Latin American developers are making waves, with the software market projected to reach $23.5 billion in 2025! Fueled by a powerful 2-million talent pool, 49% cost efficiency, and strong expertise in AI, FinTech, and Cloud, Mexico, Argentina, and Colombia stand out as the region’s top tech hubs. But what’s the real secret of this not-so-hidden destination that can take your product to the next level?

I’m David Gomez, Lead IT Recruiter in LATAM at Alcor. With our software R&D center solution, tech companies scale their teams from 10 to 100 elite software engineers in a year. We provide the perfect mix of top-notch recruitment, full EOR coverage, and 100% operational support across Latin America and Eastern Europe – all with no legal entity needed!

By the end of this article, you’ll have a holistic picture of Latin America as a region for tech product development and know whether to expand there. Plus, you’ll be able to pick the optimal location and ideal cooperation model for your tech business.

Key Takeaways:

- Latin America is becoming a go-to nearshoring region for US companies, with its software market set to gain $14 billion in service experts in the mid-

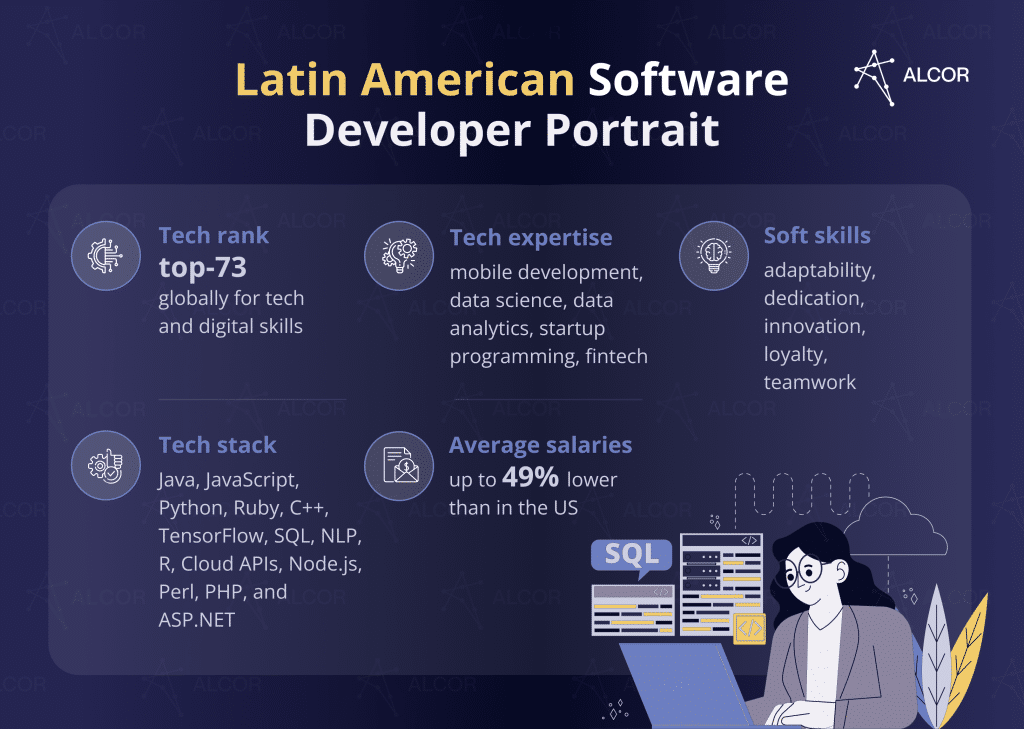

- LATAM developers excel at mobile development, data science, Java, and Python, with strong dedication, collaboration, and proactiveness.

- The annual developer employment cost in LATAM is about 53% lower than in the US.

- Mexico demonstrates the best combination of quantity, quality, and cost of tech talent, coupled with a business-friendly ecosystem.

- Labor laws, taxes, and cybersecurity are the main outsourcing challenges in LATAM. To prevent them, you need a mix of legal expertise, local market knowledge, and 100% protection of your IP rights. That’s why partnering with Alcor, a local R&D center services provider, is the most effective way to ensure hassle-free expansion.

Is Outsourcing to LATAM a Trend of 2026?

Outsourcing to Latin America is poised to be a major trend in 2026, fueled by rapid growth and investor confidence. The region’s software market will reach $16.3 billion in 2025, while outsourcing is projected to surpass $26 billion by 2029. In 2023, Latin America attracted $184.3 billion in FDI, highlighting its strong economic potential. Fintech has skyrocketed by 340% in six years, with over 3,000 companies, and Brazil, Mexico, and Colombia at the forefront. The region also boasts 9,000+ startups and 60 unicorns, securing billions in VC funding across São Paulo, Mexico City, and Buenos Aires. With accelerating digital transformation and adoption of AI, IoT, and cloud, LATAM is emerging as a leading global outsourcing hub.

Looks like it, as nearshore outsourcing is expected to add an annual $14 billion in service exports in Latin America and the Caribbean in the medium term. Looking ahead, it’s clear that becomes a strategic choice for tech leaders planning global expansion. Just see the figures:

- The South American software market is expected to reach $16.3 billion in 2025 and grow by an additional $4 billion over the next 4 years, indicating positive revenue dynamics.

- As for the revenue in the Latin American outsourcing market, it will surpass $26 billion by 2029.

- $184.3 billion of FDI entered Latin America and the Caribbean in 2023, proving foreign investors’ trust in the local economy and industry potential.

- Fintech dominates Latin America with 3,069 companies – a jaw-dropping 340% growth in just six years. Brazil, Mexico, and Colombia rule the region, accounting for a total of 57% of fintechs.

- LATAM houses over 9,000 startups, including 60 unicorns, which attracted $3.9 billion in VC investment in 2024. São Paulo, Mexico City, and Buenos Aires together received over $2 billion, while fintech led the way with $2.4 billion in investment.

- E-commerce unicorns have secured the top spot: Kavak from Mexico and Rappi from Colombia are the leading unicorns in LATAM.

- The region is famous for its high digital transformation potential and rapidly adopting software development trends such as cloud computing, AI, and IoT solutions. The stand-out LATAM countries in this regard are Mexico, Colombia, and Brazil.

Why Tech Companies Hire Latin American Developers?

Latin America is becoming a prime destination for tech companies thanks to its 2+ million developer pool and 220,000 annual STEM graduates. Countries like Mexico, Brazil, Argentina, Colombia, and Chile stand out with diverse expertise and faster hiring for niche roles. Developers excel in cloud computing, mobile apps, AI/ML, and fintech, supported by strong education and innovation programs. Another major benefit is cost efficiency: businesses can scale teams while keeping high quality. Nearshore advantages add to the appeal, with minimal time zone gaps, cultural affinity, and high English proficiency in leading hubs. Coupled with the growing motivation of LATAM engineers, these strengths make the region one of the most attractive spots to build dedicated software development teams.

#1 Abundant talent pool

Latin America has amassed a 2+ million pool of top talent. Mexico comes first with over 800K tech experts, followed by Brazil and Colombia with 540K and 165K, Argentina with 150K, and Chile with 66K.

Each year, 437 LATAM universities produce over 220K STEM graduates, thereby fostering the expertise of the local talent pool with diverse skill sets. For tech companies that embrace nearshoring, this means faster filling of in-demand roles and reduced time-to-hire of rare and niche developers.

#2 Most attractive tech hotspots

Mexico, Brazil, and Argentina are among the strongest tech hubs for software engineering. With 66% of US companies outsourcing – mainly in tech – it’s no surprise that Latin America’s IT outsourcing market hit $70.8 billion in 2024 and is projected to grow at a 10.1% CAGR through 2030, reaching $126.3 billion.

Next, I’ll dive into the key traits of developers from these countries and unveil the leading tech hubs that are becoming the go-to choice for companies seeking the perfect location to place their business – so stay tuned!

#3 Top tech expertise

Speaking of skills, Latin America boasts some of the brightest software engineers, with Brazil, Mexico, and Chile taking solid positions in the Coursera ranking for technology and data science expertise. It’s no surprise, as 24 Best Global Universities for Computer Science in LATAM and local initiatives like Mexico’s Codeacademy, Argentina’s 4.0 Program, and Chile’s Digital 2035 plan increase the tech-savviness of the local talent.

In addition, software developers in LATAM hold leading expertise in such as:

- Cloud computing: Driven by the expertise of local talent, LATAM’s public cloud market is set to grow at a 14.3% CAGR to $29.2 billion by 2030. This momentum also fuels the IoT sector, projected to exceed $45.6 billion by 2025, with Brazil, Argentina, and Colombia leading and Chile rising thanks to its strong digital infrastructure.

- Mobile app development: According to IMARC, the LATAM mobile development market hit $18.9 billion in 2024 and is projected to triple to $55.5 billion by 2033. Behind this momentum stand the expertise of regional talent, strengthened by better internet connectivity, rapid digitalization in fintech and e-commerce, and the spread of 5G. Brazil, Mexico, and Argentina lead the way in digital payments..

- AI and ML: Among the most advanced sectors in the region, with Mexico and Brazil accounting for nearly 95% of all AI patents filed in South America. Backed by top-notch expertise, the region is home to renowned AI laboratories such as Mexico’s GenAI Lab. At the same time, Chile has emerged as the leader in the Latin American Artificial Intelligence Index.

- FinTech solutions: The Latin American fintech software industry counts at least 2,482 companies, representing 22% of the global fintech landscape. Moreover, Statista estimates that in 2023, LATAM was home to 11,000 fintech startups. Brazil and Mexico dominate the fintech IT market, with Colombia, Argentina, and Chile following closely.

#3 Twice the team size, same cost

What if I told you that you can get high-quality software development at a 50% lower price? That’s possible with LATAM developers! Just compare annual salaries: a senior DevOps engineer in the US earns up to $138K, while the same tech expert in Latin America makes an average of $63K-$72K a year. That’s a $60K+ saving per developer – enough to scale your team even further, invest in innovation, or enhance your software product!

#4 Geographical proximity to the US

Thanks to geographical proximity, the nearshore software development process is hassle-free. The time zone difference amounts to 1-4 hours at most, while California-based tech companies can enjoy real-time cooperation by expanding their software development to Tijuana, Mexico. Result? Your team management will be a no-brainer.

#5 Cultural compatibility

Geographical closeness also adds another advantage – cultural affinity and similar working ethics with Western companies. Latin America’s best talent stands out for adaptability, dedication, loyalty, and appreciation of teamwork. Another trait that makes them similar to their American peers, according to the Country Comparison tool, is their strong motivation towards achievement and success, which drives consistent performance and long-term commitment to projects.

#6 Highly motivated talent

Did you know that the number of LATAM applicants for nearshore tech jobs increased by 370% during the last 4 years? Higher salaries, opportunities for career growth, and the possibility to work on high-tech projects draw LATAM developers to North American tech companies like bees to honey. For you, as a tech executive, it’s a perfect opportunity to bridge talent gaps and build a highly motivated and dedicated tech team that will elevate your software development to the next level.

#7 High English proficiency

According to the English Proficiency Index, the Latin American population overall demonstrates an intermediate-to-advanced level of English. While this might seem concerning at first glance, keep in mind that developers in the region’s main tech hubs typically have a much higher command of the language, thanks to decades of experience working with North American companies.

Latin American Developer Portrait

Latin America is home to versatile and highly skilled software developers with both technical depth and strong cultural traits. Mexican engineers excel in mobile, fintech, and data science, standing out for leadership, punctuality, and teamwork. Colombians excel in startups and JavaScript, thanks to their large developer hubs, and are valued for their adaptability, trust, and initiative. Chilean coders bring expertise in data science, analytics, and diverse programming languages, supported by high digital and English skills, while also being recognized for loyalty and communication. Argentina rounds out the picture with strong database, AI, and NLP knowledge, paired with creativity, innovation, and autonomy. Together, LATAM developers combine technical excellence with collaboration, making them a reliable choice for global expansion.

You’re probably wondering what it’s like to work with software developers from Latin America. Let’s dive into their hard & soft skills, tech stack, and cultural traits and see what they can bring to the table.

Mexico

In comparison with other developers from Latin America, coders from Mexico can be described thus:

- Experts in mobile development & fintech, plus JavaScript, Java, Python, SQL, and C++;

- Leaders in tech and data science – #2 in Central America;

- Prized for assertive and expressive communication, punctuality, and excellence-driven work ethic;

- Ranked # 6 in English proficiency in Central America;

- Excel in innovation as #3 in LATAM;

- Culturally famous for teamwork, collaboration, and continuous learning values.

Colombia

What about Colombia? Colombian developers are…

- Experts in startup programming, JavaScript, Python, Ruby, SQL, and HTML CSS;

- Leaders in JavaScript: Colombia has an entire hub with more than 3,000 members and regular JS-meetups in 8 cities;

- Prized for openness, superior time management skills, and adaptability;

- Ranked # 6 in English proficiency in South America;

- Excel in innovation as #3 in South America;

- Culturally famous for valuing trust, close-knit teams, and showing work initiative and dedication.

Chile

Chilean coders don’t lag behind:

- Experts in data science, data analytics & statistical programming, as well as Java, Python, Node.js, Perl, PHP, and ASP.NET;

- Leaders in digital skills and #6 in LATAM for English skills;

- Prized for flexibility, thirst for challenge, and smooth communication;

- Ranked #7 in English proficiency in LATAM;

- Excel in innovation as #2 in LATAM;

- Culturally famous for modesty, solidarity, and loyalty.

Argentina

Tech specialists from Argentina close the list with the following key characteristics:

- Experts in database & mobile development, plus Python, TensorFlow, SQL, NLP, R, and Cloud APIs;

- Holds #2 position in English proficiency in LATAM;

- Prized for autonomy, meticulousness to detail, and commitment to quality work;

- Ranked #2 in English proficiency in LATAM;

- Excel in innovation as #2 in LATAM;

- Culturally famous for innovation and creativity in their workplace environment.

Wondering which LATAM destination suits your business needs best? Keep reading to compare top locations with our tailored metrics!

Latin American vs US Developer Salary

When comparing developer salaries in Latin America and the US, the difference is striking. Senior engineers in the US can cost over $185K annually, while equally skilled LATAM professionals average around $88K, allowing companies to save more than 50% on labor expenses. Roles like AI/ML engineers, cloud specialists, and mobile developers are all significantly more affordable in Mexico, Colombia, Chile, and Argentina, without compromising on expertise. Beyond salaries, employers must also account for benefits, recruitment fees, and legal contributions, which are still much lower in LATAM than in the US. This cost advantage, combined with strong technical skills, makes Latin America a highly attractive destination for building efficient and competitive development teams.

Say you want to hire a software development team in Latin America, but which location is the most ideal cost-wise? Firstly, let’s take a quick look at senior developers’ wages.

|

Position |

Senior Developer Gross Annual Income, USD |

||||

|

USA |

Mexico |

Colombia |

Chile |

Argentina |

|

|

AI/ML Engineer |

151,800 |

84,600 |

72,000 |

75,000 |

66,300 |

|

Cloud Engineer |

146,400 |

79,800 |

54,000 |

64,800 |

63,000 |

|

Blockchain Developer |

156,600 |

79,800 |

78,000 |

78,000 |

54,000 |

|

Java Developer |

110,400 |

61,200 |

66,600 |

58,800 |

57,000 |

|

Python Developer |

132,000 |

60,000 |

79,800 |

75,000 |

51,600 |

|

C/C++ Developer |

114,000 |

75,000 |

57,600 |

54,000 |

57,600 |

|

Mobile App Developer |

165,000 |

54,000 |

79,200 |

76,200 |

60,000 |

|

Manual/Automation QA |

111,600 |

57,600 |

46,200 |

60,000 |

40,800 |

|

UI/UX Developer |

102,000 |

64,200 |

67,200 |

72,000 |

43,800 |

|

Product Manager |

120,000 |

69,000 |

57,000 |

64,800 |

66,600 |

As you can see, for the cost of one US-based engineer, you can build a stronger team by hiring two equally skilled software developers in Latin America. For instance, a sought-after AI or ML engineer will cost you only $66,300 in Argentina and $72,000 in Colombia. High-priced Cloud engineers, with a $146,000 price tag in the US, are only $79,800 in Mexico. Building a mobile app? The LATAM software developers, highly skilled in iOS, Android, and Xamarin, charge only $67,350 per year.

Knowing the annual salary rates is only the tip of the iceberg. To calculate the total labor expenses in Latin America, you need to add:

- employee benefits package, which typically includes health insurance, professional training, hardware, and corporate merchandise, totaling about $6,500 in LATAM and $15,500 in the US;

- recruitment fee, which is typically 20% of the gross annual salary for a senior developer in Latin America and 30% in the US.

Here is the comparison of the employment cost you need to hire LATAM developers vs American tech talent:

|

Senior Position |

Annual Developer Employment Cost, USD |

|

|

USA |

LATAM |

|

|

AI/ML Engineer |

212,740 |

99,278 |

|

Cloud Engineer |

205,720 |

88,585 |

|

Blockchain Developer |

218,980 |

97,427 |

|

Java Developer |

158,920 |

83,000 |

|

Python Developer |

187,000 |

90,173 |

|

C/C++ Developer |

163,600 |

83,222 |

|

Mobile App Developer |

229,900 |

98,000 |

|

Manual/Automation QA |

160,480 |

70,600 |

|

UI/UX Developer |

148,000 |

84,000 |

|

Product Manager |

171,400 |

87,350 |

|

Average |

185,674 |

88,163 |

With the average total cost for a senior software developer in the US exceeding $185,000 a year, you can cut your labor expenses by about 53% with LATAM software developers.

Other essential expenses that you, as an employer, should take into account are taxes and social contributions. Partnering with the local provider can take these calculations off your shoulders.

Challenges of Hiring LATAM Developers

Hiring developers in Latin America comes with several challenges that companies need to navigate. Data leakage is a major concern due to weak cybersecurity enforcement, making it crucial to secure IP rights in-house and choose cooperation models that minimize vendor involvement. Intricate taxes are another hurdle, as systems vary between traditional employment and B2B contracts, with differences in personal income and company tax rates. Although LATAM offers tax incentives for R&D investments, understanding these nuances is essential. Complex labor laws further complicate hiring, with varying regulations on working hours, PTO, and employee entitlements across countries like Mexico and Colombia. To avoid risks, businesses should rely on local legal expertise and compliant models to streamline operations while safeguarding intellectual property.

#1 Data leakage

Latin America has proven vulnerable to cybersecurity attacks due to the insufficient legal enforcement of corresponding measures. This poses a threat to your product’s core intellectual property. While Argentina, Brazil, Mexico, and Chile are adopting frameworks to guarantee data protection, it is better to stay vigilant if you hire developers in Latin America.

Ensure database security and encryption, and choose a cooperation model where you keep the IP rights within the company. For example, traditional IT outsourcing or IT staffing services in Latin America involve an external vendor that leases programmers to you. The chances of your sensitive data being exposed are much higher.

Pro tip: Consider alternative models like a software R&D center in LATAM, which allows you to hire coders directly into your team, keep your sensitive data on internal servers, and protect your IP.

#2 Intricate taxes

Latin American taxation is generally appealing to US technology companies. In Colombia, for example, tech businesses investing in R&D can receive a 30% tax credit for investing in innovation, while in Mexico, high-tech and R&D companies get immediate tax deductions of 56% to 89% on fixed asset investments.

At the same time, if you want to hire LATAM developers, you need to consider the tax difference between the two major employment contracts, such as traditional and B2B. How does that work? Take Mexican business taxes. For a software engineer employed on the FTE basis with an annual income of $60,000, the effective personal income tax rate amounts to around 27.8% of gross income (including PIT and employee social security contributions), while employers contribute an additional ~24% in social security and payroll taxes. When cooperating under the B2B model, there is only a PIT of 1% to 2.5%, which is covered by the contractor.

Pro tip: Look for providers with legal entities across LATAM to flexibly hire nearshore developers on an FTE or B2B basis – tailored to your needs. For instance, Alcor can employ programmers on FTE in Mexico and Colombia, while we hire contractors on B2B across the region.

#3 Complex labor laws

As labor landscapes differ across countries, you will inevitably stumble across differences in PTO, working hours, national holidays, etc. Before cooperating with LATAM software developers, study labor laws and weigh up all the risks. For instance:

- Mexican employees should work no more than 48 hours per week, have 7 paid public holidays, and are entitled to 10% of their annual taxable profits of the company (the pay distribution is based on the number of days worked and the employee’s salary).

- Colombian employees have a 48-hour work week and 15 days of consecutive leave after working for a company for a year. They are also entitled to Cesantía (or unemployment) interest, which is 12% of the cesantía payment.

Pro tip: Consult local experts who are well-versed in the intricacies. For instance, Alcor boasts a team of lawyers specializing in employment, labor, IP laws, tax obligations, and NDAs for tech. Our expertise in legal compliance has already saved the day for a US-based company, Franki, that was expanding in Mexico.

With Alcor’s tech R&D center solution, Franki:

- gained the ability to contract engineers on B2B terms with full compliance with Mexican legislation,

- enjoyed streamlined management of PTO, benefits, and bonus salaries.

- expanded its team with 5 senior Mobile Developers and 2 Quality Control Engineers through full-cycle recruitment, reaching an average time-to-hire of just 4 weeks.

- benefited from smooth hardware procurement, ensuring its new team was ready to perform from day one.

Your Own Software Development Team in Latin America Fast and Easy

With Alcor’s 360° software R&D center solution, you can set up a development office in Latin America in 2 months, on average. We handle A to Z tech hiring, delivering Silicon Valley-level talent with high approval and retention rates. Our EOR services ensure compliant employment without a local entity, covering payroll, taxes, and benefits in one place. Plus, we offer operational support, including office leasing, hardware, and employer branding, all of which are flexible and hassle-free. The outcome: a fully integrated team from day one, without hidden setup or buyout costs.

Looking to hire in Latin American countries? You’re in the right place! Alcor, a software R&D center accelerator, will pave the way to nearshore software development in Latin America with our 360° solution. What is in it for you?

- Tired of spending 6+ months to close a role? Get 30 Silicon Valley-caliber developers in LATAM in 3 months, 15% of whom will be hired from the 1st CV. Say bye to irrelevant candidates – 4 out of 5 developers that we present to clients are invited to interviews. Plus, you won’t have to replace them after onboarding, as 98.6% of our hires successfully pass probation.

- Had enough of legal headaches? Thanks to Alcor’s tech-oriented EOR services, you don’t need to open a legal entity, manage developer onboarding and offboarding on your own, or deal with local laws and taxes. Your team operates 100% legally and compliantly, while payroll, taxes, compliance, and benefits are all taken care of in one simple package.

- Looking for an extra provider for back-office support? Don’t worry, we’ve got it covered – whether it’s an office, hardware, or an employer branding boost. You can access full operational support whenever needed – flexible, hassle-free, and with no pre-payment.

Result: your fully backed and integrated development team from day 1 without any buyout or setup fees.

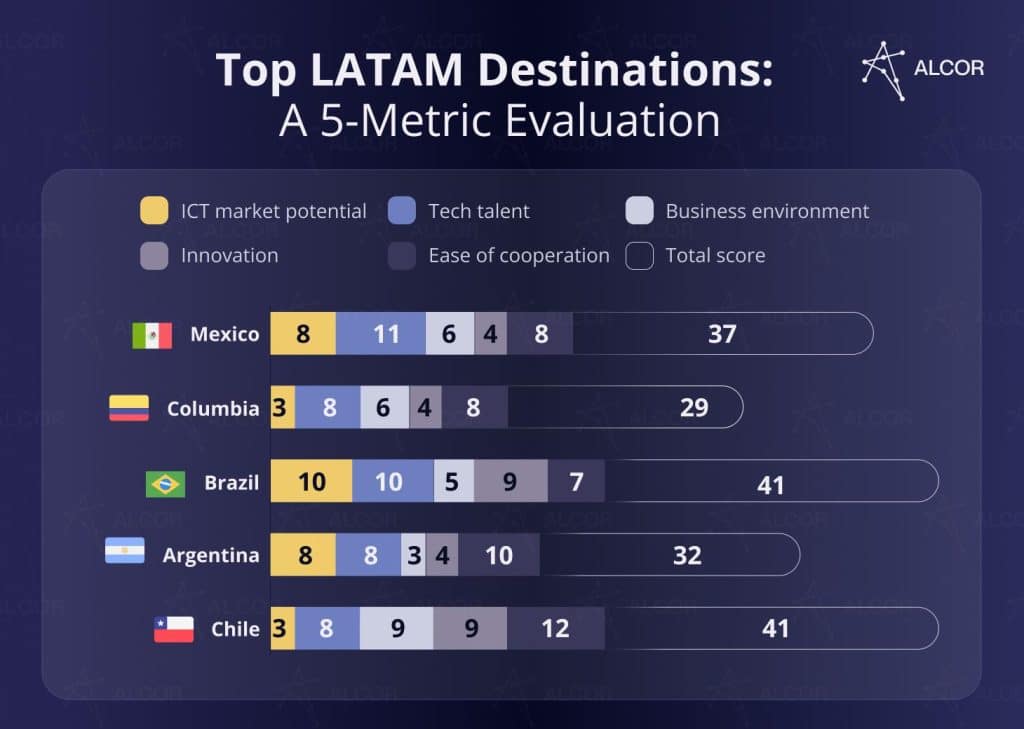

How to Choose the Top LATAM IT Outsourcing Destination

Choosing the best LATAM IT outsourcing destination requires a 360° view of ICT market potential, tech talent, business environment, innovation, and ease of cooperation. Mexico leads with its vast 800K developer pool and minimal time difference, while Colombia and Argentina balance cost-effectiveness and English skills despite bureaucratic hurdles. Chile offers innovation and stability, but it has a smaller talent base. In contrast, Brazil shines in the ICT scale, yet faces tough competition. Beyond country scores, regional hubs define LATAM’s tech scene: São Paulo excels in AI and fintech; Campinas grows as a fintech hotspot; Buenos Aires is a startup powerhouse; Guadalajara positions itself as Mexico’s Silicon Valley; Montevideo advances with Zonamerica park; and San José emerges as Costa Rica’s rising hub.

To identify the go-to nearshoring spot in Latin America, you need to conduct an in-depth market analysis. But don’t you worry; my team and I have crunched the numbers and done all the heavy lifting for you.

Here are the key metrics of our 360° market research:

- The market potential identifies the location’s appeal for foreign tech companies through two factors:

- IT services revenue forecast reflects the demand for software development,

- FDI shows how attractive the destination is to international investors.

- Tech talent is a full assessment of the local expert pool based on three main factors:

- Quantity – the size of the local talent pool.

- Quality – the level of tech expertise.

- Cost – salary savings for US tech companies hiring senior developers.

- Business environment reflects how welcoming the local scene is for expanding tech companies based on:

- Business climate identifies the location’s legal and economic reliability for foreign companies.

- Country risk is based on credit default swaps of the country, where the higher the CDS rate, the higher the perceived risk.

-

- Innovation level highlights the country’s technology capabilities through AI adoption and the Innovation Index.

- Ease of cooperation factors in the location’s Internet penetration, English proficiency, and time difference with California, the US state with the highest concentration of innovative companies.

|

Factors |

Mexico |

Colombia |

Brazil |

Argentina |

Chile |

|

|

ICT market potential |

IT services revenue |

$16.16bn 4 |

$2.33bn 1 |

$21.46bn 5 |

$3.31bn 3 |

$2.14bn 2 |

|

FDI |

$45.33 bn 4 |

$14.23 bn 2 |

$65.90 bn 5 |

$11.64 bn 3 |

$12.52 bn 1 |

|

|

8 |

3 |

10 |

6 |

3 |

||

|

Tech talent |

Pool size |

800 5 |

165 3 |

540 4 |

150 2 |

66 1 |

|

Tech rank in LATAM |

#3 4 |

#6 2 |

#2 5 |

#8 1 |

#4 3 |

|

|

Cost-effectiveness |

47% 2 |

50% 3 |

41% 1 |

52% 5 |

51% 4 |

|

|

11 |

8 |

10 |

8 |

8 |

||

|

Business environment |

Climate |

B 2 |

A4 3 |

A4 3 |

B 2 |

A3 4 |

|

Country risk |

4 |

3 |

2 |

1 |

5 |

|

|

6 |

6 |

5 |

3 |

9 |

||

|

Innovation |

Index in LATAM |

#3 3 |

#4 2 |

#1 5 |

#8 1 |

#2 4 |

|

AI adoption |

51.40 1 |

52.64 2 |

69.30 4 |

55.77 3 |

73.07 5 |

|

|

4 |

4 |

9 |

4 |

9 |

||

|

Ease of cooperation |

Time difference |

2 hours 5 |

2 hours 4 |

3 hours 2 |

5 hours 1 |

2-3 hours 3 |

|

Internet |

83% 2 |

76% 1 |

87% 3 |

88% 4 |

91% 5 |

|

|

English in LATAM |

#20 1 |

#17 3 |

#18 2 |

#2 5 |

#8 4 |

|

|

8 |

8 |

7 |

10 |

12 |

||

|

37 |

29 |

41 |

32 |

41 |

||

|

Sources: Statista, ECLAC, Coursera Global Skills Report, Coface, Country Risk, ILIA 2024, Global Innovation Index, Digital Transformation Report, English Proficiency Index, LATAM FDI |

||||||

*Our assessment is based on a scale from 1 to 5, where 1 stands for low performance and 5 describes the high performance of the location.

By applying these metrics,

- Mexico is a perfect fit for tech companies with ambitious staffing needs. With a pool of over 800K tech talent, you’ll find even the rarest talent. An appealing price-to-quality ratio, in combination with a friendly business environment and minimal time difference, will make your team expansion a breeze.

- Colombia and Argentina both have decent developer pools, with appealing cost-effectiveness and high English proficiency of the local talent. However, bureaucratic hurdles may complicate your business expansion, making local support a valuable asset for smoother operations.

- Chile is a promising tech market with the ideal business climate, ease of cooperation, and innovation. Still, its growing talent pool might slow down the scaling process for mid-sized and large tech companies, requiring strategic hiring support.

- Brazil, a well-established ICT market with access to a strong talent and innovation ecosystem, is frequently a top pick among US tech companies. However, fierce competition for talent and higher salary rates can be challenging for expanding tech startups and small businesses. Consider exploring less-heated LATAM destinations.

Having reviewed the main “rules of the game” for choosing your ideal outsourcing destination, I’ve prepared a ranking of the top tech hubs in the region that will become your go-to choice for scaling your business in LATAM.

Guadalajara, Mexico

Considered the Silicon Valley of Mexico, this tech hotspot is at the forefront of innovation, hosting the first generative AI lab, G.A.I.L., in Mexico and Latin America. Thanks to the Federal Government’s Guadalajara Creative City initiative, the city is positioning itself as a future digital media powerhouse.

Hub at a Glance:

- Startup ecosystem rating: #3 in Mexico, #3 in Central America

- Startups: 111

- Top in: Fintech, AI

- Top universities: ITESO, Universidad de Guadalajara, and Universidad Autónoma de Guadalajara

Buenos Aires, Argentina

Buenos Aires stands out as one of LATAM’s top 5 tech hubs, bringing together world-class engineers, strong English proficiency, and cutting-edge software expertise. It’s also the birthplace of Argentina’s and 58% of all local startups.

Hub at a Glance:

- Startup ecosystem rating: #1 in Argentina, #3 in South America

- Startups: 434

- Top in: E-commerce, Fintech

- Top universities: University of Buenos Aires, National Technological University, Buenos Aires Institute of Technology

San José, Costa Rica

San José, the nation’s tech capital, is rapidly emerging as one of LATAM’s must-watch hubs. Fueled by a new generation of talented professionals, the city thrives in Computer & Communications Hardware, Software, and Semiconductors – its top employment sectors.

Hub at a Glance:

- Startup ecosystem rating: #1 in Costa Rica, #6 in Central America

- Startups: 31

- Top in: Fintech

- Top universities: University of Costa Rica, University of Medical Sciences, Costa Rica, Latin American University of Science and Technology

Montevideo, Uruguay

Ranked among the in ITU America’s Global Cybersecurity Index and positioning itself as one of the most advanced in the region, the city hosts Zonamerica – the country’s leading technology park, bringing together numerous multinational firms, top-notch specialists, and the nation’s best tech expertise.

Hub at a Glance:

- Startup ecosystem rating: #1 in Uruguay, #12 in Central America

- Startups: 88

- Top in: E-commerce & Retail

- Top universities: University of the Republic, University of Montevideo, Catholic University of Uruguay

São Paulo, Brazil

Combining innovation, diverse talent, and dense startup activity, this Brazilian tech hub is renowned for its Artificial Intelligence, Agtech, and digital infrastructure sectors. It is also home to Sistema Paulista de Ambientes de Inovação (SPAI), a program that currently counts 57 accredited organizations and propels the country’s progress in technology and research.

Hub at a Glance:

- Startup ecosystem rating: #1 in Brazil, #1 in South America

- Startups: 1,477

- Top in: Fintech, E-commerce

- Top universities: University of São Paulo, São Paulo State University, Federal University of São Paulo

Campinas Metropolitan Region, Brazil

This growing tech powerhouse is known for several facts: it has its own unicorn, QuintoRadar, boasts two industrial parks, CIATEC I and II, which host numerous innovative companies and startups, and serves as a hotspot for tech engineers renowned for their fintech expertise.

Hub at a Glance:

- Startup ecosystem rating: #8 in Brazil, #16 in South America

- Startups: 28

- Top in: Fintech, E-commerce

- Top universities: University of Campinas, Pontifical Catholic University of Campinas

What Else to Consider When Hiring LATAM Devepers

When hiring developers in Latin America, it’s important to evaluate the pros and cons of each model. EOR manages payroll, compliance, and benefits, but lacks deep market expertise, which can expose companies to risks. Tech recruitment covers full-cycle hiring with access to RPO, headhunting, and talent insights, yet typically requires opening a legal entity and juggling multiple providers. A tech R&D center merges the best of both, adding office setup, equipment procurement, and back-office support – making it the most comprehensive solution. To find the right provider, focus on tech specialization, proven track record, compliance expertise, and dedicated in-country support to ensure seamless expansion.

How to Hire Latin American Developers

Once you’ve chosen the location, it’s time to hire developers. But what is the best way to nearshore software development? Should you outsource? Resort to staff augmentation in LATAM? Or go with ? Whatever your plans, I can suggest more optimal alternatives.

The main concerns about outsourcing and staff augmentation are possible IP issues, low team dedication, and their short-term nature. The long-term models of EOR, IT recruitment, and a tech R&D center imply hiring programmers directly and thus contribute to closer cooperation and higher loyalty. As a bonus, you retain complete control over your foreign team, development, and expenses.

Global EOR, or Employer of Record, involves an agency that hires software engineers you have already found on your behalf and manages payroll, legal compliance, onboarding/offboarding, and employee benefits. The tricky part about international EOR is that it doesn’t have a deep market or industry orientation, which can expose your company to compliance risks.

With tech recruitment, you get a full-cycle hiring of tech experts, from candidate searching and screening to interviews, offer negotiations, and onboarding. You can also access RPO services, headhunting, executive search, as well as developer salary and talent insights. However, most agencies don’t handle employment, compliance, and payroll, so you would have to open a legal entity abroad and juggle multiple providers.

Finally, a tech R&D center takes the best from tech recruitment and EOR and. It goes even beyond, offering your own office abroad with office lease management, equipment procurement, and other back-office support. In the case of People.ai, the R&D solution fits like a glove. With Alcor, the company got 25+ elite developers

How to Choose Your Provider

While you can follow Clutch ratings, there are a few other tips for you to find a perfect provider match:

- Prioritize market & tech specialization

Consider service providers specializing in hiring software developers and managing compliance, payroll, and back-office operations in Latin America, specifically for tech product companies. One-size-fits-all vendors will only waste your time and money.

- Check track record & client testimonials

A consistent stack of client praise speaks for itself. While reading the reviews, pay attention to comments about responsiveness, attention to detail, willingness to meet the client halfway, and readiness to go the extra mile. For instance, 93% of CTOs are satisfied with Alcor’s tech R&D center services. Check what one of them says:

- Compliance is a must

Every Latin American country has its own legal peculiarities, and compliance is key when expanding abroad. Make sure your local partner has a local legal entity and a solid legal team to keep your business fully compliant and risk-free.

Alcor’s tech-savvy lawyers provide full compliance with local and foreign laws. They mitigate risks concerning worker misclassification, social security, and tax obligations, providing clients with a solid legal shield in LATAM.

- Find out if they have Customer Operations support

When expanding to Latin America, receiving in-country support is crucial. Ensure your partner provides dedicated account managers to support your team and keep operations running seamlessly.

Alcor’s team of Dedicated Customer Success Managers is always ready to give you a helping hand, ensuring the stress-free expansion of your tech business to Latin America.

Ready to build your development team in LATAM? Fill out the form below, and let’s start your expansion journey!