Eastern European tech hubs rank in the top 15 for software development outsourcing. 65% of overseas tech companies choose to nearshore software development in Eastern Europe. But how does this market differ from those in Western Europe, Asia, or Latin America?

I’m Dmytro Ovcharenko, the CEO and founder of Alcor, a software R&D accelerator. We help US tech product companies seamlessly nearshore to Eastern Europe and Latin America by building from scratch and operating their top 10% tech teams. No legal entity needed, 40% costs saved compared to outsourcing, the team is yours from day one.

In this article, you’ll see the big picture of the Eastern European IT market and explore four EE countries with the best-developed tech industry. Additionally, you’ll learn about the benefits and challenges of nearshore software development in South-East Europe, as well as average software developer salaries and ways to make your nearshoring hassle-free and efficient.

Key Takeaways

- Eastern European IT Market shows steady growth, sustained by the expanding talent pool and booming startup ecosystem.

- Nearshoring to Eastern Europe competes strongly with other regions, offering a balance of affordability, high English proficiency, and skilled tech talent.

- The average gross annual salary for senior programmers in Eastern Europe is 1.5 times lower than in the US.

- The region shows resilience in addressing geopolitical, AI, and tech talent complexities and continues to attract global investment.

Eastern Europe IT Market Overview

According to the Future of IT Report 2023 by Emerging Europe, Eastern Europe is not only a nearshore but also an offshore paradise for software development outsourcing. Poland (3rd), Romania (8th), Bulgaria (11th), the Czech Republic (12th), and Ukraine (15th) ranked in the global top 15 of the most cost-effective and suitable locations. In addition, among other EE and Baltic countries, along with Hungary, Estonia, and Lithuania, they are at the top of the IT Competitiveness Index with the highest scores for tech talent and infrastructure.

In 2023, Poland secured the top spot with a score of 25.92 in the tech talent component. What’s more, 2023–2024 alone saw nearly 74,000 students pursuing ICT studies. Continuing to grow, Poland rose to the 35th place in the Global Startup Ecosystem 2024, surpassing all other countries, popular for nearshoring to Central-Eastern Europe, in the number of unicorns.

Dealroom also highlighted that Poland and Romania each account for 13% of VC investment in CEE, with Romania’s increasing competitiveness attributed to its superior tech infrastructure and high-speed internet. Over the last five years, the value of the CEE startup ecosystem has increased by 2.4 times, contributing to a 5.7% share of the European innovation ecosystem.

Another reason to outsource software development to Eastern Europe—Croatia and Ukraine, for instance, surpass the European average with twice the number of unicorns per funded startups.

But what does the future hold for nearshoring software development to Eastern Europe?

In 2025, IT services revenue is expected to reach $15.06 billion and continue growing at a 4.57% rate, reaching $17.99 billion by 2029.

- Poland’s IT market is expected to surge the fastest, with a CAGR of 10.15%.

- Romania comes 2nd with a 9.1% growth rate.

- The Bulgarian ICT market has seen a 300% revenue increase over the last seven years, while the IT services market is forecast to grow steadily at a 6.08% rate.

- Ukraine’s IT services are anticipated to grow at a 5.90% rate from 2025 to 2029, sustained by innovations in startup enterprises.

Why Nearshore Software Development to Eastern Europe?

The reasons for nearshore outsourcing software development to Eastern Europe boil down to these:

If you’re ready for nearshore outsourcing to Eastern Europe but still unsure which country is the ideal location for taking your product development to the next level, we’ve got your back. Let’s rate the main countries’ tech infrastructure and thus opportunities for hiring developers in Eastern Europe.

Poland

Talent pool: 650,000+ tech specialists

Tech businesses: 60,000+

Senior software developer salary: $75,500

Programming languages and technologies: JavaScript, Java, Python, TypeScript, PHP, Golang, and Node.js

English proficiency: 15th place out of 116

Time zone: GMT+2

Tech hubs: Warsaw, Krakow, Katowice, the Tri-City (Gdansk, Gdynia, Sopot), and Poznan

Special feature: 1st in terms of the tech talent pool in Central and Eastern Europe

Romania

Talent pool: 250,000 tech specialists

Tech businesses: 7,290

Senior software developer salary: $72,000

Programming languages and technologies: Java, JavaScript, C#, and Python

English proficiency: 12th place out of 116

Time zone: GMT+3

Tech hubs: Bucharest, Cluj-Napoca, Timișoara

Special feature: the leader in Europe and the 6th in the world in terms of the number of certified IT specialists per 1,000 inhabitants

Ukraine

Talent pool: 302,000 tech specialists

Tech businesses: 7,977

Senior software developer salary: $62,000

Programming languages and technologies: JavaScript, Java, C#, Python, and PHP

English proficiency: 40th place out of 116

Time zone: GMT+3

Tech hubs: Kyiv, Lviv, Dnipro, Kharkiv, and Odesa

Special feature: one of the most gender-equal tech environments, with every 5 tech specialists being women

Bulgaria

Talent pool: 108,000+ tech specialists

Tech businesses: 10,000

Senior software developer salary: $65,000

Programming languages and technologies: C#, JavaScript, Java, and Python

English proficiency: 16th place out of 116

Time zone: GMT+3

Tech hubs: Sofia, Burgas, Plovdiv

Special feature: ranks 4th among other European countries in terms of Software Engineering, Web and Mobile Development

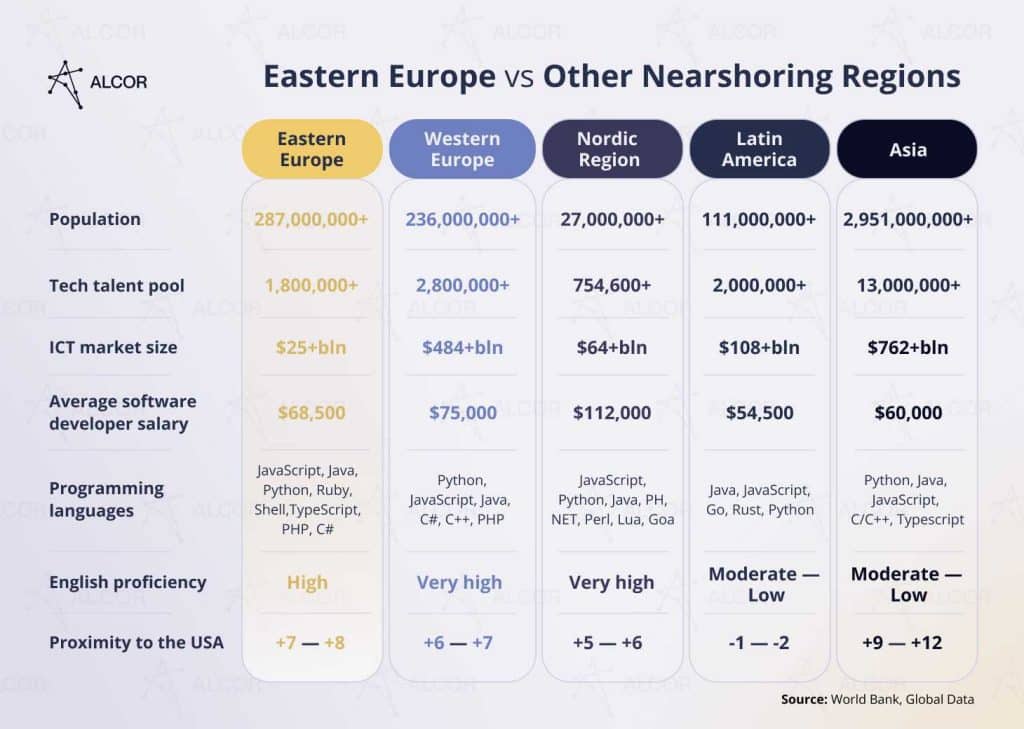

Eastern Europe vs Other Nearshoring Regions

Outsourcing in Eastern Europe demands a closer look in comparison with other thriving IT markets. In this part, you’ll learn the main features that make it stand out.

Latin America

Cons:

- Complex taxation and legislation require the expertise of a trusted local partner for successful software nearshoring in LATAM.

- Paid time off, holidays, and work hours differ widely across countries. For example, in Mexico, Colombia, and Argentina, the standard workweek is 48 hours, compared to 45 hours in Chile.

Pros:

- The Latin American region, comprising Mexico, Argentina, Colombia, and Chile, boasts over 2.75 million tech specialists.

- Up to 2 times lower software developer salaries, compared to the US.

- 1-2 hour time zone difference.

Western Europe

Cons:

- 1.3 times higher salaries than in Eastern Europe

- The need for a competitive compensation package in the face of inflation and rising cost of living for Western European software developers.

Pros:

- A strong business culture affinity in Western European countries, such as Austria, France, Germany, Switzerland, and the United Kingdom makes software nearshoring and collaboration with remote developers much easier.

- Lower salaries than in the Nordic countries.

Nordic Region

Cons:

- Costly IT nearshoring due to 2 times the salaries compared to Eastern Europe.

- Shortage of tech specialists—18,000 annually, as forecasted for Sweden from 2024 to 2028—and over 60% of Norwegian companies struggling to fill the talent gap.

Pros:

- 53 universities offer the best technical education for tech specialists in Denmark, Norway, Sweden, and Finland

- Top 15 for English language proficiency, ensuring seamless communication with offshore software developers.

Asia

Cons:

- Low to moderate English proficiency levels—India comes 69th out of 116 countries, while China ranks 91st.

- 9–12 time zone difference, which could significantly impact software development productivity.

Pros:

- The largest market for tech specialists among China, India, and other Asian destinations.

- Affordable IT salaries and a vast supply of tech talent.

Does Eastern Europe Have a Сhance to Become a TOP-1 Destination for IT Nearshoring?

Should the decision to nearshore software development to Europe be your ultimate tech expansion strategy? Let’s address concerns surrounding the eastern part of the region, especially regarding political, economic, and tech talent trends.

Tech talent shortage: myth or fact?

In Romania, 44% of executives cite talent shortage as their primary tech recruitment challenge. While that is a concern when you nearshore to Europe, Romania’s statistics are not significantly different from the global trend, where 39% of business leaders define talent shortage as their main bottleneck.

The good news is that Romania is preparing a fresh wave of tech talent. For one, nearly 545,000 students enrolled in higher education in 2023-2024. The long-term talent education strategy aligns with the CEDEFOP Skills Forecast, which predicts that Romanian employment growth will outpace the EU-27 average over the period from 2022 to 2035. With ICT as its fastest-growing sector and a strong pipeline of skilled professionals, Romania is turning a talent gap into a growth driver.

Geopolitics: will it stall the IT market growth?

The Russian invasion of Ukraine put the country’s thriving tech nearshoring industry at risk. Yet not only has Ukraine’s IT sector endured—it’s now on track to become a global leader in DefenseTech. In 2024, the UK and the US each imported over $300 million worth of Ukrainian IT services. Over the past six years, the Ukrainian tech sector has attracted nearly $1.5 billion in venture capital and private equity. Beyond DefenseTech, high-growth sectors include AI, DeepTech, Fintech, Blockchain, and cybersecurity.

Poland, too, faces geopolitical pressure due to the ongoing Russian war in Ukraine. Nevertheless, its venture capital sector is expanding. By the end of 2024, PFR Ventures—Poland’s largest institutional investor and a partner within the European Funds for a Modern Economy (FENG) program—invested €63 million in five new VC funds. In 2025, Polish startups will receive an additional €100 million from Formative, a venture fund targeting startups in AI, DeepTech, EdTech, and other innovative sectors.

These investment flows highlight a compelling trend: both Ukraine and Poland are not only weathering geopolitical instability but are actively innovating and building mature startup markets.

AI Adoption: is it fast enough?

On a business level, the worldwide trend of AI adoption is reflected in the CEE VC investment dynamics in AI startups—15% of total VC investment over the last five years and 45% in Q1 2024. Matched with the region’s stellar talent, this funding contributed to the success story of the Warsaw AI-based platform, Applica, which achieved a 170% year-on-year growth.

On a governmental level, Romania has developed a €5 billion plan for AI implementation and digitalization and launched an AI research institute at the Technical University of Cluj-Napoca. The institution will focus on cybersecurity and add to Romania’s existing pool of 49,100 AI specialists and 146 product AI companies. Ukraine, in turn, has partnered with AWS, Google, Microsoft, and techUK to implement its leadership strategy in AI, blockchain, cybersecurity, and IoT.

Software Developers’ Salaries in Eastern European Countries

Another important factor in choosing your ideal match for IT nearshoring in Eastern Europe is the salary rates of tech specialists and software engineers. So let me prove that to hire developers in Europe is far more cost-effective than doing it in the US!

For example, Polish programmers skilled in AI earn between $42,000 and $96,000 annually, while ML engineers’ salaries range from $37,000 to $104,000. In turn, the annual Artificial Intelligence programmer salary in Romania ranges between $19,000-$96,000, and in Bulgaria, middle and senior software engineers receive $48,000-$72,000.

Taking the most popular programming languages among EE nearshore countries as a criterion, an employee in the Java Developer position receives an average gross annual income of $51,000 to $84,000. A similar trend is observed for other skill sets, with higher prices to nearshore services in Poland and Romania and slightly lower prices in Bulgaria and Ukraine. Generally, senior Eastern European developers make up to $75,000 a year—58% less than their US counterparts’ average of $118,500 for the same expertise.

| Annual Senior Developer Compensation, USD | ||||

| Position | Poland | Romania | Bulgaria | Ukraine |

| Java Developer | 84,000 | 78,000 | 81,500 | 72,000 |

| Python Developer | 81,600 | 69,000 | 81,000 | 72,000 |

| .NET Developer | 78,000 | 66,000 | 78,000 | 66,000 |

| DevOps Engineer | 87,600 | 78,000 | 81,600 | 72,000 |

| C# Developer | 84,000 | 78,000 | 81,600 | 72,000 |

| PHP Developer | 75,600 | 66,000 | 72,000 | 60,000 |

| C/C++ Developer | 81,600 | 62,400 | 78,000 | 69,600 |

| UI/UX Designer | 78,000 | 57,600 | 72,000 | 54,000 |

| Node.JS Developer | 84,000 | 78,000 | 81,600 | 72,000 |

| Ruby Developer | 84,000 | 78,000 | 81,600 | 72,000 |

Challenges of Nearshoring to Eastern Europe

Legal challenges

When you consider software development nearshoring in Eastern Europe, you may encounter certain problems related to the complexity of local legislation.

For example, Poland has a fairly high Business Complexity Index, especially with regard to Rules, Regulations & Penalties, which are expected to become even more demanding over the next five years.

Regarding nearshoring to Romania, foreign companies must stay updated on this country’s frequently changing legislation. For instance, recent modifications in the Fiscal Code in 2024 highlight the need for tech businesses to monitor updates in micro-enterprise taxation, the RO e-invoice system, as well as local VAT rates.

Complex taxation

Even with the lowest taxes among CEE countries, ranging from a personal income tax of 10% in Bulgaria and 12 or 32% in Poland, which is almost 2 or even 3 times lower than in the UK and the US, navigating these regulations and recruting IT specialists in Europe still causes some difficulties. Issues such as frequent changes in tax laws, compliance requirements, and differing interpretations by local authorities can complicate the process further.

However, with the guidance of an experienced Employer of Record in Eastern Europe, you can lessen the paperwork burden and ensure full compliance with local legislation when you nearshore software development to Europe. At Alcor, for instance, we provide 100% compensation for fines caused by our mistake while nearshoring to Eastern Europe.

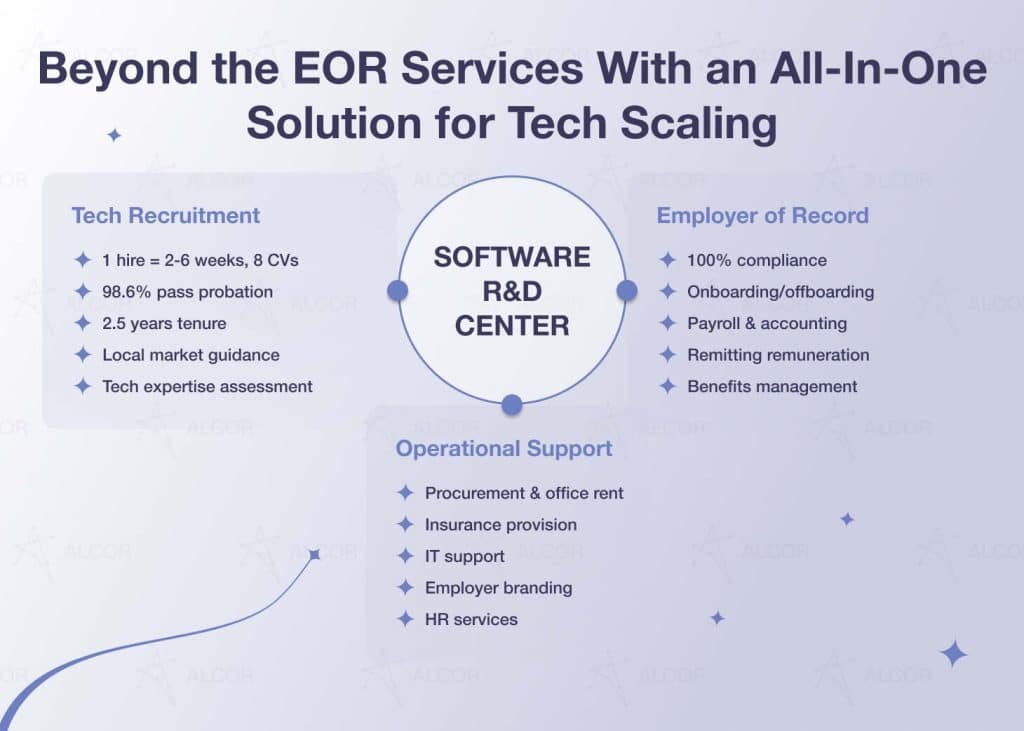

Better Than Nearshoring Software Development to Eastern Europe

IT nearshoring to Eastern Europe is easier with a reliable partner. With an R&D software accelerator model, Alcor can build you a team from 10 to 100+ hi-tech software developers in a year. We help US tech product companies scale quickly and retain talent in the long term.

One of our clients, ThredUP wanted to build its own R&D center with top-notch tech specialists chose Alcor as its partner IT staffing company from Eastern Europe.

We wowed the client:

- In just two weeks, we hired a Senior Full-Stack Engineer with rare skills in C++, C#, .NET, and TCP/IP.

- We helped their EE team grow to 47 people.

- We assisted ThredUP with lease negotiations and accompanied them through all the steps of establishing the R&D center.

As an all-in-one solution, Alcor allows you to focus on your product while our team provides everything you need for your software development in Eastern Europe. With our EOR services, you won’t need a legal entity. Tech recruitment ensures you’ll have elite programmers onboard—98% of Alcor’s candidates nail their probation period. 24/7 dedicated account support and a professional legal team will give you 100% compliance. And all that without hidden or buyout fees!

Grammarly, BigCommerce, and Sift are already conquering the EE market. And what about you? Ready to scale your company with your own high-end nearshore software development team from Europe? Explore our software R&D model in just a click.

References on Nearshoring Software Development in Eastern Europe

- Future of IT Report 2023

- Deloitte

- Global Startup Ecosystem Index 2024

- Mordor Intelligence

- Report Linker

- Trade.gov

- Statista

- Bulgarian News Agency

- WTW

- North Sweden Business

- Oslo Business Region

- Scimago Institutions Rankings

- EF English Proficiency Index 2024

- Business Review

- CEDEFOP Skills Forecast 2023

- Digital Tiger: The Market Power of Ukrainian IT 2024

- The Recursive

- Successful Investing in Poland

- Dealroom: Central and Eastern European startups 2024

- The Global Business Complexity Index

- Legal 500