Outsourcing to Latin America is an increasingly popular option for North American tech businesses due to its large and skilled talent pool, cost-effectiveness, time zone, and cultural alignment. Powered by emerging technologies like 5G, blockchain, AR, AI, RPA, and steady digital demand, Latin America and the Caribbean recorded a 27% rise in services exports, signaling stronger demand for IT exports and nearshore delivery.

I’m David Gomez, Lead IT Recruiter in LATAM at Alcor. With our tech R&D center solution, we address three expansion obstacles of product tech companies:

- In-house hiring that drags on for months,

- Vendor outsourcing that blurs quality,

- A legal maze of multi-country payroll, taxes, and IP.

We recruit, act as your Employer of Record, and provide full operational support in LATAM and EE, so you can scale offshore or nearshore teams from 10 to 100 Silicon Valley-caliber devs in a year. Plus, you keep direct control, all while saving up to 40% compared to IT outsourcing models.

In this article, you’ll get the region’s tech growth facts, its advantages, challenges, tips to avoid risks, and a clear EE-vs-LATAM comparison. Plus, you’ll discover which LATAM country delivers the best mix of talent depth, cost, and time-zone fit – and a safer, more effective cooperation model to scale your business.

Key Takeaways:

- With over 2 million developers, Latin America offers a wide spectrum of skills in fintech, AI, cloud, and analytics. Countries like Mexico, Argentina, and Colombia are home to both large talent pools and specialized tech expertise, while Chile is #1 in innovation and AI speed.

- Senior software engineers in Latin America earn about half of what their US counterparts make. This creates an opportunity for tech companies to cut costs by up to 50% while still working with highly skilled professionals across various IT domains.

- Geographic proximity to the US, minimal time zone differences, and cultural alignment make Latin America a nearshore powerhouse. This ensures real-time collaboration, smoother communication, and better project delivery compared to offshore destinations in Asia.

- Eastern Europe and Latin America show comparable growth and sizable engineering bases; pick a location based on your needs, skill sets, and business preferences.

- Instead of vendor dependency, Alcor builds your own R&D team, with zero buyout fees, no need for a legal entity, and up to 40% savings compared to outsourcing.

Is Latin America the Fastest Growing IT Outsourcing Destination?

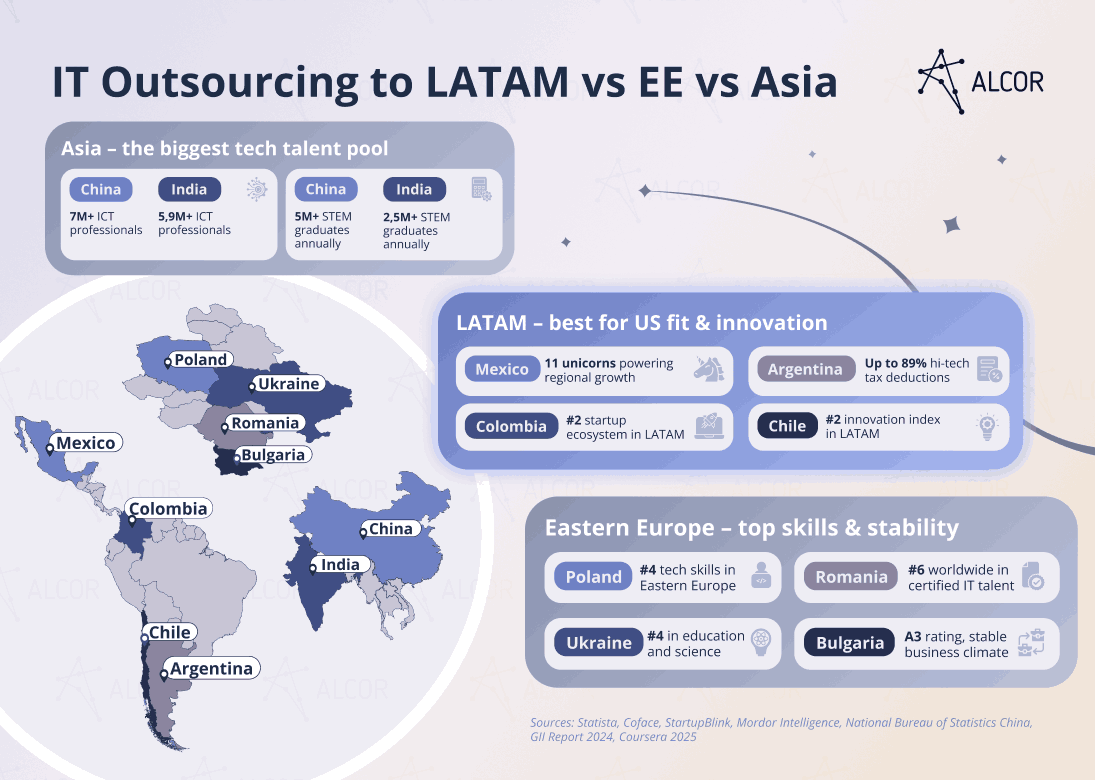

When it comes to tech outsourcing, Asia still leads in market size and workforce availability, especially China and India. For many US tech product teams, however, time zone proximity and cultural similarity push decisions toward Latin America and Eastern Europe, where day-to-day delivery, skills signals, and governance often fit better. The right choice depends on your volume needs, work style, and risk profile.

According to Statista, Asia remains one of the biggest tech outsourcing markets, with 2025 revenue projected to reach $126.9 billion. But trade-offs matter for US tech product companies:

- In India, uneven coding proficiency and widespread multitasking can reduce focus and code quality on complex builds.

- In China, intellectual property protections are less predictable than in the US, and the 12-13 hour time difference makes real-time collaboration challenging, which slows feedback and product delivery.

These factors don’t erase Asia’s strengths; yet, they explain why many tech leaders explore alternatives in Latin America or Eastern Europe when speed, control, and everyday coordination are top priorities.

Eastern Europe brings strong tech and English proficiency, as well as GDPR compliance, which suits regulated builds and client-facing roles. South America & Mexico offer an appealing price-to-quality ratio and real-time cooperation. The region also shows the fastest growth in GenAI learning, while startup funding is rebounding with active fintech deal flow, strengthening nearshore pipelines as a reason to outsource to Latin America.

On the whole, outsourcing from South America and Mexico is a booming trend, but you are probably curious about…

Benefits of Outsourcing to LATAM

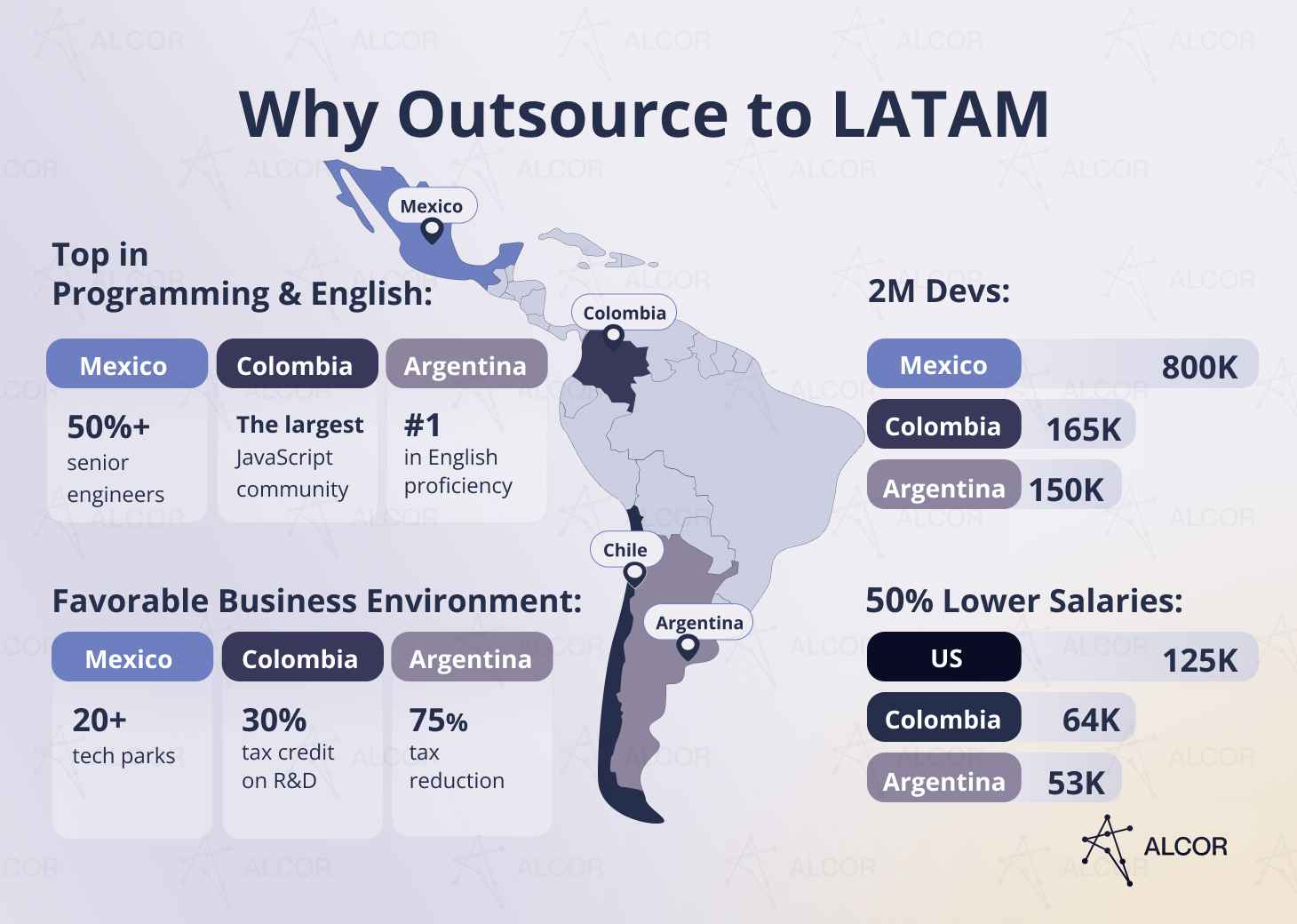

Latin America offers a large and skilled talent pool – about 2 million developers – with Mexico leading and strong depth across Brazil, Argentina, Colombia, and Chile. Senior and C-level salaries are often roughly half US levels, freeing the budget for the software product. Country strengths span data science, JavaScript at scale, AI and analytics, and enterprise delivery, supported by innovation parks and pro-tech policies. Nearshoring adds real-time overlap, bilingual teams, and cultural affinity, which speeds decisions and reduces handoffs. For many US companies, outsourced engineering in LATAM delivers faster execution and stable quality without the long-distance friction of far-shore models.

Vast talent pool

IT outsourcing in Latin America is gaining momentum thanks to the sheer number of developers – around 2 million and counting, with Mexico leading at 800K tech experts. Brazil comes second with 630K software engineers, while Argentina and Colombia boast 150K and 165K programmers, respectively. This deep, skilled workforce makes outsourcing to LATAM attractive for US-based enterprises that need reliable delivery, strong collaboration, and bilingual (EN/ES) teams across the IT industry and adjacent support sectors.

Competitive salaries

One of the benefits of IT outsourcing to Latin America is clear cost-effectiveness: if you hire Latin American developers, you can save up to 55%, which you can redirect toward your ambitious projects and product development. For instance, in Mexico and Argentina, a senior AI specialist typically costs $84,600 and $70,200, while in the US, the same candidate profile ranges from $160,800 to $182,000.

The rates for C-level positions are also more affordable: CTOs and CIOs in the US tech market will cost you around $212,000, whereas in LATAM, the average rate is $122,700. To get more insights into salaries across different LATAM countries, keep reading – my team has prepared a full table of rates for the most in-demand positions.

Impressive tech expertise

Heavy investment in tech education and the growing digital economy have made IT outsourcing to LATAM highly competitive on the global stage.

- Mexico: Mexican developers are ranked 3rd in Central America for tech and 2nd for data science skills. The country itself is LATAM’s 2nd largest fintech ecosystem, making the choice of Mexico for software development outsourcing in any area practically a winning game.

- Colombia: #2 in LATAM for startup ecosystem index, and what sets Colombia apart: it has one of the largest JavaScript communities in Latin America. Moreover, the country ranks #9 in overall technology skills in South America, excelling in operating systems and computer networking.

- Argentina: IT outsourcing to Argentina offers excellent mobile development, data analytics, and AI development, as the country ranks 3rd in the region for AI policy implementation. Moreover, thanks to government-led CESSI internships, its devs graduate fully ready for the job market.

- Chile: outsourcing software development to Chile guarantees expertise in PHP, Angular, and other languages and frameworks. Moreover, Chile is #4 in tech and #3 in data science fields in LATAM.

Cultural affinity

Latin American teams work in business cultures that feel familiar to US product organizations – direct communication, high responsiveness, and shared expectations around ownership and deadlines. Bilingual talent makes client-facing roles smoother, from product management and QA to support and DevOps. Collaboration habits also line up: agile ceremonies, documentation standards, and Jira-style workflows are common across major hubs. Proximity helps too – short flights for onsite kickoffs and quarterly planning build trust without long downtime.

Combined with near-matching workdays, outsourcing to Latin America cuts back-and-forth, reduces rework, and speeds decisions. The result is less friction in day-to-day delivery and a cleaner path from requirement to release, especially for teams that iterate rapidly and ship frequently.

Developed tech network

Outsourcing to South America & Mexico opens the door to robust ecosystems with real government support and investor confidence:

- Mexico’s 20+ innovation parks and well-established government-led incentives, such as 500 Startups LATAM and Fondo Nacional Emprendedor;

- Colombia’s innovative tech hubs, with its city Medellín dubbed the “Silicon Valley of Latin America”;

- Argentina’s Knowledge Economy lets startups convert up to 70% of employer payroll charges into a 24-month tax credit, plus reduce income tax on promoted activities.

Geographical and time zone proximity

What makes US companies choose Latin America for outsourcing is the nearshoring advantage: just 1-4 hours’ difference with major LATAM tech hubs. Mexico operates in GMT-6, Argentina in GMT-3, and Colombia in GMT-5 (aligned with New York, Washington, Florida, Virginia).

This proximity enables real-time collaboration, faster decision-making, and fewer handoffs than many APAC setups. Combined with cultural affinity and strong English/Spanish fluency, IT outsourcing to Latin America improves velocity, quality, and stakeholder alignment. This ultimately leads to faster and better product development.

As a result, companies that outsource to Latin America gain a competitive edge over longer-distance models in Asia, especially when political and economic risk management, IP, and regulation compliance matter.

Better Than Outsourcing to Latin America

To fully leverage the advantages of the Latin American market, outsourcing might not be enough to fuel your growth. Deloitte’s 2024 Global Outsourcing Survey shows a clear shift: 70% of executives have insourced previously outsourced scope in the last five years, and 78% now leverage Global In-house Centers (GICs).

But what’s the alternative? A tech R&D center – your ultimate solution to outsourcing headaches and a perfect way to expand to LATAM seamlessly under full in-country support!

At Alcor, we follow a 360-degree approach to building software development centers for our clients, which includes:

- Tech recruitment, sourcing and hiring the top-10% of talent who integrate smoothly into your team and corporate culture.

- EOR in Latin America with full regulatory compliance, payroll, and tax management to keep you free from legal risks in a new market.

- Operational support, including office leasing, hardware procurement, and, if needed, employer branding.

And all of this with zero buyout costs and up to 40% cost savings compared to traditional outsourcing.

Top Locations for Tech Outsourcing

Below, I’ll give you a comprehensive view of the 6 top locations for your IT outsourcing in Latin America: what each does best, where it’s weaker, top hubs, signals from reputable rankings, and what it takes to enter these markets. Use this to pick the right nearshore fit for your roadmap.

Mexico

- Strengths: Largest tech talent pool; strong IT sector; US proximity; fast-growing digital economy

- Best for: Nearshore product squads, fintech/data, embedded/IoT

- Challenges: Complex tax and compliance; competition for talent in major hubs

- Entity setup hurdles: Bureaucracy, notary process, plus tax and social security registrations

- Payroll tax & SSC: 32-50% of salary (SSC varies by salary/risk) + 15-day aguinaldo + state payroll tax up to 4%

- Top tech hubs: Mexico City, Guadalajara, Monterrey, Tijuana

Franki needed a Mexico-based mobile team fast. Alcor hired top-10% engineers and ran full EOR, including B2B contracts, payroll, and onboarding, so they could expand without opening an entity.

Colombia

- Strengths: High availability of tech talent; active business incentives

- Best for: Modern web/JS, platform/SRE, bilingual engineering and support

- Challenges: Extra payroll charges and local taxes add to total cost

- Entity setup hurdles: Chamber registration, tax ID, banking, and labor registrations; documentation and local reporting is a must

- Payroll tax & SSC: 38-47% (pension, health, ARL ≈ 30-39% + 13th month 8.33%)

- Top tech hubs: Bogotá, Medellín, Cali

Argentina

- Strengths: In-demand IT services; strong English proficiency in LATAM

- Best for: AI/data, analytics, mobile, complex back-end builds

- Challenges: Currency and payment regulations volatility

- Entity setup hurdles: Public registry and tax authority steps, bank onboarding, and FX rules require planning

- Payroll tax & SSC: 32-35% (employer SSC ≈ 24-26.4% + 13th month 8.33%)

- Top tech hubs: Buenos Aires, Córdoba, Mendoza

Chile

- Strengths: Economic stability; focus on innovation and tech advancement

- Best for: Regulated enterprise delivery, data engineering, governance-heavy work

- Challenges: Smaller talent pool than larger markets

- Entity setup hurdles: Clear but formal incorporation; select the right tax regime and complete required filings

- Payroll tax & SSC: 5-7% (unemployment 2.4% + SIS/work-risk ≈ 2.8–4%); no mandatory 13th month

- Top tech hubs: Santiago, Valparaíso, Concepción

Brazil

- Strengths: Large tech workforce; advanced fintech and e-commerce ecosystem

- Best for: Large-scale programs, fintech, mobile, consumer apps, leadership depth

- Challenges: Complex labor regulations; competition for talent; high dev salaries

- Entity setup hurdles: Multiple federal, state, and municipal registrations; permits and compliance reviews extend timelines

- Payroll tax & SSC: 43-45% (INSS/FGTS/RAT ≈ 35-37% + 13th month 8.33%)

- Top tech hubs: São Paulo, Rio de Janeiro, Belo Horizonte

Costa Rica

- Strengths: Stable politics; known for top-tier customer support proficiency

- Best for: Bilingual CX/IT, security/compliance work, shared services

- Challenges: Developing tech talent pool; high dev salaries

- Entity setup hurdles: National Registry and tax steps; FTZ setup is available but requires ongoing reporting

- Payroll tax & SSC: 35% (employer SSC ≈ 26.5-27% + 13th month 8.33%)

- Top tech hubs: San José, Heredia, Alajuela

Latin America’s nearshore grid gives IT outsourcing in Latin America a rare mix of real-time overlap, senior talent, and predictable delivery across fintech, web, cloud, and analytics. Independent benchmarks align: Kearney’s GSLI also places Brazil in the global top five and Mexico in the top 10 for services attractiveness, while WIPO’s GII and EF’s English Index show Chile and Argentina strong on innovation and English readiness, and Costa Rica notable for shared-services maturity and cybersecurity commitment.

What to Consider Before Outsourcing to Latin America

Before you pick a location, plan for the friction points. Start by nailing the project scope and required expertise so your outsourcing to South America plan maps cleanly to team shape, stack, and budget. I’m glad to provide a short checklist to help keep timelines and budgets on track.

Entity setup and lead time

You’re ready to hire, but paperwork stalls the kickoff. Business incorporation, tax IDs, banking, and social-security registrations take time – plus local legal and regulatory frameworks vary by country. Use an EOR to start in weeks, then convert to your own corporation when scale makes sense or a deeper partnership is justified.

Payroll, benefits, and compliance

PTO, benefits, and severance rules differ by country. Clear contracts and a dependable payroll process prevent surprises for employer and employee – and protect your reputation in competitive markets.

Taxes and incentives complexity

Headline rates look simple until you add withholdings, local levies, and incentive conditions. Map the tax footprint early with your finance and legal teams and confirm eligibility for programs like IMMEX or FTZ, so savings are real, not theoretical.

English proficiency differences

English can vary by city and role. Match the level of real-time communication you need to destinations with proven fluency – and support it with shared routines that reinforce cultural fit.

Talent competition in hotspots

Top hubs move quickly. If offers lag, candidates move on. Decide faster, and show your engineering culture so people see a future with your product – not just a paycheck.

Data security and IP

Protect both the code and the idea. Standardize non-disclosure and IP agreements, limit access by role, and ensure the country’s data privacy regime aligns with your obligations from day one.

Vendor management and quality

If you add a vendor, keep ownership. Set outcomes tied to the project requirements, code standards, and regular reviews up front – so your scaling and digital transformation stay on track and in your hands.

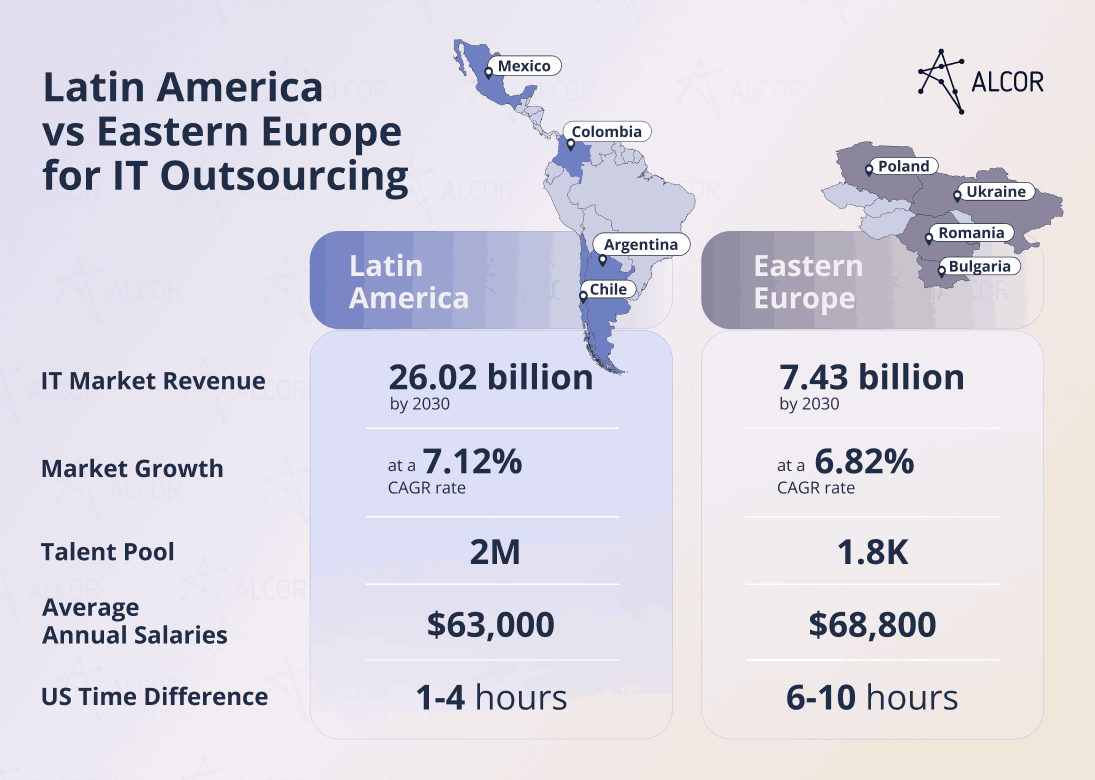

Latin America vs Eastern Europe for IT Outsourcing

Latin America and Eastern Europe both stand out as strong IT outsourcing destinations, offering large pools of skilled software engineers, solid technical education, and moderate salaries. While Eastern Europe often leads in English proficiency, Latin America provides strong cultural alignment and growing nearshoring benefits for US companies. Both regions supply highly trained workers across diverse tech stacks, from AI and data science to web and cloud.

Market growth

Eastern Europe, in terms of rapid and consistent growth, mirrors the Latin American software outsourcing market. Their projected CAGR for 2025-2030 rates are quite similar – 6.82% against 7.12%. As for the tech outsourcing market revenue projections, the Eastern European amount will reach up to $7.43 billion by 2030, while the Latin American one will grow to more than $26.02 billion.

Talent pool & skills

- The number of software engineers in Eastern Europe is also comparable to the pool of software developers in Latin America. The total number of software engineers in the region reached 1.3 million in 2023, and today, this figure has grown to 1.8 million – on par with Latin America. As of 2025, Poland houses 650K professionals, Ukraine – 302K, Romania – 250K, and Bulgaria – 116K of tech experts.

- While tech professionals from Latin America are proficient in .Net, Java, Ruby, Python, C++, C#, React, and Node.js, Eastern European software engineers excel in JavaScript, TypeScript, PHP, HTML, Swift, as well as Python and C++. Notably, both regions have decent scores in Coursera tech skill tests.

Tech education

In terms of technical education, both regions boast high-class universities in QS World University Rankings – 133, with 120K+ STEM graduates annually for Eastern Europe and 437, with 150K+ STEM graduates for Latin America & the Caribbean. Some of the most well-known higher institutions in Eastern Europe include Warsaw University of Technology, Czech Technical University in Prague, National Technical University of Ukraine, Slovak University of Technology in Bratislava, and others.

In the meantime, Latin America hosts such prominent universities as Universidad Nacional Autónoma de México, Tecnológico de Monterrey, Universidad de Buenos Aires, and Pontificia Universidad Católica de Chile, annually supplying the local tech market with 186,200 STEM graduates and providing the world with access to fresh software developers from Latin America.

English skills

Notably, Eastern Europe scores better in terms of English proficiency. For instance, Poland, Romania, Bulgaria, Hungary, and Slovakia are in the global top 20. On the other hand, developers in Latin America are proficient enough to undertake software development projects. For instance, Argentina, Uruguay, and Costa Rica boast the highest levels of English fluency, with Argentina being #2 in Latin America.

Average Salaries

Here’s a quick overview of average annual salaries for senior programming positions in Eastern Europe and Latin America.

|

Position |

Gross Annual Income, USD | |||

| Latin America | ||||

| Mexico | Argentina | Colombia | Chile | |

| Python Developer | 60,000 | 51,600 | 79,800 | 75,000 |

| Java Developer | 61,200 | 57,000 | 66,600 | 58,800 |

| Data Science Engineer | 78,000 | 60,600 | 75,000 | 75,000 |

| DevOps Developer | 78,600 | 60,600 | 72,000 | 67,800 |

| Cloud Engineer | 79,800 | 63,000 | 54,000 | 64,800 |

| Position | Gross Annual Income, USD | |||

| Eastern Europe | ||||

| Poland | Romania | Bulgaria | Ukraine | |

| Python Developer | 81,600 | 81,000 | 72,000 | 51,600 |

| Java Developer | 81,000 | 81,600 | 72,000 | 69,000 |

|

Data Science Engineer |

82,800 | 57,000 | 51,600 | 51,600 |

| DevOps Developer | 87,000 | 81,600 | 72,000 | 72,000 |

| Cloud Engineer | 81,000 | 84,000 | 69,600 | 69,600 |

As shown in the table, the average salary in Eastern Europe is slightly higher than in Latin America – $68K against $63K. Also, consider the annual employment cost: for a single senior developer in the US, it hits around $178,600/year, including salary, benefits package, and a recruitment fee. Compare that to $87,500 in Eastern Europe or $85,700 in LATAM – a savings of nearly 49-53%.

Also, while in Eastern Europe, the highest salaries are paid in Poland, in Latin America, this position is reserved for the senior software engineer salary in Mexico, whereas the lowest salaries can be found in Colombia and Argentina.

In conclusion, while both regions offer cost-saving opportunities, outsourcing software development to a team from Latin America may be a smarter, budget-friendly strategy.

How to Overcome Potential Risks

Nearshoring unlocks speed and savings, but risk management must lead the plan. Treat outsourcing to South America like any regulated rollout: design security and compliance up front, pick the right operating model (EOR or entity), and rely on local expertise to stay audit-ready.

Data protection issues

In 2024, the global average cost of a data breach in organizations reached $4.4 million. Weaker security protocols, accessing data from unauthorized networks, or low cybersecurity awareness can put your company at risk. At the same time, in any nearshore technology, data security comes first both for your product and clients.

Solution: Mitigate the risks

If you have your mind set on outsourcing software development to South America & Mexico, think of protecting digital assets beforehand. I’d also suggest incorporating data security policies into your onboarding so that your software engineering team is informed about all preventative and maintenance measures for data protection.

Need for local help

Managing Latin American tech outsourcing alone is an uphill battle. Here’s why:

- Reason 1: Complex labor laws;

- Reason 2: Confusing taxation;

- Reason 3: Time-consuming payroll;

- Reason 4: Critical operational aspects.

You’ll have to deal with local differences, whether outsourcing to Chile, Colombia, or Mexico. While it’s possible to completely outsource these processes, the fees will inevitably soar. The reason for this is that you’ll have to hope multiple outsourcing agencies, facing markups, possible hidden fees, and vendor management issues. This may undermine your compliance and prolong market entry, affecting your product development.

Solution: Find a Trusted Provider

If you decide to outsource to Latin America and need to process payroll, ensure compliance, or rent an office, but are not ready to manage these ops yourself or juggle multiple vendors, opt for a remote provider. This way, you’ll be able to negotiate expenses depending on your needs when software outsourcing to Latin America. I’ll elaborate on how to approach your search below.

How to Choose an IT Outsourcing Provider

When selecting a provider for IT outsourcing in LATAM, demand proof, not promises. Shortlist partners that offer audited compliance, IP-safe contracts, clear SLAs, and a transparent hiring process. Then, validate with references from similar stacks, seniority mixes, and markets.

Reliability

Nothing beats a proven track record when you’re searching for an experienced provider to outsource software development to Latin America. Look out for case studies and evidence of consistently great performance. This way, you’ll be able to rely on the company’s promises.

Excellent reviews

Client reviews will give you more insights into the provider’s communication and approach to cooperation. One of the most reputable resources is Clutch, but you can also check out the company’s website.

Speed & efficiency

When it comes to outsourcing software developers from Latin America or other regions, recruitment speed is undoubtedly important, and so is overall efficiency. Ideally, you’d want a fully operating team within a short time frame and without the need to replace new hires. The time to hire depends on the specific skill set, location, and employer branding of your company in the chosen market.

Why Outsource to Latin America with Alcor

We are a trusted, all-in-one R&D accelerator in Latin America and Eastern Europe. Our offer is better than simply software outsourcing from South America – not only does it guarantee a loyal team of professional devs, but it also incurs no buyout fees and is oriented toward long-term partnership.

We combine three pillars – tech recruitment, Employer of Record, and operational support – to deliver predictable scale.

But that’s not all – we bring together all three powerful elements mentioned above:

- Alcor is reliable: Alcor’s track record was precisely what compelled Sift, a US online fraud detection company, to start its cooperation with us. The client had a goal to set up a remote branch in Eastern Europe and hire 30 developers in a year. Our skilled IT researchers undertook this ambitious task and even closed the position of the Head of R&D from the second CV. As a result, Sift got 30 top-notch programmers and a fully legally compliant office in Eastern Europe.

- Alcor is results-driven: Alcor’s 40 recruiters usually “wow” our clients with their speed – just recently, we staffed 6 Full-Stack Engineers in 6 weeks for GoTransverse, a cloud-based software company. We also provided EOR services and managed procurement and tech infrastructure setup.

- Alcor is trusted: With an average rating of 5 out of 5 on Clutch and a client retention rate of 99% in 2025, we’ve proven our ability to deliver results consistently. But what do our clients say about working with Alcor? Here’s a glimpse:

If you’re interested in extending your software development teams, opening R&D offices, or technical staffing in LATAM, feel free to contact us for more information.

References on Software Development Outsourcing to Latin America

- Statista

- Deloitte

- Demandsage

- Janco Associates

- Digitaldefynd

- CESSI

- Coursera Global Skills Report 2024

- Global Startup Ecosystem Index Report 2025

- EF English Proficiency Index

- IBM

- Reuters

- ConnectAmericas