interests and align it with compliance. No fine print.

- You get speed with compliance. Contracts, payroll, benefits, OHS/medical, and GDPR are ready on day one – we start hiring immediately.

- You avoid vendor lock‑in. Scale with EOR for IT in Poland now, insource later. No buyout fees.

Learn more about a Dedicated Development Team in Poland! Read our latest article.

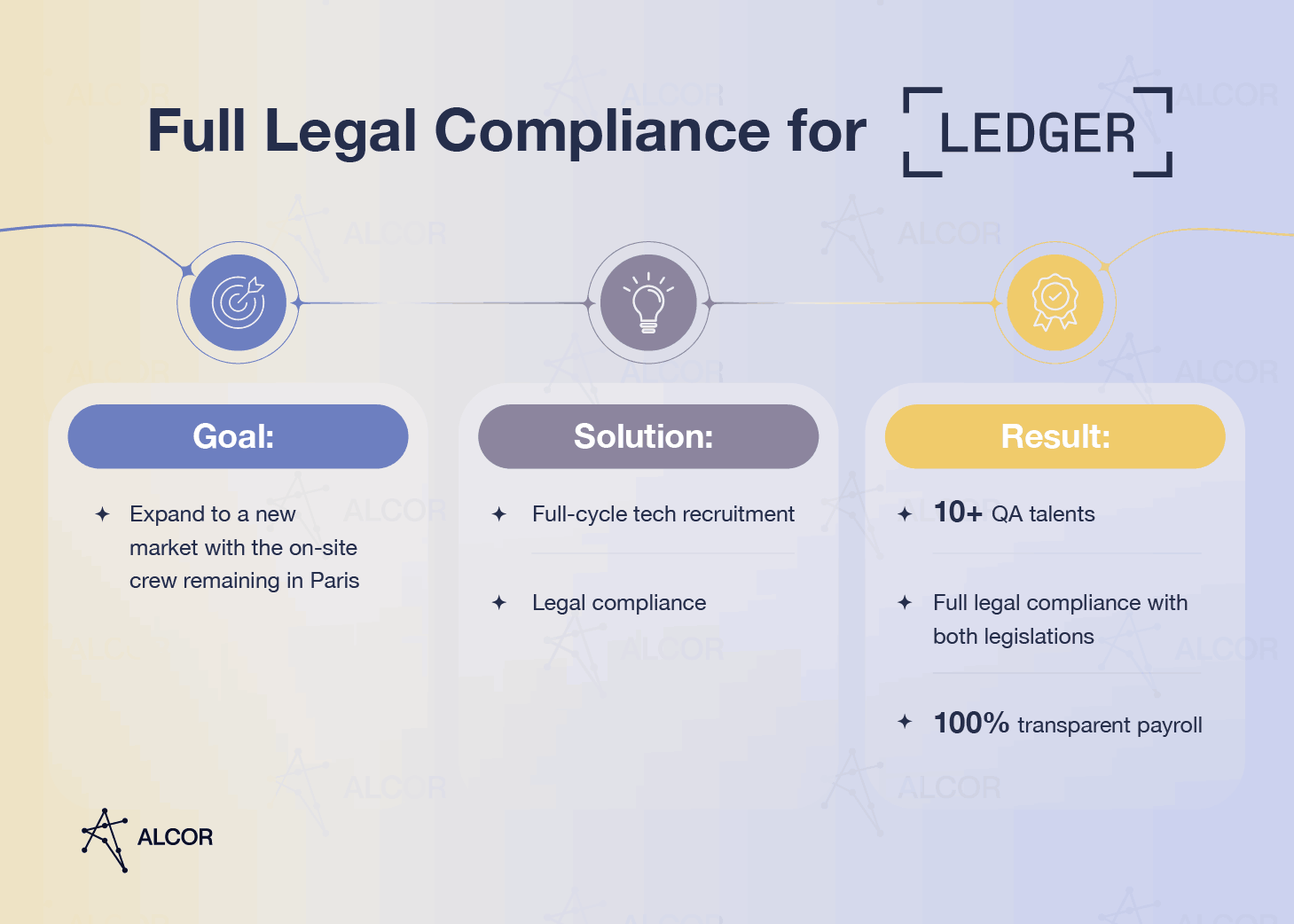

When you’re on the hook for shipping dates, you don’t need another vendor – you need a reliable, transparent partner. Alcor has already become the one for companies like Ledger, Dotmatics, and others. Here’s a quick proof:

- The crypto-security leader, Ledger, needed a compliant way to build test capacity fast in Eastern Europe. They turned to Alcor, and we acted as an EOR partner, issued compliant contracts, ran payroll and benefits, and delivered rapid recruitment sprints (including a first wave of senior QA in just 2 weeks). Result: an audit-ready team under Ledger’s workflows, with no vendor lock-in.

Dotmatics was also wowed by our services and transparency. They sought senior engineers with domain depth and enterprise practices, and Alcor combined targeted sourcing with EOR onboarding, standardizing GDPR, IP assignment, and security policies. Outcome: quick time-to-productivity, predictable payroll, and later, Dotmatics was acquired by Siemens. Worth noting that their engineers had their stock options later.

FAQ

How fast can I hire employees with an Employer of Record in Poland?

Typically, within days, if you already have vetted candidates. The EOR uses its Polish entity, contracts, payroll, and benefits templates, so you can issue offers immediately and start onboarding as soon as medical/OHS steps are done. Unlike standard EORs, Alcor also handles contingent tech recruitment end-to-end, filling roles in 2-6 weeks, with an average onboarding time of 10 days.

How does an Employer of Record help optimize payroll costs?

Base salary and statutory ZUS/PIT are the same by law. EORs remove entity setup, local payroll vendors, and ongoing compliance overhead, replacing them with a clear per-employee fee.

How does an Employer of Record in Poland reduce compliance risks?

EORs are the legal employer. They apply Labour Code rules, run ZUS/PIT correctly, manage remote-work and GDPR policies, and keep records audit-ready – lowering misclassification and filing risks.

What is the difference between EOR and PEO in practice?

EOR is the legal employer in Poland – it manages operations, while you manage day-to-day work. PEOs typically co-employ and still rely on your local entity. If you don’t have a local presence in Poland, consider choosing EOR.

Are layoff laws comparatively flexible in Poland?

They’re structured but workable. Notice depends on tenure (2 weeks/1 month/3 months), and statutory severance applies for employer-driven layoffs in larger employers. An EOR applies the correct process.

How does an EOR safeguard a client’s IP and confidential information?

Employees sign IP assignment, NDA, and security policies under Polish law. The EOR enforces these in contracts and onboarding, so IP vests in your company, and data handling follows GDPR.

What are the tax implications of using EOR vs hiring contractors in Poland?

With EOR (employment), payroll taxes are withheld monthly, and ZUS is remitted. With contractors (B2B), the company doesn’t run payroll taxes – contractors handle their own PIT/ZUS. COR (Сontractor of Record) can standardize B2B compliance.

Does Poland’s migration trend affect talent availability?

Yes. Poland’s large, diversified tech hubs (Warsaw, Kraków, Wrocław, Gdańsk) continue to attract regional and international engineers. An EOR helps you tap these pools quickly and compliantly.