Software outsourcing in Mexico is heating up and shows no signs of slowing down. In 2025, its IT services market is set to soar to almost $19 billion, while its high-tech exports already exceed 14.2%, positioning Mexico ninth in the world. Should you jump on the train of IT outsourcing to Mexico in 2025? Let’s find out!

I’m Dmytro Ovcharenko, CEO and founder of Alcor. We help tech companies build software R&D centers from 10 to 100 developers in LATAM and Eastern Europe – without the need for a legal entity or hefty buyout fees.

After reading this article, you’ll have a clear picture of whether or not software outsourcing to Mexico is your optimal strategy by exploring its benefits, myths, possible risks, and comparing Mexico to other LATAM destinations. You’ll also discover an alternative solution for your tech business expansion.

Key Takeaways

1. The Mexican tech industry is on its way to grow at 10.6% CAGR during 2025-2030, fueled by IT outsourcing, digitalization, AI, fintech, and telecom.

2. IT outsourcing to Mexico is characterized by 800K skilled tech talent pool, 47% lower salaries vs. the US, a business-friendly environment, and cultural and time zone proximity.

3. Chile and Brazil are strong outsourcing contenders, but if rapid scaling is your goal, Mexico wins hands down. Its large tech talent pool, pro-business climate, ripe tech infrastructure, and minimal time difference with the US make software development grow fast.

4. Cloudy pricing, team indifference, lack of control over development and team, and data security are the common risks of outstaffing and outsourcing IT services to Mexico. Tech R&D center solution helps you bypass all of them, as you get your own dev team from day one.

Mexican IT Industry Overview

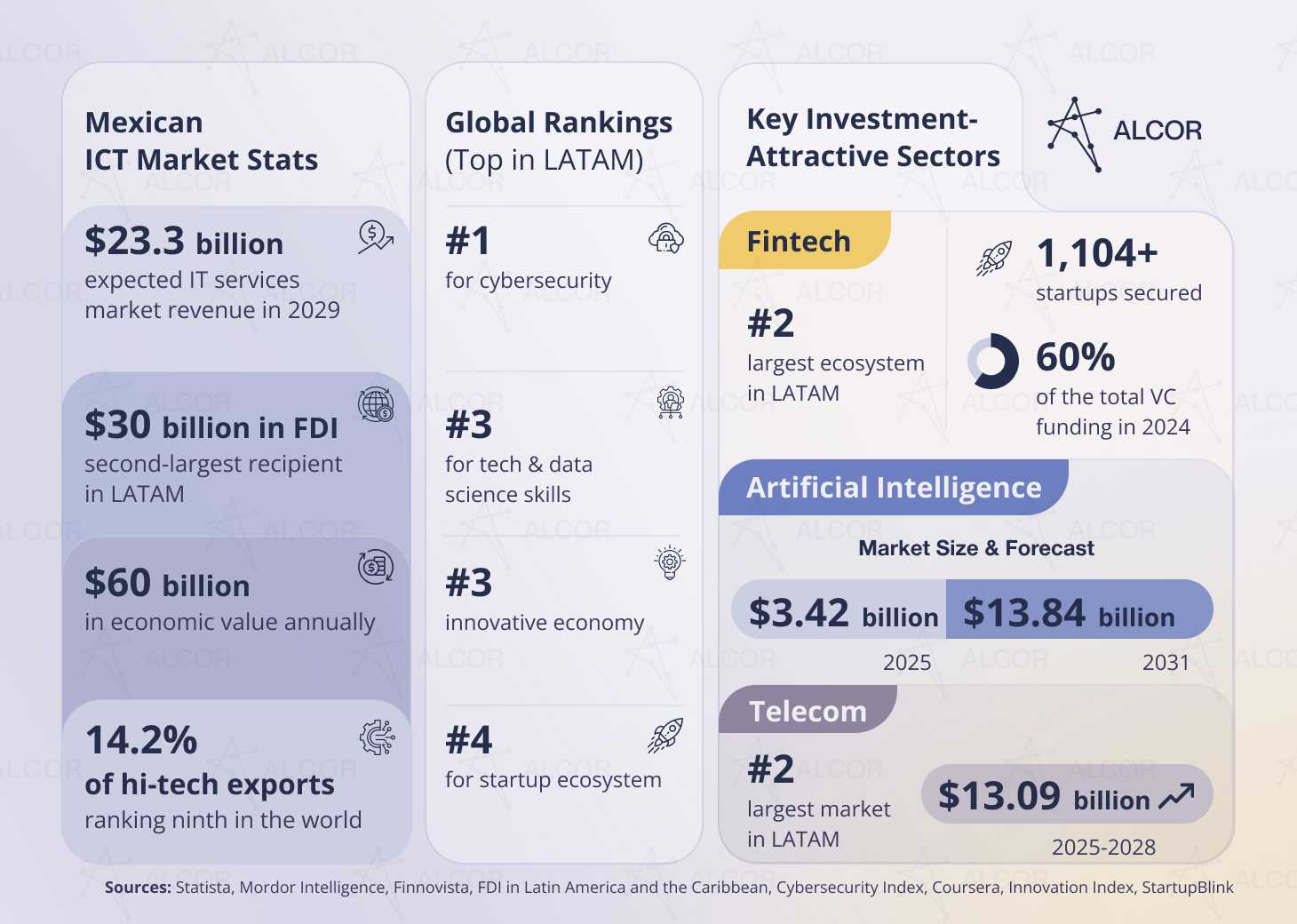

Did you know that Mexico is the third most innovative tech economy in Latin America? It contributes about $60 billion of economic value to the national GDP yearly through the digitalization and innovation sectors.

- Fintech: With 1,104 locally based and foreign startups, Mexico ranks as the 2nd largest ecosystem in LATAM, pulling in 60% of the total VC funding last year. During 2023-2024, the ecosystem shifted into a ‘scale-up’ mode, showing annual revenue growth of 31%.

- Artificial Intelligence: Growing at a jaw-dropping CAGR of 26% yearly, Mexico already ranks 3rd in UNESCO’s AI Technology and Government Readiness Index. In 2024 alone, its AI sector received $98 million for modernization, automation, and IT security.

- Telecom: It’s the second-largest market after Brazil, accounting for $81 billion in the region’s telecom industry. The local market size is experiencing growth at a CAGR of 6.51%, driven by 5G technology and the Internet of Things.

With the additional boost from FDI of over $30 billion, the Mexican technology industry is set to grow at 10.6% CAGR during the next 5 years – IT outsourcing is at its heart. Statista predicts the market volume to climb to nearly $10 billion by 2029, giving Mexico a real shot at outpacing Brazil.

Currently, Mexico is home to about 530 software engineering companies, according to Clutch. Local firms do everything from custom software to web and mobile apps – spread across key tech hubs like Mexico City, Monterrey, Guadalajara, and Mérida. But what if there’s a smarter, more reliable way to do software development in Mexico? Keep reading to uncover it!

5 Benefits of IT Outsourcing to Mexico

1. Access to 800K tech talents

Need software engineers at a senior or maybe lead level? Some niche developers or experts with rare skill sets? Mexico has you covered, as it boasts the largest talent pool in the region. And its tech hub, Mexico City, has the biggest piece of the talent pie – 300K tech talents or nearly 38% of the total ICT workforce.

Each year, this vibrant tech pool expands by 124,000 skilled STEM graduates from top local universities, namely Instituto Politécnico Nacional, Tecnológico de Monterrey, and Universidad de Guadalajara. These remarkable numbers are the merit of the government’s proactive promotion of STEM education among the younger generation. In 2023 alone, the Mexican government allocated approximately $9.1 billion to higher education and supported the launch of 1,335 undergraduate programs focused on information technology, engineering, and mathematics.

2. Shared work ethics

A long-standing experience of working for US tech companies makes Mexican software engineers the best match for cooperation. These developers stand out for their problem-solving, attention to detail, teamwork, and creativity. They proactively test new development methodologies and are always ready to go the extra mile for your product development.

What about communication? Most senior-level developers in Mexico possess high English proficiency. Coders from the top tech centers like Nuevo Leon and Jalisco demonstrate an upper-intermediate level (B2) of English. This means no language barrier when opting for Mexico’s software development outsourcing.

3. Geographical & time zone proximity

One more reason why international tech companies choose outsourcing in Mexico is its strategic location. Nestled in North America, Mexico offers proximity to many major US cities. The flight from Los Angeles to Mexico City takes just around 3 hours, making it an accessible location for in-person meetings.

Moreover, Mexico’s Tijuana is in the same time zone as California, while there is only 2 2-hour difference with Mexico City, Guadalajara, and Monterrey. This time overlap fosters real-time communication and seamless collaboration between your tech teams.

4. Business-friendly environment

Another advantage that lures US-based tech companies to outsource software development to Mexico is its financial attractiveness and A3 business environment. Notably, this nearshoring location ranks #10 in the 2023 Kearney Global Services Location Index. Moreover, Mexico benefits from a free trade agreement with the USA and Canada (USMCA), simplifying foreign investment and enhancing the protection of intellectual property rights.

Foreign tech businesses can also leverage Mexico’s well-developed infrastructure, which includes 20 tech parks. And they can enjoy tax deductions of 56% to 89% on fixed asset investments if operating in the R&D and hi-tech sectors. Plus, tech companies focusing on worker training through partnerships with educational and research institutions benefit from an additional deduction of 50% to 75% on incremental spending.

5. No Silicon Valley price tag

Another vital benefit of choosing Mexico for nearshore software development is affordable developer salaries. While in the go-to tech hubs like Mexico City and Monterrey, you pay $60K-$70K per senior developer/year, Guadalajara and Tijuana offer about $3,000 lower rates – $57K to $66K per senior developer/year.

But how much can you, as a CEO of a US tech company, slash labor costs by hiring Mexican developers?

| Senior Positions | Gross Annual Salary, USD | |||

| Mexico City | Monterrey | Guadalajara | Tijuana | |

| Full-Stack Developer | 70,000 | 68,000 | 66,500 | 63,000 |

| JavaScript Developer | 56,500 | 54,000 | 53,000 | 52,500 |

| Python Developer | 63,500 | 62,000 | 61,000 | 59,000 |

|

.NET Developer |

61,500 | 60,500 | 60,000 | 57,500 |

| C++ Developer | 62,000 | 60,000 | 60,000 | 57,000 |

The answer is up to 47%! This means more money for innovating and building new tech products!

Take, for example, the salary of a Senior AI Engineer in Mexico, which is only $62,500 per year, and compare it to the American one, $132,000 annually. The pattern holds for Senior Blockchain developer salary in Mexico, which reaches $68,500, while in the US it’s $132,000 per year. See the difference yourself in the table below.

| Senior Positions | Gross Annual Salary, USD | |

| Mexico | USA | |

| AI Engineer | 62,500 | 132,000 |

| Mobile Developer | 62,500 | 114,000 |

| DevOps Engineer | 72,000 | 138,000 |

| Cloud Developer | 68,000 | 174,000 |

| Blockchain Developer | 68,500 | 132,000 |

| Automation QA Engineer | 54,500 | 96,000 |

| Site Reliability Engineer | 68,000 | 138,000 |

| Salesforce Developer | 60,000 | 114,000 |

3 Myths about IT Outsourcing to Mexico

1. Underqualified developers

Does lower cost equal lower software products? With Mexican software engineers, it’s not the case. Let me prove it:

- Over 50% of the local tech workforce has 6+ years of experience, typically at the semi-senior level or higher.

- Coursera places them #3 for technology and data science skills in LATAM;

- They’re well-educated, graduating from higher institutions listed in the Best Global Universities ranking;

- Mexico ranks #3 for innovation, with high knowledge and technology outputs, meaning its ICT industry is fueled by tech-savvy minds;

- Tech giants are heavily investing in developers from Mexico. For instance, Microsoft is allocating $1.1 billion to train 5 million people in AI, while AWS is pouring $5 billion in Mexico over the next 15 years to boost AI and ML savviness.

On top of this, Mexican software engineers excel in a range of programming technologies, including JavaScript, Python, C#, SQL, React.js, and Angular. Many local talents are also certified in AWS, Google Cloud, and Microsoft Azure while actively contributing to open-source projects, GitHub communities, and international hackathons. So, if you are devising an outsourcing strategy in Mexico, be sure it’ll be both affordable and high quality!

2. Mexico’s outsourcing ban

Another popular myth regarding IT outsourcing in Mexico involves concerns over the legal landscape, particularly the 2021 amendment to the Federal Labor Law. This amendment reportedly bans the outsourcing of core business functions, prompting worries about the feasibility of working with outsourced programmers in Mexico.

But let me debunk this myth. The amendment’s primary objective is to combat tax evasion and does not outright prohibit Mexican IT outsourcing. Instead, it targets subcontracting, which is a distinct practice. In summary, while the perceived ban on software outsourcing in Mexico presents a challenge, professional legal guidance can navigate these complexities, allowing you to transparently engage skilled developers in Mexico.

3. The US Tariffs

The entire world has been preoccupied by Trump’s 25% tariffs imposed on Mexico and Canada. Will it put an end to UMSCA? Will there be a recession? It’s hard to tell. But what’s known for sure is that these tariffs mainly target physical goods, meaning they won’t affect digital services in Mexico. As outlined by FitchRatings, the Telecom & Media sector is at low risk. However, the same can’t be said about the automotive and electronics industries, which currently constitute about 46% of Mexican exports.

So, what does it mean for tech businesses? If you are planning to nearshore your software development in Mexico, you can dive in with confidence. The availability of Mexican tech talent remains high. The average salary of a software engineer in this market also stays half the price vs. the US, even with possible currency swings. The only real hurdle? Hardware logistics. But with a local partner like Alcor, you can easily navigate operational hassles.

5 Risks of IT Outsourcing to Mexico

Cloudy pricing

While offshore outsourcing to Mexico might appear as a cost-efficient choice on the surface, there may be better long-term solutions. Beyond the apparent expenses tied to product development, some companies incorporate additional, often unnecessary, services into their billing structure without the customer’s full awareness. Consequently, the final invoice can carry a significantly inflated price tag, exceeding initial expectations.

Questionable dedication

When tech companies opt for offshoring to Mexico with IT outsourcing providers, they often encounter challenges related to team indifference. Software developers at outsourcing companies frequently shift between projects, emphasizing output over outcome. This approach can lead to questionable dedication, product quality, and alignment with your corporate values and goals. At the end of the day, your project becomes just one among many, underscoring the importance of going the extra mile to ensure its success.

Lack of control

Outsourcing software development to Mexico comes with another risk: the potential loss of control over the team and product development. Communication with the outsourced software developers typically occurs through an intermediary, often a project manager. This can slow project delivery, increase the likelihood of miscommunication, and potentially introduce errors. Furthermore, limited visibility into the product development process can make it difficult to assess performance and quality terms accurately.

Data security concerns

When opting for software development outsourcing in Mexico, you inevitably share essential aspects of your product development with the provider. As the collaboration draws to a close, the software engineers involved often transition to fresh projects with other tech companies. This progression inherently heightens concerns related to data security, the potential for information leaks, and the safeguarding of your IP rights.

IT Outstaffing to Mexico

One of the well-known alternatives to software development outsourcing is IT outstaffing to Mexico. This approach involves a temporary collaboration with remote programmers or development teams offered by an outstaffing service provider.

This model also allows you to adjust the team size according to your current business needs and overall workload. Yet, contrary to traditional outsourcing, tech companies maintain direct control over the development process and team management, bypassing the need for intermediaries.

Still, IT outstaffing often brings a touch of detachment to your project since these team members aren’t your in-house employees. This separation can raise concerns about how it might affect product quality and data security. Consequently, potential investors may become apprehensive, questioning the future success of your product.

Apart from that, outstaffed developers grow as specialists and gain more expertise within your project. Yet, when your collaboration stops, you lose these talents. If you decide to bring them on board, you’ll have to pay tens of thousands of dollars in buy-out fees.

Better than IT Outsourcing

…your own tech R&D center!

Since outstaffing and software outsourcing to Mexico come with plenty of risks for tech companies, we at Alcor devised a solution that turns software development from a gamble into a guaranteed success. Instead of juggling third-party agencies, you get:

- Access to the top 10% talent of Mexico’s market;

- 5 devs in one month, 30 in 3 months, and 100 in a year;

- Full integration and dedication of developers from day one,

- To bypass any buyout fees, pre-payment, and markups,

- Scale with ready-made legal entities, 100% compliant.

What do our tech R&D center services include? Everything you need for hassle-free expansion, namely

– A to Z recruitment: Our IT recruiters in Mexico handle sourcing, screening, tech expertise assessment, and interviewing to hire the best-fitting developers in 2-6 weeks. The figures speak for our recruitment quality: 98.6% of our hires pass probation, while their average tenure is 2.5 years.

– Operational support: Need anything extra? We can lease an office or coworking space, make hardware procurement, and help with IT infrastructure setup – no pre-payment needed. Plus, you’ll enjoy full in-country navigation provided by our Dedicated Customer Success Managers.

– EOR in Mexico for tech: Hire software developers from Mexico on a B2B model or use our local legal entity to employ them on an FTE basis. On top of that, we cover on/offboarding, benefits management, compliance with local labor laws and regulations, payroll processing, and tax withholding.

Does it work? Absolutely! Just look at our success with the California-based tech company, Franki:

Alcor not only built a Mobile team of 7 senior developers for Franki but also ensured full compliance and a smooth onboarding process. We also consulted with them on employment models and took over management of B2B contracts, PTO, payroll, and taxes under our Employer of Record services in Mexico. But what’s so peculiar about employment contracts?

Mexican Taxation for IT Companies

Just like Franki, you can choose from two prevalent employment models when expanding to Mexico.

The first is the traditional employment model (FTE), where both parties pay taxes. Employer’s share constitutes 3% of the payroll tax and 24%-43% of Social Security Contributions (SSC), while employee’s share consists of 2.8% of SSC and a personal income tax (PIT) that ranges from 1.92% up to 35%, based on gross earnings. It’s worth noting that employers withhold PIT and SSC on behalf of the employee.

The second option is a B2B contract, which allows tech businesses to hire Mexican software engineers as contractors. Here, only the developer pays taxes – typically a PIT between 1% and 2.5%, depending on gross income. SSC payments are usually optional.

| FTE | B2B | |

| Employer’s share |

Social Security Contributions – 24%-43% Payroll tax – 3% for technology hubs such as Mexico City (CDMX), Guadalajara, Monterrey, and Querétaro |

Paying payroll taxes is not mandatory |

| Employee’s share |

Personal income tax (progressive) – 1.92%-35% Social Security Contributions – 2.8% |

Personal income tax –1%-2,5% Social Security contributions – optional |

Which one is better, you’d ask. FTE leans more toward protecting the employee, backed by Mexico’s strict labor laws. Salary amount, benefits, working hours, paid time off (PTO), and termination terms are all clearly defined. But for employers, it’s more challenging. You’ll need to set up a legal entity, handle rigorous labor laws, and manage taxes and SSC on your own.

The B2B model is more employer-friendly, as it frees you from tax and SSC hassle. Contractors benefit too: they enjoy higher take-home pay thanks to lower taxes, and their income is often tied to foreign currency, shielding them from inflation and exchange rate swings. The trade-off? Working terms, PTO, and benefits are usually more limited compared to the employment contract.

Mexico vs Other LATAM Outsourcing Destinations

When weighing the pros and cons of outsourcing to Mexico, tech executives also explore other destinations in Latin America. Let’s take a closer look at a few of these options:

Mexico vs Brazil

In 2022, Brazil’s information technology sector reached a remarkable market valuation of $45 billion, the highest in the region. Projections indicate that its IT outsourcing market will continue to grow, potentially reaching $10.38 billion by 2029. With over 500,000 software developers, Brazil boasts the second-largest talent pool in LATAM, trailing only behind Mexico.

Brazilian developers excel particularly in data science skills, although they lag behind Mexico in overall technology proficiency. They demonstrate expertise in JavaScript, CSS, Python, Java, C#, and PHP. The country’s software development ecosystem thrived last year, with over 9,000 companies actively participating in the sector. Additionally, Brazil is home to 13,000 startups, boasting the largest number of unicorns in Latin America.

Mexico vs Colombia

Another common alternative to Mexican outsourcing is opting for Colombia. In 2023, the local ICT market was valued at $20.54 billion, and it’s on a trajectory to reach $35.6 billion by 2028. Colombia boasts more than 165,000 software engineers, and over 13,000 STEM graduates join its pool every year. Developers in this country are as good at technology skills as their Mexican counterparts, but are a bit lagging in data science knowledge. You can always find Java, C++, Python, SQL, and Ruby in their arsenal.

Colombia is a burgeoning startup hub, boasting a thriving ecosystem with more than 300 innovative companies. The heart of this entrepreneurial wave beats strongest in cities like Bogotá, where 760 startups call home, followed by Medellín with 272 and Cali with 147. The country proudly hosts several unicorns, including well-known names like Rappi, LifeMiles, and others.

Mexico vs Argentina

The IT market in Argentina is on a promising path, expected to achieve a 9% CAGR between 2024 and 2029, ultimately expanding the market by $8.5 billion. Projections also indicate a steady rise in revenue of 20.6% within Argentina’s IT services market from 2024 to 2029. In addition, Argentina has more than 500 startup companies and around 11 unicorns.

The country provides access to 150,000+ tech talents and is #1 in English proficiency in LATAM. Argentinian developers also possess strong Python, TensorFlow, Cloud APIs, SQL, R, and NLP skills. These facts make IT software outsourcing to Argentina one of the top choices among US companies.

Need more insights? Our 5-metric evaluation makes it a no-brainer – check it out in the article!

Mexico vs Chile

Another noteworthy outsourcing destination in LATAM is Chile, with an estimated revenue set to reach $784.62 million in 2025. Chile has a smaller pool of software developers compared to Mexico, with nearly 100,000 talents. However, the Chilean government has implemented various educational initiatives like Talento Digital and Fundación Kodea to increase the number of graduates. Chilean IT experts are renowned for their proficiency in programming, cloud computing, operating systems, and data analysis, as well as in tech like Java, Python, PHP, Perl, Node.js, and ASP.NET.

What sets IT outsourcing to Chile apart from Mexico is its political and economic stability and lower country risk. Furthermore, Chile’s commitment to digitalization and the implementation of the Chile Digital 2035 strategy has positioned it as the leading country for AI adoption and the second most innovative economy in Latin America.

Hire Mexican Developers as Simply as Is

Planning to expand to new markets like Mexico, Colombia, Argentina, or any other Latin American and Eastern European country? Let Alcor have your back!

Alcor is an experienced provider of R&D center services with an exclusive focus on helping tech product companies like yours enter new markets with ease and scale their development teams from 10 to 100 developers in one year. We’ve already helped People.ai, BigCommerce, Sift, and ThredUP achieve their expansion goals. 93% of CEOs and CTOs are satisfied with the quality of our services, dedication, and proactivity.

Ready to explore new prospects for your tech business with a reliable partner committed to your success? Fill the form below!

References on IT Outsourcing to Mexico

- Statista

- UNESCO’s Artificial Intelligence Readiness

- Global Innovation Index 2024

- Mordor Intelligence

- Mexico Business News

- Finnovista Fintech Radar Mexico 2025

- Technavio

- Foreign Direct Investment in Latin America and the Caribbean 2024

- The Rio Times

- EF English Proficiency Index

- Kearney Global Services Location Index

- Coface for Trade

- Coursera Global Skills Report 2023

- Best Global Universities for Computer Science in Mexico

- Microsoft

- Amazon

- Wired

- Más Colombia

- ILIA Latin American AI Index

- Country Risk Report by Aswath Damodaran

FAQ

1. Why do US tech companies opt for outsourcing software development to Mexico?

800K skilled software developers, 60% lower salaries vs. the US, a business-friendly environment, and cultural and time zone proximity are some of the key reasons American tech companies offshore to Mexico. Read this article for more insights on this topic!

2. What are the prevailing risks of software outsourcing to Mexico?

Embarking on IT outsourcing to Mexico may present various risks and challenges for product tech companies. These include potential issues related to team cohesion, unclear pricing structures, data security concerns, and the loss of control over the development process.

3. What is a workable alternative to traditional IT outsourcing in Mexico?

Software development outsourcing certainly entails risks, which is why many product tech companies opt to establish their own teams of developers when expanding abroad. One effective solution is setting up an R&D center, providing access to a dedicated engineering team along with transparency, decision-making autonomy, guarantees, and comprehensive operational support. Contact us to discover more about this approach!