The Latin American IT services market will gain more than $500 million by 2028. That momentum mirrors a broader push toward nearshoring – Capgemini reports executive investment rising from 42% in 2024 to 56% in 2025 – creating clear tailwinds for the software industry. To where? Well, you’ve already put two and two together!

I’m David Gomez, Lead IT Recruiter in LATAM at Alcor. Fear slow hiring, entity setup hurdles, or runaway attrition while scaling abroad? We fix that by:

- hiring Silicon Valley-caliber talent in 2-6 weeks, whom clients retain for 2.5+ years;

- handling payroll, benefits, and taxes for you;

- and delivering back-office support, such as office leases and procurements.

All of this is included in our turnkey tech R&D center solution in Mexico, Colombia, Chile, and Argentina. You scale fast, stay compliant, and keep your engineers focused on your tech product, while also saving up to 40% compared to tech outsourcing models.

In this article, you’ll see crucial stats on the dynamics of the ITSM market in Latin America, delve into its most prospective sectors, get the view of the opportunities & threats of the Latin American software industry, and top-tier LATAM destinations for running your IT business. Ready to see where the numbers point?

Key Takeaways

- LATAM’s ITSM engine is accelerating as cloud, AI, and managed services expand, with fintech leading momentum and Brazil and Mexico anchoring the region.

- The talent bench is deepening, with 2M+ developers, strong QS-ranked universities, and growing public-private upskilling pipelines across key hubs.

- Companies realize meaningful savings versus the US – often 40-60% for senior roles – while keeping nearshore time-zone overlap to speed delivery.

- Winning teams plan for realities such as scarce senior cloud/AI architects, uneven macro and infrastructure conditions, and complex regulation, then mitigate through multi-country footprints, cloud residency, managed security, and EOR-led compliance.

- Market selection matters: Mexico and Colombia suit scale and speed, Argentina fits deep-tech cores, Chile favors regulated and data-heavy builds, and Uruguay excels with senior English-first pods.

- Alcor combines recruitment, Employer of Record, and operations to build your owned tech R&D team, keep you compliant, and avoid vendor lock-in or buyouts – so you can insource on your terms.

Latin American ITSM Market Dynamics

The region’s IT services engine is accelerating as cloud-first programs, AI, and mature delivery models converge.

- Brazil, Mexico, Colombia, and Argentina anchor LATAM’s IT economy: Brazil sets the pace for South America’s IT services, while Mexico leads IT services outsourcing as the nearshore hub.

- Cloud build-outs, AI-driven modernization, and steadier venture activity are shifting workloads to managed services – fueling ITSM market growth.

- Enterprises and government are standardizing on hybrid cloud, data platforms, and security-as-a-service, and turning to specialists for delivery and compliance.

- IT outsourcing is the pragmatic lever for speed, compliance, and 24/5 coverage – pairing local cloud regions with specialist providers and extending US & EU engineering roadmaps toward a $126.3 billion LATAM outsourcing market by 2030.

The ITSM market in LATAM continues to expand due to genuine demand in the years following the global pandemic. Why is that so? As of 2025, the South American IT services market size is $83.38 billion. It’s forecasted to steadily grow at a 7.55% CAGR through 2030 to $119.8 billion, as cloud, data, and managed services underpin transformation across sectors. Mexico’s IT services market is worth mentioning – it is set to grow steadily at 4.4% CAGR and reach $20.04 billion by 2030, underscoring its status as the primary nearshore hub for US product teams.

Within the IT services market in LATAM, the regional forecast for IT outsourcing points up: Latin America’s IT services outsourcing revenue was $70.85 billion in 2024 and is on track for $126.3 billion by 2030, which is a significant growth at 10.1% CAGR. Brazil is becoming a leading IT outsourcing destination, with projected revenue of $9.55 billion by 2030. One of the indicators is a shift to cloud-native operations in healthcare and retail platforms, which we’ll cover in more detail below.

Another factor propelling the IT services market in LATAM is a rapid digital transformation. The market size is $107.23 billion in 2025, projected to reach $242.1 billion by 2030 (17.69% CAGR growth).

Venture signals also turned a corner of the IT services market in Latin America: 2024 VC investments rose 26% YoY, with Mexico and Argentina among the biggest winners. LAVCA’s 2025 report shows $4.5 billion across 751 deals in 2024 and a late-stage rebound in Q4. Leaders in the Latin American ITSM market – Amazon, Cisco, Google, IBM, Microsoft – are scaling cloud capacity that lowers latency and unlocks AI and analytics workloads. For example, Microsoft launched the Mexico Central Azure region, and Google Cloud opened its Querétaro region, giving enterprises and government workloads local options for regulated data.

Explore the latest insights shaping the ICT market in Colombia!

Latin American IT Industry Trends

The Latin American IT sector is increasingly setting the pace for software development in LATAM.

- US companies choose LATAM for IT outsourcing because proximity, cultural alignment, competitive costs, and deep talent pools make it a pragmatic nearshore choice.

- FinTech leads the region’s tech industry, with rails like Pix driving adoption and making payments-first the default stack.

- AI is shifting from pilots to platforms, powered by expanding cloud regions and rising enterprise budgets.

- Cybersecurity is now a priority in information technology and tech amid frequent attacks, pushing managed security and AI-assisted detection.

Healthtech momentum is building, with Brazil and Mexico anchoring hubs while new digital care, data, and hospital solutions scale across the region.

Fintech

FinTech remains the biggest sector in LATAM’s tech industry, with Brazil, Mexico, and Colombia concentrating 57% of the region’s fintechs. The region now has more than 450 million unique mobile subscribers, 5G is forecast to power a quarter of connections by 2027 and over half by 2030. That reach turns into revenue as wallets and instant-pay rails scale from a base where 70% of adults already pay digitally. This momentum keeps fueling e-commerce, remote work, and payments-first products across the software industry – a shift that continues to reshape the region’s digital landscape.

On the capital side, the software industry’s center of gravity is clear: according to LAVCA’s report analysis, fintech drew 61% of all VC dollars in 2024. Brazil, together with Mexico, captured 70% of regional VC, underlining where product and revenue innovation are compounding. Brazil is the operational hub, powered by Pix – now rolling out recurring payments – Pix Automático. Analysts expect it to add $30 billion in e-commerce flows within two years, widening access for consumers without cards.

Discover how Colombia and Brazil stack up in fintech and gain other valuable insights by comparing Colombia vs Brazil for tech nearshoring!

Artificial Intelligence

Statista confirms: Latin America’s AI IT market is scaling fast – from $11.82 billion in 2025 toward $47.88 billion by 2031, showing a 26.25% CAGR. Major enterprises are locking in budget: 92% of global executives plan to increase AI spending over the next three years, underscoring how AI/ML is becoming a core line item in IT portfolios. On the innovation front, Brazil and Mexico lead the region in AI patents, together accounting for about 95% of filings – evidence of a deepening IP pipeline and talent base.

Cloud

The public cloud market in LATAM is on a 14.3% CAGR trajectory to reach $29.2 billion by 2030, while hyperscalers like IBM, Google, and Microsoft are expanding their cloud infrastructure in the region. IaaS leads spend today, while PaaS is accelerating fastest as teams rebuild data pipelines and microservices. Brazil is expected to post the strongest growth among major markets, helped by expanding availability zones and rising enterprise migration.

Internet of Things

IoT is also the sensor layer feeding these models. GSMA projects 1.3 billion IoT connections in Latin America by the end of 2025, driven by manufacturing, utilities, and smart-city programs, broadening the data fabric that AI can analyze.

The stakes are high, leading to an increased focus on preparing AI-savvy software developers from Latin America to beef up IT services. Coursera’s 2025 report records a 425% surge in GenAI enrollments in Latin America, the fastest globally. Large-scale initiatives are also training developers at pace: Microsoft Brazil’s ConectAI targets 5 million learners in digital and AI skills.

Cybersecurity

With increased digital activity, there is a growing emphasis on cybersecurity. The World Bank reports Latin America and the Caribbean have been the fastest-growing regions for disclosed cyber incidents, with a 25% annual growth rate in the last decade – an uncomfortable mix that’s drastically reshaping the security landscape across the software industry.

Budgets and education are responding: according to IDC, global security spending will grow by 12.2% in 2025 as threats force organizations to adopt more advanced defenses. Spending is set to rise even more, reaching $377 billion in 2028. On the talent side, Coursera’s 2025 report shows cybersecurity course enrollments in Latin America surged by 106%, a sharp turn from the modest 1% YoY increase seen during the 2024 review period.

Healthtech

Healthtech reflects the grand trend of the Latin American IT industry: in 2024, investments in LATAM healthtechs grew by 37.6% to $253.7 million, with Brazil leading the market – evidence that capital is returning to quality teams and regulated use cases. The Digital Health market is also expected to show a revenue of $6.93 billion in 2025 and reach $9.33 billion in 2029. Costa Rica is also worth mentioning as a high-tech manufacturing hub, with medical devices now approximately 44% of goods exports, and claims of being #2 in LATAM for high-tech exports.

Within the regional healthcare startup landscape, Brazil and Mexico together host 78% of healthtech startups. Chile, Argentina, and Colombia are strengthening as innovation hubs – together representing 20% of the region’s healthtech companies – creating a deeper funnel for clinical, data, and infrastructure solutions across the region.

LATAM IT Market Opportunities and Threats

Latin America offers a compelling mix for the IT industry: investor-friendly entry points, a large, skilled talent pool, and meaningful cost advantages that accelerate product delivery. But the flip side is also real: senior cloud/AI talent can be scarce, macro and infrastructure conditions vary by market, and legal frameworks are intricate. The software industry wins by planning for these realities: diversifying locations, adopting cloud-first, security-led operations, and partnering with specialists like Alcor for EOR, compliant hiring, and fast, senior-grade recruitment.

Pro: Profitable investment & attractive valuation

Latin American equities still trade at notable discounts to US peers, creating attractive entry points for long-term exposure to the software industry and beyond. In the IT market in Latin America, major equity indexes trade around 11-12× forward earnings versus ~22× for the S&P 500, with dividend yields near 4%. In plain terms, investors pay less for each dollar of earnings and collect higher income. If profits keep improving across the IT industry, there’s room for both price gains and dividends to lift total returns.

Mid-2025 also brought a sharp sentiment shift: LATAM stocks are up 29% YTD, led by Colombia (+54%), with Mexico and Chile (+31%), and Brazil and Peru (+27%) – a rebound few were positioned for, but one with historical precedent.

Besides, Dealroom also tracks 9,000+ funded startups in LATAM and 60+ unicorns born in the region, signaling a mature startup ecosystem.

Pro: Prime code by skilled talent

The Latin American talent pool includes as many as 2+ million talented tech specialists. Following the latest IT market trends in AI, fintech, and cloud, 136 universities have broadened their scope of services and made it to the 2026 QS World University Rankings, continually feeding the software industry with 150K+ annual STEM graduates and research strength.

Strategic partnerships are also scaling the region’s potential: AWS’s new Mexico (Central) region pairs with the Ministry of Economy and leading universities (e.g., Tec de Monterrey, Universidad Panamericana) to expand cloud education at a national scale – evidence of tight industry-government-university alignment. Isn’t that encouraging for the IT market in LATAM? For more details, read on to our section about IT market destinations!

Level up your tech product with the prowess of software developers from Argentina!

Pro: 3 times lower costs

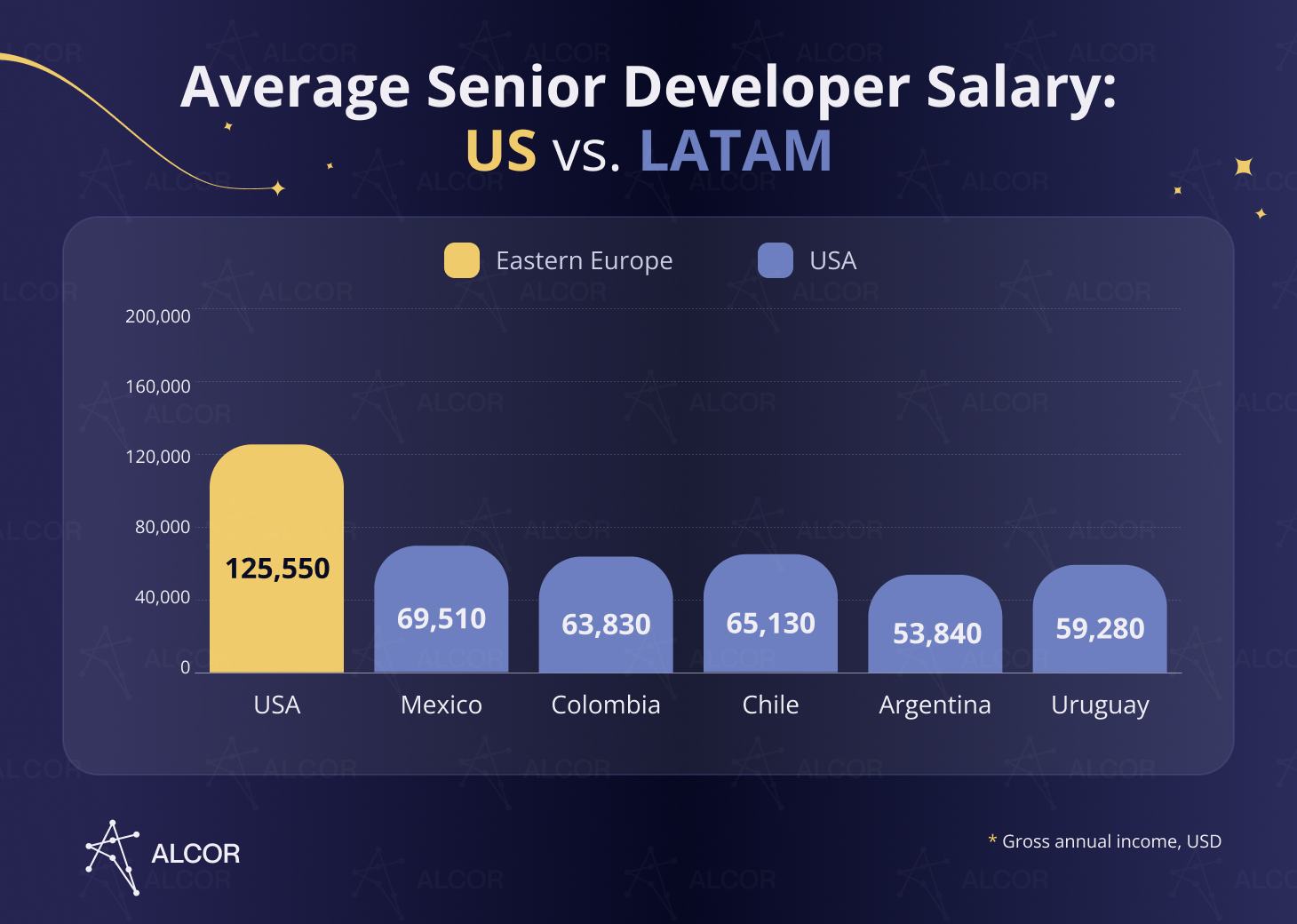

Latin American software engineers boast deep tech expertise; at the same time, they tend to be 2-3 times more affordable than their US IT Market counterparts for the same services. This cost gap is why many product companies staff remote software developers in Latin America for long-running feature work and platform ops. Look at the picture below to see the comparison between LATAM annual salaries and the US ones:

You can hire a senior AI engineer in Mexico for $84K, which is about 51% less than the $171K in the US. For a senior blockchain developer in Argentina, the gap is even bigger – $54K vs $156K, roughly 65% savings. Our IT research team compiled the full salary comparison below:

|

Position |

Senior Developer Gross Annual Income, USD |

||||

|

Mexico |

Colombia |

Chile |

Argentina |

USA |

|

|

AI Engineer |

84,600 |

69,000 |

75,000 |

70,200 |

171,600 |

|

ML Engineer |

79,800 |

75,000 |

75,000 |

62,400 |

132,000 |

|

Cloud Engineer |

79,800 |

54,000 |

64,800 |

63,000 |

146,400 |

|

Blockchain Developer |

79,800 |

78,000 |

78,000 |

54,000 |

156,600 |

|

Mobile App Developer |

76,200 |

79,200 |

76,200 |

60,000 |

165,000 |

|

DevOps Engineer |

78,600 |

72,000 |

67,800 |

60,600 |

145,200 |

|

Java Developer |

61,200 |

66,600 |

58,800 |

57,000 |

110,400 |

|

Python Developer |

60,000 |

79,800 |

75,000 |

51,600 |

132,000 |

|

Angular Developer |

61,200 |

55,200 |

55,200 |

48,000 |

120,000 |

|

.NET Developer/p> |

78,000 |

67,800 |

67,200 |

60,000 |

120,000 |

Con: Talent gap

Even with a strong base, our observation shows an obvious trend: senior cloud and AI architects are in short supply across LATAM. Most employers still struggle to find specialized skills: ManpowerGroup’s 2025 survey shows IT & Data is the hardest skill family to hire worldwide, and regional employer difficulty is high: Brazil 81%, Mexico 70%, Argentina 68%, Chile 60%, Colombia 59% report struggles to find the talent they need.

However, you can widen sourcing across Brazil, Mexico, Colombia, Argentina, and Chile and hire where the talent is via EOR. On our side, Alcor already has 253K pre-vetted candidates (the database is growing each year), and screens for the top-10% through rigorous tech assessments, runs searches with 40+ IT recruiters, and taps in-country networks to fill hard roles faster – so you get the right architect without slowing your roadmap.

Con: Macroeconomic volatility & infrastructure gaps

Latin America’s tech opportunity is real, but execution works best with a plan for uneven conditions across markets.

- Some countries, like Mexico, Argentina, Brazil, and Colombia, face currency swings, policy uncertainty, and sticky inflation that can affect investment timing and operating margins, according to the World Bank’s 2025 projections.

- Connectivity is improving, yet gaps remain: GSMA notes 2G/3G still account for over a third of connections in eight countries, and OECD highlights uneven broadband quality – so cloud-first rollouts and data-residency can be tricky. The outlook for 2026-2028 is positive, with substantial upgrades underway.

A practical playbook is to diversify across stable hubs, price contracts with FX and inflation clauses, pick cloud regions with local availability and residency options, and enforce zero-trust, encryption, and robust backups for regulated data. Alcor helps de-risk this plan with Employer of Record hiring, operational support, and setups without vendor lock-ins – plus payment in convenient (USD, EUR or other) currency with no exchange fees – so macro and infrastructure bumps don’t derail your roadmap.

Con: Legal complications

Undeniably, the Latin American software development industry is a tech-scaling magnet. However, legal matters in this IT market do pose a challenge. Issues may arise in the tax, employment, accounting, and payroll areas:

- Navigating LATAM’s complex regulatory patchwork is demanding: TMF Group’s GBCI 2025 places several LATAM markets among the world’s most complex – including Mexico #3, Colombia #5, and Brazil #6 worldwide. The friction spans HR/payroll, tax, and entity management, so local expertise materially reduces risk.

- Mexico is renowned for its pro-employee policy. When employing coders, you should know that they might have a 48-hour workweek, are entitled to a 2x salary for overtime, and have 8 annual paid public holidays and 12 days of paid vacation guaranteed after one year of work.

- Regarding software developers in Chile for hire, the company must give a notice prior to termination. Also, if you employ more than 25 programmers, 85% of them should be of Chilean nationality.

- Colombia has no treaty with the US to prevent double taxation. Hence, cooperation with a local provider of EOR in Latin America is a must.

Considering build-operate-transfer in Latin America? Compare BOT vs. owned R&D and see which scales cleaner

What can a seasoned provider do? Take the case of Franki. The LA-based experience app needed a senior mobile squad in Mexico – close to HQ, full team ownership, and no outsourcing lock-in. Alcor built a top-10%-of-market team for them and delivered 7 senior hires with an average time-to-hire of 4 weeks. Beyond recruiting, we ran Contractor of Record support, handled onboarding and PTO, kept pricing transparent, and even provided a free replacement when issues arose, which WOWed Franki. As a result, they scaled fast, with legal clarity and a reliable path to grow.

So, my tip is to aim for a Latin American IT staffing services provider with significant experience in the IT market and software industry legal aspects.

Top Latin American IT Destinations

Latin America is a prime nearshore choice for building and scaling product teams across Latin American tech hubs. Mexico offers scale and enterprise-ready hubs. Colombia excels in cloud and data platforms and secure customer apps. Argentina brings AI/ML and backend depth. Chile fits regulated, data-heavy builds. Uruguay delivers senior, English-first pods. In-demand skills span JavaScript, Java, Python, SQL, C++, TensorFlow, NLP, Node.js, and modern cloud APIs. This creates a dependable, culturally aligned, and cost-effective engine for your roadmap, from faster shipping to new R&D pods.

What’s a better way of breaking down LATAM’s software industry than looking at key players in its software development market? Let’s see the main IT market stats:

Mexico

- Talent pool: 800,000+

- IT businesses: 400 tech businesses and 1,137+ top startups

- Leading industries: mobile development and fintech

- Best for companies: US/EU product companies; enterprise nearshore hubs; fintech/e-commerce scale-ups

- Best for projects: 10-150+ engineers

- Most-prized tech skills: JavaScript, Java, Python, SQL, and C++

- The average annual salary in tech: $69,510

- Tech hubs: Mexico City, Monterrey, Guadalajara, and Mérida

Delve deeper into nearshore software outsourcing to Mexico!

Colombia

- Talent pool: 165,000+

- IT businesses: 11,000 tech businesses and 1,582+ top startups

- Leading industries: startup programming

- Best for companies: Cloud/data platforms; security-first teams; customer apps

- Best for projects: 10-80 engineers

- Most-prized tech skills: HTML/CSS, JavaScript, Python, Ruby, and SQL

- The average annual salary in tech: $63,830

- Tech hubs: Bogotá, Medellín, and Cali

Learn more about Colombia vs Costa Rica for nearshore technology outsourcing to make the right choice!

Argentina

- Talent pool: 150,000+

- IT businesses: 3,800 tech businesses and 741+ top startups

- Leading industries: database and mobile development

- Best for companies: Deep-tech R&D; AI/ML and backend specialists; product cores

- Best for projects: 5-40 engineers

- Most-prized tech skills: Python, TensorFlow, SQL, NLP, R, and Cloud APIs

- The average annual salary in tech: $53,840

- Tech hubs: Buenos Aires, Córdoba, and Rosario

Discover the pros of nearshore software outsourcing to Argentina!

Chile

- Talent pool: 100,000+

- IT businesses: 200 tech businesses and 588+ top startups

- Leading industries: data science, data analytics, and statistical programming

- Best for companies: Regulated industries; fintech/retail; utilities & telecom

- Best for projects: 5-30 engineers

- Most-prized tech skills: Java, Python, Node.js, Perl, PHP, and ASP.NET

- The average annual salary in tech: $65,130

- Tech hubs: Santiago, Valparaíso, and Concepción

Other tech hubs of LATAM include:

Brazil

- Talent pool: 763,000+

- IT businesses: 24,000 tech businesses and 3,115+ top startups

- Leading industries: fintech, e-commerce, payments

- Best for companies: US/EU product companies; fintech scale-ups; enterprise platforms

- Best for projects: 10-200 engineers

- Most-prized tech skills: Java, JavaScript/Node.js, Python, .NET, mobile developers

- The average annual salary in tech: $65,389

- Tech hubs: São Paulo, Belo Horizonte, Rio de Janeiro

Costa Rica

- Talent pool: 45,000+

- IT businesses: 1,200 tech businesses and 50+ top startups

- Leading industries: MedTech, fintech, edtech

- Best for companies: SaaS and enterprise support centers; high-seniority pods

- Best for projects: 5-30 engineers

- Most-prized tech skills: Java, JavaScript/TypeScript, Python, .NET

- The average annual salary in tech: $64,115

- Tech hubs: San José, Heredia, Alajuela

Uruguay

- Talent pool: 33,000+

- IT businesses: 530 tech businesses and 1,010+ top startups

- Leading industries: AI tech

- Best for companies: SaaS and gaming; high-seniority pods; English-first teams

- Best for projects: 5-25 engineers

- Most-prized tech skills: JavaScript languages and frameworks

- The average annual salary in tech: $59,280

- Tech hubs: Montevideo

Curious about LATAM powerhouses? Uncover the differences by comparing Colombia vs Uruguay for technology nearshoring!

Your Own Software Development Team from 10 to 100 in a year in LATAM

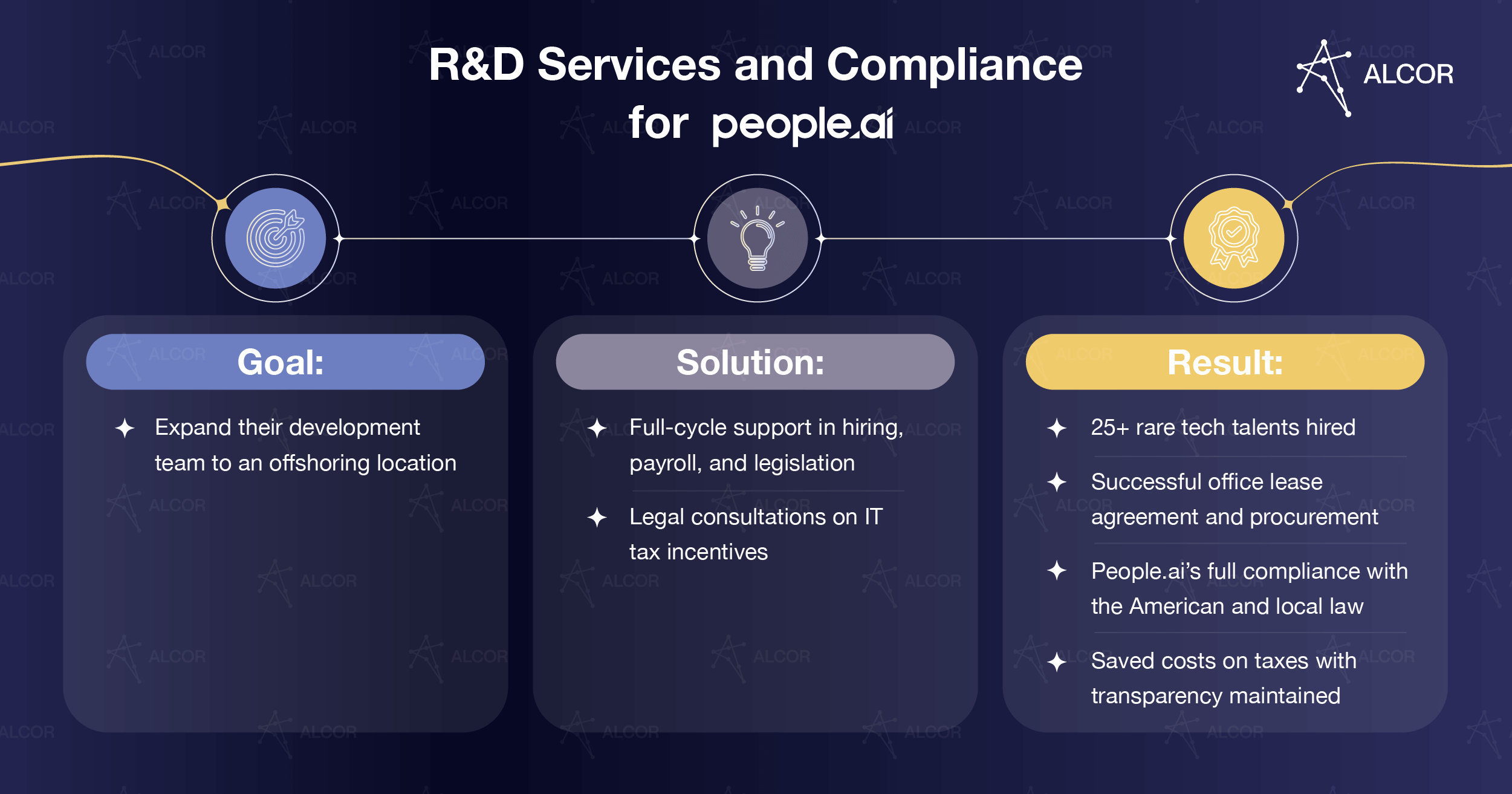

Alcor assembles your owned R&D team across hubs like Mexico, Colombia, Argentina, Chile, Uruguay, Poland, Romania, Bulgaria, and Ukraine. Our 40+ recruiters secure top talent fast, while EOR and full operational support keep you compliant and focused. As buyers shift to outcome-based models, clients like Sift and People.ai scale – and can later insource with no buyouts.

The roles that once clustered in Silicon Valley now live across LATAM and Eastern Europe. For the software industry, that means talented senior engineers are readily available at more affordable costs – without compromising quality or control. Alcor is your reliable partner in turning that access into outcomes by building your tech R&D team – fully owned, with no vendor lock-in – across such hubs as Mexico, Colombia, Argentina, Chile, Uruguay, Poland, Romania, Bulgaria, and Ukraine.

First, it’s recruitment expertise: our team of 40 headhunters hires tech IT industry gems with 15% offers accepted from the first CV, and also hires developers from Mexico and other LATAM countries. Next, we combine tech recruitment & EOR: no need to establish a legal entity, and we cover HR & payroll for you. Finally, we add the R&D center services layer – office leasing, equipment procurement, and IT infrastructure – so your leaders stay focused on product.

Want to know how Alcor’s R&D solution outperforms the BOT model for the IT industry? Check out our latest article and see which model brings better results.

This model matches how buyers are shifting. Deloitte reports that 67% of executives are moving from staff augmentation to outcome-based services, prioritizing skilled talent and agility alongside cost. Companies like Sift, BigCommerce, and Ledger reflect this shift by choosing owned, insource-ready teams. With Alcor, they hired the people, ran the operation, and now can insource on their terms – no hidden markups and no buyouts. One of our clients, People.ai, is a clear example: the hired engineers became part of their core team with no buyout required.