The tech industry of the tech hubs in Latin America – Mexico City, Monterrey, Guadalajara, Bogotá, Medellín, Cali, Buenos Aires, Córdoba, and Santiago – is growing, and I can prove it.

Fact #1: The local software market is projected to reach $28.8 billion by 2029.

Fact #2: The FinTech industry has grown by 340%.

Fact #3: A 2+ million tech talent pool is available.

Fact #4: Over 7,800 startups are driving innovation across the region.

What are the drivers of this growth? Talented LATAM software developers, 50% and higher cost savings compared to the US, and many other factors, so tech product companies grow and scale fast.

I’m David Gomez, Lead IT Recruiter in LATAM at Alcor, your tech R&D accelerator. If you’re a product tech company looking to scale without setting up a local legal entity, we’ve got you covered. With our 360° solution, we recruit elite tech talent, handle 100% compliance, and build your software R&D center from 10 to 100 engineers in a year.

In this article, you’ll go through the details about the top Latin American hubs for software product development, get the stats regarding their tech ecosystems, uncover the salaries of local developers, and learn how tech firms hire in Latin America.

Key Takeaways

- The tech industry in LATAM’s major hubs is booming, with AI, edge computing, and 5G leading the way – 30% of companies in the region already deploy AI, and the cloud market is set to hit $18.7 billion by 2027.

- The full employment cost of a senior programmer in LATAM is still 52–56% lower than in the US, even with fees, benefits, and bonuses included.

- Alcor’s all-in-one R&D model combines tech recruitment, Employer of Record (EOR), and 360° operational support. Thus, you get an elite LATAM tech team under your brand without a Silicon Valley price tag.

Top Tech Hubs in Latin America for 2026

The future looks bright for tech in Latin America. In 2025, the local IT services market is projected to hit $59.7 billion, while the region’s data center market is set to double by 2030, growing at a rapid 12.22% CAGR. With national AI strategies like the Mexican National Alliance for Artificial Intelligence, the Argentinian National Plan of Artificial Intelligence, and the Colombian National Artificial Intelligence Policy in place, Latin American tech is laying the groundwork for innovation that’s ethical, inclusive, and investment-worthy.

According to the Deloitte Tech Trends 2024 report, there are three macro and three micro forces driving the IT sphere. The major trends center around interaction, information, and computation. They, in turn, cover the soaring realms of digital engagement, machine learning, data analytics, and cloud. The minor IT trends include the business of technology, cyber and trust, and core modernization.

In plain terms? The Latin American tech industry is stepping into its prime with AI, edge computing, and 5G as the main characters. As of 2025, 87% of LATAM startups have adopted AI solutions, while only 3% report no plans to implement them. Technavio claims the cloud market in the region is expected to reach $18.7 billion by 2027. As for 5G, tech in Latin America is actively adopting this solution – Brazil, Chile, and Uruguay will have 77%, 68%, and 65% 5G coverage by 2030.

To map out the most promising LATAM tech hubs, I’ve factored in the IT trends of the region outlined above, the Global Startup Ecosystem Index 2024, plus packed in more stats. You’ll get a sharp overview of LATAM software development by city. No fluff, just the facts and opportunities that matter.

Mexico

Mexico is doubling down on innovation with national programs and over 20 tech parks, including Apodaca Technology Park, Creative Digital City, Guadalajara Software Center, and Monterrey Technology Park. And while the Trump administration’s 25% tariffs hit imports from Mexico, there’s a silver lining for tech: digital services aren’t affected. So, if you plan to set up a remote R&D center or hire developers in Latin America, Mexico is a place to consider. Btw, you can always consult a local Employer of Record service provider on this matter.

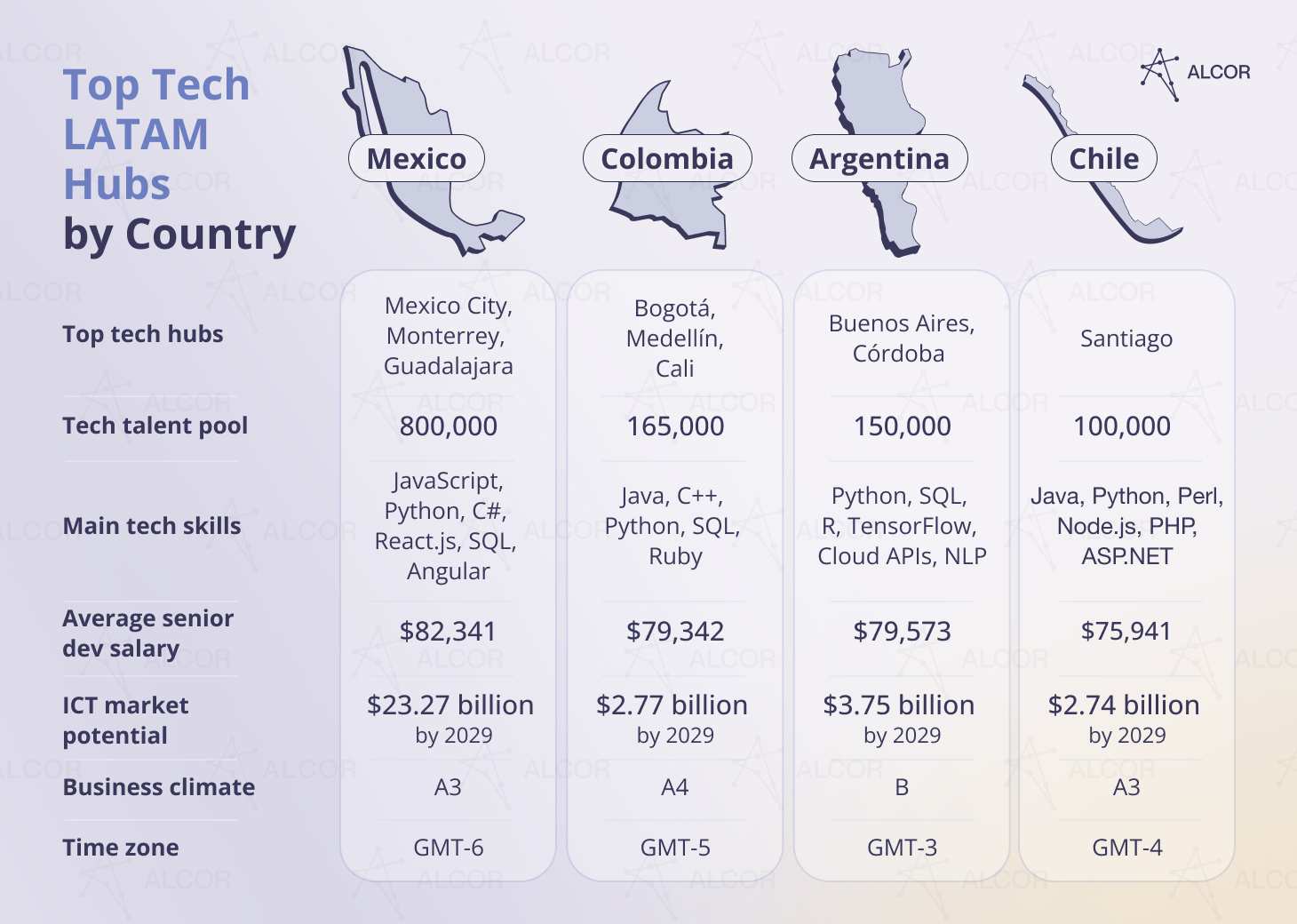

With 800,000+ programmers and a #3 ranking in LATAM for tech skills, Mexico isn’t just in the race – it’s setting the pace in the region. Let’s kick things off in its biggest tech hub, Mexico City.

Mexico City

Mexico houses 11 unicorns, and most of them trace their roots back to Mexico City. With 353 startups and 300,000+ tech experts, the city now hosts the biggest tech talent pool in all of LATAM, beating out São Paulo for the top spot. In fact, Mexico City produces 50% more tech graduates than Brazil’s top market.

Here’s the gist:

- Startup ecosystem rating: 1st in Mexico, 1st in Central America

- Startups: 553

- Top in: Fintech

- Top universities: the National Autonomous University of Mexico and the National Polytechnic Institute

Monterrey

Monterrey ranks second in Mexico’s tech scene. With over 100 innovation parks and 320+ companies, the city has become a magnet for venture capital, accounting for 25.5% of all new VC-backed startups in Latin America. Located in Nuevo León, one of Mexico’s top six regions for tech education, Monterrey is home to the Tecnológico de Monterrey and its cutting-edge, AI-powered learning ecosystem. And when it comes to nearshoring, this city leads the way. Over 70% of Mexico’s foreign direct investment tied to nearshoring now flows directly into Nuevo León, with Monterrey at its core.

Here’s more:

- Startup ecosystem rating: 2nd in Mexico, 2nd in Central America

- Startups: 123

- Top in: Edtech, AI

- Top universities: Tec de Monterrey, University of Monterrey, and the Autonomous University of Nuevo León

Guadalajara

Guadalajara is often considered the Silicon Valley of Mexico. The city is designed following the Triple Helix model of innovation, which creates a space for efficient interaction between government, industry, and academia, nurturing future talent at scale. The first generative AI lab in Mexico and Latin America, known as G.A.I.L., was launched here by Wizeline in partnership with the Tecnológico de Monterrey Campus in Guadalajara. On top of that, the Federal Government’s Guadalajara Creative City initiative is positioning the city as a future digital media powerhouse.

Here’s what Guadalajara’s tech ecosystem looks like today:

- Startup ecosystem rating: 3th in Mexico, 3th in Central America

- Startups: 111

- Top in: Fintech, AI

- Top universities: ITESO, Universidad de Guadalajara, and Universidad Autónoma de Guadalajara

With tech hubs like Mexico City, Monterrey, and Guadalajara leading the way, it’s no surprise that more tech product companies are looking to scale in Mexico. But let’s be real. Setting up a legal entity in this country to hire engineers sounds simple…until you’re knee-deep in paperwork. You’ll need to choose the entity type, register with tax authorities and Social Security, open a local bank account, etc., and hope you don’t miss a step. It’s a months-long process that burns time and money.

How to make your tech expansion journey easier? Partner with Alcor. With us, you’ll get an all-in-one solution: tech recruitment, Employer of Record, and 360° operational support.

That’s exactly what Franki did. This California-based experience app startup wanted to scale product development in Mexico fast and without dealing with entity setup or legal risks. After a recommendation from our other client, they teamed up with Alcor. Within a month, our recruiters helped them build a team of elite tech talent, hiring 7+ senior engineers from the top 10% of the market with an average time-to-hire of just 4 weeks.

Franki needed seasoned iOS and Android engineers fluent in RxSwift, a niche but critical skill for their product. Our recruiters rolled up their sleeves and delivered a shortlist of 20 strong candidates, each a standout in the local talent pool.

What impressed Franki most was the clear salary report and Alcor’s fees, plus no hidden charges. On top of that, they could build a top-tier tech team while saving 40% compared to traditional outsourcing.

Colombia

Software development in Colombia will reach the market value of $35 billion by 2028. The country houses over 1500 startups and 165,000+ software engineers, while 15,000 graduates graduate annually. On the policy side, government initiatives like the Young Entrepreneurs Law are actively encouraging the country’s tech innovation and investment.

Bogotá

Bogotá is Colombia’s leading tech city, with 62% of the country’s tech companies headquartered here. In 2024, the Bogotá-Region strengthened its appeal to international investors, welcoming 105 new investment projects. This is an 11.7% increase year-over-year. The US led the way as the top source of foreign capital. On the talent front, Bogotá has produced over 215,000 software and tech graduates in the past five years, accounting for 57% of the country’s total.

Here’s more about this tech hub:

- Startup ecosystem rating: 1st in Colombia, 2nd in South America

- Startups: 791

- Top in: FoodTech

- Top universities: National University of Colombia, University of America in Colombia, University of the Andes Colombia, Pontifical Javeriana University

Medellìn

Medellín is a 2nd vibrant LATAM hub based in Colombia. The city’s former mayor – a software developer himself – along with the local government, called Medellín a Valley of Software to reflect its tech-driven transformation.

Let’s see what this city’s got:

- Startup ecosystem rating: 2nd in Colombia, 7th in South America

- Startups: 459

- Top in: E-commerce, Fintech

- Top universities: University of Antioquia, Pontificia Bolivariana University, EAFIT University, CES University

Cali

Cali is Colombia’s third leading tech city, and it’s gearing up for a digital leap. The city’s 2024–2027 strategy focuses on modernizing infrastructure, expanding digital services, and embedding technology across public institutions.

And there’s more to back it up:

- Startup ecosystem rating: 3rd in Colombia, 13th in South America

- Startups: 147

- Top in: Tech services for the agribusiness industry

- Top universities: ICESI University, University of Valle, Javeriana University, Santiago de Cali University

Argentina

Argentina’s IT services are on track to hit $3.14 billion in 2025, with a steady 4.55% annual growth projected through 2029. But it’s not just about market size. Argentina is betting big on brains with a 150,000+ talent pool and government-backed programs like Argentina Programa 4.0, aiming to train 70,000 young programmers annually. The talent pipeline is flowing strong, adding 741 top startups and top-tier English skills (second-best in LATAM).

Buenos Aires

Let’s take a look at its capital city, Buenos Aires, one of the top 5 tech hubs in LATAM. It’s the beating heart of Argentina’s startup scene, home to both of the country’s unicorns and nearly 58% of all local startups, according to StartupBlink. The tech talent in this city combines high English proficiency and strong expertise in software engineering, cloud computing, and advanced fields like ML and AI.

- Startup ecosystem rating: 1st in Argentina, 3th in South America

- Startups: 434

- Top in: E-commerce, Fintech

- Top universities: University of Buenos Aires, National Technological University, Buenos Aires Institute of Technology

Córdoba

Córdoba – Argentina’s second-largest tech hub and proudly nicknamed La Docta – packs brainpower and business punch. Home to 400 tech firms, this city pairs academic depth with a fast-growing innovation scene.

Here are a few more reasons this city’s on the radar:

- Startup ecosystem rating: 2nd in Argentina, 12th in South America

- Startups: 189

- Top in: FinTech

- Top universities: National University of Cordoba, Catholic University of Cordoba, Blas Pascal University

Chile

Chile can rightfully be called the tech mecca of Latin America. Why so? It leads AI development in the region and boasts 92% 5G coverage. Moreover, Chilean coders stand out in English skills, securing 8th place in the region, as well as tech skills – 20th globally and 39th in data science.

Santiago

Now, let’s talk about Chile’s capital city, Santiago. In 2024, it was ranked the #1 city in Latin America by the Brand Finance Global City Index. According to StartupBlink, roughly 90% of the country’s startups are based in this city, making Santiago the highest-ranked startup ecosystem in Chile.

Here’s more about Santiago’s tech scene:

- Startup ecosystem rating: 1st in Chile, 4rd in South America

- Startups: 534

- Top in: AI

- Top universities: University of Chile, Pontifical Catholic University of Chile, University of Santiago de Chile

Comparing Tech Labor Costs: LATAM vs the US

What if hiring senior tech specialists didn’t drain your budget but still got you top-tier talent? That’s exactly what’s happening across tech hubs in LATAM, where compensation for skilled engineers comes in at half of US rates.

The table below highlights just how much you can save by hiring senior engineers in LATAM vs in the US, role by role.

| Annual Senior Developer Compensation, USD | |||||

| Mexico | Colombia | Argentina | Chile | USA | |

| AI/ML Engineer | $61,200 | $60,000 | $58,200 | $61,200 | $132,000 |

| Cloud Developer | $68,400 | $54,000 | $68,400 | $64,800 | $174,000 |

| Blockchain Engineer | $68,400 | $62,400 | $60,000 | $61,200 | $132,000 |

| Mobile Developer | $62,400 | $62,400 | $62,400 | $62,400 | $114,000 |

| C/C++ Developer | $66,000 | $57,600 | $54,000 | $54,000 | $114,000 |

| Python Developer | $62,400 | $60,000 | $57,600 | $60,000 | $126,000 |

| Java Developer | $66,000 | $60,000 | $57,600 | $60,000 | $114,000 |

| Automation QA Engineer | $54,000 | $54,000 | $54,000 | $48,000 | $96,000 |

| Manual QA Engineer | $50,400 | $45,600 | $45,600 | $45,600 | $84,000 |

| Product Manager | $51,600 | $51,600 | $51,600 | $51,600 | $120,000 |

Hiring in LATAM isn’t just cost-effective; it’s smart business. On average, senior Mexican programmers with 5+ years of experience earn around 49% less than their US counterparts. In Colombia, Argentina, and Chile, that gap stretches to 53%.

But gross salary is just the starting point. When hiring full-time employees, you’ll also need to cover taxes, benefits, bonuses, and other employment-related costs. With B2B contractors, taxes are their responsibility, but you’ll still need to account for other expenses.

Let’s say you’re paying a senior developer $5,000 per month. You will contribute additional Social Security Contributions and Payroll Taxes (excluding the latter in Argentina and Chile) on top of the gross salary in the following amount:

- Mexico: 24.1% + Aguinaldo (15 days of salary per year)

- Colombia: 30.02% + 13th-month salary (prima)

- Argentina: 27.8% + Aguinaldo (one month’s salary)

- Chile: 4.4% + Gratificación (25% of the employee’s monthly salary)

Recruitment fees in LATAM depend on the seniority of the talent:

- 15% of gross annual salary for mid-level tech specialists

- 20% for senior-level positions

- 25% and more for leads and top-tier talent

In the US, expect those fees to climb another 10%, averaging 25–35% of the annual salary.

And when it comes to benefits, Latin America keeps it lean. A standard benefits package for one developer costs around $6,500 per year, compared to $15,400 in the US. This is nearly a $9,000 difference.

The table below compares the full annual cost of employing senior tech professionals in LATAM and the US.

| Annual Senior Developer Employment Cost, USD | |||||

| Mexico | Colombia | Argentina | Chile | USA | |

| AI/ML Engineer | $82,490 | $83,500 | $81,190 | $81,215 | $187,000 |

| Cloud Developer | $91,430 | $75,800 | $94,280 | $85,610 | $241,600 |

| Blockchain Engineer | $91,430 | $86,580 | $83,500 | $81,215 | $187,000 |

| Mobile Developer | $83,980 | $86,580 | $86,580 | $82,680 | $163,600 |

| C/C++ Developer | $88,450 | $80,420 | $75,800 | $72,425 | $163,600 |

| Python Developer | $83,980 | $83,500 | $80,420 | $79,750 | $179,200 |

| Java Developer | $88,450 | $83,500 | $80,420 | $79,750 | $163,600 |

| Automation QA Engineer | $73,550 | $75,800 | $75,800 | $65,100 | $140,200 |

| Manual QA Engineer | $69,080 | $65,020 | $65,020 | $62,170 | $124,600 |

| Product Manager | $70,570 | $72,720 | $72,720 | $69,495 | $165,400 |

|

Gross Annual Salary + Recruitment Services |

|||||

Even after factoring in recruitment fees, benefits, and the Aguinaldo (13th salary), the total yearly cost of hiring a programmer in Latin America still comes in 52–56% lower than in the US.

How to Choose Where to Build Your Software Team in Latin America

If your company is considering Latin American tech hubs for expansion, start by aligning your priorities with what each country offers.

- Mexico leads the region with the largest tech talent pool – over 800,000 developers – and ranks first in Central America for startup activity. It’s home to several major hubs: Mexico City, Monterrey, and Guadalajara.

- Colombia is another top destination, particularly for companies scaling cloud infrastructure. It offers the lowest cost in the region for hiring cloud engineers. Key hubs include Bogotá, Medellín, and Cali.

- For teams that prioritize communication and collaboration, Argentina stands out with the second-highest English proficiency in LATAM. Its main tech hubs include Buenos Aires, the capital, and Córdoba.

- Chile combines cost-efficiency with advanced technical capabilities. It offers some of the region’s most competitive rates for specialized roles like C/C++ developers, blockchain engineers, and QA automation specialists. It’s also a regional leader in AI development, with Santiago as the primary tech hub.

4 Models How to Hire Developers in LATAM

Tech outsourcing

When it comes to cooperation models, outsourcing to LATAM is the most popular option. It takes product development off your shoulders by engaging a team of developers via a third party. However, that doesn’t come without pitfalls. It’s rather short-term and better suited for only non-tech companies. You incur data security risks by sharing your IP, and code quality may not be the best since programmers tend to show limited dedication, not to mention cloudy pricing.

Tech recruitment

Unlike traditional outsourcing, you’ll know exactly who’s building your product when you recruit directly. You hand-pick every programmer, align them with your goals, and integrate them into your company culture from day one.

But here’s the catch – direct hiring in every LATAM country means you’ll need a legal entity. That’s why your recruitment partner matters. You want someone with local know-how, a strong track record, and transparent pricing.

For example, we at Alcor are well-versed in tech and legal – check out our case for Ledger. Our recruiters close a tech position in 2-6 weeks and work via a transparent pricing model. No buyout fees or rate cards, only direct salaries. Additionally, we fully compensate for any fines caused by our mistake. Our 95% NPS score speaks for itself!

Employer of Record

With an Employer of Record (EOR) model, you can legally hire Latin American developers without opening a local entity on B2B or FTE terms. The provider of EOR services in Latin America handles payroll, taxes, compliance, employee benefit management, and on/offboarding, so your engineers can work directly for you while staying fully compliant with local laws.

R&D center

Own software R&D center can be called the all-inclusive resort of tech recruitment. You don’t just get top-tier tech talent, but the whole experience is handled for you.

While you steer the product roadmap, your R&D partner takes care of everything else: hiring elite Latin American engineers, running legal & 100% compliance, accounting, HR payroll, and even building your employer brand on the ground. You can forget piecing together multiple vendors or sweating the back-office grind.

This is Alcor’s model. And with this model, your Silicon Valley-caliber tech team works exclusively for you, fully under your brand, and feels like a natural extension of your HQ, just with Latin American weather.

Tip to Build Your Software Team in Latin America Fast and Easy

At Alcor, we don’t believe that you can delegate the most precious thing–your unique product development to third parties and make it successful. Our solution is different: we help tech companies set up their software R&D teams in Latin America and Eastern Europe – fully under their control, without setting up a legal entity in the region, and without giving up IP or transparency.

In our all-in-one solution, we combine:

- Eastern European and LATAM IT recruitment,

- Employer of Record (EOR), and

- 360° operational support.

That means we’ll attract the best senior, lead, and C-level tech talent, legally hire them on your behalf, handle local compliance, run payroll, negotiate your office lease, supply laptops, and more – you name it.

Now, here’s how that worked in real life with Dotmatics.

They needed to scale fast but wanted full control over hiring, team structure, and IP. So we got to work. First, we refined their job descriptions and employer value proposition for markets in the region. Then, Alcor’s team of 40 headhunters, lawyers, and accountants launched the search across our internal 253K+ talent database, HR sources, and social media. Within five days, Dotmatics had a shortlist and approved 80% of the first CVs.

From there, it was game on:

- 30+ developers hired in under 12 months.

- Roles included a Director of Engineering, Full Stack, React, QA Automation, Node.js, and DevOps.

- One back-end engineer impressed Dotmatics so much that he was upgraded to Full Stack Java Developer before he even joined.

But we didn’t just handle recruitment. Dotmatics received our full EOR package: payroll, legal compliance, benefits, onboarding/offboarding. Additionally, we handled laptop procurement for developers.

Dotmatics wanted a trusted R&D partner, and we delivered. Let’s talk if you’re ready to experience the same.

References

- Statista

- StartupBlink

- The Economist

- Research and Markets

- Deloitte Tech Trends 2024 Report

- Latin America Cloud Computing Market Analysis – Size and Forecast 2025-2029 Report

- Global Startup Ecosystem Index 2024

- The White House

- Coursera Global Skills Report 2024

- Tracxn

- CBRE

- El Economista

- GlobalData

- World Economic Forum

- El MundoCom

- Plan Estratégico de Tecnologías de la Información y las Comunicaciones (PETI)

- Et CIO com

- EF English Proficiency Index

- InvestChile

- Mordor Intelligence

- El ILIA

- LatAm AI Benchmarks 2025

- IDB’s Fintech en América Latina y el Caribe

- The Rio Times

- fDi Intelligence

- Microsoft

- Mexico Business News

- Wizeline

- Invest in Bogota

- The Report on New and Expansion Foreign Direct Investment in Bogotá-Region

- Brand Finance Global City Index 2024