Did you know that the IT market revenue in Poland is expected to grow by 34.7% by 2029, marking its ninth year of continuous expansion? While 76% of executives worldwide struggle to hire, Poland offers a clear answer: top talent, strong growth, and cost-effectiveness.

I’m Maryna Panchuk, Head of IT Recruitment at Alcor – a tech R&D accelerator that offers tech product companies a smarter alternative to traditional IT outsourcing. It’s a fully compliant software R&D center, built from 10 to 100 hi-tech developers in Poland and other Eastern European and Latin American countries, with 40% cost savings.

In this article, you’ll learn why the tech market in Poland is perfect for building remote R&D teams for American and Western European tech product companies, what the country’s benefits and largest tech hubs are, and how Alcor can help you expand to Poland without opening a legal entity.

Key Takeaways

- The IT services market in Poland is expected to reach $31.59 billion in 2025, with Polish software outsourcing alone being on track to grow to $5.97 billion by 2030.

- The technology sector in Poland is booming, with rapid growth in Game development, Cloud technologies, AI/ML, FinTech, and Healthcare IoT.

- Hiring a dedicated development team from Poland can reduce your company’s engineering costs by up to 40% compared to the US.

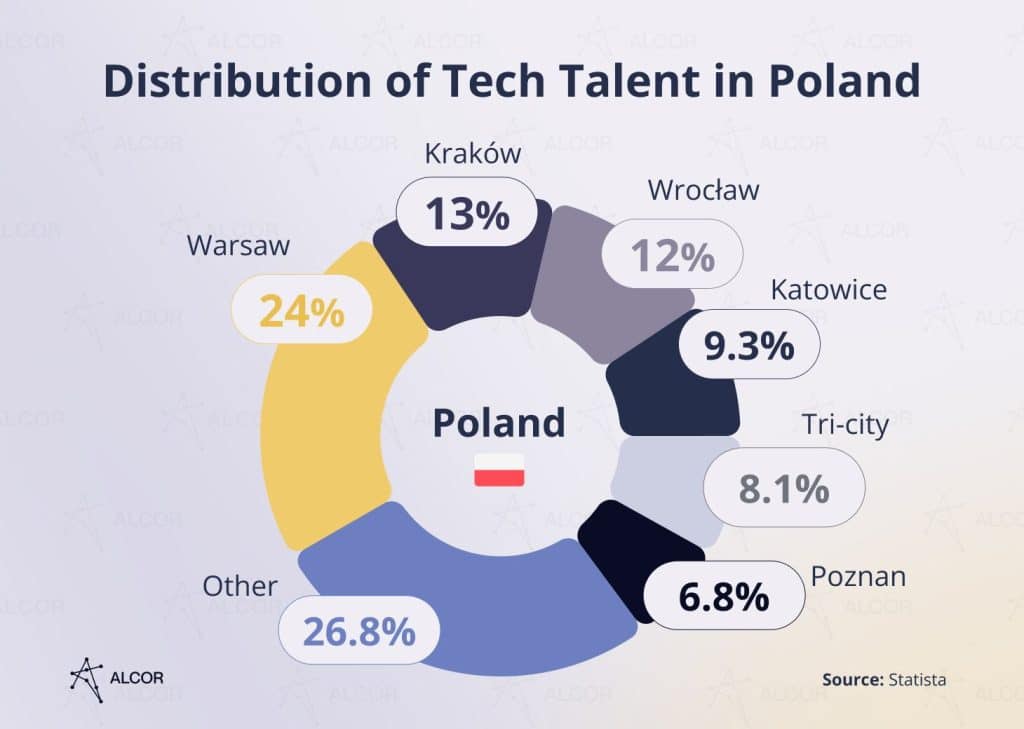

- The major tech hubs in Poland are Warsaw, Kraków, Wrocław, the Tri-City area (Gdańsk, Gdynia, and Sopot), Katowice, and Poznań. These cities offer access to top tech talent, strong STEM education, international companies, and vibrant innovation ecosystems.

- Alcor helps you build a fully-backed software R&D team of 30 top-tier tech specialists in Poland within 3 months – 100% compliant and without hidden costs or buy-out fees.

Polish Tech Industry in 2025 Overview

Poland’s tech industry is growing fast. The ICT services market is forecasted to hit $31.59 billion in 2025. According to the International Trade Administration (2025), it is projected to account for 4.5% of the country’s GDP.

This is what’s fueling the rise of Poland’s tech industry:

- The Polish startup landscape: 3,000+ startup companies, 14 unicorns (ElevenLabs, The Witcher, DocPlanner, LiveChat, and many others). 13 Poland’s cities made it into the world’s top 1000 tech ecosystems – Warsaw ranks 21st globally in Robotics, while Wrocław holds 16th place in Medtech. It’s a decentralized, innovation-driven network that keeps attracting international investors and attention, and also continues to strengthen technology recruitment in Poland.

- Poland’s European Union membership has played a major role in attracting foreign investors. In addition, special economic zones (SEZs) with tax breaks and business-friendly conditions have helped drive growth in the ICT market industry.

- Recognizing the ICT sector’s strategic value, Poland’s government launched major initiatives, including broadband internet access for 931,000 households, cybersecurity training for 380,000 citizens, and the construction of 4,200 5G stations to support nationwide digital infrastructure.

Meanwhile, investors have taken notice: Poland made its debut on the 2024 FDI Confidence Index, ranking among the top 10 countries globally. It is attracting foreign investment across high-growth sectors, including Fintech, Healthtech, AI, IoT, Edtech, E-commerce, Hardware, Green Energy, and Marketing & Sales.

Polish Tech Sector Overview by Segment

The IT industry in Poland is thriving across multiple high-growth segments.

- The game development market is one standout. With over 15,000 specialists and 65 university programs, Poland ranks second in Europe in terms of workforce size. Warsaw has entered the top 5 gaming hubs in the EU, confirming Poland as a tech hub to watch. The country is one of the few in Europe with such a strong government-university-studio collaboration model in gaming.

- In the Polish cloud technology sector, the adoption of SaaS, PaaS, and IaaS solutions continues to surge. The market is projected to reach $3.12 billion by 2025, making it a critical driver of growth in Poland’s technology industry and enabling international tech product companies to scale more efficiently.

- Poland’s government is betting big on Artificial Intelligence, with a $240 million investment fueling AI-driven innovation across automation, defense, and economic development. The country’s AI market, already valued at $1 billion, is forecast to grow nearly sixfold by 2030, signaling long-term opportunities in the tech industry in Poland.

- Poland also leads Central and Eastern European countries in the FinTech market, with 368 active companies and a sector valuation of $952 million, reinforcing its reputation in the tech industry.

- The country’s Healthcare IoT sector is growing steadily, with an annual growth rate of 10.79%, expected to reach $868.73 million by 2029. In 2023, venture capital investments in Polish Healthcare startups reached around $300 million, marking a 45% increase compared to the previous year.

IT Services Market in Poland

The IT services sector in Poland is thriving, driven by the country’s deep technical expertise and rising demand for software engineering in Poland. In 2024, Poland had the largest tech workforce among Central and Eastern European countries, solidifying its position as a significant player in innovation. A strong indicator of the Polish IT market’s growth is the $180 million in funding raised by local tech companies last year.

Curious about software development outsourcing in Poland? It’s expected to reach $5.97 billion by 2030 at an annual growth rate of 7.75%. The specializations of companies in this segment are Custom Software Development, CRM Consulting & SI, Cloud Consulting, AI, BI & Big Data Consulting, and more.

So, what lures so many tech product companies to expand to Poland? Let’s break down the key advantages.

Benefits of Hiring Polish Developers

Skilled tech talent pool

With over 650,000 tech experts, Poland’s technology hub is the largest in the CEE region. Additionally, Poland consistently ranks among the top three worldwide for developer technical expertise, with Polish software developers excelling in problem-solving and possessing advanced technical skills. They hold the #5 position at Google Code Jam, rank 7th internationally on TopCoder, and placed 4th in the 2024 Emerging Europe IT Competitiveness Index.

The Polish tech services market covers:

- Core specializations such as backend development, mobile apps, game development, data science & ML, and cybersecurity.

- Widely used programming languages like SQL, JavaScript, Python, TypeScript, HTML/CSS, and Java.

A great environment for setting up a team, don’t you think?

Strong STEM education

A strong academic foundation drives Poland’s tech talent pipeline. Over 60 public and state universities offer robust technical programs, with the country’s top institutions, such as the Warsaw University of Technology and Wrocław University of Science and Technology, earning international recognition. In fact, 22 Poland’s universities appear in the QS World University Rankings 2025.

In the 2023–2024 academic year alone, around 74,000 Polish students studied ICT-related majors. 76% of software developers in Poland hold a higher education degree, and nearly half have a Master’s degree. Beyond traditional education, Polish coding boot camps such as Coders Lab and Codecool are expanding access to tech careers even further.

Explore 100% compliant hiring of Polish developers via the Employer of Record service provider in Poland!

Western work ethics

Poland’s software developers offer more than just strong technical skills. They also align closely with Western work culture and values. With decades of collaboration with US and Western European companies, the country has established a professional environment founded on ownership, accountability, and agile thinking.

What truly sets Poland’s engineers apart is their ability to adapt, think critically, solve problems creatively, communicate clearly, and work with emotional intelligence. These are all essential soft skills for seamless collaboration between Polish tech specialists and international tech product teams.

High English proficiency

Poland’s programmers rank 2nd in Eastern Europe for English proficiency and 15th globally, making communication smooth and efficient for international teams. With most developers speaking at a B2 level or higher, they consistently exceed the expectations of tech product companies that offshore or nearshore software development to Poland.

Convenient location

Poland’s GMT+2 time zone makes it an ideal hub for cross-border tech collaboration.

- Western European tech product companies benefit from quick flights to Polish cities (1–3 hours) and real-time collaboration thanks to overlapping work hours.

- US companies benefit from the 6–7 hour time difference between the countries, allowing for overnight progress and round-the-clock development cycles.

Your Own Software Team from 10 to 100 in a Year

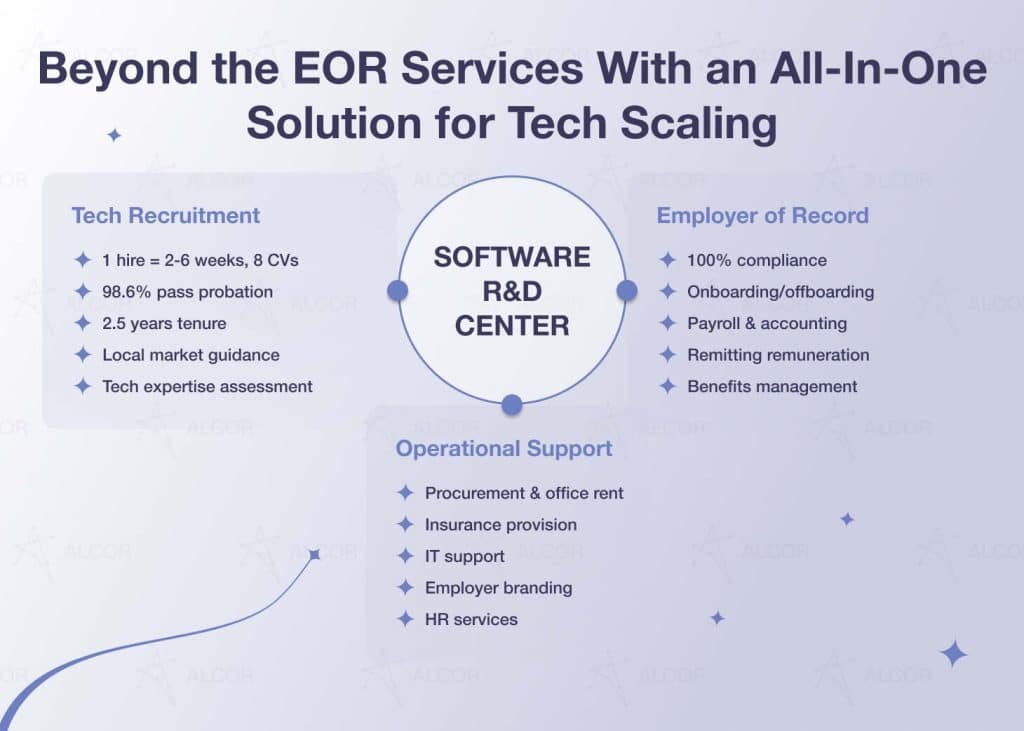

Alcor enables product tech companies to build fully operational software R&D centers in Eastern Europe and LATAM, starting with just 5 engineers and scaling up to 100+ in a single year.

Opening a tech hub in Poland with Alcor is a breeze, and that’s why:

- We hire the top 10% of tech talent and do it fast. Think 30+ top-tier engineers onboarded in just 3 months, with 98.6% passing probation.

- Our Employer of Record is built specifically for tech companies. No need to set up a legal entity or worry about complex regulations. You stay 100% compliant with our services.

- From payroll to office space and hardware procurement in Poland (or other EE and LATAM countries), we ensure your team can start strong from day one.

- And one more thing: there are no hidden costs, no buy-out fees. Ever.

And we don’t just promise results – we deliver. For BigCommerce, a global SaaS E-commerce company, we built a fully compliant tech R&D center, found suitable office space, and hired elite developers, ensuring 100% legal and payroll compliance. The result is 80 Silicon Valley-caliber engineers in just one year.

When GoTransverse, a company that develops a cloud-based billing platform, needed speed and precision, Alcor delivered: CVs in 5 days, 5 Full-Stack Engineers and a Product Manager in just 1,5 months, plus Employer of Record services to ensure a smooth, 100% compliant hiring process.

IT industry in Poland vs the USA

The United States remains a global tech leader, with a massive talent pool of over 5.4 million software developers and a highly mature innovation ecosystem. However, this dominance comes at a price, as the country’s developer salaries are among the highest in the world, and the competition for skilled talent is fiercer than ever, particularly in roles related to AI, Cloud computing, and Cybersecurity sectors. Furthermore, the US is expected to face a shortage of over 7 million tech professionals by 2034. The result is that innovation companies are eyeing offshoring locations like Eastern Europe.

In contrast, the Polish IT industry offers the largest tech workforce in CEE, with over 650,000 skilled engineers – a number that continues to grow year by year.

But the most striking difference lies in the cost. For example, hiring a senior Full Stack developer in Poland typically costs 33–40% less than in the US.

In the table below, you’ll find a comparison of salaries in the technology industry of Poland and the US.

Position | Annual Senior Developer Compensation, USD | |

| USA | Poland | |

| AI/ML Engineer | $132,000 | $80,400 |

| Cloud Engineer | $174,000 | $72,000 |

| Blockchain Developer | $132,000 | $78,000 |

| Mobile Developer (iOS/Android/Xamarin) | $114,000 | $84,000 |

| Salesforce Developer | $114,000 | $72,000 |

| Manual/Automation QA | $96,000 | $72,000 |

| Ruby Developer | $114,000 | $84,000 |

| C/C++ Developer | $114,000 | $81,600 |

| .NET Developer | $114,000 | $78,000 |

| Vue.js Developer | $120,000 | $72,000 |

However, when planning your company’s hiring budget, don’t stop at the salary. To understand the real cost, you’ll need to factor in Polish taxes, recruitment fees, and employee benefits.

Compare the software developer salary in Eastern Europe across different hubs to make a cost-effective decision.

Total employment cost

Hiring developers in Poland through the widely used B2B model comes with a major financial upside: companies aren’t legally required to cover the developer’s taxes. Polish independent contractors are responsible for handling their own tax and social contributions, which vary based on their income.

If you hire Polish full-time employees, though, expect additional costs. For a developer earning $5,000 gross per month, the employer typically pays around 20% extra in Social Security Contributions, including:

- 9.76% retirement pension contribution

- 6.5% pension contribution

- 0.67-3.33% disability pension

- 2.45% to the Polish Employment Fund

- 0.1% to the Polish Fund of Guaranteed Employment Benefits

Recruitment fees for tech talent in Poland vary by role seniority:

- 15% of gross annual salary for mid-level specialists

- 20% for senior-level positions

- 25% and more for leads and top-tier talent

In contrast, US recruitment fees typically range from 25% to 35%. That’s up to 10% savings per hire without compromising on the developer’s technical expertise.

Also, Polish tech companies typically offer benefits packages worth around $6,350 per year, covering essentials like:

- Medical insurance – $1,200

- Learning & Development – $900

- Corporate merchandise – $150

- Work equipment – $3,300

- Wellness & mental health support – $800

In the US, benefits average $15,400 per employee, so you’re saving over $9,000 for every Polish developer you hire.

For a clearer picture of savings, the table below compares the full employment cost of software engineers in Poland vs the US.

Position | Annual Senior Developer Employment Cost, USD | |

| USA | Poland | |

| AI/ML Engineer | $187,000 | $102,830 |

| Cloud Engineer | $241,600 | $92,750 |

| Blockchain Developer | $187,000 | $99,950 |

| Mobile Developer (iOS/Android/Xamarin) | $163,600 | $107,150 |

| Salesforce Developer | $163,600 | $92,750 |

| Manual/Automation QA | $140,200 | $92,750 |

| Ruby Developer | $163,600 | $107,150 |

| C/C++ Developer | $163,600 | $104,270 |

| .NET Developer | $163,600 | $99,950 |

| Vue.js Developer | $171,400 | $92,750 |

| Gross Annual Salary + Recruitment Services + Standard Benefits Package | ||

What’s the takeaway? Even after factoring in total employment costs, you can hire two senior developers in Poland for the cost of one in the US.

Take AI/ML specialists – they’re about 45% more affordable in Poland. Need Blockchain talent? You’re looking at over 61% savings, with no compromise on skills or experience.

In summary, Poland is a compelling option for US tech companies to address talent shortages and reduce hiring costs. Plus with an Employer of Record in Poland you don’t need to worry about the additional overhead when setting up a legal entity.

Top Tech Polish City Hubs

Warsaw

Warsaw stands at the heart of the IT industry in Poland, home to approximately 156,000 tech specialists, which accounts for 24% of the entire national tech workforce. The city hub is a major talent engine, graduating over 3,000 new ICT professionals annually from top-tier Polish institutions, including the University of Warsaw and the Warsaw University of Technology, both leaders in STEM education across Central and Eastern European countries.

Furthermore, fDi Intelligence recognized Warsaw as the fourth major European city of the future for 2023/24, citing its highest economic potential in Poland, its focus on innovation, the growth of its tech startup scene, and its large pool of software developers. All of this makes Warsaw a perfect landscape for companies building complex, product-focused tech teams.

Today, nearly 450 IT companies – including Google, Microsoft, IBM, and Cisco – operate here in the Polish capital. For international tech product teams, Warsaw offers the scale, advanced technical skills, and the right ecosystem to set up tech R&D centers and software development teams.

Get top-10% IT recruitment in Warsaw with Alcor’s tech R&D solution!

Kraków

Often seen as Warsaw’s quieter sibling, Kraków is anything but. The hub is home to over 84,500 IT professionals and some of Poland’s top universities, including AGH University of Science and Technology, Kraków University of Technology, and the prestigious Jagiellonian University. Kraków keeps the IT sector in Poland well-supplied with more than 2,350 new ICT graduates each year.

This strong educational pipeline continues to attract major international tech players. Companies such as IBM, Motorola Solutions, Ericsson, Nokia Networks, and more than half of Poland’s active tech unicorns have chosen Kraków as a key base for tech R&D services.

Kraków has built a reputation as a leader in tech investment, supported by a thriving startup ecosystem. It includes innovation hubs, incubators, technology parks, and active tech communities, all contributing to steady investment in this Poland’s city hub.

Wrocław

Often referred to as the “Polish Silicon Valley”, Wrocław is one of the top hubs in the tech sector in Poland, home to approximately 12% or 78,000 development tech talent. According to StartupBlink, the city now holds second place in Poland after Warsaw.

Wrocław is particularly known for its strength in MedTech – this Polish hub ranks 16th globally in the sector. Each year, approximately 1,400 STEM graduates enter the IT services market from leading institutions, such as the Wrocław University of Science and Technology, reinforcing the city’s reputation as a reliable source of highly educated tech talent.

The city hub’s innovation-friendly infrastructure is another key driver of growth. Wrocławski Park Technologiczny (WPT), one of the most prominent technology parks in Poland, currently hosts over 200 tech companies, ranging from international corporations to fast-growing startups. The WPT ecosystem offers a dynamic environment for R&D, MedTech, and advanced engineering teams.

Katowice

Located in the Silesian Metropolis, Poland’s largest urban area, Katowice benefits from access to shared infrastructure, a connected labor market, and strong government support. With over 60,000 tech professionals and 1,500 annual ICT graduates from the city hub’s universities, including the University of Silesia and the Katowice School of Technology, Katowice is earning its place in the tech sector in Poland.

Global companies such as Fujitsu, ING Tech, Capgemini, and Accenture have already set up operations here. This Polish hub’s blend of affordability, access, and talent makes it a compelling choice for long-term tech investment.

Tri-City

The Tri-City metropolitan area comprises Gdańsk, Gdynia, and Sopot. The region is home to over 52,650 tech professionals, representing 8.1% of the national tech workforce, and hosts more than 60 tech companies. The Tri-City ranks among Poland’s top five destinations for foreign investment.

Each year, over 1,000 tech graduates enter the IT services market from top institutions such as Gdańsk University of Technology and the University of Gdańsk, ensuring a steady flow of new talent. International companies, including Amazon, Intel, Nike, and GetResponse, already operate in the Tri-City area.

Poznań

Poznań may fly under the radar, but with 44,200 tech professionals and a strong presence in C++, Java, and .NET development, it’s a key hub in western Poland. Universities like Poznań University of Technology and Adam Mickiewicz University graduate around 1,500 new tech specialists annually.

Home to 80 IT and R&D business service centers, this hub offers versatile engineering talent and a business-friendly landscape that makes it a smart choice for international companies seeking efficiency and depth.

Technology Trends in Poland for 2025-2030

Poland is stepping into a new era of tech-fueled transformation. Startup investments climbed 14% year-over-year to hit PLN 1.57 billion ($392.5 million), powering breakthroughs across the AI, Fintech, Healthcare, and Sustainable Food tech markets.

Global tech companies are driving the trend with strategic investments. Microsoft is allocating PLN 2.8 billion ($744 million) toward expanding Cloud, Cybersecurity, and AI infrastructure in Poland. Meanwhile, Google is teaming up with the Polish government to fast-track AI adoption in the Healthcare and Energy sectors.

Poland’s wave of innovation is policy-supported. Under the EU’s STEP initiative, funding is also flowing into Deep tech, Biotech, Clean tech, and Advanced Medical Research. These initiatives aim to boost Eastern European digital competitiveness, with Poland leading in several key verticals.

Events like EU IndTech 2025 and the US–Poland Science & Tech Symposium highlight Poland’s international collaboration. At the same time, Poland is navigating regulatory challenges, including a proposed tax on large tech companies, to support domestic innovation while balancing the influence of global tech giants.

Polish Tech Companies to Watch in 2026

The Polish tech sector is booming, with AI startups alone raising nearly $171 million in 2024. Poland is becoming one of the top Eastern European countries for innovation-driven companies across various industries, including Artificial Intelligence, Proptech, Agtech, Healthtech, and Sustainable Food Production.

Standout performers include:

- CampusAI ($10M), an AI training platform helping individuals and companies upskill fast and integrate AI.

- Nomagic ($8.7M), a Poland’s creator of intelligent warehouse robotics, streamlining logistics with precision and automation.

- Synerise ($8.5M), SKY ENGINE AI ($7M), and Edrone ($5.1M) are companies shaping the AI landscape in the Polish tech ecosystem, from predictive analytics to next-gen marketing automation.

Among Poland’s most promising early-stage startups:

- Binaryx, a fractional real estate investment company. Its platform offers low-barrier access to high-yield rental properties.

- Cropler, a company that is revolutionising agriculture with AI-powered crop monitoring cameras designed to optimise farm productivity.

- Holi Clinic, a Poland’s company that delivers digital, personalised obesity treatment using GLP-1 therapies.

In the sustainable tech space:

- LabFarm is a company that develops lab-grown meat to address food security and reduce the environmental impact of animal farming.

- MoreGrowth is scaling online brands in wellness, finance, and parenting, with projects like HelloFinance and HiJunior already gaining traction.

Consumer platforms are rising too:

- Petsy connects pet owners with trusted sitters and vet services.

- Plain, an AI-powered shopping assistant, helps users find and visualize furniture based on their preferences and space.

Top-10% Tech Team in 2 Months & No Legal Headache

Expanding abroad and looking for IT recruitment services in Krakow, Warsaw, or Wrocław? We’ve got something even better for you.

A tech R&D center is a ready-to-go solution designed for tech product companies like yours. With Alcor, you can hire Silicon Valley-caliber software engineers in Eastern Europe or Latin America – no hidden or buyout fees, no prepayments.

Here’s why Alcor’s tech R&D solution works:

- Product-focused mindset & full control: We build teams that work exclusively on your product. You stay in the driver’s seat. Your team is aligned with your roadmap, KPIs, and culture. It’s perfect for tech companies that value consistency, innovation, and focus.

- Top-tier tech recruitment: Need to grow fast? Our 40 recruiters help you scale from 10 to 100+ Silicon Valley-caliber engineers in Eastern Europe and Latin America within a year.

- Tech-focused EOR service: Alcor lets you bypass months of paperwork and admin, taking care of compliance, payroll, benefits, and onboarding/offboarding, so that you can focus on your product.

- Transparent & flexible pricing: No pre-payment, no markups, no hidden costs. Enjoy volume discounts and customized offers tailored to your company’s specific needs.

- 360° operational support: Beyond EOR, we handle office leasing, hardware procurement, employer branding, and more – all services under one roof.

- Personalized client service: Each client is assigned a dedicated Customer Success Manager for responsive, hands-on support throughout every stage.

Want to scale in Eastern Europe with a reliable partner? Fill out the form, and let’s make it happen with Alcor.